Comparison: OptionsHouse vs Scottrade

If you have ever decided to try your hand at online investing, it was probably hard to choose between brokerage firms, each one claiming to provide the best value for your money.

We are here to provide a little help: a side-by-side comparison of OptionsHouse vs Scottrade.

Image Source: OptionsHouse vs Scottrade

We will also describe in detail various OptionsHouse fees for trading, along with Scottrade fees and how they compare. We will mention certain significant Scottrade or OptionsHouse complaints voiced by customers or experts.

Finally, we will examine the pros and cons of Scottrade and the OptionsHouse trading platform and what they offer in terms of statistics and analytical power.

Is Scottrade good for your online business? Is OptionsHouse better? Hopefully, we will have clear answers to those questions by the end of our analysis.

See Also: First Choice Capital Resources Review

Online Brokerages in 2016

The Scottrade vs OptionsHouse analysis should be considered in the context of the developments in online brokerages in 2016.

The year started with heartbreak for online investors. Shares from the Standard & Poor’s 500 index dropped by more than 10% on the average, in the worst January since 2009. By March, they almost completely recovered, but it has been a rough ride. And the difference between success and failure is the right information.

Speaking of information, its safety has increased. In 2015, Scottrade reported a breach that affected contact information of almost 5 million customers. Before you start thinking that the OptionsHouse vs Scottrade match is over before it even began, we should be fair and say that several other major brokerages had the same problem.

In the meantime, brokers have reinforced their information encryption schemes. They use overlapping systems, which means that a hacker would have to push through several security levels before reaching the data.

A hot topic in 2016, and one of the elements of the Scottrade vs OptionsHouse rivalry, is the quality of their offer on mobile devices. In this respect, OptionsHouse has some exciting features, which we will discuss later.

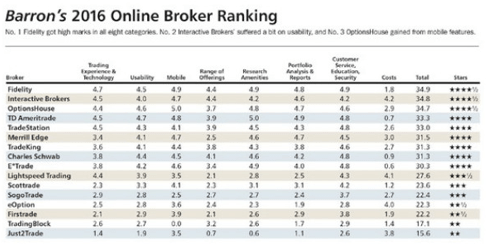

To check all kinds of indicators relevant for our OptionsHouse vs Scottrade analysis, we will use Barron’s Online Broker Survey 2016. This invaluable tool compares the top 16 online brokers in a multitude of categories. It is a huge list, but it is a must-read for anyone who wants to get serious about trading online.

Don’t Miss: iContact Review – What You Should Know Before Using iContact

Investing with Your Mobile Phone

Professional traders do their business in front of iconic multi-monitor workstations. But most of today’s casual customers are interested in mobile trading. There has been a boom in mobile apps for all kinds of investing tasks. In fact, only one of Barron’s top 16 brokers does not have a mobile offer (shame on you, TradingBlock!).

The OptionsHouse trading platform supports iOS, Android, and Windows mobile operating systems. Instead of Windows, Scottrade supports Kindle Fire. We might say that the present of mobile trading belongs to OptionsHouse, but the future might belong to Scottrade.

Regarding other OptionsHouse vs Scottrade mobile services, OptionsHouse beats Scottrade by offering multi-leg options, mutual fund trading, and account application. On the other hand, Scottrade offers international trading.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Do They Stand Out Among the Top 16?

Before we move on with the Scottrade vs OptionsHouse comparison, let us check how they fare in Barron’s top 16. First of all, neither is the overall winner: that honor goes to Fidelity Investments.

Source: Barron’s

Clearly, OptionsHouse fares much better than Scottrade, snatching third place overall, with four and a half stars. Scottrade occupies the lower half of the table, with three stars.

If we take a look at specific categories, OptionsHouse is on top again: it is the best broker for options traders. Scottrade comes into its own in the in-person service category, where it is second.

Related: IdentityForce Reviews – What You Should Know Before Using Identity Force

What About the Top 5?

Another site with interesting lists of top brokerages is Investors.com, which chose to make Top 5 lists in various categories.

We should note that neither company made it to the most important list: the five brokerages with the top overall customer experience.

Regarding the specific Top 5 lists, OptionsHouse fees and Scottrade fees were considered good enough to bring both companies into the Low Commission & Fees category. Things are balanced in general, since the OptionsHouse trading platform made it into the Options Trading Platform category, while Scottrade was included in the Customer Services category.

All these top lists just go to show that Scottrade vs OptionsHouse is a small part of a wider, fierce fight for customers among various online brokerages.

The Crucial Matter of Fees

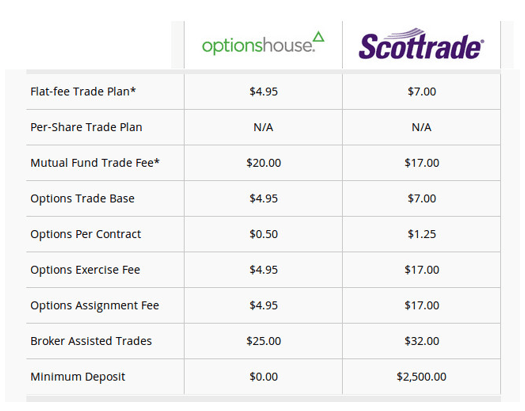

We are not exaggerating when we say that fees are the single most important factor for most people when choosing an online brokerage firm. To compare OptionsHouse fees with Scottrade fees, we used the handy table made by StockBrokers.

Source: StockBrokers

Actually, OptionsHouse fees for stock trades (a flat rate of $4.95 per trade and $4.95 + $.50 per contract for options trades) are much cheaper than all the big brokerage firms. In fact, OptionsHouse fees are number one in the entire industry, which is no small feat.One glance at the table reveals that the Mutual Fund Trade Fee is the only category where OptionsHouse is more expensive than Scottrade. In all the other categories, OptionsHouse fees are lower than Scottrade fees; no wonder there is such a difference in the total score.

In 2016, moreover, OptionsHouse has introduced the Dime Buyback program: if an option price amounts to $0.10 or less, the customer can close the position with no commission. Very handy!

Popular Article: Identity Guard Review | Get All of the Facts Before Using Identity Guard

Why is Scottrade So Expensive?

If we go back to the Barron’s list, we will see that the monthly trading costs (6 stock trades, 2 options) are $49.60 in OptionsHouse fees but as much as $81 in Scottrade fees! In fact, almost every item costs more at Scottrade.

Considering the Scottrade fees above, it is no wonder that the company earned a place among the five brokers with the highest monthly costs, both for occasional traders ($81) and for frequent traders ($2,838).

Such high fees might indicate a better service, you might say. But is Scottrade good enough to justify such exorbitant fees? We will find out right away, as we concentrate on the trading platforms.

Trading Platforms: Charts and Quotes

OptionsHouse has a simple interface where it is easy to pull up quotes. However, streaming charts are less clear and harder to customize. When we consider their narrow choice of tools and studies, streaming charts are disappointing.

Still, the customers of the OptionsHouse trading platform can sell on the chart itself, which is rare among online brokers, and they can see their past buys.

Scottrader has two platforms, Streaming Quotes and Scottrade ELITE. You must have $25,000 or more in your account to use Scottrade ELITE.

Streaming Quotes is easy to use and has nice company profiles, but there is one major issue: it was programmed in Java, a computer language that has fallen out of fashion and cannot be used on Google Chrome or Windows Edge.

Trading Platforms: Options

Not surprisingly, considering its name, the OptionsHouse trading platform has great options capabilities. But the most interesting among them is strategySEEK, which shows the option screener. Offering simple commands, it lets the user drag and drop to set the price. Then the user can check the appropriate strategies, place the trade, analyze it, or start again.

OptionsHouse has a big and impressive spectrum of tools for options traders. The customizable streaming option chain has thirty optional columns.

When the user wants to analyze an option, a window pops up showing risk and reward, a chart, key events, and emoticons revealing the good and bad sides of the option. The OptionsHouse trading platform also includes a spectral analysis of the data. A simple and intuitive interface lets you customize options and move them around freely.

Scottrade had a tool for option trading called OptionsFirst. Yes, it was what it sounds like: a program made in conjunction with OptionsHouse. When the two companies broke their partnership in April 2015, Scottrade partnered with Interactive Brokers to use their platform (not the best of solutions).

Trading Platforms: Research

Scottrade’s third-party research is below average, with too few third-party provider reports. It does offer SmartText, an analysis tool that gives the user simple explanations of what charts, industries, and earnings mean. This robotic investment advisor is a unique feature of Scottrade.

OptionsHouse provides stock research with information about companies. However, there were OptionsHouse complaints claiming that the research function was unclear and hard to understand.

What is more, OptionsHouse provides only Fundamental Report Cards, with no comparisons with other companies, no third-party research reports, and no SEC filings.

In short, research is weak in both companies, but Scottrade wins this round of Scottrade vs OptionsHouse because of SmartText.

Read More: Lexington Law Reviews – Get all the Facts before Using Lexingtonlaw.com

Free Wealth & Finance Software - Get Yours Now ►

Where OptionsHouse Shines: Mobile Trading

In 2015, OptionsHouse introduced Trigger Alerts, becoming the first brokerage that lets its users pair custom orders with price alerts. In plain language, it means that the app lets you set up an order based on a particular market move.

For example, you can tell the app to buy a thousand shares of General Motors when Ford falls 5%. Once Ford shares have fallen, your mobile will launch an alert and ask you whether to move on with the order.

Even though it is an extremely useful feature, we noticed some OptionsHouse complaints regarding the app. The orders cannot be set in the app itself; the customer must use the OptionsHouse trading platform on the web. Also, it is hard to see the Alert Manager in mobile, because it is hidden under Settings.

Where Scottrade Shines: Customer Support

If you hate help manuals of any kind and need to hear a live person explain things to you, Scottrade is definitely the winner. The company has an impressive network of five hundred local branch offices.

When you call, they ask for your zip code, and you get automatically redirected to your local office with competent staff. We guess that is where the extra money from Scottrade fees goes.

They only work during office hours, however. There is no phone support around the clock like in several other brokerages.

Conclusion: We Have a Winner, But…

If you have read the entire article, you may have noticed that OptionsHouse outperformed Scottrade in most areas.

- OptionsHouse fees are significantly lower than Scottrade fees on the average.

- Compared to the OptionsHouse trading platform design, Scottrade looks outdated.

- OptionsHouse has a better mobile offer.

Despite falling behind OptionsHouse, Scottrade is not a bad online brokerage, but its main strength lies in the offline part:

- Customer service

- More than 500 local offices

This old-school approach should appeal to a significant segment of traders.

This wraps up our analysis of Scottrade vs OptionsHouse. It is hard to tell which brokerage would be more suitable for a specific customer because of the specific features they might need. However, you should be better off with the OptionsHouse trading platform in general.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.