An Overview of 10 Professional Liability Insurance Companies

Below is a detailed review of this year’s top professional liability insurance companies and firms.

But first, let’s quickly go over what professional liability insurance really represents.

What is professional liability insurance?

Professional liability insurance has two parts to it: (1) professional liability and (2) insurance.

1.Professional Liability: This covers the specific responsibilities that professionals take on when performing their designated roles. For instance, when an investment advisor signs up a client, he/she (the advisor) takes on the responsibility of providing good financial advice to the client. When a doctor takes on a patient, he/she has the responsibility of providing accurate and adequate care. The advisor or doctor is, therefore, professionally “liable” to deliver such advice or care, and his/her failure to do so can be deemed as negligent.

2. Insurance: The term “insurance,” broadly speaking, refers to steps taken to acquire some protection against any kind of real or perceived actions or consequences. In the context of professional liability insurance, such protection is sought against possible consequences arising out of one’s professional conduct.

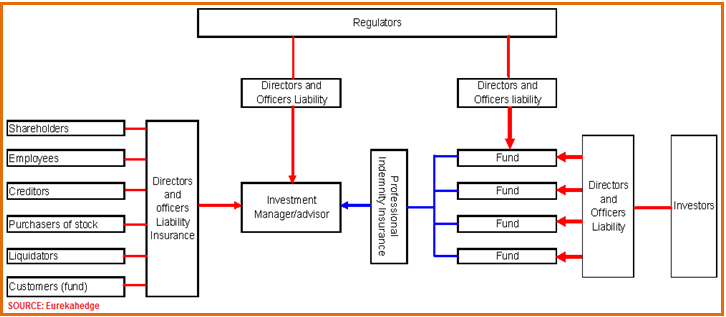

As illustrated in the diagram below (representing a hedge fund management company), professionals constantly face liability threats during the course of their work and from multiple sources.

The red lines illustrate the exposure that officers and directors of a firm face from claims arising out of a possible breach of duty.

Image Source: Eurekahedge

Such exposure can come from shareholders, employees, creditors, and even customers of the firm.

Given this huge exposure that they face, professionals involved in libelous work need some form of insurance.

Therefore, putting the sum of the parts together, we can answer the question (what is professional liability insurance?) as follows:

“It is insurance that professionals in many fields acquire to protect themselves against the consequences that might arise from conducting the business of their chosen profession.”

10 Professional Liability Insurance Companies and Firms

Except for a few professionals, most individuals delivering professional services (either directly as self-employed professionals or on behalf of an employer) opt to insure themselves against professional liability.

Professional liability insurance coverage, also known as professional indemnity insurance (PII) or errors & omissions (E&O) insurance is offered by firms specializing in the area of delivering such services.

Like all businesses, professional liability insurers come in all different shapes and sizes.

Some are local entities while others are multinational corporations.

Others offer only a restricted range of coverage, while their peers offer a gourmet of coverage.

And, still, others might offer professional liability insurance coverage to a broad spectrum of companies, while their peers simply cover selective professionals – like insurers or health service providers.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

List of Top 10 Professional Liability Insurers

The following is a list of this year’s ten top rated insurers from a cross-spectrum of the professional liability insurance business:

- American International Group (AIG)

- Government Employees Insurance Company (GEICO)

- Hiscox Insurance Company Inc. (Hiscox)

- American Professional Agency, Inc. (APA)

- The Ace Group (ACE)

- North American Professional Liability Insurance Agency, LLC (NAPLIA)

- Chubb Group of Insurance Companies (Chubb)

- Great American Insurance Group

- Marsh USA

- Allied World Insurance

Detailed Overview of the Selected Top 10 Insurers

American International Group, Inc. (AIG) operates in over 130 countries and is one of the leading professional liability insurance companies in the world today.

The company has been operating for over 95 years and has over 98% of Fortune 500 companies as its clients.

Working through a network of 64,000+ employees worldwide, the company provides unique liability insurance products for various professions and business areas, including architects and engineers, bankers, lawyers, educators, healthcare professionals, investment managers, and IT professionals.

In 2008, AIG faced the most difficult financial crisis in its history.

Because of AIG’s size and scale of operations in insuring the US and global companies and individuals, the consensus amongst financial regulators was that a collapse of AIG would wreak havoc on the US and global economies with a risk of a far more severe recession – depression.

To prevent such a dire situation, the United States Federal Reserve Bank stepped in with a secured credit facility of up to US$85 billion to prevent AIG’s complete and total collapse.

Since 2008, however, AIG has undergone a series of major company-wide, transformational changes.

According to the 2014 Forbes Global 2000 list, AIG is now the 42nd-largest public company in the world.

As of 2015, AIG’s market capitalization has risen to over $70 billion.

Government Employees Insurance Company (GEICO) is a wholly-owned subsidiary of legendary investment guru Warren Buffets’ Berkshire Hathaway and employs over 30,000 associates in 14 major offices across the country.

Created initially to cater to the needs of U.S. government and military personnel, the company now provides a whole range of insurance products and services to the broader private sector.

Its insurance services/products include professional liability insurance for beauticians/salon services, personal trainers, travel agents, management/business consultants, family/mental health counselors, career/business trainers and coaches, photographers, real estate/property managers, and many other professionals.

Coverage includes such clauses as “negligence,” “defense costs,” and “services previously performed.”

Hiscox Insurance Company Inc. (Hiscox) is a company that’s headquartered in Bermuda but delivers a diverse range of insurance services across all of the United States and in 11 other countries.

The company traces its roots back to 1901 and delivers professional liability insurance to its clients through a network of brokers.

In partnership with Lloyd’s, Hiscox has been insuring businesses in the U.S. for over 40 years.

The company offers professional liability insurance to cover specific risks within each industry, ranging from accounting and business analysts to contractors, consultants, researchers, and translators.

Amongst the types of risks covered include negligence, intellectual property infringements, loss of professional documents/data, dishonesty, and defamation.

American Professional Agency, Inc. (APA) is a company that specializes in providing professional liability insurance to individuals working in a unique niche – the mental health field.

Amongst the professionals covered include social workers, psychiatrists, psychologists, addiction counselors, mental health counselors, marriage and family therapists, psychoanalysts, social service agencies, school psychologists, clergy and pastoral counselors, hypnotists, and many other similar professionals.

The company started business operations in 1940 and prides itself in its use of technology and the extensive years of experience that its 65+ person staff brings to bear when serving its clients.

Ranked amongst the top insurance brokerages in the U.S., APA services over 110,000 policyholders.

APA delivers its services through insurance partners that include Allied World Assurance Company Holdings and AIG.

The Ace Group (ACE) is a company that delivers a diversified range of insurance services and products, including professional liability insurance across the U.S.

ACE also has a physical presence in 53 countries around the globe.

The company, through its specialized subsidiaries, such as ACE USA, ACE Private Risk Services, ACE Commercial Risk Services, Ace Tempest Re, and Combined Insurance, caters to the insurance needs of both individuals and businesses.

ACE offers errors and omissions professional liability insurance to a broad range of professions, including auctioneers, architects, engineers, contractors, education professionals, public service employees, and zoological consultants, amongst others.

North American Professional Liability Insurance Agency (NAPLIA) specializes in delivering professional liability insurance to professionals throughout the United States.

Specific services include accountant professional liability, third-party administrator (TPA) errors & omissions (E&O), Registered Investment Advisor E &O, attorney E&O, bookkeeper E&O, IP attorney E&O, employee dishonesty insurance, and open multiple employer (MEP) bonding solutions.

Chubb Group of Insurance Companies (Chubb) offers a unique set of professional liability insurance services to an even more unique clientele –other insurance companies.

It is not uncommon to have insurers get hit by lawsuits claiming (alleging) errors and omissions as the chief cause for a client’s losses.

The company offers a single platform to cover an insurance company’s employees, officers, and directors against a wide range of professional liability scenarios, including wrongful sales practices, allegations of bad faith, and other professional negligence situations.

Great American Insurance Group, through its Professional Liability division, provides professional liability insurance services to non-medical service providers.

This service offers protection to these companies against allegations of errors and omissions by the firm’s employees or contractors working on their behalf.

The company also offers a related professional liability insurance service through its Executive Liability division that delivers protection to senior company officeholders against risks such as directors & officers liability, employment practices liability, and fiduciary liability.

Marsh USA is a wholly-owned subsidiary of publicly-traded company March & McLennan Companies (NYSE: MMC) and specializes in global risk management, insurance services, and mitigation strategizing.

Operating in over 130 countries, the firm’s 26,000+ employees include not just coverage specialists but also economists, actuaries, and attorneys.

This allows Marsh to offer truly informed insurance advice and services for professionals seeking liability protection.

Through its Financial and Professional Liability Practice (FINPRO), the company offers a comprehensive package of professional liability insurance services that serves professionals in the banking, insurance, accounting, architecture, engineering, accounting, communications, media, entertainment, technology, biotechnology, and healthcare industry, amongst others.

Free Wealth & Finance Software - Get Yours Now ►

Allied World Insurance offers professional liability insurance to a specific segment of the insurance and business world – insurance companies with annual gross written premiums (GWP) in excess of $2B per year.

Designed specifically to handle the risk profiles of highly complex insurance companies and other risk transfer businesses, the firm’s Insurance Company Professional Liability (ICPL) service offers a broad spectrum of features to policyholders, including choice of defense counsel, coverage against prior acts, multiple retention options, and extra-contractual coverage.

A Matter of Tradeoffs

Once business owners and leaders understand the answer to the question (what is professional liability insurance?), the next obvious question to follow with is: Do I need professional liability insurance?

And the answer is: Most likely, yes!

Like any other form of insurance coverage, professional liability insurance is all about making trade-offs between:

- The likelihood that a libelous act of professional misconduct will happen

- The cost of dealing with such acts

Versus:

- The cost of paying the premiums associated with acquiring professional liability insurance protection against the consequences of such acts

There is no easy answer as to whether one should get insured for professional liability.

The general rule of thumb for making the decision as to whether one should be insured or not usually comes down to:

- Whether it is a general practice in the industry that many do business with

- Whether clients, business partners, and financers expect a company they do business with to be insured

- Whether the business environment is such that (even though peer groups may not deem it so) it is prudent to acquire professional liability insurance

Generally speaking, not all areas of a firm’s operations are susceptible to libelous actions.

Another aspect of the trade-off, therefore, would be to decide what specific areas of the firm or which specific individuals should be insured.

We hope this article has been helpful in your search for a top insurer.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.