RTD Financial Advisors, Inc. was recently ranked by AdvisoryHQ News as a top rated financial advisory and wealth management firm in Philadelphia, PA.

RTD Financial Advisors, Inc. was recently ranked by AdvisoryHQ News as a top rated financial advisory and wealth management firm in Philadelphia, PA.

AdvisoryHQ is a fast-growing online news media that provides coverage, detailed reviews, and objective rankings of financial firms and wealth managers across the U.S., U.K., and Canada.

Overview of RTD Financial Advisors, Inc.

RTD Financial Advisors, Inc. is a wealth management firm in Philadelphia with offices in Atlanta, GA; Bonita Springs, FL; Mt. Laurel, NJ; West Chester, PA; and Johnstown, PA.

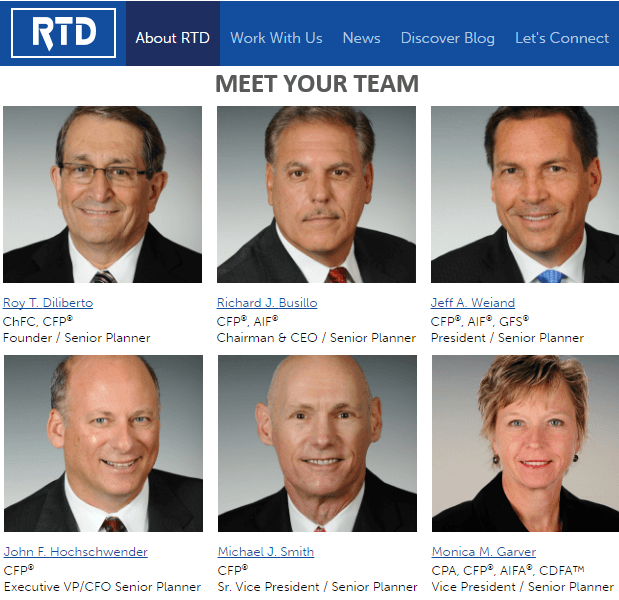

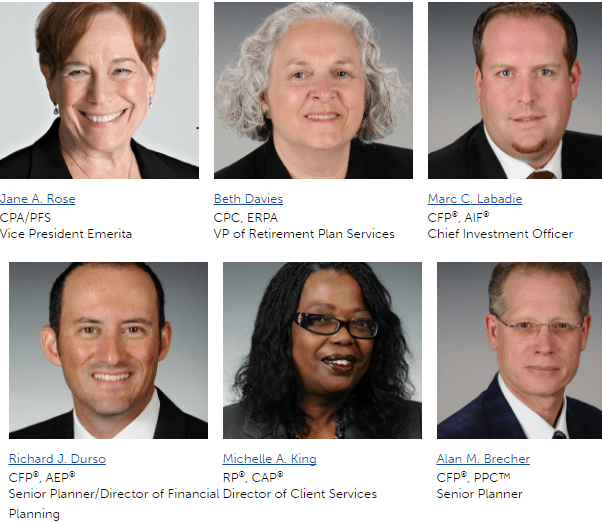

RTD was founded by Roy T. Diliberto in 1983.

The company prides itself in being one of the original independent advisory firms and is credited with pioneering Financial Life Planning™, a unique approach to comprehensive and holistic financial planning based on the Kinder Institute model, which separates client priorities into three segments: “Heart’s Core,” “Ought To,” and “Fun To.”

The firm has received numerous accolades and awards over the years, including being recognized as one of the top advisory firms by nationally acclaimed publications such as Money magazine, Worth, Philadelphia Business Journal, and Barron’s.

Key Factors That Enabled This Firm to Rank as a Top 2016 Wealth Advisory Company

Below are key factors that enabled RTD Financial Advisors, Inc. to rank as a top 2016 wealth management firm in Pennsylvania.

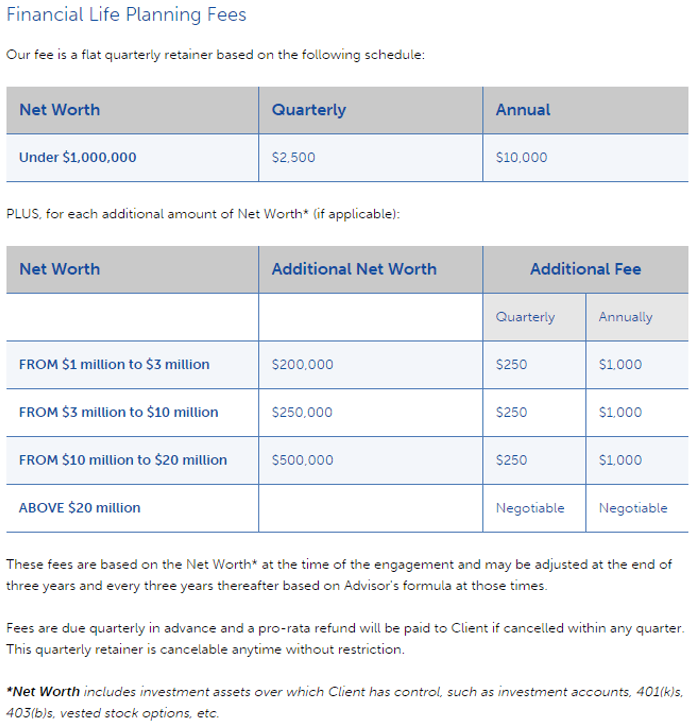

Open, Transparent Fee Structure:

RTD carries all the features that we look for in top financial advisors in Philadelphia. Namely, it is fiduciary, independent, and operates under an open, transparent payment structure.

And it’s that structure in particular that makes RTD unique.

While providing fiduciary duties to clients, RTD uses a very unique (among its peers) definition of what constitutes a fiduciary obligation; it’s one that goes far beyond the letter of the law in demonstrating a responsibility to openly discuss points of potential conflicts of interest, such as advising a client on whether to pay off a mortgage early, which could cause a depletion of funds under the advisors’ management.

Because of such inherent potential for conflicts of interest, RTD has chosen a compensation model that is based on a flat retainer fee, where the client’s fee is adjusted every three years instead of based on the assets under management.

This differs significantly from other fee-only advisors who charge based on the value of assets under their management.

RTD utilizes this model for four primary reasons:

- It reduces conflicts of interest: Firms that operate on a percentage-based scale would see their bottom line decrease if a client chose to move money from their investments with that firm elsewhere (say, to pay off a mortgage or purchase a business). RTD sees this as a conflict of interest: your money should work for you, not for them. That is why RTD implements a flat retainer fee based on a transparent scale.

- It emphasizes holistic financial planning: By charging a flat retainer, RTD can ensure that all of its services are accounted for within your personalized financial plan. Firms that charge a percentage of AUM do so regardless of whether or not you receive multifaceted wealth management advice. A flat fee gives you more bang for your buck.

- It pays advisors for what they can control: Obviously, increases in the market cannot be controlled by advisors. However, it’s very common for financial advisors to benefit from market increases despite their inability to influence the market. RTD feels that a percentage of AUM in these instances creates a conflict of interest in the advisor’s fee structure. Conversely, a flat-fee structure guarantees that you won’t face such conflicts with your RTD advisor.

- It de-emphasizes risky asset allocation: Since RTD doesn’t earn more when your portfolio does well, it avoids the conflict of interest from excessively risky investments. RTD doesn’t stand to reap a windfall if a risky investments pay off. To that end, it recommends investments that protect your wealth and grow it safely over the long-term.

RTD’s fees (also pasted below) can be viewed on the fee structure page of its website.

Image Source: RTD Financial

Learning About You to Make Your Plan Personalized:

RTD advisors strive to create a financial plan that addresses what they see as the three biggest areas of your life. These include:

- Heart’s Core: your core values

- Ought To: your responsibilities and commitments

- Fun To: your goals and dreams

To map out a customized approach that addresses these concerns, your RTD advisor walks you through a three-step process of financial planning, which includes the following:

- Discover: True to its name, this stage involves your RTD advisor getting to know you. They learn who you are, what you want to do with your wealth, your goals for family or business, and so on. Considerations, such as cash flow, financial health, taxes, and insurance, among others, are included.

- Plan: After the Discover phase, your advisor builds your plan. Every possible consideration is included during the plan’s construction, all with an eye toward making your financial goals, both short- and long-term, a reality.

- Live: As simple as it sounds. Once you and your advisor agree on the specifics of your plan, it is finalized and implemented. You then get to experience life to its fullest. No worrying about whether you’re adequately preserving your wealth or on-track to meet your goals.

Expert Education:

RTD has accrued an impressive list of designations. We like that RTD employs advisors who have such a breadth of knowledge on industry-related policy. It helps RTD as a firm to provide you with deeper levels of service than you’ll find with many Philadelphia wealth management firms.

Image Source: BigStock

Image Source: BigStock

Some of these designations include:

- Chartered Financial Consultant (ChFC)

- Certified Financial Planner (CFP®)

- Accredited Investment Fiduciary® (AIF®)

- Global Financial Steward™ (GFS®)

- Certified Public Accountant (CPA)

- Accredited Investment Fiduciary Analyst™ (AIFA®)

- Certified Divorce Financial Analyst™ (CDFA™)

- Personal Financial Specialist (PFS)

- Certified Pension Consultant (CPC)

- Enrolled Retirement Plan Agent (ERPA)

- Registered ParaplannerSM (RP®)

- Chartered Advisor in Philanthropy® (CAP®)

- Accredited Estate Planner® (AEP®)

- Professional Plan Consultant™ (PPC™)

- Chartered Retirement Plans SpecialistSM (CRPS®)

- Master of Business Administration (MBA)

Comprehensive Financial Planning Services:

RTD’s services can be divided between its Primary Services and its Comprehensive Planning Services. Between the two categories, it can create better, more customized plans that address a wider range of client needs.

Its Primary Services are as follows:

Its comprehensive planning services, for both individuals and businesses, include specializations in:

- Income tax

- Retirement

- Investment planning

- Education planning

- Cash flow planning

- Estate planning

- Special needs planning

- Risk management

- Insurance planning

- Business, 401(k), and other retirement planning

- Employee benefit planning

- Philanthropy and charitable giving

- Stock option planning

Contact

Philadelphia Office

Headquarters

United Plaza

30 S. 17th Street, Suite 1620

Philadelphia, PA 19103

(215) 557-3800 voice

(215) 557-3814 fax

Directions to our Philadelphia Office

Atlanta Office

Two Ravinia Drive, Suite 1360

Atlanta, GA 30346

(800) 893-4725

Directions to our Atlanta Office

Bonita Springs Office

27499 Riverview Center Blvd., Suite 421

Bonita Springs, FL 34134

(800) 893-4725

Directions to our Bonita Springs Office

Mt. Laurel Office

Horizon Corporate Center, Atrium II Building

3000 Atrium Way

Mt. Laurel, NJ 08054

(800) 893-4725

Directions to our Mt. Laurel Office

West Chester Office

(New Office Location as of January 2015)

121 N. Walnut Street

1st Floor, Suite 190

West Chester, PA 19380

(215) 557-3800

Directions to our West Chester Office

Johnstown Office

1 Pasquerilla Plaza, Suite 127

Johnstown, PA 15901

(800)-893-4725

Directions to our Johnstown Office

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.