2017 RANKING & REVIEWS

TOP RANKING PLACES TO BUY TRAVEL INSURANCE ONLINE

Protect Your Vacation and Buy Travel Insurance Online

Imagine having your bags packed and being ready to head to Florida for some family time at Disney World. You flip on the news the night before your trip only to see a massive hurricane is barreling straight toward the eastern coast. Flights are canceled and your trip is ruined.

Or is it?

With domestic travel insurance, the cost of this trip might be covered. This means that you won’t lose a dime, and when the weather clears, you and your family can head cross-country for the vacation you’ve been waiting for.

Unfortunately, if you didn’t buy travel insurance, you could very well be out the cost of flights, hotel, and any attractions or entertainment that was prepaid.

Award Emblem: Best Places to Buy Travel Insurance Online

The chances of this happening might sound slim, but twelve percent of all travelers have had their trips affected by natural disasters in some way. That might not seem like much, but the hassle and frustration of just one canceled trip will make you see the value in buying travel insurance for the US.

When going through the process of looking for the best travel insurance deals, chances are that you have many questions swirling around in your head, including:

- What is online travel insurance?

- Can you trust travel insurance reviews?

- Is domestic travel insurance the same as travel insurance for the US?

- What should you look for in USA travel insurance?

- Where can you find the best travel insurance deals?

- What is the best place for travel insurance?

Throughout this 2017 guide, we will answer the questions you have surrounding travel insurance reviews. We will explain how online travel insurance works, what to look for in the best travel insurance plans, and where to buy travel insurance. Finally, we will provide a detailed review of the six best places to buy travel insurance within the US.

See Also: Top Cards & Best Ways to Apply for Credit Cards with Bad Credit or No Credit

Advisory HQ’s List of Top 6 Best Travel Insurances

List is sorted alphabetically (click any of the best travel insurance plans below to go directly to the detailed review section for that travel insurance):

Top 6 Best Travel Insurances | Brief Comparison & Ranking

Travel Insurance Companies | Ease of Use (1–5) | Cost of Insurance* | Lost Baggage Coverage |

AIG Travel Guard | 4 | $50–$90 | Yes |

Allianz Travel Insurance | 4.5 | $39–$54 | Yes |

Good Neighbor Insurance | 3 | N/A | No |

InsureandGo | 4 | N/A | Yes |

InsureMyTrip | 4.5 | $17–$120 | Depends on plan |

TravelInsurance.com | 4.5 | $17–$136 | Depends on plan |

Table: Top 6 Best Spots to Buy Travel Insurance Online / Above list is sorted alphabetically

*Cost of insurance was calculated through each website for a 1-week, 1-passenger domestic trip costing a total of $1,500. Note that each policy contains different coverage.

Detailed Overview: Why You Should Buy Travel Insurance

Did you know that only about thirty percent of travelers buy travel insurance? If you don’t comprise that thirty percent, chances are that you don’t know about domestic travel insurance, or you don’t see the value in it.

When you are purchasing a trip, there are already many costs associated with it. You purchase airfare, rental cars, hotels, and possibly even entertainment. Adding travel insurance into the mix can tip the scales, when it runs you between four and eight percent of the total trip cost.

However, with the ever-increasing reasons why a trip might be canceled, losing 4 to 8% of a $1,000 trip, sounds much better than losing the full $1,000.

If you still aren’t sold on why you need to read some travel insurance reviews and purchase insurance, consider the following examples:

- You become ill while traveling and cut your trip short

- There is a natural disaster causing your flights to be canceled

- A terrorist attack occurs in the city you are traveling to

- A family member becomes ill while you are traveling

- Your baggage is lost or delayed for an extended period of time

- You need emergency medical assistance while abroad

- You get into an auto accident and need legal assistance abroad

These are all real-life examples that could happen at any time, causing you to delay, cut short, or cancel your trip. By spending often less than $100 to purchase travel insurance for the US, you can save yourself loads of frustration, worry, and unnecessary expenses.

Detailed Overview: Features to Consider When Buying USA Travel Insurance Online

There are many different places to buy travel insurance, each claiming to be the best place for travel insurance. However, not all travel insurance plans are created equally, and there are many things to consider.

When looking for a USA travel insurance plan, consider the following:

- Type of insurance

- Special circumstances

- Claim process

- Cost

When you buy travel insurance online, be sure to consider the type of insurance. You want to look at what your insurance plan will actually cover. Policies can cover anything ranging from trip cancellation and trip interruption to medical insurance and lost baggage.

Source: Deal News

You also want to look at special circumstances when reading the best travel insurance reviews. Are pre-existing medical conditions or sports-related injuries covered? Are strikes or terrorist attacks covered? These are all questions to ask.

Another thing to consider is what the claims process looks like for travel insurance within the US. Know what paperwork will you need to have and who you will need to call or file claims with.

Finally, cost is a factor. Travel insurance usually costs between 4 and 8 percent of the total trip cost, but this range depends on the coverage you are looking for.

When you are looking to buy travel insurance online, be sure to consider the factors listed above. There’s nothing more frustrating than purchasing travel insurance and not having it cover what you expected.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Advisory HQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top-Ranking Best Places for Travel Insurance within the US

Below, please find the detailed review of each online travel insurance option on our list of best travel insurance deals. We have highlighted some of the factors that allowed these best travel insurance plans to score so high in our selection ranking.

Don’t Miss: Top Black Credit Cards for High Spenders | Ranking | What Is a Black Card and How Can You Get One?

AIG Travel Insurance Review

AIG offers more than just travel insurance, but millions of travelers every year use AIG’s Travel Guard to insure their vacations.

Their website is easy to use, and you simply need to enter a bit of basic information regarding your trip before the options to buy travel insurance online are displayed.

The great thing about AIG Travel Guard is the amount of coverage that you get with this travel insurance within the US. Whether you select the Gold or Platinum Plan, 100% of your trip’s non-refundable costs are covered, as well as coverage for sickness or death of a family member, financial default, terrorist attacks, inclement weather, military duty, and even some medical coverage.

Bottom Line

If you stumble upon AIG Travel Guard when sorting through the best travel insurance reviews, that’s no accident. AIG provides quality travel insurance coverage at an affordable cost. With canceled flights, lost bags, and health emergencies covered, you can rest assured when you buy travel insurance online through AIG.

Allianz Travel Insurance Review

Allianz Travel Insurance is another that falls under the category of best travel insurance reviews. With 24/7 travel assistance, should an emergency arise, Allianz will have an agent available to assist you.

Allianz offers three levels when you have travel insurance within the US through them. There is the Essential, Basic, and Classic Plan, which increase in coverage, respectively. These plans all vary in coverage, but even the lowest levels cover trip cancellation, interruption, travel delay, and provides coverage for existing medical conditions.

The Classic Plan is the most popular and also covers medical emergencies and transportation, as well as baggage loss or damage, change fee coverage, and missed connection coverage.

Bottom Line

If you are looking for several options when looking to travel insurance within the US, Allianz could be a good option. The plans are affordable, but you can choose what level of coverage you would like, which is a big bonus.

Related: Top HSBC Credit Card Offers | Reviews | Top HSBC Hotel, Flight, Rewards Card Offers

Good Neighbor Insurance Review

Good Neighbor Insurance also offers three levels of insurance for those looking to buy travel insurance online. They offer three plans for anyone coming or returning to the United States who are looking for short-term medical insurance. The plans are the HCC Life Short-Term Medical Insurance Plan, the Roundtrip Choice Plan, and the Easy USA Plan.

These insurance plans are good in all 50 states and are a good way to get medical coverage for a short stay in the United States. You can easily request a quote online or have Good Neighbor Insurance email you a comparison of quotes, which helps make it even easier to buy travel insurance online.

Bottom Line

With the option of three affordable USA travel insurance medical plans, you have the added benefit of choosing your coverage level. The travel insurance reviews aren’t wrong on this one. Good Neighbor Insurance can be a good option to make sure that you are medically covered for a trip in the United States.

InsureandGo Review

InsureandGo also receives some of the best travel insurance reviews out there. No matter where you travel domestically in the United States, InsureandGo has you covered.

InsureandGo offers 100% coverage if your trip is canceled, as well as comprehensive medical coverage. If you are going to buy travel insurance online, you should consider InsureandGo. With the added benefit of emergency medical evacuation coverage, you can rest assured that you will be covered.

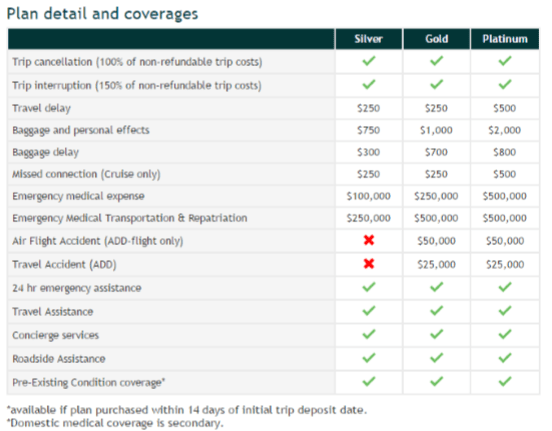

There are three coverage levels—Silver, Gold, and Platinum—and you can see how they stack up against each other below.

Source: InsureandGO

Bottom Line

InsureandGo can be a good option for domestic travel insurance. With coverage for trip cancellation, travel delays, stolen or lost bags, and emergency medical coverage, this plan offers a lot of protection.

Popular Article: Top Credit Card Balance Transfer Offers & Deals | Ranking | Interest-Free Credit Card Transfers

InsureMyTrip Review

The great thing about InsureMyTrip is that they offer 24/7 assistance no matter where you travel. If your flight is canceled or you need to find the best hospital after breaking your leg hiking, InsureMyTrip will be there to help you out.

InsureMyTrip is essentially the Kayak or Expedia of online travel insurance. If you are looking to buy travel insurance online, after entering your trip information, InsureMyTrip scans the web for the best travel insurance deals.

One great benefit is that you can select a plan type and what coverage you want in order to weed out any plans that aren’t right for you. If you want rental car coverage or evacuation coverage, select those boxes, and InsureMyTrip will show only the plans with those specific coverages.

Bottom Line

Overall, InsureMyTrip is a great tool for anyone looking to buy travel insurance online. This site will help you find the best travel insurance plans at the most affordable prices so you and your wallet can rest easy on vacation.

Free Wealth & Finance Software - Get Yours Now ►

TravelInsurance.com Review

Like InsureMyTrip, TravelInsurance.com offers a similar model. You will enter your basic trip information and then choose from the best travel insurance plans that TravelInsurance.com can find from the top-rated companies.

Again, the great thing is that you can narrow your search by types of coverage, so if you are looking for specific types, it is easy to locate plans containing them.

Source: TravelInsurance.com

As shown above, next to each plan, there is also a screenshot showing what type of coverage is listed, so you can easily compare plans for travel insurance within the US without having to click on each plan.

Bottom Line

If you are the type of person who is always looking for the best deal or likes to have a lot of options, then you might want to buy travel insurance online through TravelInsurance.com. With the ability to sort by coverage and price, you can find what you need for a price you are willing to pay.

Conclusion—Top 6 Best Places to Buy Travel Insurance within the US

There’s nothing worse than dealing with the sadness of a canceled trip along with the loss of expenses that comes with it. By purchasing travel insurance within the US, you can avoid some of the hassle.

Spending less than $100 now to buy travel insurance online can save you thousands in the long run. It’s worth the investment, if only for the peace of mind that comes with securing the best travel insurance deals.

The tricky part is sorting through the best travel insurance reviews to find the right policy for you. There are so many options out there now that you can travel insurance within the US online, and it is easy to become overwhelmed.

Source: The Single Wives Club

With so many options available, when looking into the best travel insurance reviews, consider the following:

- Type of insurance

- Special circumstances

- Claim process

- Cost

When you buy travel insurance, it’s important to make sure that you have all of the coverage that you need. Lost baggage, medical, and trip cancellation are all different types of coverages to consider. Adding all of them to your policy may be more expensive, but you’ll thank yourself when your bag hasn’t rolled off the trolley in baggage claim after an hour of waiting.

Take the time to consider a few of the best travel insurance reviews before making your final decision. Then you can relax, knowing that whatever comes your way, you will be covered.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.