Intro—Superior Federal Credit Union Reviews & Ranking

AdvisoryHQ recently published its list and review of the top credit unions in Ohio, a list that included Superior Federal Credit Union.

Below we have highlighted some of the many reasons Superior Federal Credit Union was selected as one of the best credit unions in Ohio.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Superior Federal Credit Union Review

Superior Federal Credit Union has roots dating all the way back to 1915 with the Superior Coach Corporation. The top Ohio credit union was formed when twenty employees of Superior Coach Corporation signed a charter creating the Superior Coach Employees Federal Credit Union in 1954. When Superior Coach Company closed in 1981, the directors of the credit union in Ohio lobbied the NCUA and obtained the first ever community charter granted in the United States to a city with more than 50,000 residents.

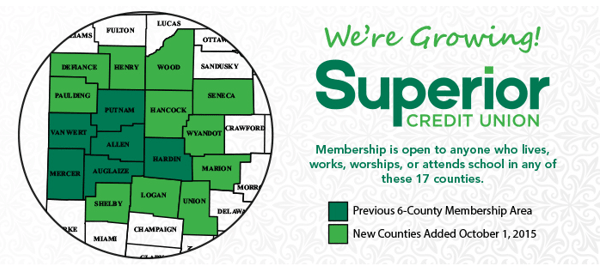

Today, Superior Federal Credit Union has expanded its membership to include those who live and work in seventeen northwest Ohio counties. The Ohio credit union serves more than 50,000 members and holds $464 million in assets, making them the eighth largest credit union in Ohio by both number of members and amount of assets. Headquartered in Lima, Ohio, Superior Federal Credit Union serves its northeastern Ohio membership across ten branch locations.

Image Source: Superior Federal Credit Union

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Credit Union Firms

Upon completing our detailed review, Superior Federal Credit Union was included in AdvisoryHQ’s ranking of this year’s best credit unions based on the following factors.

Superior Federal Credit Union Review: Checking Account Options

Superior FCU offers many great checking account options that allow their members to choose what they do and don’t want in a checking account. Regardless of a members age, financial status, or lifestyle this credit union in Ohio has an account for them.

They offer checking accounts with area high school and college mascot logos on checks, and they are the only checking account in the region for those under the age of 18.

Checking account options at this top Ohio credit union are:

- Free Checking: at Superior FCU, free means free with no monthly fees, no minimum balance requirement, and first box of checks free

- iChecking: no monthly fees when minimum balance of $1,000 is retained, earns dividends on balances of $1,000 or more

- YChecking: available to teens aged 15–17 only, free checking with no minimum balance requirements, free first box of checks

- Fresh Start Checking: for those who have had trouble with checking accounts in the past, $5 monthly fee, comes with debit card but no checks

Image Source: Superior Federal Credit Union

Superior FCU also offers several great checking options for small businesses, all of which come with the first order of checks free:

- Free Business Checking: no minimum balance requirement or monthly fee, 200 items per month free

- Premium Business Checking: monthly fee if daily balance falls below requirement, up to 400 items a month free

- Business iChecking: $1,000 minimum balance to avoid fee, 100 items a month free, earns dividends based on balance

Superior Federal Credit Union Review: MoneyMAX Money Market Accounts

A MoneyMAX Money Market account at Superior FCU is a super high-yield account designed to help members take their money to the max. With this specialized account, members get to earn a higher rate of return on their deposits like a share certificate while retaining the ability to withdraw money like a regular savings account, making it the best of both worlds.

Other benefits of a MoneyMAX Money Market account from this top Ohio credit union are:

- Low minimum balance requirement

- Dividends paid monthly

- Earn high interest rate while retaining access to funds

Superior Federal Credit Union Review: Loans

Superior FCU is committed to supporting their members in achieving their goals and they offer a full line of loan products to help them do just that. This credit union in Ohio offers a full-service menu of low-interest loans with flexible repayment terms, all offered with the local and personable service that their members desire.

Loan options are:

- New and used auto loans

- Home equity loans

- Home equity line of credit

- Student loans

- Mortgages

- Recreational loans

- Signature loans

- Share-secured loans

This top Ohio credit union also specializes in small business lending and offers a full array of agriculture and commercial business borrowing solutions:

- Construction loans

- Commercial real estate loans

- Equipment loans

- Business line of credit

- Small Business Administration loans

In addition to reviewing the above Superior Federal Credit Union review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top rated banking firms & credit unions:

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.