Intro: Top 4 Stock Portfolio Management Websites

The decision to invest your money, particularly in the stock market, isn’t likely one you took lightly.

With that in mind, you probably want the best tools and resources to ensure you’re adequately monitoring your investments and that they’re growing. When it comes to stock trading and investment, perhaps the best way to do that is through the use of a stock portfolio app or investment tracking software.

This method of portfolio tracking is different from a personal financial software solution, which only provides you with a means of tracking your daily income, spending, and general budgeting.

Best Stock Portfolio Management Websites

There may be personal finance software options and apps that also integrate the capacity to track stocks, although not all do.

Most professional traders (and even enthusiastic amateurs) rely on investment tracking software specifically designed for that purpose. With stock portfolio management software there’s often the option to track multiple asset classes from one platform, making it easy to manage a wide variety of investments.

These modernized platforms have almost entirely replaced the use of a simple Excel sheet as a portfolio tracking solution.

Features of Portfolio Management Software

Common features of investment portfolio management software include:

- Simultaneous management of stocks, bonds, cash, mutual funds and a variety of other investment types.

- Transactions can be retrieved directly from a broker or mutual fund company and then imported in customized formats.

- One of the advantages of using stock tracking software are the detailed reports that let you choose what you want to see, in the format you select. This gives you flexible ways to view your investments and how they’re performing, as do the many graph options often integrated with portfolio software.

- If you want to make smarter investment decisions, one of the best ways to do that is to look at trends. Many platforms offer the ability to view trend lines on a range of graphs so you can back your investment decisions by data.

- Create and manage your financial and investment goals within many available platforms. You can organize your goals based on asset types and sectors in some products.

- Some of the best stock portfolio websites also offer access to a stock portfolio app, so you can track your investments from anywhere, even on-the-go from your smartphone or tablet.

These are just some of the many offerings making stock market portfolio software and apps so appealing to investors. Many of the top products also feature versions specifically for advisors and financial professionals.

The Top Investment Portfolio Management Software

So, knowing the modern features and advantages, how do you select the best stock portfolio tracking solution for your needs?

To help consumers choose the right option, we created this list of our top four picks:

- Personal Capital

- Betterment

- FutureAdvisor

- Google Finance Portfolio

Each of the top four picks has unique features and offerings, which we’ll explore in detail.

Personal Capital

Along with the personalized offerings, one of the reasons Personal Capital made our list is because it’s great for someone seeking access to a free portfolio website.

Many of the available options are free of charge to users, and Personal Capital has a longstanding reputation for its services, managing more than $2 billion in assets.

Overview

Personal Capital unites the advantages of innovative technology with the expertise of veteran financial services professionals.

Personal Capital’s goal is to build a better money management experience, which empowers people to make the best choices.

There are one million registered users, and Personal Capital continues to grow thanks in large part to its client-centric business model.

The company is built on the principles of making the financial industry more accessible, affordable, and honest. Other essential components of the Personal Capital business model include tailored service and transparency, as well as objectivity.

Financial Tools

As one of the best free portfolio websites, Personal Capital represents some of the best online stock portfolio features and tools.

These include:

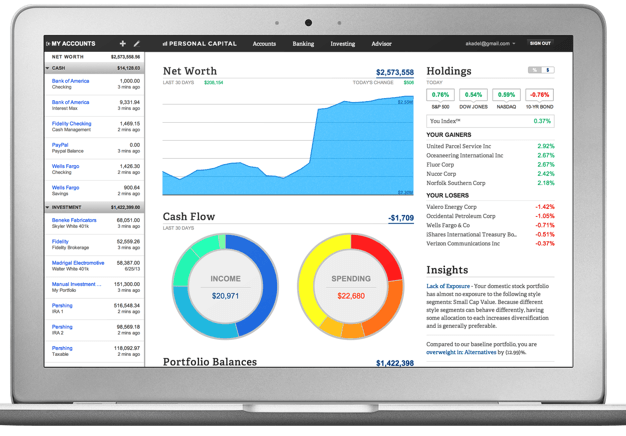

- Manage all aspects of your financial portfolio in one location with the free analytics dashboard.

- Know your net worth based on views of all of your financial accounts, including not just investments and IRAs but also checking, savings, mortgage loans, and credit cards. Access this information at any time and from any device.

- Use Personal Capital to uncover hidden fees you may be paying your broker, which can add up to thousands of dollars every year.

- Analyze your portfolio with the Investment Checkup tool, which shows you any fast improvements you could make on the path to achieving your long-term goals. Your recommended portfolio will maximize returns and minimize risks.

- Link accounts to your Personal Capital dashboard to see changes in real-time, and also assess the impact life events are having on your portfolio so you can make proactive changes.

The “Best Free Finance App Available!” – Macworld

In your central Personal Capital dashboard, you can see:

- Net worth

- Cash flow

- Portfolio balances

- Portfolio allocations

- Key holdings

- Top gainers and losers

- Account balances and transactions

- Spending by account and category

- Income reports

- Spending reports and upcoming bills

- Investment returns

- Projected investment fees

Personal Capital is favored by users because it’s comprehensive, simple to set up, and easy to use. Most U.S. financial institutions are supported within the platform, and all information is securely stored through a third-party, providing an extra layer of security.

Click Here: Join Personal Capital Today!

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Financial Advising

Distinctively, this free portfolio website also features financial advising options for users.

While the above features are free of charge, there is a fee for using the financial advisory services available from Personal Capital, but it’s all-inclusive and based on a percentage of assets managed.

Advantages of using management services from Personal Capital include:

- You’ll have an experienced professional on your team who will work in your best interest.

- Using a smart management strategy and Smart Indexing methodology, the advisors will optimize risks and returns.

- Using Personal Capital eliminates commissions, transactions, and annual fees.

- Advisors are available on-demand when you need advice or assistance.

- Personal Capital considers your total net worth when creating investment strategies personalized to you, rather than just looking at what you manage through the company.

Our Analysis

Personal Capital is great for so many reasons, including the options available on its free portfolio website, as well as its ease-of-use.

You can quickly sync all of your accounts in one location and see summaries of your net worth that are easy to understand and analyze.

You don’t have to pay anything unless you opt for the advisory services offered by Personal Capital, and even then many of the traditional fees are eliminated.

All in all, this is an excellent product for anyone seeking the best free portfolio websites, as well as options for more personalized advising services.

Click below to sign-up

60 Seconds Sign up – Personal Capital

Betterment

Betterment is one of the largest and most used automated investment services, with more than 125,000 customers and more than $3 billion in investments.

Overview

This stock portfolio management website aims to help users plan for a stable financial future, with a focus on transparency, efficiency, and tailored strategies.

The ultimate goal with Betterment is to reach optimal returns, no matter your level of risk.

This is done by focusing on:

- Diversification

- Automated rebalancing

- Better behavior

- Lower fees

According to the team at Betterment, clients can expect 4.3% higher returns compared to a do-it-yourself investor.

Betterment also offers customized portfolio allocation, with a goal-based framework that lets customers know how well they’re doing on their path to their investment objectives, whatever they may be.

The Betterment platform is centered around holding a globally-diversified, passive portfolio with 12 asset classes. It’s all focused around the client’s level of risk and how much time they have. This approach is developed from research as well as the Modern Portfolio Theory, which was the subject of a Nobel Prize.

Features

With this stock portfolio management platform, you’ll enjoy a range of automated features that make your financial life effortless.

Some of these automations include:

- Auto-deposits are scheduled so you can stay in-line with your goals.

- Using SmartDeposit, your extra cash is automatically invested.

- Each time you make a deposit or receive dividends, your portfolio is automatically rebalanced to reflect these changes.

- The interface and design of Betterment make it a favorite among investors. You’ll use a single login to access multiple portfolios, and you can also invest in taxable accounts as well as trusts and IRAs.

- Every area of the investment experience is tackled by Betterment, meaning you’re going to get the best possible experience, including improved security.

- Fractional shares are purchased, so there isn’t performance loss resulting from holding cash.

Tax Loss Harvesting

With a focus on efficiency, Betterment offers a feature called Tax Loss Harvesting. This means that Betterment will assess portfolios to see losses that can offset what you’re paying in capital gains taxes.

The result of this distinctive offering can mean an increase of about +0.77% annually.

Betterment is a stock portfolio tracking solution that also offers a broad range of services.

Some of the financial services include:

- Financial Planning: As a client, you can access personalized investment strategies based on your goals, whether it’s planning for retirement or building general wealth. With these planning services, all advice is completely personalized and risk-adjusted to your unique needs.

- Retirement: The signature RetireGuide will calculate how much you’re lacking for retirement so you can compare how much you have to how much you’ll need. It integrates every area of your life into the calculations, from where you live to your tax rate.

- IRAs: Create an IRA through Betterment and you’ll likely find fees are lower than other options you’ve explored, and the Betterment team will recommend the optimal level of risk based on your needs.

- Trusts: Intelligently create and manage a trust with simple signup and smart cash flow management where every deposit and dividend means an automatic rebalancing. You can create multiple goals based on the beneficiary and automate cash transfers on a customized schedule. You can also manage several different trust accounts with a single log-in.

The pricing of this stock market portfolio and comprehensive investment tool is a lower fee structure compared to traditional account fees.

Currently, the Betterment Fee is around 0.15%, as compared to a regular account fee of around 1% (both reflecting an account balance of $100,000).

Our Analysis

Betterment is unique in the way it harnesses technology and automated algorithms to take the effort and guesswork out of investing.

It’s a great stock tracking platform with award-winning functionality, smart automation, and retirement planning features.

You get even more services than you’d find with a traditional brokerage, offered at lower costs, which is why we put Betterment on our list of the top four stock investment portfolio management software and web-based products.

FutureAdvisor

FutureAdvisor is billed as a way to bring together existing investment accounts and make them smarter through the use of technology.

The ultimate goal is to create investment accounts that are more efficient and can help you achieve your goals faster, as they’re integrated to work together.

Overview

With FutureAdvisor, all of a client’s investments are managed in a “holistic” way so that you can maximize the benefits of each account, whether that be flexible investing, deferrals or any number of other potential advantages.

The FutureAdvisor platform is backed by a team of expert licensed advisors and specialists who can provide customer service, answer questions, and offer the knowledge you need to make the best investment decisions.

FutureAdvisor is an automated wealth management and portfolio tracking solution that uses the power of a proprietary algorithm to monitor your stock trading actions and review your portfolio on a daily basis to find opportunities to save on taxes.

The philosophy behind this stock market portfolio management platform is that a long-term and completely diversified investment strategy is going to yield the best results.

The investment portfolio management software behind FutureAdvisor links directly to existing accounts, so it’s easy to use.

When all of your accounts are linked and your goals are input, FutureAdvisor provides recommendations and advice that will help you stay on track.

All money stays in your name at U.S. brokerages, so you have control and peace of mind.

Retirement

This stock portfolio tracking software is based on Modern Portfolio Theory, and retirement-centric benefits include:

- A simple, user-friendly interface

- Free recommendations and analysis

- You’ll be up and running in less than two minutes

Your assets are directly managed in a Fidelity or TD Ameritrade account that stays in your name.

For the first three months, retirement services are completely free, and if you don’t find the services to be valuable, you can leave FutureAdvisor without any financial obligation.

Retirement services features and advantages include:

- Complete transparency: FutureAdvisor aims to simplify how you make financial decisions by showing you exactly what’s happening. You’ll see not just how the decision will impact your current portfolio and financial standing, but also how it will affect your goals and future plans.

- You’ll receive up-to-date analysis of all of your accounts, so you can maximize your returns while ensuring you maintain the correct level of risk for you.

- With on-call financial advisors, you can discuss your retirement plans and have your questions answered by a seasoned professional. You can also reach out to advisors in the way that best suits you, whether by phone, online chat, or email.

College Savings

Along with traditional retirement planning and stock portfolio management, FutureAdvisor also features services and tools to save for a debt-free college education for your children.

These managed savings plans are free, and the service scans all of the available types of accounts in each state in the country to find one that will be flexible and offer peace of mind while also providing tax savings.

Each recommended solution is designed around the client’s particular needs.

College savings services from FutureAdvisor include the following steps:

- You’ll be asked a few questions to help FutureAdvisor estimate the cost of college and create a plan based on your children, your goals, and your budget.

- The laws of your state are analyzed to identify the best matches regarding education investment accounts that are tax-efficient.

- If you already have savings to put toward college, it will be consolidated with your action plan.

- Any new accounts required will be opened and managed by FutureAdvisor. Multiple custodians are used, ensuring the best possible results.

The accounts are automatically monitored, and contributions are invested in a way that’s effortless for you. Investments will be adjusted as necessary, with a diversified approach.

Our Analysis

Many of the available offerings from Future Advisor are free, and we also like the option to divide your investment tracking into retirement or college savings.

This solution is perfect for someone who has long-term investment goals but wants effortless management.

The interface is user-friendly and intuitive, and years of research underlie the entire philosophy from FutureAdvisor.

Google Finance

Google Finance is a simple-to-use, free platform to manage your stocks, investments, and finances.

It’s backed by one of the leading free portfolio management software platforms, so you get the trusted reputation and quality offerings Google is known for.

Overview

This specialist realm of Google services encompasses both tools for stock tracking and portfolio management, as well as integrated financial news and updates that could be pertinent to you.

It’s a basic stock market portfolio platform, but many people enjoy it for its simplicity and, of course, that it’s free of charge.

With the Portfolio Tracker tool, you have the ability to track stocks from a variety of sources and also look at the total value over time.

Google Finance includes cash totals for the money you’ve deposited with your broker, but that isn’t yet invested, for a complete picture.

As compared to some of the other online stock portfolio options, Google Finance doesn’t have advertising, which is something many clients enjoy over other similar tools.

Free Wealth & Finance Software - Get Yours Now ►

Features

To access Google Finance, you’ll need a Google account, which many people already have.

If you don’t, it often takes less than a minute to sign up. Once you have an account, you’re ready to create your portfolio, which is similarly straightforward.

After a portfolio is created, add your stocks and mutual funds. You can then view your portfolio in different modes, which include:

- Overview Mode: This view will show you your stock’s last price, as well as things like percentage change, volume, and high and low prices for the current session.

- Fundamentals Mode: If you move to Fundamentals mode you’ll see the last price of stocks in your portfolio, as well as other data such as average volume and highs and lows over a 52-week period.

Editing your portfolio is simple in Google finance, and you can also change your currency with the click of a button.

If you’re exploring Google Finance and you see there are limited menu options, it’s because you haven’t uploaded your portfolio. Once you create your portfolio, the full menu options will become available, and you can edit.

Discussion Groups

Something distinctive about the use of Google Finance are the discussion groups you can participate in.

Discussion groups give you unique access to advice, opinions, and other conversations related to either a particular stock or even a group of stocks. You can read the discussion content without having a portfolio, but to participate, you need to be a registered user of Google Finance.

Portfolio Charting

In 2010, Google launched a Portfolio Charting option, which overlays individual assets so you can more easily track your entire portfolio. This provides you with historic performance views in a complete sense, rather than simply offering the option to follow specific stocks.

News Links

Another unique aspect of Google Finance compared to other investment tracking software and some of the best free portfolio websites is the inclusion of news links.

You can receive automatic news updates from the companies in which you invest, so you don’t have to manually search news sources to find out what’s happening with these organizations.

You’ll also be automatically alerted of upcoming events that could impact your investments or portfolios, such as earnings reports. These can even be added to your personal Google Calendar.

Our Analysis

Google Finance is entirely different from the other three stock portfolio management tools on our list.

It features a much simpler approach, which is something some investors prefer.

We like not only its simplicity and that it’s one of the best free portfolio websites, but also that it brings together news and current events.

It also ranked on our list because of how fast set-up is.

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Conclusion

There you have it—our roundup of the top four stock portfolio management websites and online tools.

There are of course other fantastic options available, but we feel these four are unique in their features, offerings, and approach, and all are backed by a strong infrastructure while remaining easy to use.

There are so many reasons investors and even advisors turn to investment tracking software and online stock portfolio options.

There are a few advantages of harnessing the power of technology to manage your investments:

- You can bring together a wide range of investments into one streamlined, centralized location. This makes it easier to view your assets and a more comprehensive investment picture of your holdings and trends along your entire portfolio. You may have stock market investments in one account, a 401(k) in another, and then an IRA account in yet another. Using stock tracking software, apps, or online solutions will simplify the management of all of these accounts, in one place.

- You can customize updates and email alerts that let you know things like prices and other new data as it becomes available in real-time.

- Diversity is often essential to a successful investment strategy, and using a software or online tracking option is an excellent way to maintain diversity. You can then break down your investments based on asset classes, industry, sectors, and other criteria to more effectively managing diversity across your portfolio.

- Software programs and online platforms operate independently of your brokerage, which gives many investors a greater level of comfort when it comes to calculating potential returns and losses. It’s an independent third-party resource which can allow you to make decisions in an unbiased way, something many investors really enjoy.

Image Sources:

- https://www.bigstockphoto.com/image-53194807/stock-photo-financial-management-on-mobile-devices

- https://www.personalcapital.com/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.