Intro: Scottrade vs TD Ameritrade Comparison

Scottrade and TD Ameritrade have a lot in common. Both brokerage firms offer banking and investment products, as well as research and financial advice to beginner, intermediate, and advanced investors.

So, should you choose Scottrade or TD Ameritrade? Read on for an analysis of Scottrade vs TD Ameritrade, including a look at Scottrade and Ameritrade fees, services, promotions, and reviews.

Image Source: Scottrade vs TD Ameritrade

About Scottrade

Headquartered in the St. Louis suburb of Town and Country, Missouri, Scottrade is a privately-owned American financial firm with four main lines of business:

- Scottrade Inc.: provides online brokerage services

- Scottrade Advisor Services, a division of Scottrade Inc.: serves registered investment advisors

- Scottrade Bank: offers retail banking products and services, and commercial lending and equipment financing

- Scottrade Investment Management: offers investment advice and services

Formerly called Scottsdale Securities, Scottrade has served investors for more than 35 years.

See Also: Top Futures Trading Brokers Trading Platform Reviews

About TD Ameritrade

TD Ameritrade has helped clients meet their financial goals for over 40 years. Based in Omaha, Nebraska, the company first began as First Omaha Securities, later evolving into TD Ameritrade. Ameritrade became the first to offer touch-tone phone trading in 1988. Today, the company holds over $600 billion in assets, providing investing and trading services to its six million clients.

Scottrade vs TD Ameritrade (Fees, Promotions, Services, Reviews)

Scottrade vs Ameritrade is a difficult decision, as the two companies are competitors with similar offerings.

Services

A look at the services offered by each firm can help you determine whether to invest with Scottrade or Ameritrade.

New and existing clients can conveniently open accounts online with either Scottrade or TD Ameritrade, choosing from a diverse selection of Standard Accounts, Individual Retirement Accounts (IRAs), and Education Savings Accounts (ESAs). Both firms have comparable account options. Keep reading for a breakdown of products to help you differentiate TD Ameritrade vs Scottrade.

Standard Accounts

Whether you choose a standard account with Scottrade or TD Ameritrade, you’ll have flexibility and access to diverse investment products. Both firms offer:

- Individual accounts, which give a sole owner much trading freedom

- Joint tenant accounts shared by two or more account holders

- Guardianship/conservatorship accounts, which are managed by a guardian or conservator on behalf of another person, usually a minor or an individual who cannot manage his or her own assets

Individual Retirement Accounts

Scottrade or Ameritrade each offer a variety of IRAs to help you meet your investment goals.

1. Roth IRA – Under U.S. law, Roth IRAs are retirement accounts that are generally not taxed. This means that you can make after-tax contributions while also benefitting from tax-free growth. The caveat? Your money must be in the account for at least five years and contributions are not tax deductible. However, because qualified withdrawals from Roth IRAs are not considered taxable income, your money will continue to grow tax-free. Individuals with a Modified Adjusted Gross Income (MAGI) of $132,000 or less are eligible.

2. Traditional IRA – No annual income limits and tax-deferred contributions are among the benefits of Traditional IRAs. The annual maximum contribution limit for 2016 is $5,5 00 for those 49 years old and younger. The annual maximum contribution limit increases to $6,500 for those 50 and older. Individuals whose income equals or exceeds the amount of contributions are eligible.

3. SEP IRA – Simplified Employee Pension – or SEP IRAs – are available to self-employed individuals, the sole employee of a small company, and small business owners. SEP IRAs can help this cohort save for retirement tax-deferred. Similar to 401(k) accounts, contributions can be made by employers on behalf of employees. The annual maximum contribution for 2016 is the lesser of 25% from one’s annual compensation or $53,000.

4. Simple IRA – Small business owners with 100 employees or fewer can benefit from Simple IRAs: Savings Incentive Match Plan for Employees. Both employers and employees can contribute, provided the employer doesn’t already hold another retirement plan. The annual maximum contribution for 2016 for employees is $12,500 for those 49 years old and younger, and $15,000 for those over the age of 50. Employers are required to match up to 3% of employee contributions.

5. Education Savings Accounts – Once again, TD Ameritrade and Scottrade are markedly similar when comparing education accounts. Scottrade offers two types of accounts to help adults save for the future education of a child: Coverdell Education Savings accounts (ESAs) and custodial accounts.

Coverdell ESAs provide tax advantages to investors while they save for a minor’s higher education. Any combination of mutual funds, stocks, and bonds can be chosen. Moreover, ESAs require no minimum investment or balance, and withdrawals for eligible educational expenses are tax-free. Up to $2,000 per year can be contributed by investors until the child’s 18th birthday.

Custodial accounts are managed for the benefit of a minor until he or she reaches age 18 or 25, depending on the termination age in your state. Unlike ESAs, withdrawals from custodial accounts can be used for any purpose without penalties. Custodial accounts also carry the following benefits:

- No contribution limitations

- No income limitations

- Tax advantages: earnings are tax-free up to $950

- Eligible account for the annual $14,000 federal gift tax exclusion.

In addition to Coverdell Education Savings accounts and custodial accounts, TD Ameritrade also offers 529 plans. These plans allow investors to save for the higher education of beneficiaries, while money grows tax-deferred. 529 plans are qualified tuition programs that are established by states under Section 529 of the Internal Revenue Code. 529 plans do not require a minimum annual contribution.

According to TD Ameritrade, “The 529 Plan is designed to meet the needs of virtually every family and every budget.”

Overall, TD Ameritrade vs Scottrade education accounts are comparable, though Ameritrade offers more variety in account types.

Don’t Miss: Top Forex Brokers –Comparison of the Best Forex Trading Platforms

Specialty Accounts – Specialty accounts with Scottrade vs TD Ameritrade vary. Ameritrade offers nine different specialty accounts. These include:

- Trust

- Limited partnership

- Partnership

- Investment Club

- Limited liability

- Sole proprietorship

- Corporate (profit or non-profit)

- Non-incorporated

- Small business plans

Scottrade, on the other hand, carries just four specialty accounts:

- Trust

- Estate

- Investment Club

- Corporate/Partnership/Association.

When comparing TD Ameritrade vs Scottrade’s specialty accounts, Ameritrade once again offers more variety for customers to choose from.

Depending on the account(s) they hold, investors can also choose from a number of Ameritrade or Scottrade products, including stocks, options, margin loans, mutual funds, exchange-traded funds, bond investing, and international investing.

Related: Best Political Consulting Firms (Ranking & Review)

Fees

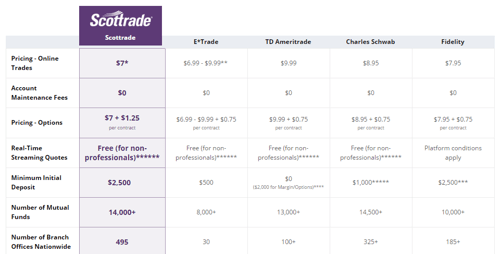

A comparator on Scottrade’s website looks at how Scottrade’s products and services stack up against those provided by other brokers. While both firms boast $0 in account maintenance fees, when considering Scottrade or Ameritrade online trading prices, Scottrade undercuts Ameritrade fees by $1.99. Scottrade may also appeal to clients who prefer to do their banking in person, with 495 branch locations compared to TD Ameritrade’s 100+.

Ameritrade, however, does not require an initial deposit, while Scottrade’s requirement of a $2,500 minimum investment seems hefty in comparison.

Image Source: Scottrade

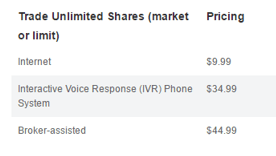

Be sure, however, to look closely at your financial firm’s fee scheme, as broker-assisted trading fees and trades made by telephone are much higher, such as $32 for Scottrade.

Image Source: Scottrade

Ameritrade fees start at $9.99 for internet trading. Ameritrade fees for trades are a constant $9.99 per trade, regardless of account balance or the frequency with which trades are made. Therefore, investors who conduct regular trades should be mindful that Ameritrade fees may add up quickly. To minimize Ameritrade fees, multiple trades can be made on the same day to be charged a single commission.

The complete price scheme for Ameritrade fees also indicates higher prices than Scottrade for both broker-assisted trades and trades made by phone. Notably, the Ameritrade fees for broker-assisted trades are nearly $13 more than Scottrade, at $44.99 and $32 respectively.

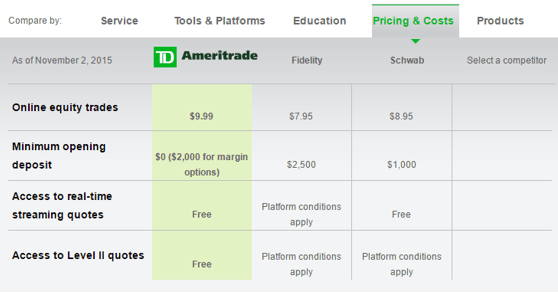

Image Source: Ameritrade

Ameritrade fees for online trades are also higher when compared to other brokers. Fees for other services, including minimum opening deposits, access to real time streaming quotes, and access to Level II quotes, are comparable to other brokers.

Image Source: Ameritrade

Overall, Ameritrade fees are significantly higher than Scottrade, as well as other brokers. As mentioned, however, Ameritrade offers more diverse account types.

Popular Article: Best Online Stock Trading Sites for Investors – Top Rankings

Promotions

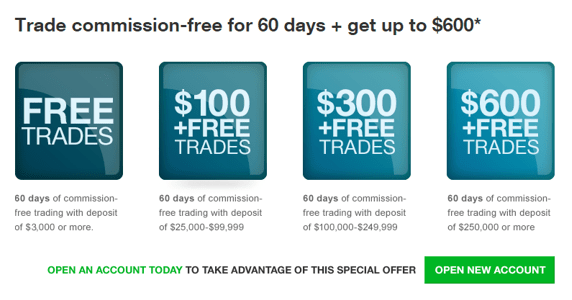

Several Ameritrade promotions offer significant cost savings. Currently, new customers can trade commission-free for 60 days when they open a new account. Depending on the amount of your initial investment, Ameritrade promotions increase in value. New customers can take advantage of a $100 cash bonus plus free trading for 60 days with a $25,000-$99,999 deposit or $300 plus free trading with a deposit of $100,000-$249,000. Customers who deposit over $250,000 in a new account can benefit from an Ameritrade promotion of $600 cash bonus plus 60 days of free trading.

Image Source: Ameritrade

Scottrade or TD Ameritrade: A Look at the Reviews

A 2016 StockBrokers.com review asserts that opening a new account with Scottrade is simple and that the customer service is superb. The same review confirms that Scottrade fees are less expensive than those charged by other full service brokers. The author identified Scottrade’s Live Chat function as useful. Lastly, Scottrade’s huge selection of nearly 14,000 funds ensures that clients will have no trouble finding the right products to meet their investment goals. Overall, Stockbrokers.com gave Scottrade 4 out of 5 stars.

NerdWallet.com reiterates that Scottrade is known for its exceptional customer service. NerWallet also gave the firm 4 out of 5 stars.

When comparing Scottrade vs Ameritrade on StockBrokers.com, however, Ameritrade comes out on top. The platform gives Ameritrade 4.5 out of 5 stars. According to the reviewer: “TD Ameritrade charges more than its competitors, but delivers with fantastic platforms, mobile apps, education, and strong customer service. The all-around experience is absolutely worth the higher price per trade.” Likewise, the firm received 5 out of 5 stars in a NerdWallet.com review. According to TD Ameritrade’s website, Barron’s 2016 Online Broker Survey ranked TD Ameritrade #1 for Long-Term Investing for four consecutive years.

Interestingly, however, neither Scottrade nor Ameritrade received many positive reviews on ConsumerAffairs.com. Of 33 Scottrade ratings, a whopping 26 gave the firm only 1 out of 5 stars. Similarly, 77 of 94 Ameritrade reviewers on the same platform gave the firm just 1 star.

Free Wealth & Finance Software - Get Yours Now ►

The Verdict: TD Ameritrade vs. Scottrade

After analyzing services, fees, promotions, and reviews of TD Ameritrade vs. Scottrade, the two firms are remarkably similar. Whether you’re a seasoned trader or a beginner investor, you will find various standard, retirement, education savings, and specialty accounts at Scottrade or Ameritrade. While Ameritrade fees are significantly higher than both Scottrade and other brokers, keep in mind that Ameritrade also has a greater selection of education savings and specialty account types.

Reviews, however, fall on both ends of the spectrum, with both firms receiving as many glowing reviews as they did negative reviews. With this in mind, it is worth considering either Scottrade or TD Ameritrade to determine which best suits your investment needs!

Read More: Top Futures Brokers for Futures Trading (Ranking, Reviews, and Ratings)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.