What Does a Tax Advisor Do?

There are few sets of regulations and laws more complicated than those that govern taxes.

A tax advisor is defined as a professional who helps clients navigate the muddy waters of taxation regulation.

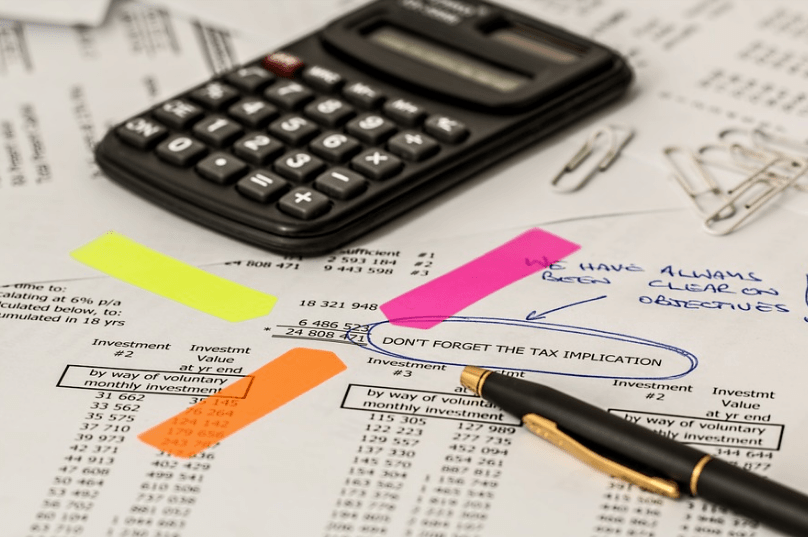

Image Source: Pixabay

Image Source: Pixabay

This is especially important for people who have complicated tax situations.

For an individual who has just one income source, filing a return is a relatively simple feat.

Most people can complete this themselves with no difficulty, especially with the advent of filing online.

Many people have more complicated income situation, however, which require the help of a tax advisor.

A tax advisor helps a client understand what types of investments and costs may affect their taxation situation, and in what ways.

They may advise a client on how to make tax-favorable investments.

They are often retained by self-employed individuals or those running small businesses to help them understand what expenses can be written off, and how.

Tax advisors may also work for large corporations in the area of corporate tax law. Tax advisors help businesses understand how to best manage their money throughout the year in order to minimize their tax burden and maximize profits wherever possible.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.