What is Self-Build Insurance?

Self-build insurance (also known as builder’s risk insurance) is a type of insurance that protects new homes during construction, or existing homes during renovation.

As the name suggests, self-build insurance applies to individuals who are constructing or renovating their own homes.

Why is Self-Build Insurance necessary?

An individual who undertakes the construction or renovation of a house must insure the project independently.

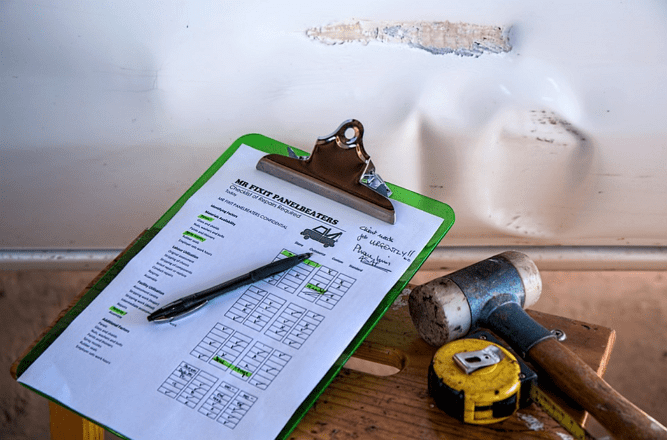

Image Source: What is Self-Build Insurance

Banks extending loans for self-build projects will often require self-build insurance before the loan is finalized, and most local governments will not issue building permits without proof of insurance. The inherent dangers of operating a build-site over a period of several months make self-build insurance a necessity.

What does Self-Build Insurance cover?

Self-build insurance protects against a large number of risks throughout the building process, including accidents, theft, contractor disputes, and even arson.

Most self-build insurance policies also cover liability.

If someone is injured or killed on a build-site, even if the person was trespassing, builders can be held responsible for medical bills and other expenses.

Self-build insurance protects builders in such cases.

Why can’t I find Self-Build Insurance in the U.S.?

Self-build insurance is primarily a term used in the United Kingdom.

In the United States, this type of insurance is more commonly known as builder’s risk insurance, although the nature of the insurance is the same.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.