Intro: Quizzle Review

Quizzle is an online service that—for free—lets you discover your credit score and credit report to help make your financial planning decisions more informed.

Launched in 2008, they rival services such as credit.com and creditkarma.com.

Quizzle’s own website carries some big-hitting testimonials, such as The Wall Street Journal and LifeHacker, but this is not enough to ease the minds of many new users.

Because of the detailed level of information they ask for, many users ask, “Is Quizzle safe?” or even, “Is Quizzle legit?”

Well, in this article, we’re going to lay out the answers to these questions with the help of Quizzle reviews around the Web and our own study of the company.

Image source: Bigstock

About Quizzle

Your credit score is a three-digit number that simply tells lenders how much they could lend you, and how likely you are to pay the money back.

It can be helpful to know your own credit score, especially if you’re looking for a loan or you’ve been recently rejected and don’t know why.

Historically, the only way for you to get that information was to pay for it through the big agencies that generate it, such as Experian.

Now though, there is a new breed of online businesses that will provide your score for free, such as credit.com, creditkarma.com, and of course, quizzle.com.

Quizzle makes money by selling you a monthly credit score update (quarterly is free) and through recommending financial products that you may wish to buy, such as loans or credit cards, from which they earn a commission.

This is a standard practice in the market, but it’s good to be aware of it.

See Also: CreditRepair.com Reviews and Overview (Before You Sign Up)

Quizzle Credit Score Review

Quizzle, like the other free credit score companies, uses a scoring method known as VantageScore, which was developed in 2006 by major credit bureaus. This is used by the largest banks in America and thousands of other lenders.

However, it is different from the FICO credit score which, back in 2006, had the credit scoring market to itself and today is still considered the premier scoring system. This is because it draws on a number of other sources of information that VantageScore does not.

Understandably, you might be wondering “Just how accurate is Quizzle with their credit score?”

To answer that, let’s talk a little bit about how a credit score is created.

How Is Your Credit Score Created?

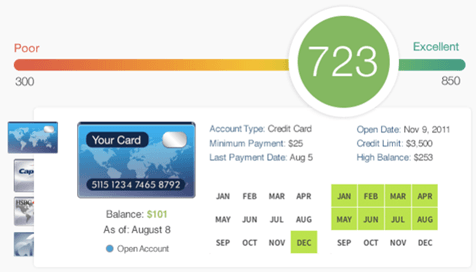

Image source: Quizzle

Credit scores are made up of factors such as payment history, where late payments reduce your credit score; depth of credit, covering the types and for how long you’ve had credit; and Debt Burden, which is a complex measure of the amount of credit you have available to you versus the amount you’ve taken up.

FICO and VantageScore measure the importance of these factors (and what makes them up) in different ways, which means they do come out as a different number, although they both have the same score range: 300 – 850.

You have to pay about $20 to see your actual FICO score, but you can use this estimator to get a free view of the range your actual score is likely to fall within.

You can probably see now that the answer to “How accurate is Quizzle?” depends on how you measure. If you compare it to your FICO score, it will be different, but that is true of any agency using VantageScore.

Compare it to any other online credit score company, though, and you’ll see that it might be slightly different (depending on where they draw their data down from); however, it almost certainly will be in the same range—and it’s that ability to compare which is important to you and your lenders.

Don’t Miss: Brief Review of Credit Sesame

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Quizzle Reviews

With any company that looks at your very personal financial information, it’s perfectly understandable for you to worry about whether they are operating properly.

When searching for Quizzle reviews, the common themes that we found time and again were “Is Quizzle legit?” and “Is Quizzle safe?”

Since they are such common concerns, let’s look into them a little more deeply.

Is Quizzle Legit?

The short answer is: Yes!

Quizzle is a well-recognized credit scoring company which has been in the industry for eight years. You just don’t stay at the top of your game if you’re scamming your customers.

As explained above, they have to pay for the credit score data, which they give to you for free. They don’t collect credit card data from you (which makes it easier for you to feel safe signing up for their service), though they will collect your email address.

Quizzle’s Legit Business Model

Their legitimate business model makes valuable use of your email address. As well as advertising on their website, they’ll use your email address to send offers from third parties (e.g., credit card providers) your way. If you sign up for one of these, the lender will pay Quizzle for bringing them your business.

This is a fairly standard business model in many industries, so it throws no doubt on whether or not Quizzle is legit.

However, to get more effective at their business, Quizzle does have access to and uses your personal data. This is what leads to perhaps the more important question—“Is Quizzle safe?”—which we’ll deal with in a moment.

They also make money by offering comparison facilities for auto loans, personal loan and debt solutions, as well as their own paid-for credit score facility, Quizzle Pro, which we’ll look at towards the end of this detailed Quizzle review.

Is Quizzle Safe?

This is a crucial question whenever you are asked to share your personal information with a business.

To begin answering it, we reviewed Quizzle’s Security and Privacy Policies. You can read the opening statement for yourself in the snapshot above.

They are very clear about the information they take from you (which includes your email address) and what it will be used for, e.g. “to gain access to your…financial profile.”

Related: NASA Federal Credit Union Reviews – What You Should Know (Credit Card, Mortgage & FCU Review)

Who is Part of the Quizzle Family of Companies?

As part of this detailed quizzle.com review, we found their policy very clear that information will not be shared outside the Quizzle family of companies. They are less clear on who is in the family, but it is known to include Quicken Loans, as well as others.

It is safe to assume that the “family” makes money from the Quizzle site by using the data it gathers to sell Quicken Loans.

You do have access to all the data they hold on you and you retain the right within the Quizzle policy to correct any of that data.

Does Quicken Have Your Data Safely Protected?

The biggest risk you have is the same whenever you share your data with a company: they could suffer a data breach.

This would mean that a rogue person or entity steals your data from them and tries to use it for fraudulent activity.

To safeguard against that, the Quizzle site uses SSL encryption and 128-bit Domestic Grade Strong Encryption which, they say, is “the most powerful encryption commercially available for Internet products.”

On top of that, all of their employees have to undertake and be tested on data security protocols, and they can only access data relevant to the work they are doing.

As a final layer of protection, they use firewalls and have developed their own security processes and procedures to keep the data they store inaccessible to fraudsters.

Is Quizzle safe, then? Yes, seemingly as safe as any customer-facing business on the web!

Quizzle Review: Remaining Questions

Now that we’ve dealt with the biggest questions, let’s take a look at the kinds of questions that you may be thinking of when reading Quizzle reviews.

We’ve done a lot of research to find questions posed in other Quizzle.com reviews and have broken them down into the most common themes so you have all the answers in one place!

How Accurate is Quizzle?

We dealt with the question of accuracy earlier, but there are lots of questions out there, like in this Quizzle review, wondering how their score compares to the FICO score.

The answer is handled well and reiterates the advice that all of these agencies will produce a slightly different score, and they will all be different from your FICO score. What matters is that they should all be approximately similar.

Will A Quizzle Report Affect My Credit Score?

This question is common to all the Quizzle reviews we found.

There are two types of “pulls” carried out on your credit report: hard and soft.

A hard pull happens when you apply for credit. This does have an impact on your score—especially if you make a lot of applications in a short period of time.

Soft pulls have no impact on your credit score, and a review of your credit record (which is what Quizzle does) counts as a soft pull.

So, no: having a Quizzle report will not impact your score.

Is Quizzle Pro Worth It?

Quizzle Pro is Quizzle’s monthly payment plan, which gets you access to deeper and more regular information about your credit score.

For $8 per month (on a “cancel at any time” basis), you will get a monthly report with details on:

- Your TransUnion credit report

- Your credit score

- 24/7 credit monitoring (which you can have delivered to your inbox)

- Score analysis and trending—to help you get closer to that 850 score

- Timeline of changes to your credit file, including what and who made the changes

- Comparison facility—compare last month to this to see the changes

As we noted in the Quizzle credit score review section above, this is still not a FICO score.

But, if you’re trying to improve your score quickly (and because you can cancel at any time), this may be a great way to keep track on progress.

If you don’t have any real credit problems, the benefits over the free report are questionable, despite the low cost.

Popular Article: Prosper Reviews – All You Need to Know Before Using Prosper.com

Quizzle Review Conclusion

Quizzle’s central offer is free access to your credit report every six months.

You’ve seen that this is not your FICO score, but it is a well-established no. 2 in the market: VantageScore. This is comparable enough to let you know whether your credit score is in a good or bad place.

Now that you know how it works and what it can do for you, why not give Quizzle.com a try for yourself and see how your credit score is looking?

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.