Top Tips & Checklist for Buying a House

Purchasing a new home, whether it’s your first or fifth, can be an intimidating process for most individuals.

The house buying process is filled with intricate rules and suggestions from experts. It can be difficult to keep all of the house buying tips straight when it comes down to it.

Most people wish there was a simple checklist for buying a house that would allow them some peace of mind during the process of buying a house. Do you know what you should be looking for or doing to prepare for the best ways to buy a house?

AdvisoryHQ understands that the process of buying a house can be stressful and scary for potential homeowners. To help put your mind at ease, we created a list of the top six tips for buying a house on today’s market. These real estate tips for buyers range from preparing to purchase all the way through selecting the house of your dreams.

If you’ve been searching for the best ways to buy a house before you sign on the dotted line with a lender, you’ll want to take a closer look at these tips on buying a house first.

See Also: How Much House Can You Afford Today?

Top 6 Best Tips for Buying a House | Brief Comparison

Tips for Buying a House | Why You Need to | How to Do It |

| Hire a home inspector. | Avoid homes that need too much repair and could cost a fortune. | Find a professionally trained inspector for an additional fee (averages $315). |

| Improve your credit score. | A better credit score qualifies you for better mortgage rates and more favorable terms. | Check your credit report and score with free resources. |

| Know what you can afford. | Knowing your finances allows you to purchase a home you can afford long-term. | Make a detailed budget. |

| Look at all expenses. | Your monthly payment is more than just your mortgage. | Check the costs of insurance, taxes, maintenance, and more. |

| Research the neighborhood. | The area is a critical consideration when it comes to resale value. | Investigate crime rates, school districts, and convenience of community services. |

| Wait to make large purchases. | Large purchases and new loans can negatively affect your credit score. | Hold off for three to six months on making large purchases or taking out new loans. |

Table: Top 6 Best Ways to Buy a House | Above list is sorted alphabetically

What Do You Need to Do to Buy a House?

The process of buying a home is becoming more and more appealing to the millennial generation. The average age of a first-time home buyer hasn’t changed much in recent years, with most people first making a purchase around the age of thirty.

In the end, what is it that leads them to investigate the process of buying a house of their own?

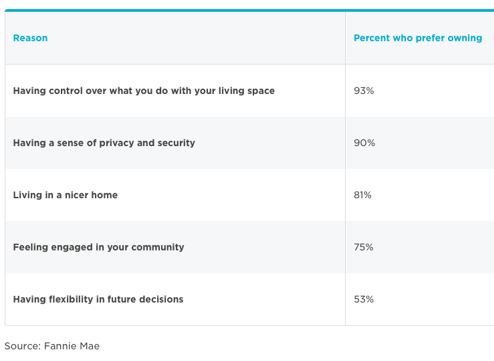

According to recent surveys conducted by Fannie Mae, the majority of millennials will be purchasing a home in order to have control over what they do with their living space (93%) or having a sense of privacy and security (90%). Secondary reasons they may be looking at the best ways to buy a house include getting a nicer home or becoming more engaged within the community.

What Do You Need to Buy a House?

When you’re deep into the process of buying a house, what does it typically look like?

Many people may think that the easiest thing to do is to locate the house of their dreams first. Unfortunately, the house of your dreams may not be within your budget, so you should ultimately seek a lender first. One of the first tips on buying a house is to become pre-qualified or pre-approved for a mortgage before you begin to shop.

Once you have a greater awareness of what you can afford to purchase, the next tips for buying a house would lead you to start looking at potential options. Research on your own and alongside a real estate agent to find the property that best suits your needs. Consider making a checklist for buying a house to find a property that has most or all of your must-have items.

From here, you will typically make an offer in the process of buying a house. Once that offer is accepted, you can return to your lender to start processing the mortgage itself. Experts recommend checking your mortgage rates to ensure that you are getting the lowest rates and most favorable terms.

Your interest rates will follow you for the lifetime of your mortgage, and they don’t accomplish much for you financially. The lower your interest rate is, the lower the actual cost of buying a house will be over the course of your loan term.

Many experts put forth real estate tips for buyers for first-time and experienced home buyers. The process of buying a house can be time-consuming and confusing, though it really doesn’t have to be. If you need to know the best ways to buy a house this time around, take a look at our recommendations below.

Don’t Miss: Buying Rental Property | Guide to Investing in Rental Properties

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Detailed Review – Best Tips for Buying a House

Below, please find the detailed review of each tip on our list of best ways to buy a house. We have highlighted some of the factors that allowed these real estate tips for buyers to score so highly in our selection ranking.

Hire a Home Inspector

You’ve certainly heard stories from friends and family members who fell in love with a house only to find later that it was a money pit. The electrical wiring was faulty, the plumbing was leaking, and the foundation needed to be repaired quickly. Hiring a home inspector is a critical part of the home buying process for this very reason.

Bringing a home inspector into the process allows you to remove yourself slightly from the equation during the process of buying a house. Professionally trained inspectors can offer a third-party opinion on any issues that are pre-existing with the home that need attention.

By knowing what is lurking just beneath the surface and is invisible to the untrained eye, you have a better idea of the real cost of homeownership. One of the top tips to buying a house that won’t cost you a small fortune in repairs is to investigate any potential issues before you buy the house.

Practical Tips for Buying a House

Why does hiring a home inspector rank as one of the top tips for buying a house? Besides the fact that it can save you from potential financial ruin, it also gives you more bargaining power when it comes to making an offer. If an inspection shows major issues within the home, you can use that information to ask sellers to lower the cost of buying a house.

According to HomeAdvisory.com, the average home inspection averages around $315.

This cost is relatively low when you consider how much it could save you when it comes to potential repairs in the future. Having a home inspector as part of your home buying process is one of the best ways to buy a house that you can afford to take care of long-term.

Improve Your Credit Score

One of the best ways to buy a house at an affordable rate is to work hard on improving your credit score before you ever start the process of buying a home. Financial experts can agree that having a good to excellent credit score is one of the best tips to buy a house with low rates and overall affordability.

Your credit score is determined by several different factors, including your ability to make payments on time, your credit utilization, and the length of your credit history. Lenders review your credit score when you’re in the process of buying a house to determine if you are a trustworthy borrower.

Lenders still offer mortgages to borrowers with credit scores hovering around 580, but the best ways to buy a house are offered to those with scores of 700 or higher. Most lenders search for minimum credit scores that are more in the middle, according to officials reporting to Bankrate. The best ways to buy a house are difficult to find for borrowers with credit scores lower than 640.

Practical Tips for Buying a House

Improving your credit score is a useful tip in buying a house, but it’s important for more than just that. Because of its significance for borrowers, a number of free resources are available to help you take control of your score:

- Get a free credit report annually from the three major bureaus at AnnualCreditReport.com and check for errors.

- Keep tabs on your score with free sites like Credit Karma.

- Follow suggestions for ways to improve your score with free credit score sites or from a financial advisor.

- Work hard to make timely payments, lower high credit utilization, and demonstrate financial responsibility.

Related: California Real Estate License | Guide

Know What You Can Afford

Do you already have a detailed budget in place with specific funds earmarked for your new home? You should know upfront what you can afford before you go any further on tips for buying a house. Without the money set aside to cover the long-term expense of your mortgage, home buying isn’t going to be a successful endeavor.

Experts recommend keeping your debt-to-income ratio low whenever possible. In fact, they suggest that your monthly mortgage payment should not consume any more than 30% of your take-home income.

Tips for Buying a House

One of the best house buying tips is to craft a detailed budget that shows how much you make each month alongside your pre-existing bills. Determine how much you intend to put into savings each month, as well as for incidentals, and see how much is left over. The best ways to buy a house always include making sure that you can afford to keep it and maintain it for the entire course of your loan.

Practical Tips for Buying a House

When you are considering what you can afford as one of the best ways to buy a house, you should head straight to your lender’s office. Many of them will prequalify individuals who are in the process of buying a house. However, you want to find one that will pre-approve potential buyers.

The difference lies in the paperwork: a preapproval looks at all of your financial documents to tell you exactly what you can afford and what they are willing to lend you. These tips for buying a house can put you in a better spot to shop realistically. You won’t be spending money you don’t have on a house you can’t afford for the next thirty years.

Look at All the Expenses

How much will it really cost you to buy a house? If you think that your mortgage payment is the only expense you’ll pay each month when house buying, you might need to think again. One of the top tips to buy a house is to ensure that you are paying close attention to all of the expenses and not just your monthly mortgage payment.

Most lenders offer consumers an estimate of what their monthly mortgage payment, combined with interest, will look like. They don’t necessarily provide the true cost of buying a house. Take a look at your estimate to see if it includes items that could be required, including:

- Private mortgage insurance

- Homeowner’s association dues

- Utilities

- Potential repairs

- Commuting costs based on new location

- Taxes and insurance

It’s uncommon to find a lender that provides an analysis of finances so thorough during your process of buying a house. The best way to buy a house without finding yourself in a financial struggle is to look at the real costs of homeownership before making an offer on the home.

Practical Tips for Buying a House

What can you expect to pay in hidden costs that are associated with the best ways to buy a house? Housing experts at Zillow estimate that the additional costs of buying a house could reach as high as an additional $9,000 each year. That number can include things such as closing costs, taxes, insurance, moving costs, and maintenance on an annual basis.

HGTV estimates that the cost of maintenance typically runs between one and three percent of the value of your home each year. For example, if your home costs $100,000, you should plan on spending between $1,000 and $3,000 annually on maintenance. While the other expenses may be relatively simple to calculate, maintenance can be trickier to estimate when it comes to tips for buying a house.

Popular Article: First-Time Home Buyer with Bad Credit

Research the Neighborhood

If the only time you’ve seen your new potential neighborhood is in broad daylight on a weekday, you may want to reconsider whether the house is right for you. Many individuals find that the neighborhood may look safe enough during the day but has a lot of room for improvement after dark. Researching the neighborhood thoroughly is one of the best ways to buy a house.

Beyond simple research that you can conduct on the internet, you should be visiting the property multiple times during the process of buying a house. You will have a more realistic feel of the neighborhood, your neighbors, and the overall area when you visit again and again.

Key tips for buying a house recommend just driving past the house at different times of day to ensure you’re satisfied. You don’t have to let the seller know you are doing so, and they don’t have to prepare for you to stop by. Just take a good look around each and every time before you get too far into the process of buying a house that you won’t be satisfied with long-term.

Practical Tips for Buying a House

While the obvious appearance of the neighborhood and feeling of safety you get at all times of day is important, you should be researching more than just crime rates. Consider all of the things that go into potential resale rates. HGTV gives the following tips to buy a house:

- Consider the distance to the closest grocery store.

- Pay attention to the services that are available close by.

- Evaluate traffic patterns at various times of day.

One of the best ways to buy a house is to take a look at the school district. Homes within the same area can be drastically affected by a good school district over a bad one, sometimes by as much as 20%.

Wait to Make Large Purchases

You may have had a recent windfall of cash, but that doesn’t mean that you should go out and make tons of large purchases all at once. One of the top tips for buying a house is to hold off on making large purchases for a while prior to considering home buying.

Lenders don’t want to see that you’ve made tons of new financial commitments directly before you applied for a new mortgage. Responsible repayment of your debt is one of the best tips for buying a house, and they can’t see payment history on brand new loans.

Taking out auto loans, refinancing a car, or applying for new lines of credit can all affect your credit score. Allow your score to be the best it can be while you’re in the process of buying a house. After all, the higher your credit score is, the lower your interest rates are likely to be when you’re house buying.

Practical Tips for Buying a House

Many experts recommend holding off on making major purchases within three to six months of entering the process of buying a house. This gives you plenty of time to save up extra cash for your down payment, to demonstrate reliable repayment of current debt, and to show lenders that you are a trustworthy borrower.

Keep in mind that your debt-to-income ratio will need to fall within certain limits to qualify for a loan. House buying tips frequently recommend keeping your debt to less than 43% of your income. When your monthly expenses exceed this number, most lenders are not able to approve you for the house buying process.

Read More: Florida Real Estate License | How to Become a Real Estate Agent in Florida

Conclusion—Top 6 Best Tips for Buying a House

The true cost of buying a house is sometimes hidden beneath layers of red tape and stacks of paperwork. The best tips on buying a house usually revolve around making sure that you are financially prepared and stable enough to make the monthly mortgage payments and then some for the foreseeable future.

Potential homeowners who want to know the best ways to buy a house should be taking a careful look at their current financial situation. Evaluate what you can afford as well as what this house will cost you in necessary maintenance, repair, and upgrades. If you need to take time to fix your finances with some of these tips for buying a house, it will definitely be time well spent.

The house buying process can be frustrating and taxing, even for homeowners who are thoroughly prepared for house buying. Preparing yourself now using these tips for buying a house can give you the upper hand when dealing with lenders, sellers, and real estate agents.

Be confident that you have a handle on your finances and your future home with these best ways to buy a house on today’s market.

Image Sources:

- https://www.nerdwallet.com/blog/mortgages/millennials-and-homebuying/

- https://pixabay.com/photos/home-for-sale-buy-sell-mortgage-1682316/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.