Intro – Peoples Bank Reviews & Ranking

AdvisoryHQ recently published its list and review of the top banking firms in Washington, a list that included Peoples Bank.

Below we have highlighted some of the many reasons Peoples Bank was selected as one of the best banking firms in Washington.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Peoples Bank Review

Peoples Bank was started in 1920, and, today, this bank serves communities throughout Washington, yet the values and principles remain the same. Central to everything Peoples Bank does is a dedication to excellent customer service and longstanding core values.

This leader among Washington banks keeps a diversified loan portfolio to minimize risk and maintain stability. It’s also well-capitalized, and it funds loans in the community through gathering deposits in markets served.

Peoples Bank operates 25 locations and three loan offices throughout the state of Washington.

Photo courtesy of: Peoples Bank

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Banking Firms

Upon completing our detailed review, Peoples Bank was included in AdvisoryHQ’s ranking of this year’s best banking firms based on the following factors.

Peoples Bank Review: Personal Relationship Checking

Personal Relationship Checking is an account option available from Peoples Bank that rewards clients for doing business with it. The higher the combined balances an account holder has, including loans, the more benefits they receive.

As their account balance grows, the benefits package automatically adjusts in line with it.

Also included with Personal Relationship Checking are options to have monthly fees waived, enrollment in the Peoples Perks program, combined statements, and online transfers.

Within the Personal Relationship Checking Packages, there are Gold, Platinum, and Diamond levels, and classification is dependent on the amount of deposits a person has at Peoples Bank.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Peoples Bank Review: Peoples Perks

The Peoples Perks program is part of the package that is available to Personal Relationship Checking account holders at no extra charge. It includes everything from personal protection benefits to money-saving opportunities.

Some of the features of Peoples Perks include:

- Shopping and dining discounts from both local and national merchants

- Savings on prescriptions

- Fraud resolution services

- Payment card protection

- Travel, hotel, and entertainment discounts

- Identity theft assistance

- Up to $800 a year in cell phone protection

- 24-hour roadside assistance

- Personal identity protection

- $10,000 travel accidental death insurance

Peoples Bank Review: Consumer Marine Loans

One of the lending products available through Peoples Bank are Consumer Marine Loans. These loans provide funding to qualified borrowers who want to purchase a power boat, sail boat or charter boat.

The minimum loan amount for this program is $30,000, and funds can be used to purchase or refinance, to buy a new or used boat, to finance boats in charter or to buy wood, steel or aluminum hulls.

There are 25 and 30-year loan terms available, local loan servicing and underwriting, and competitive interest rates.

Peoples Bank Review: Mobile Cash

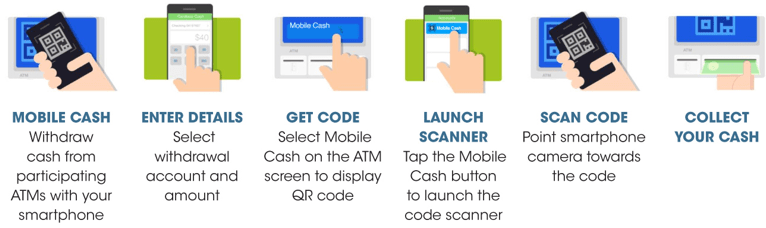

Peoples Bank offers extensive online and mobile banking options, and one of the newest features to be added to its mobile banking app is called Mobile Cash. Mobile Cash lets account holders withdraw money from an ATM quickly and securely using their smartphone so that they don’t even need their debit card.

A smartphone can be used at any Peoples ATM without having to insert a card, add a PIN or make a swipe. It saves time and also offers the utmost level of security for cash withdraw transactions.

Photo courtesy of: Peoples Bank

In addition to reviewing the above Peoples Bank review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top rated banking firms & credit unions:

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.