Introduction: Social Security Tax Rate

If you are currently in retirement or nearing retirement age, you may be wondering several of the following questions about Social Security and taxes:

- What is Social Security tax?

- Is my Social Security taxable?

- How and when can I get Social Security benefits?

- What are the taxes on Social Security benefits?

If you are still working or self-employed, your questions may differ. You may be wondering what the connection is between Social Security and taxes as well as the current Social Security tax rate. You may also want to ask about FICA and how is it connected to Social Security taxes.

Social Security and taxes is a very complex monster. Hopefully, you will find some of the following information in this article useful in helping you maneuver through your Social Security tax questions.

Image source: Bigstock

What Is Social Security Tax?

Social Security tax is tax that is collected from employers and employees based on the current Social Security tax rate. A small percentage of the Social Security tax is applied toward Medicare.

The Social Security tax collected goes into the Social Security program to be given out as benefits. Benefits are paid to:

- Retired persons

- Disabled persons

- Survivors of workers that have died

- Dependents of beneficiaries

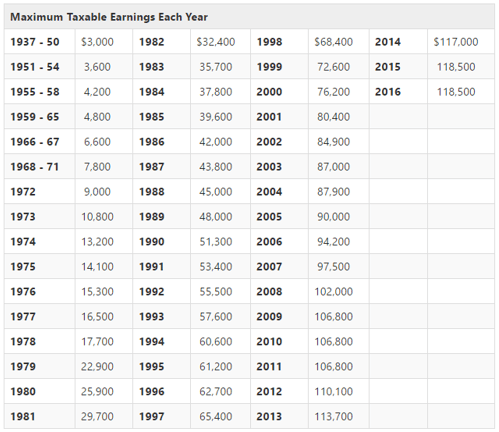

The levy on Social Security taxes is equally divided and is taxed based on the wages or net earnings for the self-employed (half of the Social Security tax for self-employed individuals is income tax-deductible). The Social Security taxable income threshold for 2016 is $118,500.

Image source: SSA

FICA tax, or Federal Insurance Contributions Act tax, is a United States federal payroll/employment tax which funds Social Security tax and Medicare. The Social Security taxes get put into what’s called Social Security trust funds.

Social Security trust funds are financial accounts held by the Department of the Treasury. There are two types of trust funds which are funded by Social Security taxes: The Old-Age and Survivor Insurance (OASI) Trust Fund pays retirement and survivor benefits while Social Security Disability Insurance pays disability benefits.

There are three income sources that contribute to the Social Security trust funds. Eighty-five percent of the contributions are Social Security taxes from payrolls, and eleven percent is added by the Department of Treasury using the excess funds and derived interest. The final four percent comes from taxes on Social Security benefits that are paid in.

What Is the Current Social Security Tax Rate?

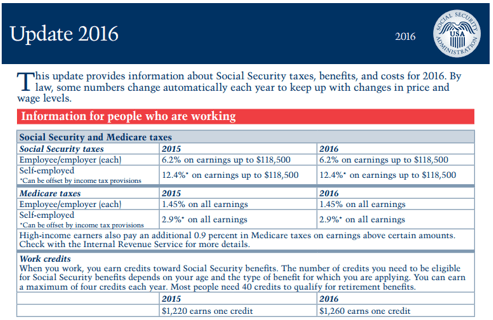

Image source: SSA

The current Social Security tax rate is 6.2% per employee, 6.2% per employer, and a total of 12.4% for self-employed (remember, there is a tax deduction). There was no increase in the Social Security tax rate in 2016 because Social Security benefits did not undergo a cost-of-living adjustment (COLA) for the first time since 1975. The consumer pricing index plays a role in the COLA increases.

Don’t Miss: What Is Debt Consolidation? – Is It Good or Bad? (Ways to Consolidate & Explanation)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

When and How to Apply for Social Security Benefits

Workers must pay Social Security taxes. Social Security taxable income, in return, earns you credits. For 2016, workers earn one credit for every $1,260 earned.

You are only allowed up to 4 credits annually. Forty credits, or approximately 10 years of work and paying Social Security taxes, qualifies an individual for benefits.

The payment of Social Security tax will provide you access to benefits but will only replace some of your earnings. Social Security benefits are based on an individual’s lifetime of earnings.

The payment of Social Security taxes is indexed and adjusted over time. Depending on your monthly wages and the amount of Social Security taxes paid, Social Security applies a formula and derives your primary insurance benefit amount.

The primary insurance benefit amount is what you will receive at retirement age from paying tax on Social Security. The full retirement age for Social Security tax payers is based on an individual’s year of birth.

If you choose to retire at your full retirement age, you will receive your full benefit amount. However, if you decide to retire early, you will get reduced benefits.

Related: What Is Brexit? – Get the Definition & Review (Britain Leaving EU?)

Are My Social Security Benefits Taxable?

For the last 32 years, federal income tax thresholds for taxes on Social Security benefits have not risen. As your wages increase, so does your Social Security taxable income. Be aware that thirteen states charge taxes on Social Security income. Most states only charge a tax on Social Security benefits on federal income.

The Social Security Amendment Act of 1983 stipulated that beneficiaries with income over a specific threshold had to pay 50% taxes on Social Security benefits. Ten years after the introduction of the act, a budget bill stipulated a higher threshold, taxing up to 85% of Social Security benefits as income.

If your income is less than $25,000 (or $32,000 if married and filing a joint return), there are no income taxes on Social Security benefits. Social Security taxes are based on 50% of your income if you are single and earn between $25,000 and $34,000 (or $32,000–44,000 for married filing a joint return).

In almost all cases, any provisional income over $34,000 for single filers or $44,000 for married filers on a joint return will be taxed at 85% of their benefits income.

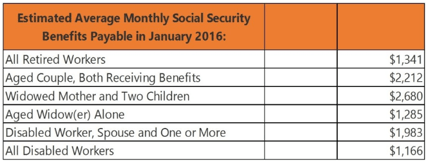

Knowing the current monthly Social Security benefits will help you assess where you fall based on any additional income you have (see the worksheets in IRS Publication 915 for additional help):

Image source: IRS

Also, Social Security offers a printed version of your Social Security tax payments every five years. You can now sign up for an online account that will provide a summary of your Social Security taxes paid. You can find this here.

Popular Article: What Is a Decent Credit Score? Get All the Facts! (What Is Bad Credit?)

What You Can Do to Safeguard Your Retirement?

During your working years, you pay Social Security taxes with the expectation to receive benefits in return. As we have seen, taxes on Social Security are not keeping up with the cost of living, so we need to be creative in securing our retirement.

Social Security alone may not provide a comfortable retirement, which makes myRA a solid option for individuals who do not have a retirement plan through their employer or other options.

This alternative puts your tax money to work on your own retirement fund: you earn interest on investments that you put directly into your account after taxes.

Unlike Social Security taxes, which you pay directly out of your wages and with no guarantee on payments of benefits, this option will work in your interest – you can even pull weekly and monthly contributions.

The myRA option is similar to the tax on Social Security in that the annual and lifetime earned income limit applies.

Another option may be a Roth IRA. This is an individual retirement account that is taxed upon contribution – not unlike the taxes on Social Security. However, with a Roth IRA, you are not held accountable for income taxes on withdrawals like with Social Security taxable withdrawal income.

When you start collecting the Social Security benefits that you have paid into the trust fund, you will be restricted by what their formula regulates as your payments. But with a Roth IRA, you receive unrestricted withdrawals from your wage-taxed contributions to your own private fund.

The unrestricted withdrawals with a Roth IRA can happen when you reach 59-and-half years old as long as your account has been in existence for five or more years. Social Security taxes are income-based, and you are not eligible until 62 years of age (remember, this is age-restrictive and comes with a penalty if you are not at full retirement age).

When you pay taxes on Social Security, it goes directly into the trust funds whereas with a Roth IRA, you have many investment options. Also, compared to the income-driven tax on Social Security, a Roth IRA provides better options upon reaching retirement age when you don’t have to worry about income taxes, especially if your income is large.

Now that we have completed this arduous journey on Social Security and taxes, we hope you will now be armed with all on the necessary information regarding the subject of tax on Social Security.

Read More: What Is Swing Trading? (Basics, How-to & Strategies)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.