Intro: Shawbrook Bank Reviews – Is It Safe? (Review of Shawbrook Loans, Savings, and Bank Services)

As a relatively “new kid” on the banking block, investors, savers, and borrowers may wonder when dealing with Shawbrook Bank – is it safe?

The 2008 credit crisis has given pause to many individuals and groups who regularly deal with large, small, and medium-sized financial institutions.

One way to ascertain the safety of your investments is to consult Shawbrook Bank reviews and analysis presented by credible sources. Among other objectives, our review of this institution is a step toward addressing the question, “Is Shawbrook Bank safe?”

Shawbrook Bank Reviews

See Also: Aldermore Bank Reviews (UK) – How Safe Is Aldermore Bank? (Mortgages & Bank Review)

History and Beginnings

We’ll begin our Shawbrook Bank review by briefly going over the genesis of the bank and reviewing the bank’s current ownership. Knowing its history and beginnings will give customers and investors a sense of where the bank came from and where it is likely to go from here.

- Jan 2011: A group of private investors, led by state-owned Royal Bank of Scotland subsidiary RBS Equity Finance, acquired Whiteaway Laidlaw Bank. This positioned Shawbrook Bank savings and lending services to be offered to a vast yet underserved retail and commercial segment of British society.

- Feb 2011: The investors followed the initial deal by acquiring the commercial mortgage business of Commercial First. This placed Shawbrook loans and commercial mortgages within reach of small businesses and other real estate investors.

- Oct 2011: On October 17, 2011, the newly formed entity was rebranded as Shawbrook Bank. The new bank dedicated itself to offering deserving retail clients and Small and Medium Enterprises (SMEs) access to Shawbrook Bank savings products and Shawbrook loans as an alternate to banks and other lending institutions that aren’t able to respond efficiently or act quickly to providing credit and loans when needed.

- April 2015: The company went public on April 8, 2015, on the London Stock Exchange (LSE), and became a member of the Financial Times Stock Exchange (FTSE) on June 22, 2015.

The bank is run by a professional management team, with an independent 11-member board of directors overseeing its operations. Ian Cornish (Chairman) and Steve Pateman (CEO) could be viewed as the public faces of the bank.

But who owns Shawbrook Bank? A group of private investors put initial seed money into acquiring the bank and many of its component entities. The bank is also listed on a publicly traded stock exchange (LSE) and is a member of Britain’s well-respected FTSE. In response to the question, “Who owns Shawbrook Bank?” members of the British public and other shareholders who own shares in the publicly listed bank are its true owners.

So, given its history and evolution, is Shawbrook Bank safe to do business with? Our Shawbrook Bank reviews show that, through a series of well thought out acquisitions and a range of strategic moves to open and transparent governance, the bank has definitely positioned itself as a reliable mainstream financial organisation.

Don’t Miss: Top UK Banks | Ranking | Biggest British Banks & Best Banks in the UK

The Service Offerings

As part of this Shawbrook Bank review, let’s take a closer look at what the bank has to offer commercial and retail clients.

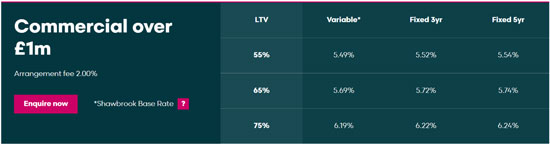

Commercial Mortgages: Shawbrook loans and commercial mortgages provide short and conventional-term financing to both commercial and residential property professionals, including real estate investors.

Shawbrook Bank Savings

This division enjoyed a 78% customer satisfaction rating in the bank’s 2015 Customer Insight Survey.

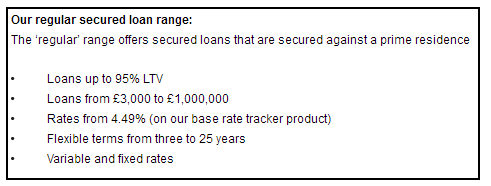

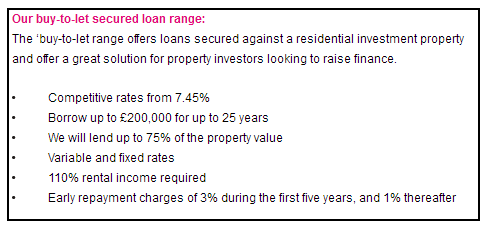

Secured Lending: Near prime, prime, and super prime borrowers have access to a range of secured Shawbrook loans through an array of products that are backstopped against prime or investment residential properties as collateral.

Shawbrook Loans

These funds can then be used for a variety of purposes, including purchase of large-ticket consumer items, major milestone events, debt reduction, or home improvements.

This division enjoyed a 92% customer satisfaction rating in the bank’Fs 2015 Customer Insight Survey.

Asset Finance: Funds received through the extensive portfolio of Shawbrook Bank savings products are lent to established SMEs, as well as businesses in the healthcare market. These Shawbrook loans are secured through borrower assets or account receivables.

This division enjoyed a 90% customer satisfaction rating in the bank’s 2015 Customer Insight Survey.

Business Credit: This division of the bank provides loans to small and medium sized UK businesses that generate revenues between £2 million and £100 million. The funding provides SME owners the ability to undertake a variety of additional business-critical activities.

Our Shawbrook Bank reviews noted that the bank serves 20 business sectors and is highly competitive (viz., other “established” players) in terms of speed of providing finances to clients, diversity of credit offerings and the quality of service provided.

This division enjoyed a 95% customer satisfaction rating in the bank’s 2015 Customer Insight Survey.

Consumer Lending: The bank’s Consumer Lending operation offers unsecured Shawbrook loans for a number of consumer areas, including:

- Personal Loans offered through a network of selective lending partners

- Home Improvement loans disbursed via reputable regional and national home improvement companies

- Holiday Ownership finance that is delivered in close partnership with holiday ownership business owners

- Retail financing extended in concert with online and in-store retailers and other professional practice owners

This division enjoyed an 87% customer satisfaction rating in the bank’s 2015 Customer Insight Survey.

Retail Savings: Shawbrook Bank savings products offer British individuals, businesses, trusts, and charities an easy, convenient, and transparent way to grow their savings through a variety of vehicles, including:

Reviews of Shawbrook Bank

- Fixed rate deposits in terms of up to 5 years

- Individual Savings Accounts (ISAs) that allow clients’ savings to grow without paying tax on interest earned on their savings

- Easy Access Savings Accounts that provide convenient and flexible access to savings accounts online

- Notice Accounts that provide account holders flexible access to the funds in their accounts within an appropriate notice period

In 2015, the bank earned a 94% customer satisfaction rating for its Savings division, which should put to ease any doubts about Shawbrook Bank being safe.

But are they competitive? Or are they customer-focused? While many might dismiss other accomplishments, a customer loyalty and brand perception of +47, as indicated by the bank’s Net Promoter Score (NPS), is definitely worth noting if you are wondering, “Is Shawbrook Bank safe?”

Related: Robo Advisors (UK) – Everything You Should Know! (Investment Help & Advice)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

A Risky Proposition?

If you are a client of Shawbrook Bank wondering is it safe to have them hold your money, you are probably looking for a much deeper assessment of the bank’s financial standing.

Many Shawbrook Bank reviews tend to focus on the safety of the institution in terms of the markets they operate in, and type of services they offer. But in trying to answer the question, “Is Shawbrook Bank safe?” our Shawbrook Bank review looked beyond the Shawbrook Bank savings products that customers have access to or the portfolio of Shawbrook loans extended to clients in different sectors.

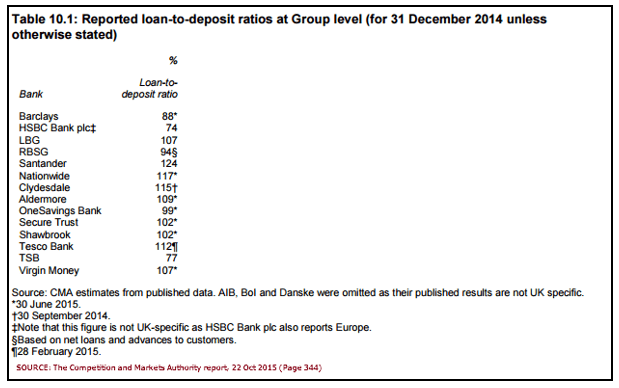

We looked at a key metric: the bank’s Loan to Deposit (LTD) ratio, a measure of the liquidity and solvency of a financial institution, and compared it against its peers.

Shawbrook Loans

According to an investigative report from The Competition and Markets Authority, Shawbrook Bank’s LTD ratio stood at 102% in late 2015. This compared highly favourably against many of its competitors, including Tesco Bank, Nationwide, and Santander.

So, is Shawbrook Bank safe to do business with? If you are looking to deal with an institution that is not likely to “go under” in a hurry, then your Shawbrook bank savings are as safe as they’d be in any institution in the UK.

A Safe Haven?

In today’s post-2008 financial crisis, low-interest-rate era, challenger banks are stepping up the competition to win business from mainstream, “established” players. Our Shawbrook Bank review looks not just at the bank’s products, but also its operational performance and corporate policies to determine if it is indeed a safe haven for savers and borrowers.

So, when both of these aspects of the organisation are reviewed, what can prospective clients conclude about Shawbrook Bank? Is it really safe?

Shawbrook Bank loans seem to be a darling of critics and industry watchers alike. In 2015, the company won Insider Deal Makers’ “Asset Based Lender of the Year” award for the third consecutive year. The bank has also been recognised as the “Best Secured Loans Lender” and “Commercial Lender of the Year” for three years running.

Not to be outdone, Shawbrook Bank savings products have earned industry accolades in 2015 too, including:

- Best Notice Account Provider

- Best Fixed Account Provider

- Best Online Savings Provider

The Final Assessment (Shawbrook Bank Reviews – Is Shawbrook Safe?)

Our assessment of Shawbrook Bank from reviews of its component operations and offerings is that this is as solid an institution as any relative newcomer to the UK banking scene.

With Shawbrook Bank savings products and Shawbrook loans offered through platforms and predecessor institutions such as Whiteaway Laidlaw Bank, Commercial First, Link Loans, Singers Asset Finances, and Centric Commercial Finance, customers of the bank can rest assured they are in good hands.

In fact, Stephen Johnson, business director of the bank, said this when Shawbrook was newly launched: “Becoming Shawbrook Bank isn’t about throwing away any of our well respected heritage, it’s about using everything we have learnt to become even better.”

A modern bank built on a sturdy past. Is Shawbrook bank safe for commercial and retail customers to deal with? Our assessment would be a resounding yes!

Popular Article: Top Rated Accounting Firms in London | Ranking of UK Accountants

Image sources:

- https://property.shawbrook.co.uk/

- https://property.shawbrook.co.uk/property-finance/our-markets/commercial-investment/

- http://assets.publishing.service.gov.uk/media/563377e8ed915d566d00000f/Retail_banking_market_investigation_-_PFs_V2.pdf

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.