Mint App Review: From $0 to $170,000,000 in 2 Years

Aaron Patzer started building Mint in 2006, and officially launched Mint software in September of 2007. Two years later, in November of 2009, Aaron sold Mint to Intuit for $170 million. At that time, there were about 1 million users of the Mint.com app.

By 2013, its user base had climbed to over 10 million.

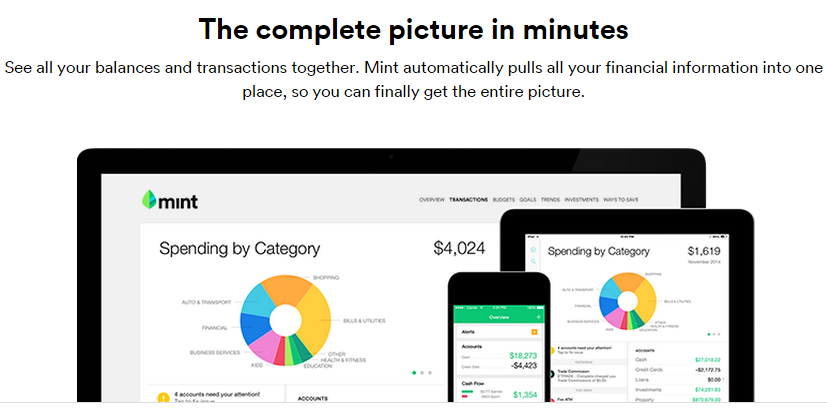

Mint Software: An All-in-One Financial App

Mint is what is considered an All-in-One personal finance app.

It allows you to get a clear picture of your total financial life, including money management, budgeting, and bill payments.

Using the platform, you can aggregate all your financial information into one place, and quickly see what you own (assets) and what you owe (debt).

Mint App Review

Using the Mint personal finance platform is a great way to combine multiple financial concerns into one fluid personal finance app. Of couse, as an all-in-one app, there are plenty of other components to consider.

Our Mint.com review aims to cover every facet of Mint software, answering the following consumer questions about the Mint finance app:

For those who are looking for a personal finance app, Mint personal finance software is a great way to maintain a budget, stay on top of bills, and start learning how to better manage your money.

See Also: Personal Capital App Review | What You Should Know About Personal Capital

Mint App Review

As a personal finance app, Mint is making huge waves. After its sale to Intuit, the Mint.com app continued its success, providing free access to valuable money management tools for anyone who chose to sign up.

What exactly are these money management tools that define Mint personal finance? How does Mint work, and why is the Mint finance app so valuable for consumers who want better control over personal finances?

In this section, our Mint app review will look at each component of the Mint finance app to provide a thorough analysis of this popular personal finance app.

Across All Major Mobile Platforms

Mint is designed for Android, iPad, iPhone, Mac, Windows, and a wide range of other platforms.

Its multi-mobile-platform capability allows you to easily and quickly see your financial life in one place.

What’s especially important about the Mint.com app is that using any major mobile devices, you can quickly see real-time information of all your financial transactions and balances.

Easy to Use

When we began our Mint.com review and analysis, it didn’t take long for a distinct trend to emerge: users constantly raved about how easy it was to set up an account and use the platform.

When we tested opening an account, it took us less than five minutes. However, note that this is referring to just opening a Mint account.

Linking your Mint account to your various online banking and credit card accounts does take much longer, depending on how many external accounts you need to connect to your Mint.com account.

Nevertheless, since Mint.com connects online to most US financial institutions, it is very easy to quickly connect your various online accounts.

Not only is it quick and simple to connect your accounts, but our Mint app review found that this personal finance app was able to provide an immediate estimate of spending habits and trends.

As each financial account is connected, it looks at your spending habits right away, something that many other budgeting apps simply don’t do.

Mint is easily customizable so you can easily track your spending patterns, investments, cash flow, and more.

Don’t Miss: Best Small Business Accounting Software | Ranking | Online and Business Accounting Tools

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Budgeting Made Easy

Our Mint.com review found that, with Mint, budgeting can be a breeze. For those wondering “How does Mint work with a budget,” the answer is that this personal finance app makes budgeting accessible, simple, and even fun.

How to Budget with Mint

The Mint software provides you with the capability to create budgets that you can actually abide to.

Its budgeting feature provides you with a customizable view to easily see how and where you are spending your money.

You can also aggregate all your bills to one place and pay them all on the spot.

Most importantly, Mint allows you to see how your spending decisions today would impact how much you have left at the end of the month or year.

Our Mint app review found that this trait was one of the most valuable features of a personal finance app. Oftentimes, it is easier to stick to a budget when a personal finance app shows you the effects of spending habits, in real time.

Sign up for Personal Capital Now!

Plain English

One of the best discoveries during our Mint app review is that this personal finance app uses plain English that is easy for anyone to understand.

For example, how many times have you seen something along the lines of “POS TGT X89G CHIC IL 87.66” on your bank statement?

It would have been much easier for your bank statement to show: “Spent $87.66 at Target”

This plain English simplification is a major attraction for a lot of Mint users and has generated a steady flow of one positive Mint.com review after the next.

After all, to be effective, managing a budget should be as simple as possible. This is one example of how the Mint app strives to make the process simple and accessible.

In addition to using plain English, the Mint personal finance app will also automatically detect the right category for your various expenses. This makes it easy to look at spending totals across all your accounts.

Join Personal Capital for Free Here!

Related: Best Payroll Software for Small Business Firms | Ranking & Reviews

Easy to Personalize

Being able to customize a personal finance app is important. After all, not every user will have the same spending categories or types of transactions. Our Mint app review found that the Mint app comes with a wide range of naming conventions to categorize the “in and out” cash flow.

While our Mint.com review found hundreds of default categories, we also discovered that it was very easy to rename categories for virtually any transaction.

If you want to customize more than categories, naming tags can be easily added within the category. The Mint personal finance app will automatically apply those tags going forward if you choose.

Our Mint.com review also found that this personal finance app is great at paying attention to details. For example, for a $102 ATM withdrawal, the Mint finance app will automatically separate the $2 ATM fee.

Real-Time Updates

A great advantage of using the Mint app relative to its peers in that it provides real-time updates.

Mint automatically updates and categorizes your financial information in real time, allowing users to see changes and updates as soon as they occur.

This powerful capability ensures that you are aware of your financial situation at every point in time. In comparison to other budgeting apps, our Mint app review found that the Mint app surpasses much of its competition with this integral feature.

Popular Article: Learnvest vs Mint | Ranking, Comparison & Competitors

Security

Whenever you use a personal finance app, it’s common to have worries about security. For that reason, this portion of our Mint.com review will address the question: “Is Mint.com safe to use?”

The good news is that Mint app security is just as high as that of your own bank.

Mint app security is extremely high, as the Mint app uses the same level of 128-bit SSL encryption standards used by financial institutions.

The software is also continually monitored by 3rd party security firms, including TRUSTe and VeriSign. This constant monitoring increases Mint app security, making for a positive Mint app review for high-security standards.

Our Mint app review found that the mobile app is safeguarded with a 4-digit code or touch ID access. Should your phone ever get stolen or lost, all information can be deleted remotely.

It’s also important to note that, while users allow the Mint.com app to access financial information, the Mint app can’t actually do anything with that information.

The only exception to this is when enrolling into bill pay, which our Mint app review discusses in detail below.

Bill Payments

Paying bills through Mint software is a simple, efficient, and dependable process. Our Mint app review found the following features to be particularly beneficial:

- Payment settings can be remembered, eliminating the hassle of entering information on a monthly basis

- Bill reminders can be sent to your phone or email to keep you updated on automatic withdrawals

- Due date alerts will prevent late payments and late charges

- Alerts are sent for low funds, eliminating the frustration of overdraft charges or denied payments

Additionally, Mint app security features will alert you when any suspicious charges appear, keeping your finances as safe as possible.

Free Credit Score Monitoring

For some Mint app users, understanding credit score and keeping an eye on credit changes is an important part of managing a budget. Having a good credit score can help users get better rates for auto loans, home loans, insurance, and credit cards.

Our Mint.com review found that the Mint app provides this service free of charge, and without any requirements.

What makes this personal finance app stand out is that credit score is displayed along with financial information, keeping with the “all-in-one” functionality of the Mint app.

Our Mint.com review also found that users can have daily credit monitoring alerts through the Mint app, making it easy to keep an eye on credit.

Not only does Mint provide you with a free credit check, but it also provides users with guidance on how their credit is evaluated, and how to improve their score.

Read More: Stash Invest App Review | What You Need to Know (Fees, Pros, Cons, Services)

Conclusion: Mint App Review

Our Mint.com review found plenty of things to like about Mint software. With real-time reporting, free credit checks, top-rated Android and iPhone apps, and an effortless enrollment process, Mint truly is an all-in-one personal finance app.

For those who are still wondering “Is Mint.com safe to use?” we hope that our Mint.com review has dispelled any doubts. Mint app security uses multi-factor authentication and strong encryption to keep your information safe and secure.

With a wide range of 100% free budgeting services provided by the Mint app, this software boldly stands out as one of the best personal finance apps to consider using.

Image Sources:

- https://www.mint.com/how-mint-works

- https://pixabay.com/en/environmental-protection-886673/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.