Intro – Southwest Airlines Federal Credit Union Reviews & Ranking

AdvisoryHQ recently published its list and review of the top credit unions in Dallas, Texas, a list that included Southwest Airlines Federal Credit Union.

Below we have highlighted some of the many reasons Southwest Airlines Federal Credit Union was selected as one of the best credit unions in Dallas, Texas.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Southwest Airlines Federal Credit Union Review

Southwest Airlines Federal Credit Union has a history of more than 30 years, and it started out being run by Southwest Airlines employees from their personal offices. Throughout the years, this Dallas credit union has continued to grow, and it now includes more than 70 employees.

Southwest Airlines Federal Credit Union has five office locations in three major cities, and there are more than 31,000 members and assets in excess of $185 million. Membership is available to employees of more than 150 Select Employee Groups, and immediate family and household members may also be eligible to join this leading Dallas credit union.

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Credit Union Firms

Upon completing our detailed review, Southwest Airlines Federal Credit Union was included in AdvisoryHQ’s ranking of this year’s best credit unions based on the following factors.

Southwest Airlines Federal Credit Union Review: LUV Reward Checking

LUV Reward Checking is an account that earns 4.0% APY and also includes perks such as unlimited ATM fee refunds on a nationwide basis. There is no monthly service fee, there are no minimum balance requirement to earn rewards, check writing is unlimited, and overdraft protection and courtesy pay are available.

This NCUA insured account requires only a $30 minimum deposit to open, and you can access your account through online banking and telephone banking.

If your balance is up to $25,000, you receive the standard 4.0% APY. For balances over $25,000 the APY ranges from 4.0% to .25%. If you don’t meet certain qualifications, it includes 0.10% APY.

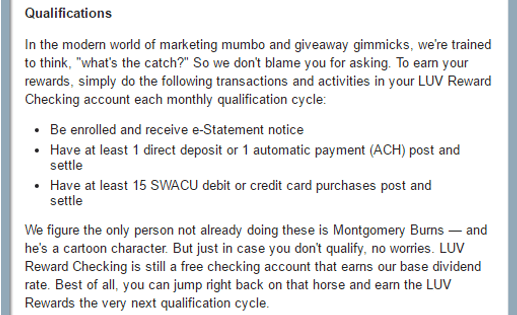

The qualifications for the account are shown below:

Image Source: Southwest Airlines Federal Credit Union

Southwest Airlines Federal Credit Union Review: MoneyIsland

The MoneyIsland account is uniquely designed for children ages 8 to 14, and it’s designed to provide a fun, game-like online destination that lets kids play while they also learn important financial concepts.

MoneyIsland is free to all members, and this free, multi-level online game also includes content, blogs, and contests. It meets the national standards for financial literacy, and parents can access the advanced admin tools.

This online game account includes real-life rewards, and it’s also linked to an actual savings account.

Southwest Airlines Federal Credit Union Review: Tablet Banking

This credit union in Dallas offers a variety of conveniences, and one of those is tablet-specific banking. Tablet Banking is optimized so members can not just bank on their mobile phone, but also their iPad or another tablet.

The tablet app includes the ability to send money by text or email with Popmoney, the ability to schedule and pay bills, and options to view account balances and history.

You can also use the tablet app to make mobile deposits.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Southwest Airlines Federal Credit Union Review: Free LUV Checking

For members who want a simple, straightforward, convenient, and low-cost checking account, there is Free Luv Checking. This account is simple, and there are no transactions to track or limits to worry about.

There is no monthly service charge, no minimum balance requirement, and no limits on check writing privileges.

This checking account includes a free debit card, free ATM withdrawals at SWACU, CU Here, and CO-OP ATMs, as well as available overdraft protection.

The account requires only $30 to open, and online banking with bill pay are available.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.