PersonalLoans.com Reviews – Get all the Facts before Using PersonalLoans.com

Among the many online services claiming to simplify the process of matching borrowers with lenders, PersonalLoans.com has generated significant buzz and many reviews. But in what ways does PersonalLoans.com differ from other loan companies?

The AdvisoryHQ News staff has performed a detailed review of PersonalLoans.com, and now presents their PersonalLoans.com reviews and findings to provide you with the many factors to consider before using PersonalLoans for your next loan.

Image source: PersonalLoans.com

The History of PersonalLoans.com (Reviews)

PersonalLoans.com is a subsidiary of Cash Advance, a search aggregator based out of Houston, Texas, and owned by Arrow Media, LLC. Arrow Media, LLC, is operated under the sovereign provenance of Native American Ute Tribe in Utah.

Cash Advance works exclusively online, utilizing affiliates and partners to give its customers access to a deep pool of lenders. PersonalLoans.com premiered in the 1990s and the site has grown steadily over nearly two decades, building relationships with quality lenders which allows it to offer loans from several different lending sources.

PersonalLoans Amounts and Rate Terms

Something to note before we progress further in this Personal Loans review is that PersonalLoans.com does not loan money, but rather acts to connect borrowers and lenders.

Due to the number of partnerships that they’ve established, PersonalLoans.com can provide loan services to a variety of individual borrowers who might not qualify for traditional lending.

Loan amounts start at $1,000 and can go as high as $35,000. Borrowers with credit scores between 580-720 will qualify for higher loan amounts and more borrower-friendly terms.

However, PersonalLoans.com has lenders on hand who are often able to help borrowers with a sub-500 credit score.

Personal Loans Reviews – APR and Rates

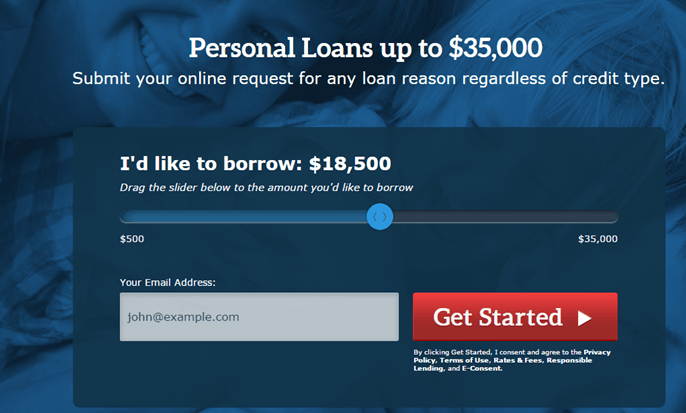

Image source: PersonalLoans.com

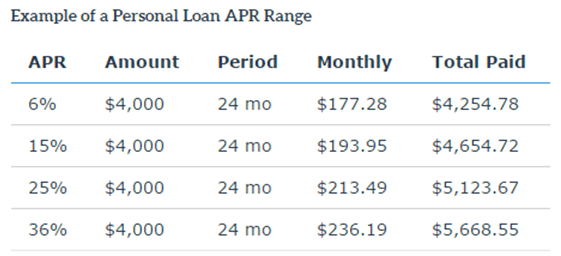

The annual percentage rate (APR) listed by PersonalLoans is the annualized interest rate that is charged on a personal loan.

The APR averages between 6% and 36% but will vary from person to person based on such factors as loan type, loan amount, repayment terms, credit score, repayment history, the state in which the borrower lives, and the specific lender loaning the money.

In addition to these requirements, PersonalLoans notes that borrowers cannot be delinquent by more than 60 days on any current loans. Borrowers must also be at least 18-years old, have a Social Security number, and be a permanent resident or a US citizen.

PersonalLoans has negotiated fixed repayment schedules ranging anywhere from six months all the way to 72 months. This feature of PersonalLoans stands in contrast to many traditional lenders whose loan terms limit repayment to within a 12- to 36-month window. Not only that, but borrowers with good credit can oftentimes choose whether to repay their loan in bi-weekly or monthly schedules.

But what if a borrower needs a loan fast and they can’t afford to pay interest for six months? They have two options:

1) Take out a short-term loan, or

2) Apply for a payday loan

Short-term and payday loans come with repayment plans that do not exceed six months, making it ideal for borrowers who are low on cash or want to pay off their loan quickly.

Another great feature of doing business with PersonalLoans is that their lenders do not charge prepayment penalties. Both short- and long-term borrowers can repay their loans prior to the due date with the satisfaction of knowing they will only be required to pay interest for the period in which the loan was outstanding.

The Process

The process of applying for a loan on PersonalLoans.com has been streamlined for all parties involved in the loan process, especially potential borrowers. In fact, borrowers frequently give high ratings to PersonalLoans’ ease of use, hassle-free interface, and quick approval time.

Visitors to the site will undergo a three-step application process, the first step of which involves entering basic biographical information. This includes name, address, loan amount, loan reason, annual income, employment, and similar information.

The second step occurs when PersonalLoans matches the borrower to a lender that fits their eligibility and loan criteria. From there, the borrower can choose which lender to work with and receive details about their loan terms. Should the lender require more information to process the loan, they will simply request it from the borrower at this time.

The last step of the process takes place after the lender processes the loan, which usually happens in 1 to 5 days. The loan amount is deposited into the borrower’s bank account via ACH (Automated Clearing House). Whether remodeling a home, buying a boat, or paying for their children’s college education, the borrower is free to use the money as they wish.

One other nice feature of PersonalLoans.com is that borrowers will never be surprised by hidden fees as the service is 100% free. However, depending on the loan type, individual lenders may charge an origination fee that is included in the cost of the loan. Potential borrowers will be notified of any fees charged for a loan up front.

PersonalLoans.com Loan Types

PersonalLoans makes three different types of loans available to its customers:

- Peer to Peer Loans

- Personal Installment Loans

- Bank Personal Loans

Rather than borrow from a bank, a Peer-to-Peer loan lets borrowers receive funds directly from an investor. Investors in these types of loans may be an individual or a company seeking greater ROI than standard investments. This is especially useful for borrowers who need smaller loan amounts than what a traditional lender would allow. Peer to Peer loans may also require the borrower to pay an origination fee assessed anywhere from 1% and 5%.

Peer to Peer loans have more restrictions than Personal Installment or Bank Personal loans. Not only must the borrower have a 600 or above credit score, but they must also earn a base monthly income of $2,000 and be able to verify their income with pay stubs or employment records. PersonalLoans allows both employed and self-employed borrowers to apply for Peer to Peer loans in amounts between $2,000 and $35,000.

The second type of loan is a Personal Installment Loan, also known as a broad range personal loan, and features much more oversight and regulation by state governments. Exactly how much regulation depends on the borrower’s home state and the loan laws therein. State regulations will also affect the terms of the loan even after such factors as the borrower’s income, loan amount, repayment history, and credit score have been taken into account.

Personal Installment loans through PersonalLoans require nothing lower than a 580 credit score and an income of at least $2,000 per month. One way Personal Installment loans differ from Peer to Peer loans is that borrowers do not need to be employed or self-employed to apply.

Borrowers who collect disability payments or Social Security benefits may also qualify. Personal Installment loans can be taken out for as low as $1,000 and as high as $20,000.

The third and final type of loan available through PersonalLoans.com is a Bank Personal Loan. What distinguishes a Bank Personal from a Peer to Peer or Personal Installment is that PersonalLoans provides assistance to borrowers who wish to apply for a loan at a local bank.

While some local banks allow borrowers to apply for personal loans online, many still require borrowers to appear in person. In this way, PersonalLoans can be beneficial for people who want to do business locally rather than with a lender online but who need a hand in kicking off the process.

Borrowers who request a Bank Personal loan need a credit score of 580 or higher. Whereas Peer to Peer and Personal Installment will consider borrowers who make only $2,000 or more a month, a Bank Personal can only be taken out by borrowers with a $3,000 monthly income who are employed or self-employed. However, just like Peer to Peer, Bank Personal loans can extend from $1,000 to $35,000.

Each loan type requires automatic repayment which will be withdrawn from the borrower’s bank account on the same day of each month according to borrower’s preference.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Positive PersonalLoans Reviews

PersonalLoans.com reviews were nearly unanimous in the ease with which borrowers were able to navigate the site. PersonalLoans.com reviewers and customers alike have said that the PersonalLoans.com interface is intuitive and easy to navigate. Entering the required information is a breeze, and the borrower is led swiftly through each phase of the process.

They have also given high marks to PersonalLoans’ ability to process loans quickly, thereby expediting the entire loan request so that borrowers receive their money faster. Borrowers have more options than they might be given with other aggregators, and this feature has helped borrowers feel less pressured and more in control during the process.

PersonalLoans has also received kudos for excellent customer service. Borrowers report that their questions and concerns were handled quickly and with a refreshing customer-first attitude. Phone assistance has typically consisted of short hold times, and representatives have gone above and beyond to help resolve matters.

Who Benefits the Most from PersonalLoans?

After a thorough PersonalLoans review, it has stood out as an excellent option for borrowers with good to poor credit. The broad list of lenders which PersonalLoans makes available to customers means that fewer potential borrowers will be turned away when compared to the same customers requesting loans from more conventional lending institutions.

Those with fair to poor credit should be especially pleased with their options at PersonalLoans.com.

Borrowers with excellent credit, on the other hand, might find that their interest rates on PersonalLoans are higher than what they might receive elsewhere.

PersonalLoans.com Complaints and Reviewer Concerns

One area of concern raised again and again in several PersonalLoans.com reviews is regarding interest rates.

Rates on PersonalLoans can vary from 25% to 150%, a fact that many reviewers have deemed to be higher than average. Several borrowers have also said that the interest rates they were given on their loans were higher than they expected, but not so out of proportion to the loan amount that they were unhappy or terminated the loan request process.

However, when focusing on short-term or payday advance loans, reviewers are more weary of PersonalLoans’ interest rates. Several questioned whether PersonalLoans was the best choice for such loans as the interest often rivaled or even exceeded the original loan amount.

Payday advance loans are notorious for high interest rates to start with, but it appears that PersonalLoans cannot guarantee competitive rates on these kinds of loans. Most reviews advise borrowers who are seeking short-term lending options to do their homework by comparing PersonalLoans with other loan opportunities.

Another concern had to do with the impact of “soft” and “hard” inquiries on borrowers’ credit reports. Our own PersonalLoans review found that each loan request initiates a soft inquiry for every individual borrower, but that hard inquiries are often processed at the discretion of the lender. One downside appears to be that a potential borrower has no means of discerning whether or not their credit report will undergo a hard inquiry prior to choosing a lender.

A few comments left by reviewers about Personal Loans also brought up the fact that PersonalLoans.com, and by extension Arrow Media, LLC, is owned by the Ute Indian Tribe of Utah. According to the Privacy Policy on the PersonalLoans.com website:

PersonalLoans.com is Arrow Eagle, LLC, which is a limited liability company chartered pursuant to the laws of the Ute Indian Tribe and is wholly owned by enrolled members of the Ute Indian Tribe. By your use of this website you consent to the laws and jurisdiction of the Ute Indian Tribe as it relates directly or indirectly to your use of this website.

This means that should a borrower ever attempt to bring legal action against PersonalLoans.com, the laws of the United States government will not apply. Instead, the borrower will be forced to contend with the legal process of the Ute Indian Tribe. Reviewers have agreed that this likely will never affect the vast majority of potential borrowers or their experience with PersonalLoans, but they advise readers that it is still better to be informed.

State Restrictions

Not all loan types are available to potential borrowers in every state. Certain loan types are restricted according to state. For example, borrowers in Illinois can apply for Peer to Peer, Personal Installment, as well as Bank Personal loans. Borrowers in Pennsylvania, however, are restricted to Peer to Peer and Bank Personal loans, whereas Kansas borrowers can request either Peer to Peer or Personal Installment loans.

Borrowers applying through PersonalLoans in other states, such as Michigan, Minnesota, and New York, have only one loan option, which is nearly always Peer to Peer. Currently, borrowers from Maine and North Dakota have no loan options.

In Conclusion (Review of PersonalLoans.com)

PersonalLoans.com has a comprehensive network of lenders ready and willing to work with borrowers of all stripes, whether those with great credit who need a long-term loan to those with poor credit who need cash fast.

The loan request process is clear, simple, and fast, matching lenders to borrowers in a very timely manner that serves the realworld needs of customers and helps them get on with their lives.

While potential borrowers should investigate interest rates to ensure they are getting the best deal, most people borrowing through PersonalLoans.com will be satisfied at their rates and terms. Without a doubt, this is one online aggregator that consistently puts the borrower first and foremost.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.