Overview: Do You Want to Open a Checking Account Online? What You Need to Know

Online banking has become the norm in America. Even if you did not specifically open a checking account online, you are probably accessing your current checking account via your computer or mobile phone app or through phone banking.

Doing banking online is a wonderful convenience for customers in order to avoid hassles like lunchtime lines at the bank and fiddling around at the ATM in bad weather.

However, do not forget that banks are promoting online banking for their own convenience as well. Online banking actually pushes the work onto the customer, massively reducing operating costs for banks.

Should I Open a Checking Account Online?

The banks want you to be doing your banking online – but does that mean it is good for the customer too?

As always, AdvisoryHQ is here to answer all the questions you have! In this article, we will look in depth at:

- How to open a checking account online

- Whether is it safe to open online checking accounts

- Review online banks with high interest rates

- Where to find the best online interest rates

- Which banks offer high interest online savings

See Also: Banks with Free Checking Accounts | Top Ways to Find Free Checking Account Banks

Have Your Documentation Ready

Although online banking is convenient and quick, when you want to open a checking account online, banks are still required to verify your identification, address, and some other details in order to process your request for a new account.

In order to open an online checking account, if you do not already have an account at the bank you are opening an account with, you will most likely be asked to provide supporting documentation and information, including:

- An ID, such as a driver’s license or state ID

- Proof of citizenship or residency

- Social Security number

- Utility bill (at least one) with your name and address on it

- Date of birth

Some Restrictions When Going to Open Online Checking Accounts

The verification process to open a checking account online may have some extra hoops to jump through if:

- You are under 18

- You have no credit history

- You have had previous issues with credit

- You are not a citizen

- Your account is for business

This will vary from bank to bank, each of which has different rules and regulations for customers who open online checking accounts.

Don’t Miss: How to Find the Best Banks with Free Checking and No Minimum Balance

Deposits and Withdrawals

The reason that you are going to open a checking account online is convenience, right? However, when it comes to depositing and withdrawing cash, it is not always so easy. While online banks can promise you higher interest rates and lower fees, it may be difficult to find a location to deposit or withdraw cash.

ATMs: When, Where, How Much?

When you open a checking account online, some banks entice you with easy apps to find the nearest ATM available. What you may not realize is that you could be charged a fee for using a branded ATM.

However, banks are evolving to meet the needs of customers in this technology-driven environment and will facilitate depositing checks; for example, by post – or even by taking a photograph of the check with your smartphone!

In fact, a Federal Reserve Payments Study released in 2014 showed that over half of the checks deposited in American banks were done so via smartphone. Banks that facilitate this type of depositing include:

- Chase Bank

- PNC Bank

- Citibank

- Wells Fargo

- Bank of America

It is notable that each of these banks will have different rules and regulations; for example, the format in which the photos can be submitted, the quality of the photos, and the amount that can be deposited using this method.

Related: The Best Checking Accounts This Year | Tips to Finding the Best Bank for a Checking Account

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Interest

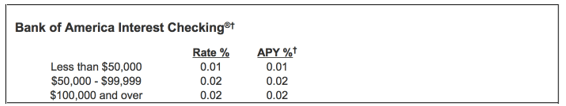

Many traditional, brick-and-mortar banks nationwide do allow customers to open online checking accounts. However, in most cases, if the institution is a large, traditional organization, the interest rates will also be traditional on checking accounts (whether they are opened online or not) – and these are traditionally low.

Source: Bank of America

Online Bank Interest Rates

If you are after the best online interest rates, you may want to look at online banks. Online bank interest rates can be higher because these institutions have lower overhead costs.

Bank5Connect is an online-only bank. In comparison to Bank of America’s 0.01% rate, its online bank interest rates are 76 times higher, offering one of the best online interest rates, at 0.76%.

Best Online Interest Rates: Think Outside the Box

As institutions move online, they, too, are evolving and moving even further away from the custom idea we have of banking. One example of this is an interesting organization called Aspiration.

Aspiration describes itself as, “a new kind of investment firm – built on trust, focused on the middle class instead of millionaires, and founded on the idea that we can do well and do good at the same time.”

So, why are we telling you about a new investment firm when you are looking for information to open online checking accounts? If you are looking for the best online interest rates, this might be your answer! As well as an APY of up to 1% on checking accounts, Aspiration promises access to any ATM in the world, and the company also uses its profits to make charitable donations.

Image Source: Aspiration

Look at Maintenance Fees

Something to look out for is maintenance fees. Even if you do find online banks with high interest rates, before you open a checking account online, have a look at the fees involved in maintaining the account.

Simply put, you will be paying $120 a year in fees unless you make at least 10 purchases from your debit card per month, have a relevant debit card or fulfill various deposit and balance requirements.

When Online Savings Interest Rates Don’t Matter

Even if your bank is promising high yield online savings, if you are paying fees every month, having the best online interest rates may not be of any benefit to you. The Simple Dollar recently reviewed the best free checking accounts available, and it named Capital One 360 as its number one recommendation.

Simple Dollar states that if you want to open a checking account online, then Capital One 360 has a lot to offer. The features of this online checking account include:

- A huge choice of ATMs to use

- A good mobile app

- No foreign transaction fees

- Free online banking

- 24/7 live customer support

Popular Article: No-Fee Checking Accounts | Top Tips to Finding Checking Accounts with No Fees

Online Savings Account Interest Rates

If you are really determined to make some money on your money, think about opening a savings account. Banks do not traditionally offer high yield online savings with checking accounts because checking accounts are so liquid and are intended for daily use.

Savings accounts are designed for you to accrue interest on your money. Online savings account interest rates can be really promising for customers who have a bit of money to put aside for a while.

The good news is that you can open a checking account online as well as get another account with online savings interest rates at the same time! Banks know that, in the current economic climate, people are looking for low-risk ways to save but also need an easy way to pay bills and move their money around. This is why banks offer several types of accounts depending on your needs.

Best Online Interest Rates

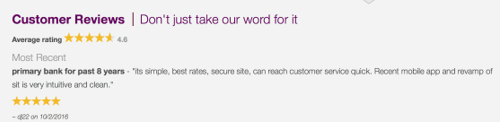

When it comes to the best online savings account interest rates, Capital One 360 comes out on top again with an offer of 1% on deposits of over $10,000. This is well above the average interest rate of 0.6%.

Online savings interest rates are staying steady in the 1% region, so there are lots of choices out there for those looking for high yield online savings.

- Ally: This popular bank, which is a member of the FDIC, also offers high interest online savings with 1% APY and a promise of no maintenance fees. Interestingly, it has nearly 7000 online reviews of its products, with 94% of reviews recommending the product.

Image Source: Ally

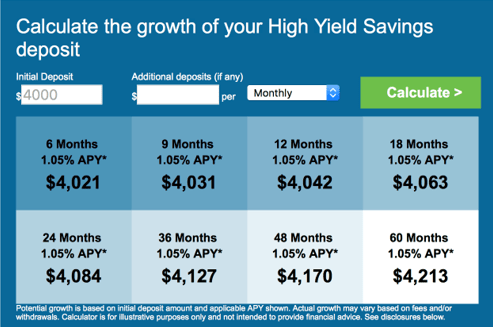

- Synchrony Bank: Synchrony is advertising above average online savings account interest rates, with a slight increase on the others, with a 1.05% APY. Its easy-to-use online savings interest rates calculator will let you quickly find out how much you can make depending on the amount you are able to deposit.

Image Source: Synchrony

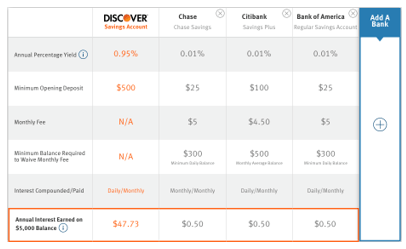

- Discover Bank: Another bank guaranteeing high-interest online savings is Discover Bank. On its site, it offers an easy way to compare the best online interest rates with other banks as well as giving you a snapshot view of the actual yield – not just confusing percentages!

Image Source: Discover Bank

Read More: Best Online Savings Account | How to Find the Best Online Savings Account in This Year

Safe Ways to Open Online Checking Accounts

Although banks are embracing the world of technology and the consumers’ demands for online banking, there is a downside. It may be easy to open online checking accounts, but online bank fraud is also increasing at a rapid rate.

Before you get sucked in by the promise of high yield online savings, make sure that you are satisfied with the terms and conditions, including who is liable if something goes wrong.

The Guardian reports that one in ten banking customers falls victim to fraud. Some high-level financial and technology experts themselves refuse to open a checking account online. One such expert is Professor Ross Anderson of Cambridge University in the UK, who does not trust online banking.

This is because of:

- A huge increase in online banking fraud year on year

- Liability moving from the bank to the customer

Luckily, in the US, the government has stricter regulations which cap the customer’s liability at $50, so you do not need to be deterred if you are going to open a checking account online. For all the details on Regulation E, check out the Federal Reserve website.

Nonetheless, it is advisable that you check out the small print when it comes to liability to ensure that your money is safe. What you should be looking for is $0 or a very small liability when it comes to unauthorized transactions on your account.

One good example comes from HSBC Bank, which guarantees $0 liability on credit card and bank account fraud. However, when checking the fine print, it indicates that the $0 liability may be in jeopardy if you:

- Have a business account that is not covered by Regulation E

- Do not report suspected fraudulent activity within 60 days

- Do not report a stolen PIN or password

- Do not take the appropriate steps to protect your account (e.g., firewalls)

Find the Right Bank for You

You might not be comfortable with the idea of your money being somewhere on the Internet and may prefer human interaction in a solid building with doors and windows. However, all around you, banks and customers are embracing technology, and unless you want to put your cash under your mattress, you are going to get left behind.

Image Source: www.rd.com

You shouldn’t worry if you are new to Internet banking and want to open a checking account online. The banks understand that there is a huge proportion of the population that does not know how to download a bank app and may not trust sending a photo of a check through a mobile device.

That is why banks are, for the most part, offering a lot of handholding to support customers who need assistance in using online banking effectively and safely.

Scotia Bank’s landing page offers comfort to first-time online bankers: “We know how intimidating opening a bank account online can be, so we are happy to answer any questions you may have to get started.”

So, aside from looking for online banks with high interest rates, make sure that you are happy with the customer service that they offer so that you can continue to bank safely and comfortably.

Final Recommendations to Open an Online Checking Account

As with all banking-related issues, the first thing you should do is read the small print. It is easy to open an online checking account if you can provide the appropriate documentation, have the required minimum deposit amount at hand, and agree to the terms and conditions of the bank.

Checking accounts have historically low interest rates, but you can find a good deal if you look around for online banks with high interest rates. Remember, the best online interest rates may not be with “banks” at all, but with new types of institutions, such as investment organizations, that also offer daily banking.

If you are looking for high yield online savings, opening a savings account might be a better option for you. Online savings account interest rates are often higher than those of checking accounts.

Before you open a checking account online, make sure you are happy with the following:

- Interest rate

- Maintenance fees

- Customer service

- Deposit and withdrawal facilities

- Liabilities

By following these simple steps, your banking experience can become easier and more rewarding than ever, with the first benefit being no more lines!

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.