What Is Regulation V? Definition

Regulation V, also known as the Fair Credit Reporting Act, is a United States federal law that ensures accurate and accessible reporting of consumer credit.

The law mainly deals with the way credit reporting agencies collect, manage, and present credit information on individuals.

The main provisions of Regulation V are as follows:

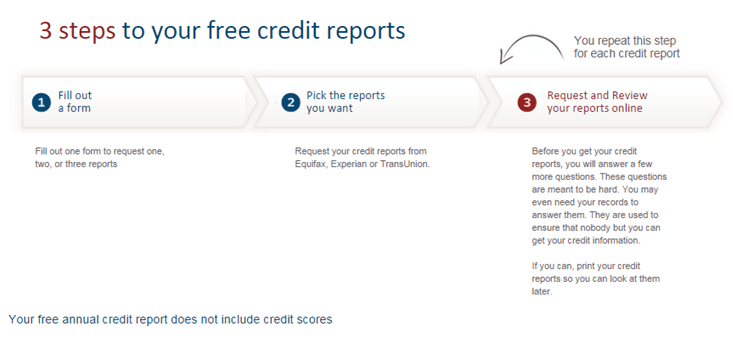

- Credit reporting agencies must provide free, accurate credit reports to individuals upon request, so long as the individual presents acceptable identification.

- Credit reporting agencies cannot just share information with anybody that asks. In order to get information about a person’s credit report, the soliciting party must demonstrate “permissible purpose” in accordance with the Fair Credit Reporting Act.

- If an individual notifies a credit reporting agency of inaccuracies on his or her credit report, the agency must take investigative action and correct or delete all items that are found to be inaccurate.

- Individuals who fall victim to identity theft are entitled to certain rights, including the omission of fraudulent transactions from credit reports.

- Negative items cannot remain on an individual’s credit report indefinitely and must be removed after a certain period of time.

See Also: Best Personal Finance Software, Apps, and Tools

Accessible Online Portal

Regulation V also stipulates that the three largest credit reporting agencies—Equifax, Experian, and TransUnion, maintain web portals where credit reports can be easily solicited.

Additional Overview and Definition

Regulation V was signed into law by President Richard Nixon in October of 1970 and has since been enforced by the U.S. Federal Trade Commission.

Image source: Big Stock

The Fair Credit Reporting Act is divided into 18 sub-parts and various appendices that detail regulatory requirements on credit reporting, identity theft, use of medical information, risk-based pricing, and affiliate marketing.

This law, the Fair Credit Reporting Act, is the main body of legislation protecting consumer credit rights in the United States.

The rules set out in Regulation V pertain to any party who generates, obtains or uses consumer credit reports. Some rules set forth in Regulation V apply to banks but only those that are members of the Federal Reserve.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.