Intro: Popular Mint Alternatives | What Are the Best Alternatives to Mint?

For the past two years, AdvisoryHQ rated Mint.com as one of the best personal finance software and apps of the year.

Since we first ranked Mint as a best personal finance software in 2015, emails have been pouring in from users asking questions about Mint alternatives and seeking information on similar apps like Mint.

Although Mint is an innovative personal finance software, the Mint app may not be for everyone. Thus, it may be helpful to have a review focused on alternatives to Mint.

After conducting extensive research into the types of Mint alternatives currently available, we have narrowed our list down to the two best alternatives to Mint.

In the article below, we’ve presented two key apps like Mint that are this year’s best Mint.com alternatives.

2017’s Top Mint Alternatives

After thoroughly researching apps like Mint and Mint alternatives, we have highlighted the two best alternatives to Mint to consider in 2017: Personal Capital and You Need a Budget (YNAB).

These Mint.com alternatives have been selected based on the comprehensive money management, budgeting, personal finance features, and user-friendly interfaces that they provide.

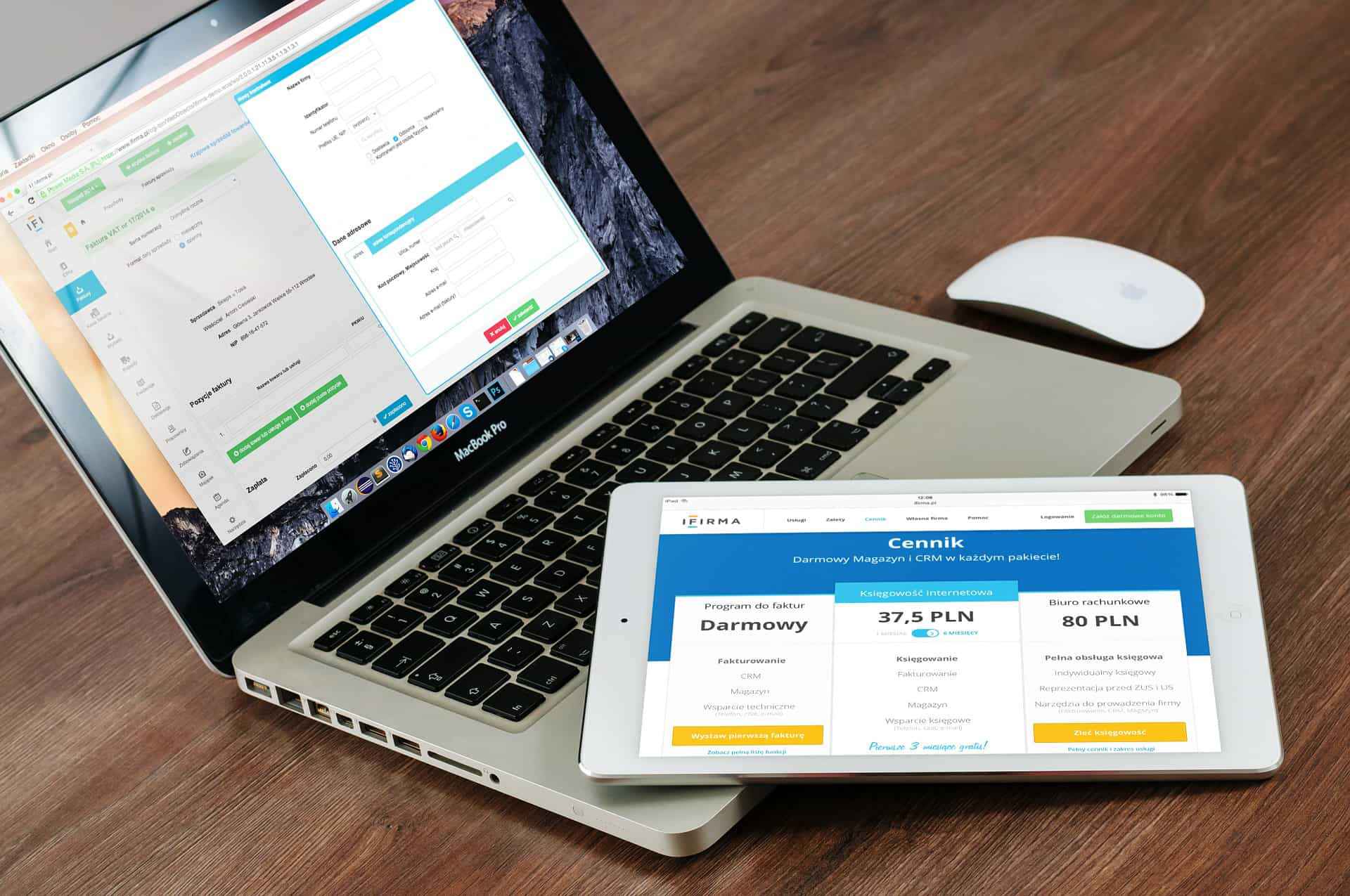

Image Source: Top Alternatives to Mint

In the sections below, we’ll take a closer look at each of these alternatives to Mint to see exactly how they compare to the Mint app.

Personal Capital – Top Alternative to Mint.com

Personal Capital, the first Mint alternative in our review, is similar to Mint to some extent. Both act as personal budget software platforms and provide users with tools to better manage their money.

However, when looking at Personal Capital as one of the best Mint alternatives, there is a distinction to be made–while it is also a powerful budgeting tool, Personal Capital is much more of a personal finance software, rather than a personal budget software.

What does this distinction mean?

Personal Capital – See Your Complete Financial Picture in one Place – FREE!

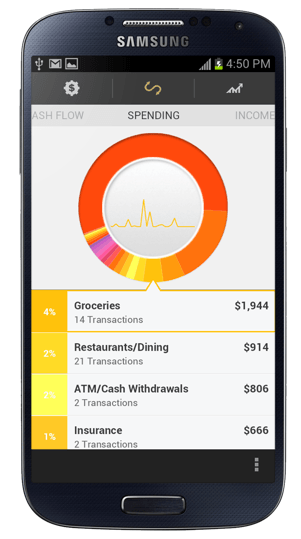

Image Source: Personal Capital

Well, in the case of Personal Capital, this personal finance software provides users with tools beyond simple budgeting and bill pay.

As a popular Mint alternative, Personal Capital provides users with advanced graphics, a net worth dashboard, intuitive retirement planning, extensive investment management, cash inflow, and outflow.

Best of all, Personal Capital is a completely free Mint alternative, available for anyone to download and use.

Because Mint is also a free financial app, Personal Capital is a great alternative to Mint to consider, as neither software options will take anything extra out of your budget.

Most importantly, this Mint alternative can be used to manage your complete financial picture, including income, debt, expenses, investing, portfolio management, etc.

Click here for a more detailed review of Personal Capital vs. Mint.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Key Features of Personal Capital | Top Alternative to Mint

As a top-ranking alternative to Mint.com, Personal Capital provides you with the interfaces and features listed below.

Financial Stress Testing

With Personal Capital, you can easily run “financial stress testing” of your financial situation and easily see how life events can impact your finances.

This includes planned and unplanned, such as college, a baby, an illness, an accident, loss of job, medical expenses, or even a decline in stock values.

Conducting financial stress testing will allow you to evaluate how you spend/save today and make the necessary changes before it’s too late.

Like Mint, Personal Capital does not have access to the funds in your accounts.

This is both a good thing and a bad thing when looking for the best Mint alternatives: although you can’t transfer money between accounts, this element also increases the overall safety of the app.

Dashboard

As one of the top Mint alternatives, Personal Capital provides a powerful financial dashboard for its users. This is where you can view and manage your finances across all your accounts and investments.

Users can track how investments are doing over time, and see how much money is coming into and out of their checking, savings, and other accounts.

Additionally, this dashboard also allows you to monitor your net worth and easily see the impact of specific expenses. You can also analyze and track your credit card expenses and determine which expenses are having the most impact on your financial worth, and much more.

Fee Analyzer

As one of the most popular Mint alternatives, Personal Capital understands that mutual funds and other investments come with different types of fees.

Personal Capital’s Fee Analyzer provides you with insightful reviews of the performance and expense ratios of thousands of the most popular mutual funds.

Investment Checkup

Using Personal Capital’s Investment Checkup tool, you can better track how your investments are performing over time.

You can also perform best-in-class comparison ranking by comparing your existing portfolio allocation to a pre-determined “ideal target allocation model” that is designed to minimize risk and optimize investment returns for goals that are similar to yours.

Retirement Planner

With Personal Capital’s Retirement Planner, data from the Dashboard is used to determine retirement readiness at any moment.

Create an ideal retirement age, and add any anticipated expenses to the Retirement Planner. These anticipated expenses are the “financial stress testing,” including big events like vacations, children, purchasing a home, or saving for college.

Spending habits are analyzed with robust tools to determine what your monthly spending ability will be in retirement.

Combined with free download and use, these powerful analytical tools are what makes Personal Capital one of the top Mint alternatives on the market today.

Click here for additional comparison: Personal Capital vs. Mint Comparison Table

Personal Capital Versus Mint | Is Personal Capital the Best Mint Alternative?

So, which one of these two platforms are the best? Should you sign up with Personal Capital or Mint?

That answer really depends on you and what you are looking for. While Mint focuses primarily on empowering users with better budgeting tools, more efficient bill payment, and increased control over their finances, it does leave out retirement planning.

This is where Personal Capital excels by focusing on the long-term financial picture.

Many consider Personal Capital to be an exceptional personal finance software, for this reason, making it one of the best Mint alternatives for those who prefer to focus on investment strategies and monitoring.

On the other hand, both the Mint and Personal Capital apps are free to use, so you can open an account with both and perform your own test drive free from obligation.

You Need a Budget – Top Alternative to Mint.com

The second most popular alternative to Mint.com is You Need a Budget (YNAB).

Unlike Personal Capital, which is an all-in-one free personal finance app, YNAB is focused on budgeting.

Something to note here is that although YNAB is a great Mint alternative, it is not a free tool. Still, this alternative to Mint does come with a 34-day free trial.

When the trial ends, the platform will automatically lock itself up and become inaccessible to you. You’ll need to pay $50 per year after that.

After you buy this top performing alternative to Mint.com, YNAB will send you an activation key to unlock the application. Just enter the key and you can continue where you left off in the trial.

Key Features of YNAB | Top Alternative to Mint

As a top ranking alternative to Mint.com, YNAB provides you with the interfaces and features listed below.

Categorizing Transactions

While Mint is mostly an automated app, YNAB functions as both a manual and an automated finance app. You can pick and choose how transactions are categorized versus everything being solely automatic.

Mint does have some level of manual capabilities, especially with regards to your ability to categorize transactions. However, with YNAB, you can easily split up expenses manually.

For example, let’s say you paid a single check of $1,500 to your landlord for rent, the water bill, and electricity. This check can quickly be split up into three expense transactions using YNAB.

With Mint, your $1,500 check would only show that one transaction to your landlord, and it won’t be easy to see which part is rent and which isn’t.

Spending Rules

YNAB works by giving users a series of rules to follow. These rules apply to any incoming or outgoing cash as a way to prioritize spending and saving.

Here’s a quick look at the four rules that this alternative to Mint.com utilizes:

- Rule One: Create categories to prioritize paying bills overspending

- Rule Two: Embrace expenses by planning for them

- Rule Three: Be flexible and learn to adjust to overspending

- Rule Four: Don’t spend until your money is at least 30 days old

Synced Accounts

YNAB connects with over 12,000 banks, making it easy for this personal budget software to analyze your spending and saving in real time.

As a top alternative to Mint, YNAB takes syncing one step further by integrating their intuitive budgeting app across a variety of different platforms. YNAB is available for:

- iPhone

- Android

- iPad

- Web

- Apple Watch

- Alexa

With a variety of different methods to access your budgeting tools–and continuous syncing for real-time data–YNAB makes it easy to stay on top of your budget.

Budgeting Education

YNAB excels in providing educational resources for its subscribers. One of these resources comes from An Evening Without Netflix–more specifically, a series of free online workshops to help subscribers learn how to better manage their money.

These workshops are held every day of the week, and promote one-on-one learning with YNAB teachers. Current topics include:

- Desperate to be Free From Debt?

- Dream of Never Fighting About Money?

- Tired of the Variable Income Rollercoaster?

- Stuck in the Paycheck to Paycheck Cycle?

YNAB vs. Mint | Is You Need a Budget the Best Mint Alternative?

So, how do you decide between YNAB and Mint as the best personal budget software? Mint and YNAB share many of the same qualities, like the ability to categorize transactions, set goals, and view reports.

However, there are two crucial differences between Mint and this alternative to Mint.com:

- Mint is free– YNAB costs $50 per year

- Mint provides portfolio investment tracking — YNAB does not

If you want your personal budget software to include investment tracking, you may want to choose Mint instead of YNAB– or, for more advanced investment tools, you may want to choose Personal Capital.

YNAB is an incredibly user-friendly, interactive interface, and it has gotten some great reviews— but you’ll want to try the 34-day free trial out first before committing to a paid personal finance software.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Best Mint.com Alternatives | Which Mint Alternative Is Really the Best?

So, which of these two popular “Mint.com alternatives” should you sign up with?

That answer depends on you and what you are looking for in a personal finance app. After reading in-depth reviews of popular alternatives to Mint, you should have a fairly good hunch pointing you towards the bst personal finance software for you.

The good news is that there are plenty of cost-effective ways for you to personally determine which personal budget software is aligned best with your financial goals.

Keep in mind that both Personal Capital and Mint are both available completely free of charge, so you have nothing to lose by trying out a new personal budget software or a great Mint alternative.

Although YNAB is a paid service, their free trial keeps this Mint alternative accessible and risk-free, which certainly makes YNAB a worthwhile alternative to Mint.com.

Ultimately, the key is to find a personal finance software that works with you and supports your budgeting, saving, spending, and investing success.

Whether you choose to use Mint.com or you decide on one of these best alternatives to Mint.com, you can rest assured that you are taking dynamic steps towards a stable financial future.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.