Intro – SunTrust Bank Reviews & Ranking

SunTrust Bank was recently ranked and reviewed by AdvisoryHQ as a top rated banking firm. Firms on our top rated lists were selected after they successfully passed AdvisoryHQ’s ground-breaking, four-step banks and credit unions selection methodology.

Click here for a step-by-step breakdown of the methodology and selection process used during our SunTrust Bank review: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

The SunTrust Bank review below provides a detailed assessment of SunTrust Bank, including some of the factors used by AdvisoryHQ News in its ranking and selection of SunTrust Bank as one of the top banking firms.

SunTrust Review

With a simple purpose to light the way to financial well-being, SunTrust Bank is one of the largest financial services companies in the country and has just become larger through a merger with BB&T.

For the time being while a transition is in the works, both banks are keeping their individuals’ names and websites, however, both are now known as Truist. The new bank is headquartered in Charlotte, NC, has 275 years of combined SunTrust and BB&T history, and serves approximately 10 million U.S. households.

Currently, customers with a SunTrust bank account can use their debit card at any BB&T ATM for no fee.

SunTrust Bank Review 2020-2021

One of the principals of SunTrust is that everyone can achieve financial confidence, and its services are designed to be supportive of its customers and help them navigate financial roadblocks and get on the right path.

Our SunTrust Bank review found that the firm offers a wide array of financial services, as you would expect from one of the largest and best banking companies. These include personal and business banking accounts, loans, investing/retirement, and wealth management.

Key Factors Leading Us to Rank SunTrust Bank as One of the 2020-2021 Top Banking Firms

Upon completing our SunTrust Bank review, SunTrust Bank was included in AdvisoryHQ’s ranking of the 2020-2021 best banking companies based on the following factors.

SunTrust Bank Reviews | Delta SkyMiles® Debit Card

The Delta SkyMiles® Debit Card is an available perk to those with a SunTrust Bank account, and it allows users to earn miles on their everyday purchases.

The Delta SkyMiles® World Debit Card is for individual account holders, and it includes bonus points after your first PIN POS or signature purchase and one mile for every $2 spent on PIN POS or signature-based purchases (up to 4,000 per card monthly).

Miles do not expire and can be redeemed for seat upgrades, Delta Sky Club memberships, and more.

For business owners, the bank offers the Delta SkyMiles® Business Debit Card. This card offers similar benefits, with a 2,000 miles per card per month cap.

See Also: Top Long Beach Credit Unions & Banks

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

SunTrust Bank Reviews | Balanced Banking

For customers that like to stay on top of their spending, there’s a special type of SunTrust bank account they can use.

With Balanced Banking, account holders can take advantage of features designed to help them more effectively manage their money and limit the possibility of an overdraft.

If you attempt to make a debit card purchase and there aren’t enough funds available to cover it, then it’s declined, but this means the account holder doesn’t have to pay overdraft fees.

This special SunTrust checking account also limits fees when a check is returned due to insufficient funds. The returned item fee is $20, as opposed to the standard fee of $36.

Other features of this account include a 10% cashback bonus with the SunTrust Cash Rewards credit card when your cashback is redeemed into your deposit account. You also receive a free 10-pack of custom checks or 50% off any available check style.

Additionally, there is a $12 monthly maintenance fee, but this can be avoided with a $3,000 minimum daily total deposit balance through the Balanced Banking account and any linked savings or investment accounts.

This unique option designed to help customers avoid overdraft fees is one of the factors that makes SunTrust one of the best banking companies to use if you need help with spending controls.

Don’t Miss: Ranking – Fantastic Fresno Banks & Credit Unions

SunTrust Bank Reviews | SunTrust Premier Program

The SunTrust Premier Program is an exclusive offering that allows select clients to gain membership, which then gives them personalized attention and banking services. Premier Program members have a dedicated Premier Banker who makes tailored recommendations.

Our SunTrust Bank review also found that customers that are a Premier client get special VIP services, such as direct access to a live person via phone and premium 24/7 online access.

You also receive a second opinion review of all your retirement, investment, savings, and borrowing plans.

Premier clients also receive all the benefits associated with the SunTrust Advantage Checking account. This SunTrust Bank account includes:

- Interest on checking balances

- Ability to link four Essential Checking accounts and have the monthly fee waived

- $25 discount on a safe deposit box annual fee

- 50$ Loyalty Cash Bonus with a SunTrust Cash Rewards credit card

SunTrust Bank Reviews | Wealth Management and SunTrust SummitView®

Another way that SunTrust stands out as one of the top banking firms in the country is its investment and wealth management services and tools.

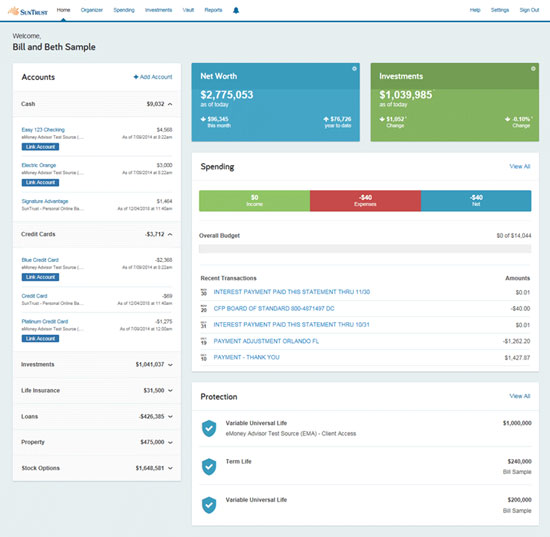

One of their unique digital tools the bank has is SunTrust SummitView®, which makes it easy for you and your financial advisor to work together to build a custom wealth management plan.

Our SunTrust review found that there are multiple benefits of this web-based interface that make this a simple but powerful way to manage and monitor investments and accounts.

SunTrust Review | SunTrust SummitView® Tool

With SunTrust SummitView® clients can:

- See all your SunTrust and other accounts in one place

- Establish multiple financial goals and track progress

- Model “what if” scenarios to evaluate how spending, investing, and economic changes may impact your plan

- Store important financial documents securely

Related: Best Credit Unions & Banks in Sacramento

Rating Summary

For those who are looking for one of the best banking companies that has multiple locations throughout the country and a large national footprint, SunTrust (now Truist) is an excellent option.

Our SunTrust Bank review found that not only does this bank offer a wide variety of services, they also have exclusive accounts and programs that add value to a customer’s banking experience.

With a focus on client convenience and a large array of digital banking tools, SunTrust Bank is one of the top banking firms to consider partnering with in 2020-2021 and is awarded a 5-star rating.

In addition to reviewing the above SunTrust Bank review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top-rated banking firms:

Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the rate table(s) displayed on this page.

Image sources:

- https://www.suntrust.com/about-suntrust

- https://www.suntrust.com/investing-retirement/financial-planning-advice/suntrust-summitview

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.