Intro: Ria Money Transfer Review

Due to the intricacies of international currency transfers, it’s not surprising that there are many companies that offer these services.

But what might surprise you is that many of these services have very mixed online reviews. One such company is Ria Money Transfer. For that reason, we decided to do a Ria Money Transfer review of our own.

For AdvisoryHQ’s Ria Money Transfer review, we decided to focus on some key areas: The history of Ria Money, what you should know about Ria Money transfer fees, the Ria online money transfer process, and Ria Money Transfer reviews.

Image Source: Ria Money Transfer

History: Ria Money Transfer Online Funds

According to their website, Ria Money began in 1987 with a small store in New York City and a goal of helping its clients send money to their loved ones back home. Today, Ria Money Transfer online has grown into the third-largest money transfer service, with an agent network of more than 316,00 locations in 150 countries.

Yet Ria Money does more than just money transfer services; Ria Money Transfer also offers bill payment, mobile top-ups, prepaid debit cards, check cashing, and money orders. Yet by far, the most important thing people want to know is this: How well does Ria send money?

See Also: Snapdeal Review | Is Snapdeal Safe? What You Should Know About Snapdeal

How High Are Ria Money Transfer Fees?

How much does it cost to have Ria transfer money? It depends.

According to their website, consumer costs will vary with the amount you are sending, the speed with which you are sending the money, and the country that you are having Ria send money to. Of course, as with most other transfer sites, the actual cost increases with the amount of money you are sending, but the price per dollar decreases as you send more money.

When it comes to how quickly Ria transfers money, the company gives you three standard options based on the vehicle through which you are transferring funds:

- Credit card: These have the highest fees, but funds are said to be generally available to your recipient within minutes.

- Debit card: Money sent from a debit card is also said to be available within minutes, but generally at a lower cost to you.

- Bank account: This least expensive option takes the most time. You first must verify two micro deposits Ria will make into your account. Then, sending money will take four business days.

Because prices for a Ria online money transfer will necessarily vary with continually fluctuating exchange rates, the company has set up a convenient Price Calculator on their site. A client simply selects the country they wish to send funds to, the amount they wish to send, the payment method and the payout method, and they receive an instant quote.

We ran the numbers a few different ways to give you some real life examples of Ria Money Transfer fees. (Please note that since currencies fluctuate, so these figures may be different at the time you are reading this Ria Money transfer review; please verify all figures for yourself.)

To begin, we used Mexico as a benchmark, since that is the most popular destination for U.S. bank transfers, according to the World Bank. We began with $1,000. If we chose to use a bank account, we saw total Ria Money transfer fees of $3. With a credit card, we encountered total Ria Money transfer fees of $35, while a debit card garnered total Ria Money transfer fees of $4. (In comparison, TransferWire, one of the highest rated online transfer services for amounts under $10,000, quoted fees of $14.95 for a transfer of $1,000 to Mexico as of this writing.)

When we adjusted the amount sent to Mexico to $2,000, we got the same $3 in Ria Money transfer fees for a bank account and $4 in Ria Money transfer fees for a debit card, but we saw a jump to $65 in Ria Money transfer fees for a credit card. When we reached the maximum Ria online money transfer amount of $2,999, we were still at the same $3 in Ria Money transfer fees for a bank account and $4 in Ria Money transfer fees for a debit card, but we saw a jump to $105 in Ria Money transfer fees for a credit card.

We then looked at another popular country for transfer in a completely different part of the world: India. We began with $1,000. If we selected bank account, we got a total of $0 in Ria Money transfer fees. With a credit card, we got a total of $30 in Ria Money transfer fees, while a debit card garnered a total of $6 in Ria Money transfer fees.

When we adjusted the amount to India to $2,000, we got the same $0 in Ria Money transfer fees for a bank account and a higher $11 in Ria Money transfer fees for a debit card, but there was a jump to $60 in Ria Money transfer fees for a credit card. When we reached the maximum Ria online money transfer amount of $2,999, we were still at the same $0 in Ria Money transfer fees for a bank account and a slightly higher $16 Ria Money transfer fees for a debit card, but there was a jump to $90 in Ria Money transfer fees for a credit card.

Currently, the company is running a promotion that makes using the service much more attractive by temporarily eliminating Ria Money transfer fees. It allows new Ria members to enjoy 30 days of $0 fee money transfers when they pay with a debit card (excluding U.S. to U.S. transfers).

Don’t Miss: Plated Reviews & Cost | What You Need to Know About Plated Food Delivery

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How Does Ria Online Money Transfer Work?

We would be remiss if we did a Ria Money transfer review without describing in detail how their process works. For new customers, the process involves several steps:

- First, you’ll use their price calculator to select your transfer destination country, how much money you’d like to send, and whether you’ll pay via a debit card, credit card, or bank account. The calculator will determine the exchange rate and payment method price for a total transaction cost.

- Then, you’ll select how your money will be delivered. Delivery options include transferring funds to the recipient’s bank account, a cash pick up at an agent locations, or in select countries, via a courier delivery.

- Next, you’ll enter your recipient’s information as displayed on their government-issued ID, as well as either an e-mail address or phone number. To deposit money directly into your recipient’s account, you’ll also need his or her bank account and routing number.

- Then, you’ll select exactly where and how your money will be transferred.

- Finally, you’ll complete your registration process, which includes verifying your bank account if you select that as your method of payment.

- Transfers are then reviewed, which typically takes one business day.

It’s worth noting that a Ria Money transfer online is limited to $2,999. If you’d like to send more than $3,000 in one day, you may do so by visiting one of the company’s agent locations. (Please note that the maximum a customer may send at this time during any 30-day period is $7,999).

As a side note, you can not send cash online, but the company does allow you to do so at its locations. To find one near you, visit their online location finder.

How Does Ria Online Money Transfer Verify My Account?

Since many Ria Money transfer reviews seem to center on account verification, we wanted to discuss that aspect in our Ria Money transfer review.

As they explain on their website, Ria Money goes to extra steps to confirm that the person requesting a bank account transfer is indeed the owner of the bank account in question. To that end, they require all customers to go through a one-time confirmation that they say allows them to “properly and effectively protect you and your money.”

As is common practice with many other online financial service companies, Ria will make two small deposits (each of less than $1.00) in your bank account that will appear as “RiaMoneyTransfer.” The deposits will appear within 4 to 24 hours if the account was created on a business day or between 48 and 72 hours if the account was created on a weekend or holiday. The customer then signs into their bank account, gets the exact amount of those deposits, and enters those amounts into their Ria account.

Once this confirmation is complete, you will no longer need to verify your account.

Related: Is RoseGal Legit & Safe? Is It a Scam? What You Need to Know Before Shopping on RoseGal

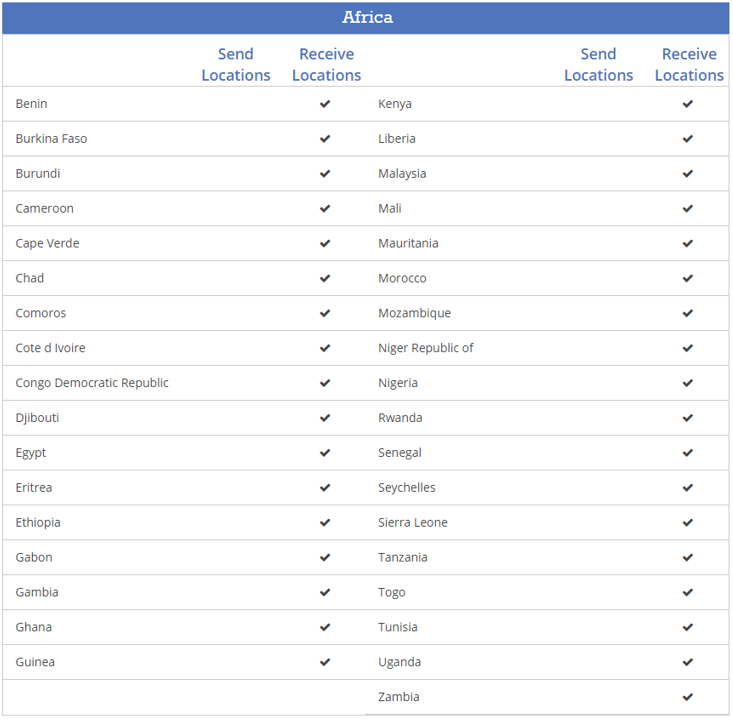

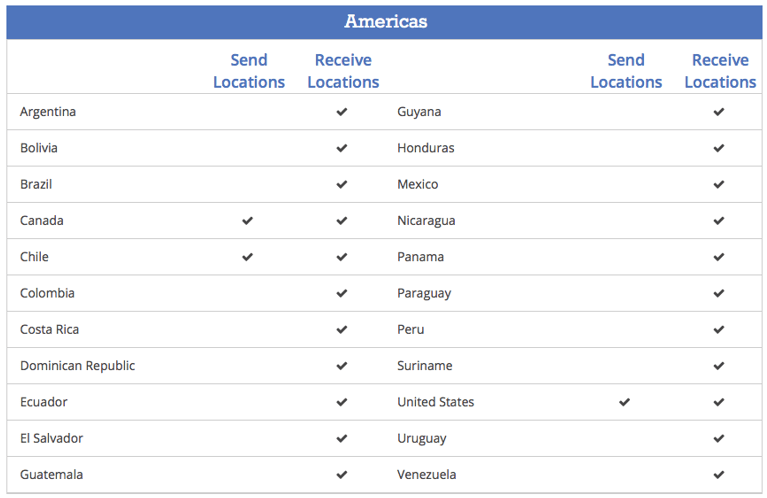

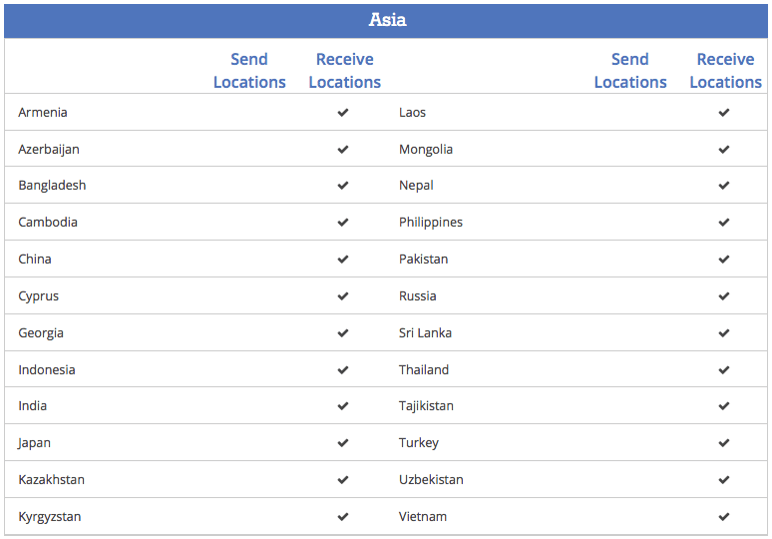

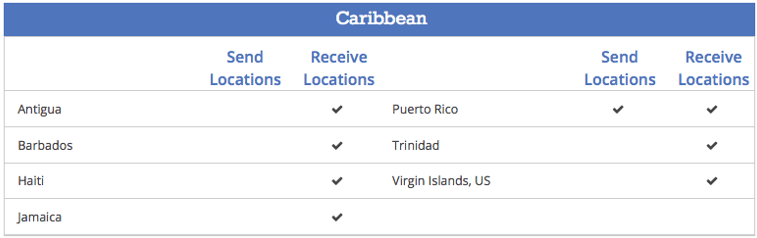

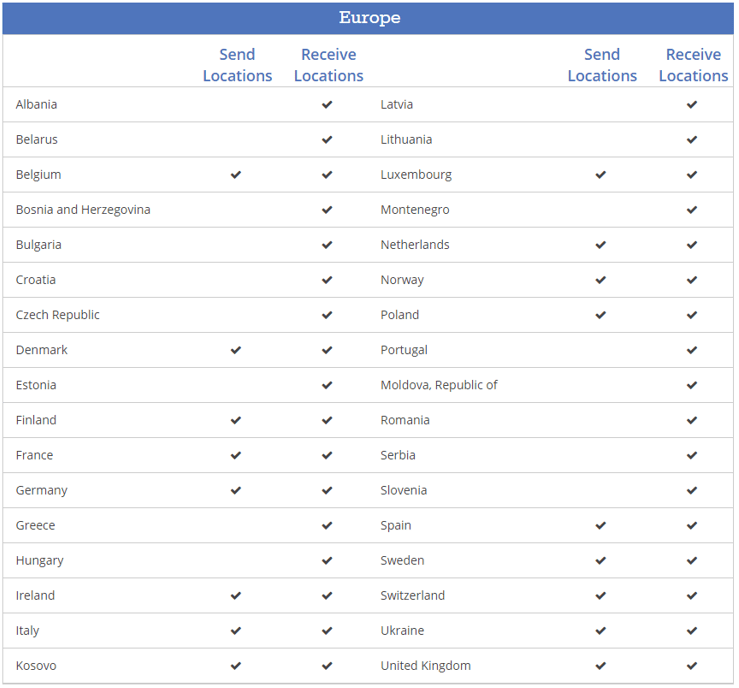

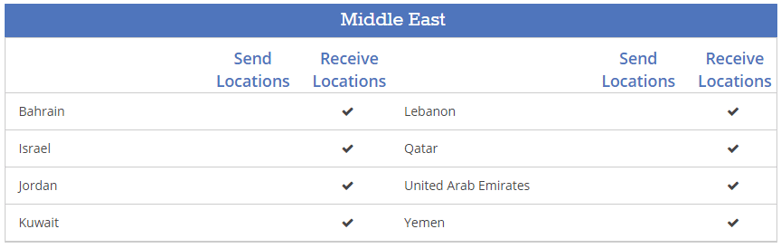

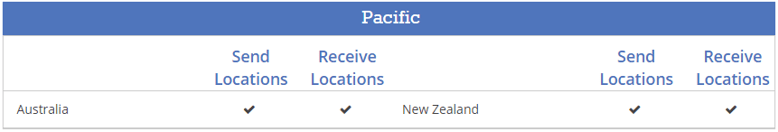

To Which Countries Can I Send a Ria Online Money Transfer?

To how many countries does Ria send money? The answer right now is 150, and the company continues to expand. Currently, only customers who are physically in the United States or Spain can use their online service to send money. Here is a breakdown of the countries to which U.S. and Spanish customers can transfer funds:

Images source: Riamoneytransfer.com

One of the most unique Ria Money transfer online features — courier delivery to home or office — is only available in select countries at this time: Vietnam, Philippines, Dominican Republic, Nicaragua, and Peru.

So, What About Ria Money Transfer Reviews?

When we started looking at Ria Money Transfer reviews, they were admittedly all over the board. So we started with a reliable source: the Better Business Bureau. The BBB has posted an online review of Ria Financial Services, the parent company of Ria Money, which has been a BBB accredited business since June of 2015.

Ria Financial Services has received an A+ rating from the BBB. In the past 3 years, there have been a total of 32 complaints closed with the BBB, the majority of which (17) related to issues with the product or service.

When it came to other Ria Money transfer reviews, we did come across quite a few negative ones. Many appeared to focus on Ria online money transfer security. The complaints seemed to be that Ria was slow to send money when there was a question about either verifying the authentict of or the security of an account, though whether this is a positive thing or a drawback may be in the eye of the beholder.

When we looked at the compiled Ria Money transfer reviews on Ria Money’s own website, they ranked a 7.3 out of 10 based on 438 reviews. It appeared that even some of the folks who initially complained about security turned out to appreciate it.

Here is part of a 5-star review left by client Jama Asatillayev:

“I was very skeptical when I started using it because their security checks continued longer than I expected. Money was on hold for some time even though I selected minutes. However, after clearing the security, life became a lot easier with Ria…My advice to those who complain about security – if you’ve setup your account recently, try not to send urgent transfer using Ria. Or transfer them well ahead, give them 2-3 days. For me it took about a month to be cleared from security checks now, even bank account transfers are so fast.”

The conclusion of our Ria Money Transfer review is that Ria Money transfer fees are competitive, the Ria online money transfer process seems to be smooth – barring some Ria Money Transfer reviews that focus on security verification – and that the company offers services in the countries typical U.S. customers most want to reach.

Popular Article: What You Should Know about SammyDress | Reviews. Is SammyDress Legit? Scam?

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.