2017 RANKING & REVIEW

TOP REVERSE MORTGAGE LENDERS

Overview: What to Expect from Reverse Mortgage Lenders | Top 6 Best Reverse Mortgage Lenders

Reverse mortgage companies and the general concept of reverse mortgages are met with mixed reviews by many consumers.

Essentially, a reverse mortgage is used by seniors who want to derive cash from the equity they have in their home. It’s a home equity loan, but it’s aimed at older homeowners, and it doesn’t require a monthly mortgage payment.

When a homeowner works with reverse mortgage providers, that reverse mortgage lender then makes payments to the borrower. The amount of these payments is based on a pre-determined percentage of the equity the homeowner has acquired in their home.

The loan isn’t repaid until the borrower passes away, moves out, or sells their home.

Image Source: Top 6 Best Reverse Mortgage Lenders

Reverse mortgage lenders provide products to seniors aged 62 or older. To be eligible, a borrower typically has to completely own their home or have a very small mortgage.

The money obtained through these home equity programs is often used as supplemental income for seniors who may be on a fixed income. It can also be utilized for any number of other purposes, including to pay for healthcare or existing debts; the availability of funding is what makes reverse mortgage lenders an attractive option for some qualified senior homeowners.

The following ranking and review of reverse mortgage companies not only highlights the best reverse mortgage lenders; it also explains some key considerations for homeowners before obtaining a reverse mortgage.

AdvisoryHQ’s List of the Best Reverse Mortgage Companies

This list is sorted alphabetically (click any of the below names to go directly to the detailed review that reverse mortgage lender).

- All Reverse Mortgage Company

- American Advisors Group (AAG)

- Finance of America Reverse

- Home Point Financial Corporation

- Liberty Home Equity Solutions

- One Reverse Mortgage

Best Reverse Mortgage Companies

Reverse Mortgage Lenders | Websites |

| All Reverse Mortgage Company | https://reverse.mortgage/ |

| American Advisors Group (AAG) | https://www.aag.com/ |

| Finance of America Reverse | http://www.fareverse.com/ |

| Home Point Financial Corporation | http://www.homepointfinancial.com/ |

| Liberty Home Equity Solutions | http://libertyhomeequity.com/ |

| One Reverse Mortgage | https://www.onereversemortgage.com/ |

Table: The Top 6 Best Reverse Mortgage Lenders | above list is sorted alphabetically

What Is the Process for Reverse Mortgage Lending?

Before deciding on a reverse mortgage lender, it’s important to have a clear understanding of the process that reverse mortgage banks undertake when offering these home equity loans

The first step when working with reverse mortgage lenders, as with a traditional mortgage, is the application. Reverse mortgage lenders will ask potential borrowers to decide on a payment plan, which in most cases can include a credit line, monthly advances, or a combination of both. The information often required during the application process with reverse mortgage lenders may include identifying information, the deed to your home, and information on any debts or liens on your home.

Then, once the homeowner submits their application information, it moves on to processing. During this time, the reverse mortgage lender will start things like a title search. An appraiser assesses the value and condition of the home, and in some instances, if there are problems or repairs that need to be made, they will have to be taken care of before loan qualification.

Once processing is finished, the loan is approved by the reverse mortgage lender’s underwriters. Closing date is set, much like with a traditional mortgage, and there is often a brief period after signing the papers during which the borrower can decide to cancel the loan.

Once this period has passed, the loan funds are paid to the homeowner, and if necessary, these funds can be used to pay off the remainder of the debt of the home. A new lien is placed on the borrower by the reverse mortgage lender, and then the loan is serviced, either in-house by the reverse mortgage lender, or it’s sent to another company.

What is the Process of Reverse Mortgage Lending?

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Is a Reverse Mortgage a Good Idea for You?

Before going to reverse mortgage companies, many homeowners wonder if it’s the right decision for them. There is no right or wrong answer; working with reverse mortgage banks might be the only solution for some homeowners, but there could be alternatives for others.

Some of the things to consider when making the decision include the following:

- What is your reason for considering working with a reverse mortgage lender? If your primary goal is to have more income to cover your cost of living, you may explore other programs that can help you make ends meet. You could also think about selling your home, to lower your expenses.

- Are you facing a financial emergency? Sometimes, choosing to work with reverse mortgage companies may be the best way to cover these situations, depending upon your circumstances.

- Will you be able to pay your homeowners’ taxes and insurance? Most reverse mortgage lenders will require that these continue to be paid unless the borrower opts for a plan where these costs are included in their loan. For seniors on a fixed income, this payment burden can be eliminated with a reverse mortgage.

- What is your family situation? If you have children or heirs that you’d like to leave your home to after you pass away, a reverse mortgage is probably not the best idea.

- How long are you planning to stay in your home? If you are going to live in your home for a long time, a reverse mortgage is generally a better idea, as compared to someone who only plans to be there for a short time. Working with a reverse mortgage lender can mean expensive upfront costs, and those costs don’t make sense in the short-term for the homeowner.

What Are the Costs Associated with a Reverse Mortgage?

Even with the best reverse mortgage companies, there are going to be some upfront costs. In some instances, depending on the program offered by different reverse mortgage providers, the costs may not be upfront, instead of being included over time.

Regardless of whether they’re up front or spread out over time, however, there are things to consider before selecting a reverse mortgage lender.

Some of the costs and fees can include mortgage insurance, which is based on the size of your loan, as well as lender fees, and as with a conventional mortgage, real estate closing costs.

These costs will vary depending on the type of loan, how much money you take upfront, and also the reverse mortgage lender you work with. It’s also important to realize that regardless of the reverse mortgage lender you select, a reverse mortgage is generally going to be more expensive than a conventional home loan product.

Don’t Miss: Top Best Refinance Companies to Refinance with | Top Mortgage Refinance Lenders

Methodology for Selecting the Best Reverse Mortgage Companies

What methodology does AdvisoryHQ use in selecting and finalizing the companies, services, and products that are ranked on its various top rated lists?

Please click here to see “AdvisoryHQ’s Ranking Methodologies,” a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated companies, products, and services.

Detailed Review — The Best Reverse Mortgage Companies

After carefully considering reverse mortgage lenders and the largest reverse mortgage lenders, we compiled the following list of the six top reverse mortgage lenders. As you continue reading, you’ll find detailed reviews of each of our picks, as well as an outline of the factors used in the decision-making process.

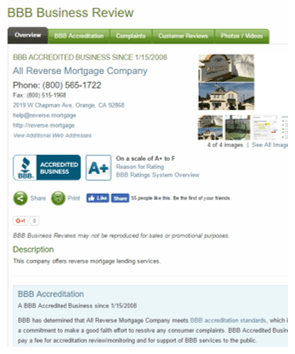

All Reverse Mortgage Company Review

All Reverse Mortgage Company is a HUD-approved direct reverse mortgage lender that has been recognized by media outlets such as The Huffington Post, which said, “The Maverick is All Reverse Mortgage.”

All Reverse strives to bring positive life changes to customers who receive a reverse mortgage from them, and this family-owned company has more than 100 years of combined experience in the mortgage banking industry. All Reverse is a leader among reverse mortgage companies, as it’s their only area of expertise. They work to find customers the best terms while delivering seamless experiences and fast closings.

Key Factors That Enabled This to Rank as One of 2017’s Best Reverse Mortgage Lenders

Factors that led to the inclusion of All Reverse Mortgage on this reverse mortgage lenders list are detailed in the following list.

Customer Reviews

When shopping for the best reverse mortgage lenders and the best reverse mortgage companies, you must read the reviews from real customers. This is an area in which All Reverse excels. Along with having an A+ Exemplary Rating from the Better Business Bureau, All Reverse has many customers who share their positive experiences working with the company.

For example, some of the points of praise regarding All Reverse include calling it the most pleasant experience customers ever had with a mortgage company, that all of their questions and concerns were answered with sensitivity and professionalism, and that the company displays the utmost in knowledge, patience, and courtesy.

All Reverse is also a reverse mortgage lender with a five-star rating on the TrustLink website.

All Reverse Mortgage Company Review

NRMLA Membership

In terms of finding the top reverse mortgage lenders, credentials and national association memberships can be important in terms of establishing credibility and reputation. All Reverse is a member of the National Reverse Mortgage Lenders Association (NRMLA).

NRMLA is a national organization with 300 member companies that works with the federal government including Congress and the Department of Housing and Urban Development, as well as bank regulatory agencies and state governments, to review and modify how reverse mortgages are delivered. Membership in NRMLA signifies a reverse mortgage lender is dedicated to the highest ethical standards and putting client needs above personal gain.

To be a member of NRMLA, reverse mortgage companies must sign and adhere to a Code of Ethics and Personal Responsibility.

Low Costs and Fees

All Reverse is not only one of the best reverse mortgage lenders but is also one of the reverse mortgage companies offering direct lender reverse mortgages approved by the Federal Housing Association. This is important because more than 99% of all reverse mortgage loans that close today are the FHA-insured Home Equity Conversion Mortgage, backed by HUD.

This offers the borrower the protection and peace of mind of federal safeguards.

However, while most companies offer and close the same reverse mortgage, many charge much more than All Reverse. While all lenders may offer the same federal guarantees, they differ in their rates and costs. All Reverse strives to save clients thousands of dollars per transaction.

Additionally, since All Reverse doesn’t work with brokers, they pass the savings on to their clients.

Specialization

As the company name implies, reverse mortgages are the entire focus of All Reverse. The only product they offer is the FHA-insured Home Equity Conversion Mortgage (HECM). This allows the company to concentrate completely on this product and understand even the subtlest features and complexities of this loan, and its impact on the borrower.

There is a low staff turnover at All Reverse, and every member of the team is an expert at reverse mortgages, so clients are going to receive the benefits that come with this high level of specialization and expertise.

Related: Top Best Mortgage Lenders and Companies | Best Mortgage Companies

American Advisors Group (AAG) Review

American Advisors Group (AAG) is perhaps one of the most recognizable names on this list of the top reverse mortgage lenders, and it is one of the largest reverse mortgage lenders in the country. AAG has been in business for more than ten years and strives to provide the funding seniors need to tap into their home’s equity and transform it into cash to pay debts and living expenses, or just to enjoy their retirement to the fullest.

All of the reverse mortgage professionals employed by AAG are required to go through in-depth training and licensing process and have an obligation to pass federal and state tests before they earn their licenses, ensuring AAG is one of the best reverse mortgage lenders if you want professionalism and the highest level of knowledge.

Key Factors That Enabled Us to Rank This as One of 2017’s Top Reverse Mortgage Lenders

When compiling this reverse mortgage lenders list, the following are some details why AAG was selected as one of the best reverse mortgage lenders.

Recognition

During its business history, which spans more than ten years, AAG has consistently been recognized as one of the best reverse mortgage lenders. This fully-accredited business has an A+ rating with the Better Business Bureau, but they’ve also been ranked as the number one reverse mortgage lender in the country, closing more loans than any other industry lender.

AAG was ranked as the number three Orange County Workplace in 2013, and also received top workplace honors in 2014 and 2015.

AAG is also an approved reverse mortgage lender by the U.S. Department of Housing and Urban Development.

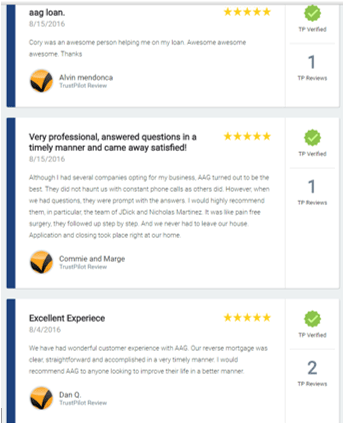

Customer Satisfaction and Reviews

AAG is one of the top reverse mortgage lenders, and that shows in their customer satisfaction and ratings. AAG has a 96% customer satisfaction rating, and they publish customer reviews from real borrowers as well. There are more than 1,600 customer reviews currently available on the AAG site, and of these, this reverse mortgage lender has an average of 4.2 out of 5 stars.

Some of the things many customers say they enjoyed their experience with AAG, based on verified TrustPilot reviews, include:

- Reliable, fast service including a relatively simple lending process

- Questions are answered promptly and effectively

- Fast distribution of paperwork and required documentation

- Excellent overall customer service

- Compassionate representatives who calm anxieties and take care of everything without requiring the borrower ever even leave their home

AAG Review

Jumbo Reverse Mortgage Loans

AAG offers a unique product not provided by all reverse mortgage companies, which is the jumbo reverse mortgage loan. FHA-insured Home Equity Conversion Mortgages (HECM) have a loan limit of $625,000 regardless of the value of the home of the borrower.

Jumbo loans, on the other hand, allow qualified borrowers to obtain a reverse mortgage on a home value of up to $6 million.

AAG began offering jumbo reverse mortgage loans in 2015, and they continue to grow the number of states they offer these products in. The loan is called the AAG Advantage Loan.

Membership in NRMLA

As mentioned above, AAG is a member of the National Reverse Mortgage Lenders Association. This is an important consideration when reviewing reverse mortgage companies and deciding the top reverse mortgage lenders.

NRMLA is considered the “national voice” of the industry, and it provides educational resources and advocates regarding public policy. It was established in 1997 to improve the level of professionalism of the reverse mortgage industry.

The NRMLA provides information to consumers about the pros and cons of reverse mortgages and also trains lenders to be sensitive in their dealings with clients. Finally, NRMLA also enforces adherence to its Code of Ethics and Personal Responsibility.

Related: Best Top Online Mortgage Lenders | Ranking & Reviews

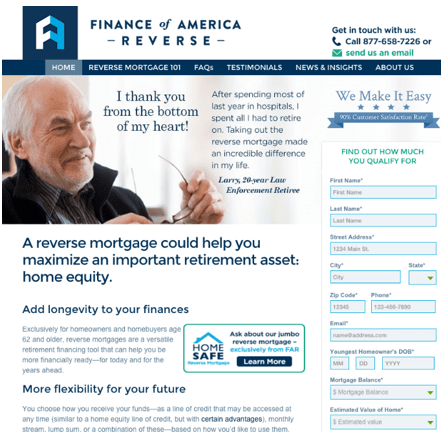

Finance of America Reverse Review

Finance of America Reverse is one of the top reverse mortgage lenders in the country, offering products for homeowners and homebuyers aged 62 and older. Finance of America Reverse was founded as Urban Financial Group in 2003, and since that time it has grown to become one of the most significant reverse mortgage providers in the country.

As one of the largest reverse mortgage lenders, Finance of America Reverse has grown through investments from names like The Blackstone Group, and they continue to develop and offer the very best in products and services to seniors.

Key Factors That Led Us to Rank This as One of 2017’s Top Reverse Mortgage Lenders

When ranking reverse mortgage providers and the best reverse mortgage companies, below are some reasons the Finance of America Reverse is a leader.

Finance of America Review

Simple Process

For many consumers, when choosing the best reverse mortgage lenders, it’s important that the company offers clarity, responsiveness, and simplicity.

Finance of America Reverse excels here. As one of the top reverse mortgage providers on this reverse mortgage lenders list, this company pairs clients with licensed reverse mortgage specialists. These highly trained professionals walk clients through every step of the reverse mortgage process, making sure to answer any and all questions and provide individualized guidance that’s right for the specific client.

HomeSafe Jumbo Reverse Mortgage

One of the exclusive products available to clients of this leader among reverse mortgage providers is the HomeSafe Reverse Mortgage. This is a proprietary product that offers the opportunity to gain access to greater loan proceeds than what a client would get with a traditional reverse mortgage.

The HomeSafe Mortgage offers loans up to $2.25 million, as compared to conventional reverse mortgages or Home Equity Conversion Loans, which have a much lower legislated maximum loan amount.

This product is ideal for those homeowners with significant value in their homes, and they can receive not just more loan proceeds, but also more cash upfront, potentially.

Online Qualification Information

For consumers seeking not only the top reverse mortgage lenders but also reverse mortgage companies that offer convenience and simplicity, the Finance of America Reverse is an excellent option.

As one of the top reverse mortgage providers, Finance of America offers the opportunity to find out how much you qualify for online. Consumers simply visit the company’s website and fill out their name, address, contact information, and the youngest homeowner’s date of birth. They then include their mortgage balance and the estimated value of their home.

After submitting, they can get instant results about how they qualify for.

Education

When reviewing the testimonials and reviews from real customers of this pick for one of the best reverse mortgage lenders, you’ll notice that one of the areas where Finance of America Reverse does well is in educating their clients.

Clients consistently report feeling as if the company worked with them from the start to help them understand the ins and outs of a reverse mortgage and how it would impact their lives. They often say Finance of America Reverse is one of the best reverse mortgage companies because they take the time to provide knowledge and education, while also ensuring the process is one that’s comfortable.

Home Point Financial Corporation Review

Home Point Financial is a licensed mortgage lender and also one of the leading reverse mortgage lenders in the country, led by William Newman. Newman has 25 years of mortgage experience, and he serves as the CEO of the company.

Home Point Financial is not just one of the top reverse mortgage lenders but also delivers financing to borrowers for primary, secondary, and investment residences. The company is headquartered in Ann Arbor, Michigan, and has 23 offices in 13 states.

Key Factors That Enabled This to Rank as One of the Best Reverse Mortgage Companies

When creating this reverse mortgage lenders list, below are some reasons Home Point Financial was included as one of the best reverse mortgage lenders.

BBB Accreditation

When considering the best reverse mortgage companies to include on this reverse mortgage lenders list, consumer reviews and opinions were important, and Home Point Financial is not only accredited by the Better Business Bureau, but also has an A+ rating.

Home Point Financial has been accredited since 2009, meaning they have seven years of continuous accreditation.

This means the BBB has determined this reverse mortgage lender meets their standards, which include maintaining a commitment to making a good faith effort to resolve any and all consumer complaints.

Some of the standards of accreditation include establishing and maintaining a positive track record in the marketplace, adhering to established standards of advertising and selling, and telling the truth.

Transparency

A reverse mortgage isn’t for everyone, and it’s not ideal for every situation, so rather than trying just to get new clients, Home Point Financial strives instead to be honest and transparent, which is a key part of their operational financing. As part of this approach, Home Point makes it clear that a reverse mortgage will cost more than a traditional loan.

In addition to the potential downsides of a reverse mortgage, Home Point also educates clients on the safeguards that are part of a reverse mortgage, including mandatory HUD-approved counseling, capped interest rates, advanced disclosures, and a three-day recession period.

With all loan products offered by Home Point, including the reverse mortgage, the company makes a conscious effort to explain all of the factors a borrower should consider before taking on that loan.

Cultural Philosophy

Home Point Financial is one of the reverse mortgage lenders on this reverse mortgage lenders list that has a carefully defined cultural philosophy, which is summed up by the phrase “We Care.”

Home Point also conducts themselves with the utmost in ethical standards and adherence to high-level industry practice, and they work to not only provide value, service, and excellent products to customers, but also to build strong communities in the areas they serve.

Branch

As mentioned in the introduction for Home Point Financial, this company has an extensive presence throughout the country and licensing in 13 states. This means that this is one of the reverse mortgage lenders that’s highly accessible to many consumers.

Additionally, Home Point Financial operates many brick-and-mortar offices throughout the country, including in cities like Baltimore, Charlotte, San Diego and Red Bank, New Jersey.

As compared to those reverse mortgage lenders and reverse mortgage companies that only have an online presence, a client of Home Point Financial has the opportunity to meet with their loan officer in person and have those valuable face-to-face interactions.

Popular Article: Top Banks to Get a Mortgage from | Ranking of Best Banks for Home Loans

Free Wealth & Finance Software - Get Yours Now ►

Liberty Reverse Mortgage Review

One of the largest reverse mortgage lenders in the U.S., Liberty Home Equity Solutions is a company that works to help consumers and homeowners understand how a reverse mortgage might assist them with the funding they need to address short-term financial goals and have a more secure retirement.

For almost a decade, Liberty Home Equity Solutions has been working with seniors to help them secure Home Equity Conversion Mortgages (HECMs). To provide lower costs, simplicity, and personal attention, Liberty Home Equity Solutions is also a direct reverse mortgage lender, which is one of many reasons it’s included on this reverse mortgage lenders list.

Key Factors That Allowed This to Rank as One of 2017’s Best Reverse Mortgage Companies

Key reasons Liberty is part of this ranking of the top reverse mortgage lenders and the best reverse mortgage companies are below.

Fees

One of the aspects of working with Liberty that makes it unique among other reverse mortgage companies and reverse mortgage lenders is the fact that they don’t charge upfront lender fees.

There are no upfront lender fees at all, so all processing and loan fees can be financed with the mortgage itself.

Also, Liberty features overall competitive pricing and flexible terms, and they can offer lower general costs and faster closing times because they have in-house underwriting and processing for all of their reverse mortgage loans.

Iron Clad Guarantee

A signature feature of doing business with Liberty and one of the primary reasons it’s ranked as one of not only the largest reverse mortgage lenders but also one of the best reverse mortgage lenders is the Liberty Iron Clad Guarantee.

This guarantee includes the following:

- Clients will receive fair and competitive pricing all the time, and if Liberty can’t match or beat a program offering from other reverse mortgage companies, they will provide the client with a $100 gift card.

- The loan will close within 60 days or less from the date the application is received as well as the HUD Counseling Certificate. If the loan isn’t closed in 60 days or less, Liberty issues the client a $500 credit toward their closing costs.

- Clients will reach a live person during business hours, rather than a machine, who will answer all questions and concerns with knowledge and courtesy.

- The team of loan experts will provide weekly updates throughout each step of the process.

- Borrowers can change their mind or stop the process at any time while their loan is being funded.

Liberty Iron Clad Guarantee

Products

Liberty offers several different products aimed at consumers seeking a reverse mortgage loan. In addition, this top pick among reverse mortgage companies also provides in-depth information about each so that consumers can make an informed decision.

- HECM Loan: This is a reverse mortgage loan that lets homeowners convert a portion of the equity in their home into cash. It’s not due as long as the borrower lives in the home as their primary residence and meets mortgage obligations, such as keeping up with property taxes and insurance.

- HECM Zero: This affordable reverse mortgage is an alternative to obtaining a Home Equity Line of Credit, with competitive rates, zero closing costs, and an interest rate cap that’s usually lower than a HELOC.

- HECM for Purchase: This is a reverse mortgage that lets buyers aged 62 and older purchase a home to be used as their primary residence. The difference between the purchase price of a home and HECM proceeds will be paid in cash from the sale of an existing home or another source of available funding.

Learning Center

The decision to obtain a reverse mortgage can be a significant and even a challenging one for many homeowners. Liberty strives to make the process as easy as possible for clients, and one way they do this is through the provision of their exclusive “Learning Center.”

The Learning Centers is an online hub of information that answers questions homeowners might have about reverse mortgages and clears up misconceptions many consumers have about these products and the process.

Some of the topic areas covered in the learning center include:

- How a Reverse Mortgage Loan Works

- Safeguards

- Misconceptions

- Benefits of a Reverse Mortgage Loan

- Is a Reverse Mortgage Loan Right for Me?

- Using a Reverse Mortgage Loan to Purchase a Home

Read More: Top Mortgage Lenders | Reviews of the Best & Largest Mortgage Lenders

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

One Reverse Mortgage Review

One Reverse Mortgage was founded in 2001, and in that time it has grown to become one of the largest reverse mortgage lenders in the U.S. One Reverse Mortgage is a Quicken Loans company and is licensed in all 50 states with current operations in 47, and this widespread service availability is one of many reasons they’re considered one of the best reverse mortgage lenders.

One Reverse Mortgage is led by CEO Richard Mandell and President & COO Gregg Smith. It has been featured on CBS, Fox News, and other national networks. One Reverse Mortgage has more than 150 licensed specialists, and the only states they don’t currently operate in are Rhode Island, West Virginia, and Vermont.

Key Factors That Enabled Us to Rank This as One of 2017’s Best Reverse Mortgage Companies

Among reverse mortgage lenders, below are some reasons One Reverse Mortgage is considered one of the top reverse mortgage lenders and was included on this reverse mortgage lenders list.

Credentials

No borrower wants to work with a reverse mortgage lender that isn’t highly experienced, has credentials, and has an excellent reputation — and top-notch credentials are one of the reasons One Reverse is ranked on this list of the best reverse mortgage companies and the best reverse mortgage lenders.

One Reverse is approved by the Federal Housing Administration (FHA), and the loan program is insured by the U.S. Department of Housing and Urban Development (HUD). In order to maintain approval by both HUD and the FHA, reverse mortgage banks and reverse mortgage providers are required to follow the strictest guidelines, which are put in place to provide protection to consumers.

One Reverse Mortgage also has an A+ BBB rating and is a member of the National Reverse Mortgage Lenders Association (NRMLA).

State Knowledge

As mentioned, One Reverse Mortgage is considered one of the best reverse mortgage companies, as well as being the largest reverse mortgage lender, because of their federal backing and credentials.

At the same time, with licensing in all 50 states and current operations in 47, One Reverse Mortgage offers an extensive service network. This requires not only knowledge of federal regulations and laws affecting the reverse mortgage industry but also an understanding of state regulations.

One Reverse is unique because they can offer both of these things to their customers.

Reasonable Fees and Terms

One of the best sources of information when determining the best reverse mortgage companies and the best reverse mortgage lenders come from real clients of the company.

When looking at reviews from clients of One Reverse Mortgage, many customers appreciated the reasonable fees and the flexible, convenient terms they offer.

Customers also say they were given ample choices, could customize their reverse mortgage to their needs and received more funding than they expected.

Retirement Planning

One Reverse Mortgage is one of the names on this reverse mortgage lenders list of the best reverse mortgage companies that puts a lot of focus on using this type of product as a retirement tool.

As a result, they also offer resources that highlight how homeowners can most effectively use a reverse mortgage as part of their retirement, and they also feature a retirement blog with news and updates that might impact consumers considering a reverse mortgage during retirement.

One Reverse Mortgage also highlights two ways their line of credit offers can be used as a retirement planning strategy, including taking the money as a lump sum or receiving monthly distributions, as well as foregoing an initial withdrawal of any money and keeping unused funds for the future.

Conclusion—Top 6 Best Reverse Mortgage Lenders and Best Reverse Mortgage Companies

Why do seniors age 62 and older turn to reverse mortgage lenders?

There are many reasons to work with reverse mortgage banks and reverse mortgage providers, including the ability to cover unexpected expenses with the equity in your home, to have money for day-to-day life, and to build a stronger retirement plan.

Regardless of the reason for opting to work with reverse mortgage banks and reverse mortgage providers, it’s incredibly important to find a reputable company. The best reverse mortgage companies will often have years of experience, many will specialize in working only as reverse mortgage lenders, and they’ll often be credentialed members of professional organizations. The best reverse mortgage lenders also often have government backing, providing peace of mind to borrowers.

Finally, when searching for the top reverse mortgage lenders, it’s important to ensure they provide excellent customer service, the ability to answer questions in an honest and transparent way, and a simple, fast process.

All of these considerations were included in the creation of this reverse mortgage lenders list. Each of the reverse mortgage lenders on this ranking is not only considered one of the largest reverse mortgage lenders in the country, but they also adhere to the above criteria, making them the best reverse mortgage lenders for a wide variety of senior borrowers.

Image Sources:

- https://pixabay.com/photos/new-home-for-sale-real-estate-1553256/

- https://www.trustlink.org/Reviews/All-Reverse-Mortgage-Company-205978139

- https://www.aag.com/reviews/

- https://www.trustpilot.com/review/americanadvisorsgroup.com?utm_medium=trustbox&utm_source=Grid

- https://www.fareverse.com/

- https://libertyreversemortgage.com/about-us/iron-clad-guarantee

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.