Intro – Security Bank & Trust Co. Reviews & Ranking

AdvisoryHQ recently published its list and review of the top banking firms in Minnesota, a list that included Security Bank & Trust.

Below we have highlighted some of the many reasons Security Bank & Trust was selected as one of the best banking firms in Minnesota.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Security Bank & Trust Co. Review

Founded in 1935, Security Bank & Trust Co. is a hometown community bank headquartered in Glencoe, Minnesota. This community bank in Minnesota operates 15 full-service banking locations in Minnesota.

Security Bank & Trust has a strong financial foundation and reported assets in excess of $497 million at the end of 2016. They offer a wide range of traditional banking and lending options to the communities they serve in addition to trust and investment services.

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Banking Firms

Upon completing our detailed review, Security Bank & Trust was included in AdvisoryHQ’s ranking of this year’s best banking firms based on the following factors.

Security Bank & Trust Review: Certificates of Deposit

CDs are a great way to keep your money safe and growing, and Security Bank & Trust offers FDIC insured CDs with flexible terms and competitive rates.

The features and benefits of a CD from this Minnesota bank are:

- Choose from terms from 3 months to 5 years

- Competitive interest rates

- Interest can be paid by check, compounded, or automatically deposited into a checking or savings account

- Automatically renewed at maturity with a 10-day grace period to allow changes without penalty

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Security Bank & Trust Review: Coverdell Education Savings Account

The cost of higher education is constantly on the rise, making it more important than ever to build up funds to pay for future higher education costs.

Security Bank & Trust is a bank in Minnesota that makes it easy to begin saving for future education costs with a Coverdell Education Savings Account.

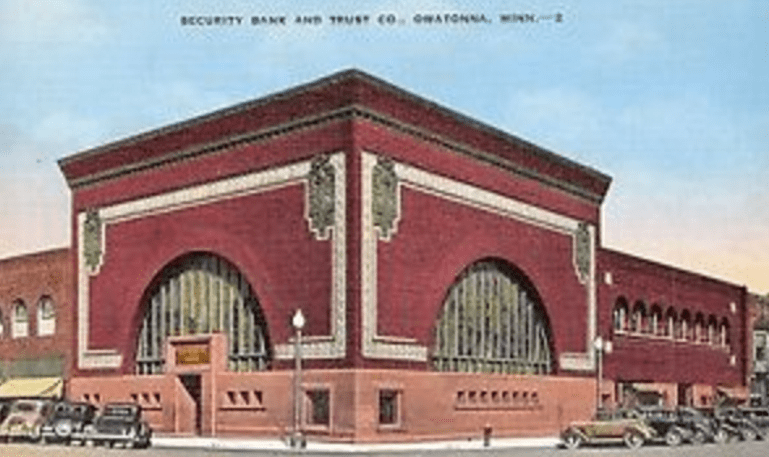

Photo courtesy of: Security Bank & Trust Co.

Features of this specialized savings account are:

- $2,000 contribution limit annually per beneficiary

- Contributions can be made for children younger than 18

- Funds must be used by age 30

- Variable and fixed rate accounts available

- Earnings are tax-free if used for qualified education expenses

Security Bank & Trust Review: Trust Company

The Security Bank & Trust Company has been providing beneficial investment and financial planning services to their customers for more than thirty years.

Employees of this top bank in Minnesota work hard to help customers reach their individual objectives, and they provide education and assistance to help get the job done right.

The Trust Company provides reliable and unbiased advice to customers in the matters of:

- Investment services

- Personal trust services

- Estate settlement services

- Individual retirement rollover accounts

- Cash management

Customers have the option to enroll in online access for even easier management of their portfolio.

Security Bank & Trust Review: Mortgage Options

Security Bank & Trust provides many mortgage lending options to home buyers.

With so many flexible options to choose from and competitive interest rates, this bank in Minnesota makes it easy to find a mortgage option to fit every budget and every individual borrowing preference.

Mortgage options offered by Security Bank & Trust are:

- Fixed-rate mortgage

- Balloon mortgage

- Adjustable-rate mortgage

- Second mortgage

- Home equity line of credit

- Construction mortgage

- Bridge loan

In addition to the above Security Bank & Trust review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top rated banking firms & credit unions:

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.