Intro – Tarrant County Credit Union Reviews & Ranking

AdvisoryHQ recently published its list and review of the top credit unions in Fort Worth, Texas, a list that included Tarrant County Credit Union.

Below we have highlighted some of the many reasons Tarrant County Credit Union was selected as one of the best credit unions in Fort Worth, Texas.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Tarrant County Credit Union Review

Founded in 1955 by a group of Tarrant County employees, Tarrant County Credit Union today has accumulated various awards, assets of $77 million, and a membership of 10,000. This credit union’s charter includes all residents of Tarrant County as well as certain Select Employee Groups and their family members.

Some of the awards this credit union in Fort Worth, TX has received include the Pinnacle Award for eMail and Electronic Marketing from the Cornerstone Credit Union League as well as the CU Hero Certificate of Achievement from the Credit Union National Association.

Image Source: Tarrant County Credit Union

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Credit Union Firms

Upon completing our detailed review, Tarrant County Credit Union was included in AdvisoryHQ’s ranking of this year’s best credit unions based on the following factors.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

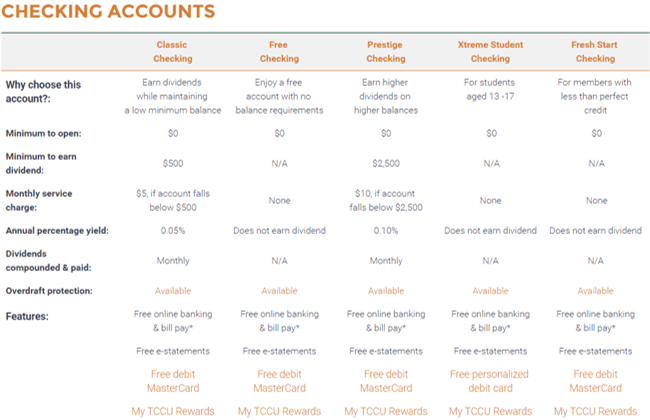

Tarrant County Credit Union Review: Checking Accounts

TCCU offers a variety of checking account options to serve nearly any need.

These checking accounts include:

- Classic Checking: This has a low minimum balance requirement and a low monthly maintenance service charge while also allowing account holders to earn dividends.

- Free Checking: With free checking, users can get a free account that has no balance requirements.

- Prestige Checking: This is designed to offer higher dividends on higher balances.

- XTreme Student Checking: For students ages 13-17, this account has no monthly service charge and comes with features like free online banking and bill pay.

- Fresh Start Checking: This second chance account is for people who have less-than-perfect credit, and it doesn’t have a monthly service charge.

Image Source: Checking account

Tarrant County Credit Union Review: My TCCU Rewards

using their TCCU debit and credit cards.

The rewards can be used for merchandise, travel, gift cards, and more.

To participate in the program, users register, sign in, and choose from the offers. They can then use their rewards-linked card at participating merchants to earn points. It’s a simple program with no codes or coupons required. Points are automatically added to accounts.

Tarrant County Credit Union Review: Sprig

Members of TCCU can take advantage of the Sprig by Co-Op app. This app allows credit union members to turn their mobile device or personal computer into a “wallet.” This means credit union members can access all of their accounts at participating institutions through one app.

They can see their balances, available credit, transaction history, and payment due dates in one place as well as transfer money between credit unions.

This app also includes person-to-person payment options, the ability to transfer funds to make loan payments, and advanced security features.

Tarrant County Credit Union Review: Autosmart

As one of the premier Fort Worth credit unions, TCCU offers a full lineup of loans including auto loans. If you’re going to obtain auto lending from this credit union in Fort Worth, you can also take advantage of the AutoSmart online shopping tool.

Image Source: Tarrant County Credit Union

This tool lets you quickly and easily browse available vehicles from local dealerships without leaving the Tarrant County Credit Union website. Users can also search and filter to find detailed information and photos for available vehicles.

A big advantage of using AutoSmart, aside from convenience, is that it lets car dealers know potential buyers are working with TCCU, which can make the whole process of buying a new vehicle go faster and more smoothly.

In addition to reviewing the above Tarrant County Credit Union review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top rated banking firms & credit unions:

Top Rated Banks

Top Banking firms

Review of Top Mortgage Firms

Bank Reviews