Intro: Nutmeg Investment Reviews (Nutmeg Investment Performance, ISAs, and other Details)

Nutmeg Investment was one of the very first UK robo investing platforms to hit the industry in the UK, and it has been leading the way until the surge of other popular platforms came to light in recent years.

Nutmeg Finance, founded by Nick Hungerford, became the first online discretionary wealth management business in the UK and has enjoyed that success ever since.

Around since 2011, founder Nick Hungerford reminisces about the humble beginnings of the company, claiming to have been met with mixed reactions from potential investors in Silicon Valley.

Some believed in the model, curious enough to ask additional questions, while others could not believe that Nutmeg Finance would ever have the potential to change an industry that had become entrenched in face-to-face meetings.

Nutmeg Finance has grown since its inception in the early 2010s, becoming a widely recognized name in discretionary wealth management services in the UK. No longer considered a “lone wolf” in the industry, several companies have since been created to be a viable alternative to Nutmeg. But how is Nutmeg Investment really doing?

It would be hard for AdvisoryHQ to have missed the interest swirling around a detailed Nutmeg Investment review. Consumers and potential clients are hungry to know more about the services offered by Nutmeg Investment, the fees they charge, and the Nutmeg investment performance.

If you’re one those individuals who has been wondering if this robo advisor is worth your time, join us as we investigate some of the finer details regarding what you can expect from Nutmeg UK.

Source: Nutmeg.com

Don’t Miss: Top Rated Best UK Robo-Advisers | Ranking | Top Automated Investment Firms in the UK

Nutmeg UK Services

What most people prize about Nutmeg Investment is their commitment to helping investors figure out the best choices based on their personal profiles.

A Nutmeg Investment review would be remiss not to point that this company is ideal for beginner investors or those who are looking for a more laissez-faire type of investment strategy.

The premise of robo investing is that you allow the algorithms within the system to be monitored by professionals who work directly for Nutmeg Investment.

Fill out a brief questionnaire and allow some time for a Nutmeg Investment review of your personality, savings goals, and your tolerance for risk.

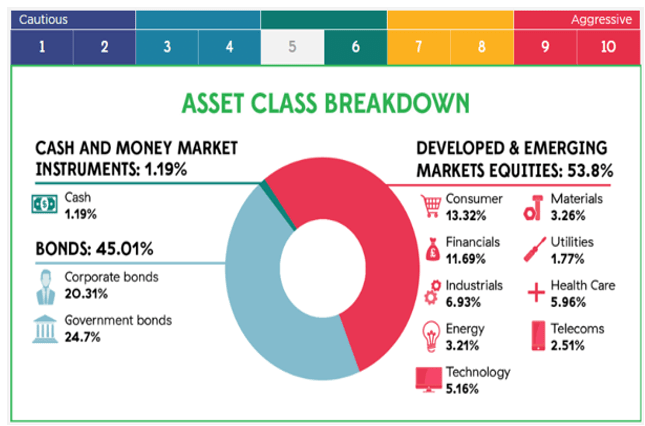

You can be categorized as one of ten separate sections on the risk scale, spanning from cautious to aggressive. No matter where you fall on the scale, you can count on a Nutmeg Investment review of your personal information before they assign a unique strategy or investment plan for you.

Source: How We Invest – Nutmeg.com

Aiming to be completely transparent, Nutmeg Finance is up front about the wide range of assets that they use to build portfolios.

They include bonds, equities, cash, commodities, and real estate to create a highly diverse portfolio that suits your risk level. Those assets are usually purchased through ETFs due to the ease of trading and their low cost.

See Also: Freedom Finance Reviews—UK | What Is Freedom Finance? Pros & Cons

Types of Nutmeg Accounts

Their robo investing strategy remains the same, with algorithmic trading leading the way on how to best balance and allocate all of your assets. However, there are different types of accounts you can choose from that offer this service. Nutmeg UK specializes in two primary categories of wealth management: individual savings accounts and pensions.

A Nutmeg ISA gives you the opportunity for a fully managed portfolio that makes the most of your allotted £15,240 investment for an ISA. Your portfolio is constructed in less than ten minutes, and you have a clear idea of exactly where the funds in your Nutmeg ISA are going. There is constant Nutmeg Investment review of your funds, so they are constantly rebalancing your portfolio and making sure that it is in line with the goals you initially set forward to achieve.

For those who don’t want to put all of the allowance into a single fund, Nutmeg Investment also allows you to create as many separate funds as you would like under your single Nutmeg ISA wrapper. You can divvy up your allowance toward a college fund, down payment on a house, a new car, or toward your retirement while they manage the taxes and contribution limits associated with a Nutmeg ISA.

With a pension fund from Nutmeg Investment, there are a few more things to note with a Nutmeg review. Similar to the Nutmeg ISA, the pension fund takes just a few minutes to complete and then displays a potential plan for a diversified portfolio that remains under their management.

One of the most important features to note in a Nutmeg review is the instant 25 percent top-up that they add to your account from government tax relief when you make monthly contributions. This money comes directly out of the company’s funds so that your account can benefit from it faster. According to their own Nutmeg Investment review, they are one of only a select few providers in the UK who offer this service.

Don’t Miss: Robo Advisors (UK)—Everything You Should Know! (Investment Help & Advice)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Nutmeg Investment Performance

No Nutmeg review would be complete without a thorough analysis of the performance of the premade portfolios available. They feature ten different portfolios (one for each risk level), and each customer is paired up with one of these already managed portfolios. What kind of return can you expect on your investment?

Our Nutmeg review will take a closer look at the simulated data provided by the company to determine the Nutmeg Investment performance.

All of the numbers we will cover are based on a larger account size of £25,000 after fees with the average rate paid by Nutmeg finance customers. The all-time statistics for each portfolio cover the time period between October 2012 and June 2016.

At the lowest risk portfolio, level one, you don’t expect to see much growth because it is far more conservatively invested. The objective is to maintain your initial investment and keep losses to a minimum.

As a result, they post their all-time increase at 6.2 percent. For those interested in more moderate growth, a mid-level portfolio might be a better fit. Their level five portfolio boasts a 22.4 percent increase over all-time as opposed to a 20.2 percent increase for a similar portfolio from a company that would be an alternative to Nutmeg.

On the highest end of the spectrum, level ten, clients can expect to see a much greater return on their investment. However, keep in mind that there is a lot more volatility with a risk level this high.

Their statistics show a 39.1 percent level of growth compared to just 30.3 percent from another company that would be an alternative to Nutmeg.

For more detailed breakdowns of the various Nutmeg Investment performance analysis, see the chart below with the returns listed for each of the risk levels.

You may also want to view the graphs available through the company’s own Nutmeg Investment review here.

Nutmeg Investment Performance Breakdown

Nutmeg Risk Category | Percentage Returns | Nutmeg Competitor Returns |

1 | 6.2 | Not available |

2 | 11.7 | Not available |

3 | 15.8 | 13.4 |

4 | 20.0 | 13.4 |

5 | 22.4 | 20.2 |

6 | 24.4 | 20.2 |

7 | 28.6 | 25.7 |

8 | 31.7 | 25.7 |

9 | 36.0 | 30.3 |

10 | 39.1 | 30.3 |

Table: Nutmeg Investment Performance Breakdown

Nutmeg Investment Review of Fees

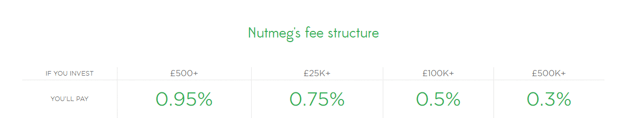

Even if it sounds like Nutmeg Finance might be the best robo advisor for your particular needs, it’s imperative to consider the financial aspect of what their fee structure entails.

Paying too muc in fees over the years can seriously eat into your money’s growth potential.

However, we think that you’ll agree that the fees in the Nutmeg Investment review are pretty competitive with those that would an alternative to Nutmeg.

Like many online investment companies, Nutmeg Finance assigns fees based on a tiered system. The rate you pay is based on your total contributions into accounts with the company (both ISAs and pensions) and can then be applied to the total balance of your portfolio.

For detailed information on how the fees are broken down, see the chart below. Each percentage also includes VAT, so there are no additional charges here.

Source: Fee – Nutmeg.com

Because Nutmeg Finance attempts to be so transparent with their anticipated costs, they also give an underlying fund cost openly. Compared to the average fund cost of 1.43 percent for UK active funds, their Nutmeg Investment review is quick to point out that theirs is substantially lower at just 0.19 percent.

You pay no trading fees on the investments you make with them nor do you pay for them to rebalance your account on a regular basis as necessary.

Related: List of Top-Rated Best Advisors and Wealth Managers (US & UK)

Opening a Nutmeg Investment Account

If you wish to open up an account with Nutmeg Investment, setting up your account is absolutely free and takes less than ten minutes to complete. Because it is online, one of the major advantages of using a robo advisor is that it can be completed whenever it is convenient for you as opposed to scheduling an in-person meeting with a traditional financial advisor.

If you want to open a Nutmeg ISA, be prepared to deposit at least £500 for your initial balance, as well as £100 monthly until you reach at least £5,000 in your account. Opening a pension account requires a much larger initial deposit of £5,000 or more in order to adequately set up your account.

If you have a stocks and shares ISA or an ISA with a different company that you would like to transfer to Nutmeg, you can transfer those accounts onto the platform. This allows you to receive a Nutmeg Investment review of all your holdings and get a clearer picture of what to expect from your overall investment strategy.

The fees that are incurred on your account will be deducted directly from your account without any additional deposits or payments to be made on your end. They are collected on a monthly basis according to the annual rates that are assigned to the overall value of your investment portfolios with Nutmeg Finance.

You aren’t locked into using the services with Nutmeg Investment. If you find that it isn’t for you, or you just need access to the funds you’ve deposited into your Nutmeg ISA sooner than you anticipated, you can withdraw those funds at any time.

Withdrawing money from your pension account is subject to the rules governing all pensions. However, you can roll it over to another provider or investment company if you desire to do so.

Popular Article: Best Financial Advisers in Leeds, UK

Conclusion: Nutmeg Investment Reviews

Nutmeg Finance, created by Nick Hungerford, is one of the top choices for an online investment portfolio and robo advisor. Particularly popular among new investors or those who prefer to have someone else take charge, a Nutmeg Investment review can carefully track the overall success of your investments and Nutmeg Investment performance shows this to be a wise investment.

It requires very little in terms of fees and minimum deposits.

If you’ve been considering jumping into the world of robo advising and investing with one of the new and upcoming UK online investment companies, you may want to consider conducting your own Nutmeg review to determine if their services are right for you.

Create a profile free of charge to see what Nutmeg Investment can do for your long-term wealth building.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.