What are Wealth Management Services? Definition

The term “wealth management services” has acquired greater significance today, post the 2008 financial crisis, than it ever had during the pre-crises days.

Why?

Because after going through the horrors and nightmares of financial stress of epic proportions, wealthy individuals (often referred to as High Net-Worth Individuals or HNWIs) realize now, more than ever before, that they need professional wealth management services to better protect and manage their wealth!

But what exactly are these services, and how do they help HNWIs? Let’s explore these questions in greater detail to find out.

Image source: Freeimages

Image source: Freeimages

Servicing the wealthy

Many of you operate your own bank accounts.

You may also create, manage and track your own investment portfolios.

And sometimes, you could even build complex spreadsheets to figure out how much you are earning, spending and saving.

But once your personal wealth grows beyond a certain limit, and you enter the HNWIs category (technically HNWIs are those with $500,000+ in assets),”doing it yourself” might get complicated.

Professionals providing wealth management services offer a wide range of services to their HNWI clients. HNWIs turn to these professionals because they (HNWIs) may:

• Not have the time to manage their own wealth anymore

• Don’t have the same level of knowledge, as the experts offering wealth management services, to do it themselves beyond a certain point

• Don’t have the professional networks required to do it well

A professional wealth manager takes on the responsibility for ensuring that his/her client’s wealth is protected, and grows over time, in line with the clients’ vision and needs.

All activity required to achieve those objectives are either carried out by wealth managers, or coordinated with the help of other professionals, as part of wealth management services.

Not every financial advisor is a wealth manager

Often, in the U.S., professional designations such as Certified Financial Planner (CFP), Chartered Financial Consultant (CFC) or Chartered Financial Analyst (CFA) are needed to deliver wealth management services to clients.

And surprisingly, it’s not just the BIG financial giants, like UBS, Merrill Lynch, JP Morgan or Goldman Sachs that offer wealth management services to their clients.

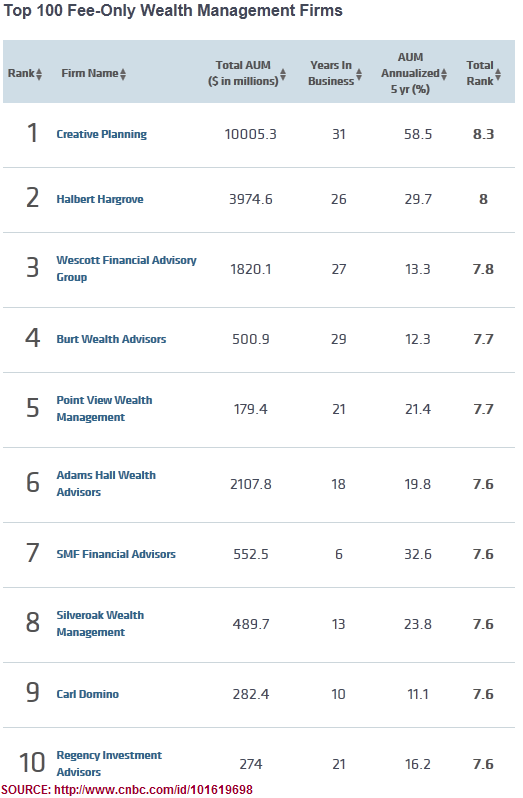

There are a number of lesser-known entities that manage their client’s wealth on a Fee-only basis.

Image source: CNBC

Granted that each wealth management firm may have differing management styles, and they may all have varying levels of personal wealth thresholds for individuals to qualify for their services (starting from $250,000 upwards).

However, they all work toward the same objective: Protecting and growing their client’s wealth.

Services for the wealthy

So what are some of the wealth management services that HNWIs usually require?

Let’s take a closer look at the 5 most common ones that wealth managers offer:

FINANCIAL PLANNING:

In broad terms, comprehensive wealth management services often start with a Financial Plan.

This is a document that seeks to formalize (in writing) the financial goals and objectives (short-term, intermediate-term and long-term) of the client, and then lays out a detailed road map for how to achieve them.

The plan may address goals like: Debt Reduction, Homeownership, Income and Investment goals, Retirement Plans etc.

INVESTMENT PORTFOLIO PLANNING:

Once an investment portfolio grows beyond a certain limit, untrained HNWIs need wealth managers to review, restructure and manage the portfolios.

Providers of professional wealth management services will structure investment portfolios to correspond with, and compliment, a clients’ Financial Plan.

Not every investment will further the goals set out in the Financial Plan, and only a qualified professional can offer advice on such matters.

TAX PLANNING:

Depending on how much wealth has been accumulated over time, and what types of investment vehicles have been used in the portfolio, HNWIs may be saddled with a significant tax bills each year.

One of the wealth management services includes strategies to reduce, avoid or defer tax payment in ways that are beneficial for the client.

PRIVATE BANKING:

HNWIs sometimes have extremely complicated banking needs, including creating and managing off-shore bank accounts, storing high-value possessions in vaults and safety deposit boxes, and acquiring, setting up and managing specialty financial products.

Some wealth advisors may also include “personalized concierge serves” as part of their wealth management services to private banking clients.

ESTATE PLANNING:

Ultimately, no one (even HNWIs) can take it all with them when the time comes! And planning now for the inevitable is what Estate Planning is all about.

Professional wealth managers will work with HNWIs to ensure their assets are passed on to survivors/heirs in accordance with their clients wishes.

They may act as executors to the will, or as trustees to operate Trust Funds that may have been set up to manage their assets after the pass away.

Estate planners will always strive to minimize estate taxes and fees on their client’s assets.

Conclusion

Wealth management services might also include a large number of services not covered here.

For instance, if a HNWI also owns a large business, wealth managers often provide financial advisory and planning services – such as commercial banking – to their clients. In short, any financial service that might provide a client peace of mind can become part of a comprehensive wealth management offering.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.