Why Bother with Payroll Systems for Small Businesses?

One of the most important things that any small business can do is to pay its employees fairly and on time. This sounds like an easy task until you realize how much has to be done. You have to account for different salaries, necessary deductions, tax form generation, and much more. How can a process like this be streamlined and automated?

That’s where payroll programs come in!

Whether it’s payroll software for Mac or Windows, you need the best small business payroll software that you can find. And if it just happens to be a free payroll software download, that’s even better for ensuring that your small business operations run smoothly with next to no additional cost. This begs the key question that you probably want to know the answer to: What is the best payroll software that you can use for your small business?

Award Emblem: Top 5 Best Payroll Software for Small Business Firms

This article will feature payroll software reviews of some of the best payroll programs for small business firms that are currently available. We have taken the time to carefully use and evaluate these payroll programs to make sure that you, the reader, are choosing from the cream of the crop. Feel free to try out these payroll systems for small businesses and see them in action for yourself!

AdvisoryHQ’s List of the Best Payroll Software for Small Business Firms

List is sorted alphabetically (click any of the names above to go directly to the detailed review section for that firm/product)

Why Bother with Automated Payroll Programs?

You might be asking yourself, “Why would I want to use online payroll software? What’s wrong with the old-fashioned way that I have been using this whole time?” There are three primary benefits to using the best payroll software available for your small business:

- Speed! Can you imagine spending countless hours with endless stacks of paper, employee schedules stacked everywhere, and a tiny calculator? It can take up several hours of your valuable time that could be better spent running your business. Let the online payroll software do the laborious work of number-crunching for you.

- No more fear of tax fines. When people were surveyed as to why they chose to use payroll systems for small businesses, the top reason was to properly complete federal and state tax forms. Given the heavy penalties that small business employers and employees will receive just for failing to pay taxes, it makes sense from a business perspective to invest in the best payroll software you can get your hands on. As we said before, you can always use free payroll software if you are concerned about spending hard-earned money on software.

- Easy access of important data. By using payroll programs for small business firms, you can keep everything conveniently stored in one electronic database. Schedules, timesheets, deductions – all of it available at your fingertips. One click and your online payroll software shows you the data that you need!

Are There Advantages to Using In-House Payroll Software for Small Businesses vs. Outsourcing It?

When it comes to using payroll software for small business firms, people will debate over using the programs in-house compared to outsourcing the entire process to a third party. According to statistics, most small businesses spend 1–5 hours a month on payroll if done internally while the majority of small businesses who outsource the task spend anywhere from $100–1000/month on it.

Image Source: Best Payroll Software for Small Business

With that being said, there are good reasons to prefer an in-house process for payroll programs:

- Instant access. When payroll systems for small businesses are kept within the business itself, data is accessible within a second. Had you made the decision to outsource payroll, you would have a time delay of 1–2 days in order to get the answer you are looking for.

- Saves money. Many of the solutions out there are available for a small cost, and there’s even free payroll software for small business owners that are strapped for cash. Plus, if you are dealing with a small number of employees (5 of fewer), you might not really need that much in the way of features that some payroll software programs include.

- Security concerns. Many small business owners simply do not feel comfortable handing over sensitive information to a third party, no matter how trustworthy it is. They would rather use online payroll software that they know is completely in their control. The data is for their eyes and nobody else’s.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Top 5 Payroll Software for Small Business Firms

| Payroll Software | Website |

| Paychex | https://www.paychex.com/ |

| QuickBooks | http://payroll.intuit.com/ |

| Wave | https://www.waveapps.com/payroll/ |

| Xero | https://www.xero.com/us/ |

| Zenefits | https://www.zenefits.com/payroll/ |

Table: Best 5 Payroll Software for Small Business | Above list is sorted alphabetically

Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated firms, products, and services.

Detailed Review – Top Ranking Best Payroll Software for Small Business Firms

Below, please find the detailed review of each firm on our list of top payroll software for small businesses. We have highlighted some of the factors that allowed these payroll programs to score so high in our selection ranking.

Paychex Review

The first contender in our series of payroll software reviews is Paychex. Having been around since its founding in 1971 as Paymaster, it has now grown into an industry leader that serves over 600,000 clients across the country. To this day, it still remains true to its goal to serve small and medium-sized businesses in America (100 or fewer employees).

With numerous acquisitions of companies over its 3-decade time span, Paychex has grown in its scope and in the number of services it is able to provide to clients. Employee benefits, human resources tasks, and payment processing are just a sample of the many features you will receive when signing up with it.

Key Factors That Enabled This Software to Rank as a Top Online Payroll Software

Below are primary reasons we selected Paychex to be rated as one of this year’s top payroll systems for small business firms.

Multi-Platform Access

When people think of payroll programs, the first thought that comes to their mind is a computer program that is managed from the business owner’s desk. That may have been true a few years ago, but the rapid advancement of technology has allowed online payroll software to become accessible from any platform.

For this reason, Paychex has worked hard to make its payroll software available on tablets and mobile platforms. As you can see from the list of benefits in the above picture, business owners and their employees can manage their finances while on the go. This allows for easier 24/7 access to important financial information.

Tax Calculations

If you recall what was stated earlier, you will remember that tax completion is one of the most useful features provided by the best payroll software platforms out there. Fortunately, Paychex falls into this category through providing several tax services to small business owners who can’t be bothered to calculate them by hand.

Taxpay, the payroll tax service provided by Paychex, helps deposit payroll taxes while automatically filing tax returns. Taxes at the federal, state, and local levels are accounted for along with sales tax and tax credit.

Educational Resources

Even with the best small business payroll software at your disposal, you still have to know how to properly take care of certain financial aspects of your business. The software can only do so much since it must be used by somebody who knows what the rules are.

Paychex has you covered by regularly providing fresh online content regarding payments and updates on new laws that affect small business operations. You will never have to worry about being out of the loop again!

QuickBooks Review

QuickBooks is an online accounting platform that was developed in 2005 by software enterprise company Intuit, also known for creating the budgeting app called “Mint.” It has recently begun reaching out to medium-sized enterprises along with nonprofit organizations and product sellers.

With new features continually added, old ones being optimized, and available payroll software for Mac & other platforms, it will surely continue to occupy a larger portion of the market over time. This fact alone is a testament to its status as one of the best payroll software for small businesses that you can get your hands on.

Key Factors That Enabled This Software to Rank as a Top Payroll Software for Small Business Firms

Below are some of the critical reasons we were able to name QuickBooks as one of this year’s top small business payroll software.

Integration with Several Software Programs

Although online payroll software offers much in the way of automating the payroll process, it is still yet another program among hundreds that must be managed on the owner’s computer. Wouldn’t it be great if payroll platforms could integrate with other programs to create a more efficient operation?

QuickBooks has been equipped with integration among several common apps used by business owners. For example, data from Excel spreadsheets can be imported into QuickBooks with only a few mouse clicks. There is also email integration with Microsoft Outlook and marketing integration with the Google search engine. This multi-app compatibility is what allows QuickBooks to be such a versatile platform.

“Try Before You Buy” Option

One of the biggest problems that you will see with payroll programs is that no trial option is offered. You have to pay money upfront to try the platform out, and it can become difficult to withdraw from the platform once you have put all of your information in it. Recognizing this, QuickBooks provides users with a 30-day trial period in which they can use the platform without any missing features.

Newcomers will find that setup only takes a couple of minutes, and they can withdraw at any time without any pressure or contingencies. This is most preferred for small business owners who would prefer to try a product out before investing money in it. This brings us to the next important feature of QuickBooks.

Low Operating Costs

Cost is a big factor for business owners investing in software to help improve their operations. The return on investment they get in extra time gained or greater revenue must be greater than what they are putting into the payroll software. Fortunately, QuickBooks offers several affordable plans, making the software accessible to all small businesses.

In independent payroll software reviews, QuickBooks is praised for offering fair pricing in its “Basic” and “Enhanced” options. The former does automatic payroll combined with tax calculations and 24/7 expert support for $20/month (+$2 for every employee using it). The latter includes everything in “Basic,” with the automatic filing and paying of all taxes by the system for $31.20/month (+$2 per employee).

Wave Review

Wave is easily the youngest of the payroll programs to be featured in this list, having been founded in 2011 by co-founder Kirk Simpson. To date, it has tracked over 235 million transactions for 1.7 million customers across 200+ countries. It is also cloud-based, making it versatile for any device or operating system.

One of its standing features is the fact that it is built exclusively for small businesses. While other platforms on this list can be expanded for medium and large-sized businesses (55+ employees), Wave is engineered to serve businesses with 9 employees or less. This means less of the features that small businesses don’t need and better functionality of the features that they need to stay afloat.

Key Factors That Enabled This App to Rank as a Top Payroll Software for Small Business Firms

Below are some of the elements we found compelling enough about Wave to name it as one of this year’s best payroll programs.

Simple User Interface

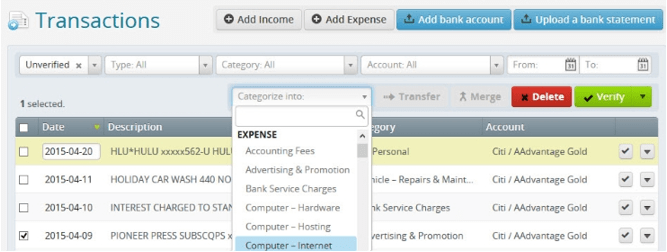

Image Source: Wave

When payroll software for small business firms is constructed, the first thing that comes to mind is to jam it with every single feature under the sun. Unfortunately, this success comes at the expense of a complex interface that has a steep learning curve. The last thing that small business owners need is wasted time put into learning an extremely complex piece of software.

The image that you see above is a “busy” page on the Wave cloud platform. There is clearly a lot of things that can be done with such a simple layout. Income can be added, bank accounts can be worked with, and downloaded transactions can be viewed. Simplicity is the modus operandi of Waze, and it shows in its ease of use.

Buffed Security

When it comes to anything that is related to the financial aspects of small businesses, privacy and security are the chief concerns. Even the best payroll software needs to have some level of protection against malicious hackers and those with bad intent. When a small business owner scouts out payroll programs to use for his/her business, that individual will need to have the confidence that his/her information will be kept safe.

Wave offers automatic backup of all data in its system along with 256-bit SSL encryption. In the case of a crash or an attack, the data will be kept intact and accessible from any other location. You will never have to worry about losing data because you forgot to hit the “Save” button!

Pro Network

Wave offers the option for business owners to use their “Pro Network” in order to search for an accountant that offers services through the Wave application. This is a great way to get connected with credible people who are familiar with the platform you are using. Full contact information and credentials are made publicly available to interested parties. If you are an accountant, you can join the network and become a hot target for interested business owners.

Xero Review

Xero is an online payroll software platform that was founded in New Zealand back in 2006. It has seen exponential growth every single year in the total number of subscribers and has recorded NZ $1 trillion in 2015. Named as the World’s Most Innovative Growth Company by Forbes in the past two years, Xero advertises itself as the QuickBooks alternative that everyone has been looking for.

Funny enough, Xero offers seamless data transition from QuickBooks to Xero. It only takes a few minutes of data transfer and easy installation to transfer all of your QuickBooks information and begin using Xero as a stand-alone product.

Key Factors That Enabled This App to Rank as a Top Free Payroll Software

Below we’ve compiled a list of some of our most compelling reasons Xero has made our list of this year’s top rated online payroll software platforms.

Multiple Features in a Single Cloud Platform

Rather than switch between numerous apps that belong to an entity, this platform offers multiple financial functions that are crucial to the operation of any small business. They include:

- Cash flow (inventory, budgeting, bank reconciliation, etc.)

- Invoicing (invoice reminders, quotes)

- Payments (bill entry, purchase orders, personal expenses)

- Payroll (built-in timesheets, employee payment)

- Tax (W2 & 1099 preparation, sales tax rate calculation, file tax returns)

- Mobile usage (iOS + Android)

Integrates with 350+ Business Applications

With full integration among some of the most widely-used business apps on the platforms, streamlining and syncing data has never been easier. Data from these apps can be transferred towards the invoicing and time tracking functions that are made available in Xero. This is what makes it one of the best small business payroll software platforms around. Industries include:

- Accounting

- Agriculture

- Automotive

- Construction

- Franchises

- Health

- Hospitality

- Manufacturing

- Not-for-profit

- Professional services

- Property & realty

- Retail

- Tourism

Unlimited Users

While Xero may not be free payroll software, it does come with a very low monthly rates for its packages by offering a discounted rate for the first six months. However, its unique feature is the capacity to add on unlimited users without charging an extra dime. This is an extremely attractive option for small business owners who have plans to scale their operations in the near future. This benefit exists for all of its packages, and there are no catches or gimmicks to this rule.

Zenefits Review

With a 2013 launch, Zenefits is easily the youngest small business payroll software application to be featured on this list. Founded with a vision to ensure that small business owners do the least amount of work possible to run the administrative side of their businesses, it has garnered heavy press attention for its innovative approach towards automatic payroll and accounting.

In spite of the hands-off approach advertised by Zenefits, it has been touted by its users for its incredible accuracy in handling payroll-related tasks with next to no errors. Look out for Zenefits in the near future – it is bound to disrupt the payroll industry and set new standards.

Key Factors That Enabled This Software to Rank as a Top Small Business Payroll Software Program

Below are some of the most significant reasons we selected Zenefits as one of the year’s top payroll programs for small business firms.

Strong Emphasis on Automaticity

The earliest pioneers of payroll programs had the vision of accounting that required no additional input from humans whatsoever. Zenefits seems to respect that vision by automating everything possible within its software platform. As you can see from the diagram posted above, everything is designed to be automatically updated in real time. No need to remind Zenefits to release payments or file taxes – all of that is done for you!

Complete Payroll Timeline

One of the most difficult things to do, even in the best payroll programs for small business firms, is to keep track of everybody’s payment history. With multiple employees to manage and monitor, it becomes easy to spend hours combing through past history in order to find a certain piece of data.

With Zenefits, you get a visual timeline that tracks every single payroll change for all employees. You can see who was paid what and when, new hires, salary increases, and so much more. There is an easy-to-use filter at the top of the timeline that allows you to narrow your search results and find exactly what you are looking for.

FREE! (for a Limited Time Only)

Although this offer will expire at the end of the 2016 calendar year, Zenefits Payroll is currently being offered for FREE! This makes it the one application on this list that can be considered as free payroll software for small businesses. You get the full features of the soon-to-be-premium product, after which it will be $25/month + $4/employee per month. Take it for a spin and see if Zenefits is right for your company!

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – Top 5 Payroll Software for Small Business Firms

We hope that these payroll software reviews were helpful in showing you the best payroll software platforms that are currently available for small businesses. Payroll programs are becoming far more advanced in terms of functionality and scalability, and this trend shows no sign of slowing down. Take advantage of this and don’t spend any more time doing payroll by hand.

Now, is there a single best small business payroll software app for everyone? Of course not – the platform that is “best” for you will depend on your industry and your individual business needs. Payroll systems for small businesses offer similar features to one another, but, at the end of the day, they are each trying to achieve their own objectives. This is why you must take the time to review these platforms and decide which one you can use. Don’t try to use more than one online payroll software platform at once!

When in doubt, you can contact these companies and receive a free consultation on whether or not their small business payroll software is right for you. All of the companies mentioned in this article are known for having exceptional customer service, and thus they will be happy to answer any questions you have. Happy accounting!

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.