Personal Capital vs. Mint – Ranking & Comparison

This Personal Capital vs. Mint comparison review is a follow-up to our recently published article: How Personal Capital is Revolutionizing Money Management. _

Before we go into the comparison details between Personal Capital vs. Mint, let us very quickly review these two companies and consider the key factors driving their popularity.

Personal Capital App Review (Personal Capital vs. Mint)

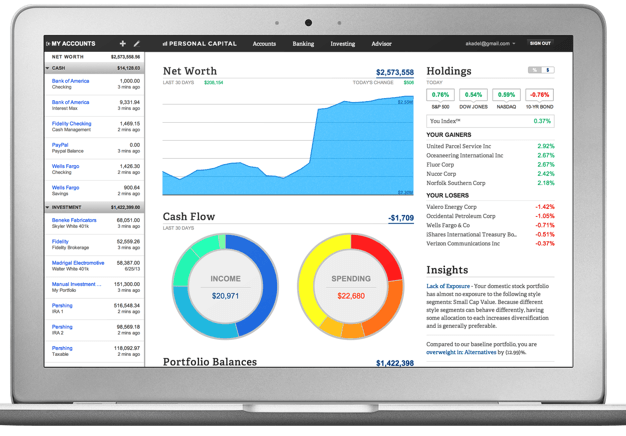

Personal Capital provides groundbreaking and highly enhanced personal finance and money management tools to consumers. Best of all, it provides these tools for free. You can use Personal Capital’s personal finance software to see your complete financial picture in one place. Using the dashboard, you can quickly link all of your financial accounts (savings, credit cards, checking, investments, IRA, 401K, mortgage, line of credit, home equity, etc.).

Open Your FREE Account with Personal Capital

Linking all of your accounts allows you to easily see your financial position at every point in time. You can see how much cash is coming in (cash inflow) and how much cash is going out (cash outflow).

Over time, you’ll see (via enhanced charts and graphs) whether your net worth is trending positively or negatively and take the appropriate steps to make adjustments in your spending and saving habits. In addition to being one of the best money management apps, Personal Capital is also a hybrid robo-advisor because it provides automated investment tools as well as dedicated financial advisors, investment managers, and planners who can help you manage and invest your money.

Using Personal Capital’s dashboard application, you can quickly plug in all your accounts — checking, savings, 401(k), college fund, loans, home equity, mortgage, investments — and get a sense of how your bottom line has moved at every point in time. What do all your expenses — the mortgage, bills, loan payments, groceries — look like against all your earnings?

The Personal Capital dashboard puts “Money-In vs. Money-Out” stats on the top of dashboard when you log in. You can flip back and forth between “view income” and “view spending,” and dive in deeper by clicking whichever slice of the pie you want for a more detailed view of your transactions.

>> Manage your investments with Personal Capital. Join Now! <<

Image Source: Personal Capital

If you are interested in having a lot more control over organizing your expenses, the Personal Capital dashboard allows you to easily categorize your transactions, either in general groups like “Entertainment” or “Insurance,” or in customizable fields, like “Kirby’s dog food” or “Mom’s stuff.” You can even add your own descriptions of each transaction.

When you sign up to Personal Capital’s financial advisory and investment management services, you’ll be provided with Personal Capital advisors who will work with you to develop a portfolio strategy, execute your investment plan, and manage your portfolio on your behalf. Click here for a detailed overview of Personal Capital’s portfolio management services: Detailed Personal Capital Review.

What Is Mint (Mint vs. Personal Capital)?

Similar to Personal Capital, Mint provides a highly “advanced and easy to use” personal finance app.

You start out by linking your various accounts to your Mint dashboard: checking, savings, 401, banking, credit cards, etc.

By linking all of your accounts, you can view your whole financial picture from a holistic viewpoint. You can see how much you have, what you owe, and easily track your spending and investments.

In addition, Mint automatically reflects your transactions as they occur in real-time. That way, you can quickly determine your remaining balance across your accounts at every point in time.

Just as with Personal Capital, you can perform a portfolio benchmark analysis with Mint by comparing your portfolio to standardized market benchmarks and instantly see your asset allocation across all of your investment accounts like 401(k), mutual funds, brokerage accounts, and even IRAs.

Click here for additional detailed information on Mint.

Personal Finance Software Reviews – Personal Capital vs. Mint

So how do the two firms compare or differ in this Personal Capital vs. Mint comparison review?

The tables below present a detailed comparison of the similarities and differences between these two top-ranking personal finance and money management apps. One key difference is that Mint is mainly a personal finance app/investment tracking tool while Personal Capital is mainly two things: a registered investment advisor/wealth manager (registered with the SEC) and a personal finance app/investment tracking tool.

Click Below to Open Your Free Account with Personal Capital

>> Open Your Account with Personal Capital <<

Personal Capital vs. Mint Comparison Table

The table below provides a high-level comparison of these two platforms.

Personal Capital vs. Mint Comparison Factors | Personal Capital | Mint |

| All-in-one financial app where you can see all of your balances, accounts, and transactions in one place | Yes | Yes |

| Get a free credit score and learn how you can improve it | No | Yes |

| Display advertisements are shown on your dashboard | No | Yes |

| Cleaner (less crowded) interface | Yes | No |

| Wealth management and investing interfaces | Yes | No |

| Sets alerts and thresholds – get notified when a transaction is over a specific amount or when it’s time to pay a bill | Yes | Yes |

| Easy to use and personalize | Yes | Yes |

| Provides the most money management features and is the easiest to use (between the two platforms) | Yes | No |

| Compares your portfolio allocation against market benchmarks | Yes | Yes |

| Easily see your net worth at any point in time | Yes | Yes |

| Access to a financial planner | Yes | No |

| 401K and portfolio allocation | Yes | No |

| Easy budgeting | Yes | Yes |

| Advanced budgeting (can set up budgetary categories to manage your monthly bills) | No | Yes |

| Online account security (i.e., 128-bit SSL encryption, monitoring by third-party security firms, and physical security standards) | Triple Layer | Triple Layer |

| Additional security (device authentication) required to first authenticate each device that links to your account | Yes | No |

| Secured funds (can’t move money in, out or between any accounts you link to the app) | Yes | Yes |

| See all your bills in one place | Yes | Yes |

| Retirement planner (highly advanced retirement planning calculator) | Yes | No |

| Wide range of colorful graphs and charts | Yes | Yes |

| Tracks business and/or tax-related items | Yes | Yes |

| Asset allocation | Yes | No |

| Mobile capabilities (iPhone, Android, iPad, and Windows phone/tablet, etc.) | Yes | Yes |

| Apple iWatch | Yes | No |

| Gives tips on saving (i.e., tips on credit cards with lower rates) | No | Yes |

Table: Personal Capital vs. Mint Comparison

So which one of these two platforms are the best? Should you sign up with Personal Capital or Mint?

That answer really depends on you and what you are looking for.

On the other hand, the Mint and Personal Capital apps are free to use, so you can open an account with both and perform your own test drive.

Click Below to Open Your Free Account with Personal Capital

>>Open Your Account with Personal Capital<<

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.