Prime Lending Review

PrimeLending has been a household name for nearly three decades. The company boasts home financing programs complete with personal attention and genuine guidance without the gimmicks. Sounds pretty good, right?

Homeownership, though, is a big deal. Let’s look at the company, its products, and PrimeLending reviews – including PrimeLending mortgage reviews and prime lending complaints – in more detail.

PrimeLending Review

About PrimeLending

Based in Dallas, Texas, PrimeLending is a member of the PlainsCapital Corporation group of businesses, one of the largest financial institutions in the United States. PrimeLending is licensed to provide loans for mortgages in all 50 states and the District of Columbia.

Since 1986, the company’s team of nearly 1,500 loan officers has worked with over half a million homeowners to buy, renovate or refinance their homes, making it the 6th largest purchase lender in the nation.

Since its inception nearly 30 years ago, the company’s staff has grown from just 20 to over 2,500, with more than 300 branches in 42 states. This has earned PrimeLending reviews as a top mortgage lending institution.

Its promise to customers is “Home Loans Made Simple.” Indeed, starting the process is easy, with the option to kick-start home financing online, by phone or in person.

From 2012 to 2015, MarketTrac, a market data provider for lenders, ranked PrimeLending among the top 10 purchase lenders nationwide. Chairman and CEO Todd Salmans said, in a February 2016 article by PR Newswire, that being recognized as a top-ten lender for purchase units demonstrates PrimeLending’s top-notch services, team, and commitment to its customers.

In fact, it has an A+ rating by the Better Business Bureau of Dallas and Eastern Texas (BBB). While some prime lending complaints do exist, these positive prime lending reviews are generally consistent across the board.

See Also: Cost to Build a Home – What You Might Be Missing! (Typical Closing Costs, Estimated & Average)

Loan Options

PrimeLending offers a suite of loan options tailored to its customers’ needs, including:

- Fixed-rate mortgages

- Adjustable-rate mortgages

- VA home loans

- FHA home loans

- Jumbo mortgages

- USDA mortgages

Built for different types of borrowers, each loan type has its merits and drawbacks. Let’s take a closer look at Prime Lending mortgage reviews and offerings.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Fixed-Rate Mortgages

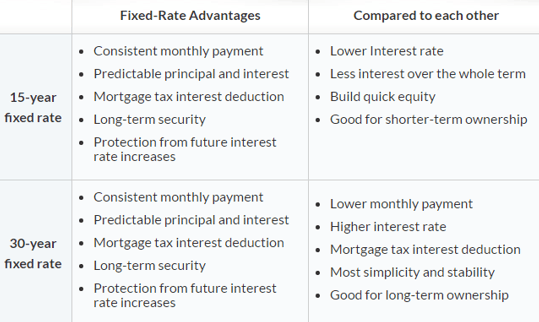

Characterized as stable and low risk, fixed-rate home loans offer consistent monthly principal and interest (P&I) payments for 15 to 30 years, depending on the length of the loan. If you’re ready to stay in one location for many years, this may be the option for you. Prime lending reviews show that stability and predictable payments are the major selling points of fixed-rate mortgages.

Fixed-Rate Mortgages

Adjustable-Rate Mortgage (ARM)

Borrowers are drawn to ARMs as a mortgage loan for its flexibility. Planning on moving in the next five years? Are you financially able to manage a variable interest rate that could increase? Expecting your income to increase reasonably in the next few years? Perhaps you should consider an ARM.

What’s more, recent protections have been put in place to protect borrowers with ARMs, including an adjustment cap and a lifetime cap. This means that there is a cap on how much the interest rate can adjust in a single adjustment period for the former and over the term of the loan for the latter.

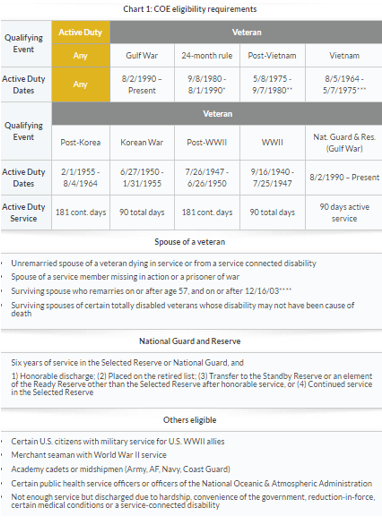

VA Home Loans

Recognizing the unique needs of military families, especially the importance of a home base, a VA home loan is available to military personnel during and after their service. The U.S. Department of Veterans Affairs guarantees VA home loans in part, normally by a quarter of the total loan value. This allows lenders like PrimeLending to provide current or retired military personnel with more favorable terms.

The following are also benefits of VA home loans:

- No down payment required

- Higher loan value

- Limit on closing costs

- The seller can opt to pay closing costs

- Early payoff without penalty fee

- No private mortgage insurance

- Possible VA assistance for loan holders who find it difficult to make payments

To qualify for a VA home loan, a Certificate of Eligibility must be obtained by applicants from the Department of Veterans Affairs. Detailed eligibility requirements are summarized by PrimeLending.

PrimeLending Review – PrimeLending Eligibility Requirements

Notably, the online news media and prime lending reviews for VA home loans periodically identify special discounts and promotions for veterans, making the process of securing a mortgage even easier for this cohort.

Don’t Miss: Citibank Mortgage Reviews – What You Want to Know! (CitiMortgage, Complaints & Review)

FHA Home Loans

A low 3.5% down payment, low closing costs, and flexible income and credit requirements are among the benefits of Federal Housing Authority (FHA) Loans. These government-insured loans aim to help first-time homebuyers, seniors or others with limited capacity to purchase a home. This program aims to help these former homeowners get back in the housing market as quickly as possible.

FHA “Back to Work” Home Loans

The 2008 economic crash was detrimental for many homeowners. Even those with a strong payment record found themselves facing foreclosures or with poor credit ratings.

To qualify, homeowners must have demonstrated a strong pre-recession payment record that was impaired by a temporary job or income loss during the recession, causing:

- A 20% decrease in the household for a period of 6+ months

- A credit-impairment such as bankruptcy, foreclosure, a short sale or delinquencies

When it comes to short sales, prime lending reviews on Yelp.com, a popular consumer review website, were particularly favorable. In the case of prime lending complaints for such loans, company representatives responded to online client concerns professionally.

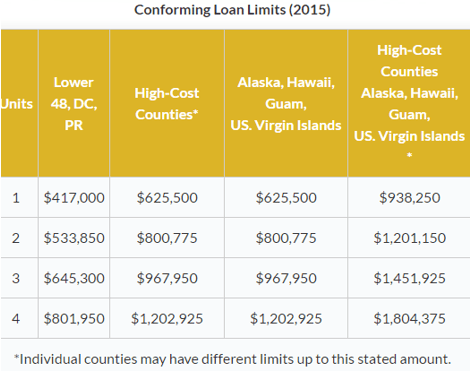

Jumbo Home Loans

Loans above the conventional loan limit are known as jumbo home loans. Also referred to as non-conforming mortgages, these jumbo loans are needed to purchase homes valued above the federal cap of $417,000 in most U.S. counties. For certain high-cost areas, the cap is higher.

Jumbo Home Loans

So, what is the value of jumbo home loans according to prime lending reviews? Homebuyers can avoid making an exorbitant down payment to reach a conforming mortgage level. Keep in mind, however, that this generally means the interest rate will be higher.

USDA Mortgages

The United States Department of Agriculture (USDA) home loan is the only loan of its kind that can be fully financed without a down payment. This 100% financing option is available to those with few financial alternatives in designated USDA rural areas.

Here’s how it works. Instead of loaning money to the home buyer directly, the lender is given a 90% guarantee. This, in turn, encourages that the borrower is approved for a mortgage.

These government-insured loans offer the following benefits to eligible borrowers:

- 102% financing (loan value plus 2% loan guarantee fee)

- 30-year fixed-rate

- Affordable interest rates

- Self-employed income accepted

- No limit except affordability

- No mortgage insurance required

- No reserves required

You might qualify for a USDA home loan if:

- You have a low to moderate household income

- Have a low credit score

- Have thin credit history

- Live in a designated USDA-designated rural area, including small towns, suburbs, and exurbs

Eligibility depends on the homebuyer’s income, location, and property size, among other factors. Visit USDA’s website to determine if you are eligible for a USDA mortgage.

Online prime lending reviews recommend the company for USDA home loans, putting prospective borrowers at ease.

Related: How to Get a Home Equity Loan with Bad Credit (What You Need to Know)

PrimeLending Reviews and Complaints

So, can you trust PrimeLending with your mortgage loan? After examining Prime Lending mortgage reviews, the short answer is “yes.” Of course, only you can decide what lender is the best fit for your needs, but PrimeLending reviews suggest the firm is highly reputable.

Like most companies, though, PrimeLending is not without complaints. Here’s what select customers have to say regarding PrimeLending complaints. BBB reports a total of 30 PrimeLending complaints over the past three years. In examining the cause for these PrimeLending complaints, a common theme of “problems with the product/service” emerges, with a total of 18 complaints in that category.

Other PrimeLending complaints were related to advertising/sales issues (4 complaints), billing/collection issues (6 complaints), and delivery issues (2 complaints). No complaints, however, were lodged for guarantee/warranty issues. Overall, PrimeLending has an A+ BBB rating.

To date, BBB contains no PrimeLending reviews by customers. One Prime Lending review, written by a dissatisfied customer on WalletHub, gave the institution a rank of only 1 out of 5 stars. Though this represents only one of many customers, the unprofessional and unhelpful staff was cited as the reason behind the poor rating.

In 2010, the LA Times reported on a legal case in which PrimeLending faced allegations by the U.S. Department of Justice that it had discriminated against its African American customers between 2006 and 2009.

According to a news release by the Department of Justice, “the complaint alleges African American borrowers nationwide were charged higher (interest rates) on retail loans made through PrimeLending’s branch offices.” PrimeLending denied any wrongdoing but agreed to pay $2 million to borrowers to resolve the case.

In better news, LendingTree.com contains a whopping 827 PrimeLending reviews with an average score of 4.2 out of 5. This translates to 89% of customers that would recommend PrimeLending. Additionally, more than half of reviewers gave PrimeLending the full 5 stars. Only 66 of 827 PrimeLending reviews gave the company just 1 star.

The same LendingTree review consistently ranked the institution as “good” in the following four categories: interest rates, fees and closing costs, customer service, and responsiveness.

PrimeLending itself boasts a 96% customer satisfaction rating for loan officers, based on a third party-administered survey given to customers after loan closing.

Mobile Application

PrimeLending’s mobile app is freely available for iOS or Android devices. It “provides you with on-the-go access to information and tools you need whether you are simply thinking about buying a home or have an application in process.”

You can use the app’s mortgage calculators and educational resources to determine the loan option that makes the most sense for your unique financial situation. The app also enables you to upload documents securely, chat with a loan officer via instant messaging, and view real-time status updates.

Popular Article: Types of Mortgage Loans – What You Need to Know Before (Mortgage Types & Review)

Free Wealth & Finance Software - Get Yours Now ►

Should You Use PrimeLending as Your Mortgage Provider?

Choosing a mortgage provider is a big decision that should not be taken lightly. It’s important to do your research to determine the best fit. With that in mind, PrimeLending’s many offerings are worth considering. Its website is easy to navigate and makes often complex financial concepts easy to understand.

It is clear that PrimeLending strives to foster a positive and productive corporate culture for its employees. Likewise, overwhelmingly positive PrimeLending reviews make the company reputable among its customers and within the financial industry in general. Indeed, despite a few inevitable negative PrimeLending complaints, one thing is clear: numerous happy customers recommend PrimeLending based on its diverse product offerings and stellar customer service.

You can visit PrimeLending’s website to search for a branch near you for more information or to begin the journey to homeownership.

Image Sources:

- https://www.bigstockphoto.com/image-92315261/stock-photo-house-with-open-interior-on-top-of-blueprints%2C-documents-and-mortgage-calculations-and-builbers-con

- https://www.primelending.com/types-of-loans/fha-home-loans

- https://www.primelending.com/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.