Methodology for Selecting AdvisoryHQ’s Lists of Top Software Apps

What methodology does AdvisoryHQ use in selecting the software applications listed on its various reviews and ranking of top financial-related software?

Using publicly available sources, AdvisoryHQ identifies a wide range of software applications that are available on the market.

After applying selection factors (for example, mobile device capabilities, ease of use, security level, comprehensiveness, budgeting features, cost, sophisticated accounting interfaces, and maintenance requirements), the team is able to narrow the list down to the top software apps that are ranked on our lists.

Longevity Selection Factor (How Long Will a Software App Be Around?)

Longevity is a very important but also complicated selection factor that AdvisoryHQ integrates into its selection algorithm when researching software applications to review and rank. Initially, we struggled with this selection factor and had a lot of brainstorming sessions before finalizing how to integrate longevity as a selection factor.

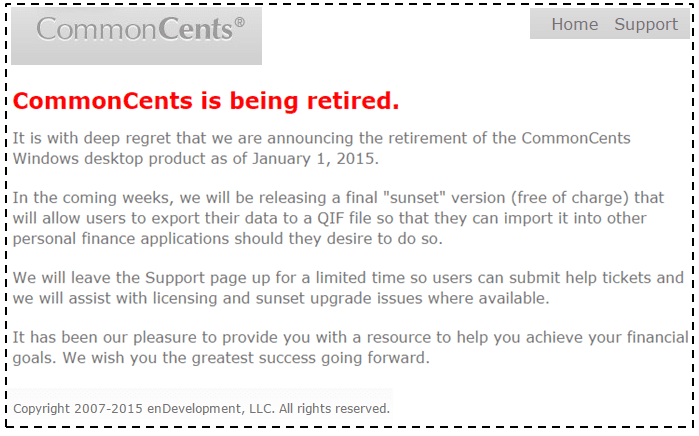

A finance software like CommonCents is a good example of a “come and gone” finance software. CommonCents is one of the financial and accounting software that ignited the financial software revolution. It was a budgeting tool that was based on the tried-and-true envelope budget system.

In 2015, the company behind the app decided to shut it down as it had turned into what is known as a “legacy” app. Often a pejorative term, “legacy” app often implies that an app has gone out of date or is in need of replacement, especially when compared to the newer, more-advanced subscription-based and free personal finance software hitting the market.

As such, when selecting our lists of top software, we ensure that we are focusing on software that have a high probability of being around five years from now.

We apply popularity, user growth, and revenue capability to estimate a financial software’s longevity.

When it comes to longevity, revenue is one of the biggest components to consider. A platform that is losing money will need to be bought out at some point (if possible) or shut down.

And just because a software is free does not mean it cannot bring in revenue. For example, although free, a financial app like Mint (mint.com) has longevity potential. Mint makes money when users save money using the “Ways to Save” feature on the platform. In addition, when a user signs up for a checking, savings, or credit card account marked as sponsored, Mint earns a referral fee.

Within two years of being launched, Mint was acquired by Quicken for $170 million.