Intro – The Golden 1 Credit Union | Ranking and Review

The Golden 1 Credit Union was recently ranked and reviewed by AdvisoryHQ as a top rated credit union.

Firms on our top rated lists were selected after they successfully passed AdvisoryHQ’s ground-breaking four-step banks and credit unions selection methodology.

Click here for a step-by-step breakdown of our methodology process and selection process: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Below we have provided a detailed review of The Golden 1 Credit Union, including the specific factors we used in our decision-making process.

The Golden 1 Credit Union Review

The Golden 1 Credit Union is one of the leading credit unions that serves all those that live or work in the state of California. It’s also the sixth-largest credit union in the country, with more than $13 billion in assets, impressive 1 million members, and 1,800 employees.

As part of its strong reputation and network, The Golden 1 delivers financial solutions with value, convenience, and exceptional service to its members. As a dynamic and trusted leader, Golden 1 is committed to enhancing the financial well-being of Californians and their diverse communities.

Golden 1 offers the utmost in access and convenience for its members, such as 72 branches, 4 home loan centers, and 227 ATMs.

Members of this California-based credit union can also visit over 30,000 surcharge-free ATMS throughout the U.S. The number of credit union locations from The Golden 1 is only one of many factors that make this an excellent financial institution.

Key Factors That Enabled This Credit Union to Rank as One of the Top Credit Unions

When comparing the best credit unions, below are details why The Golden 1 was included in this ranking.

The Golden 1 Platinum Rewards Card

While all the credit cards available from The Golden 1 have benefits such as low interest rates, worldwide acceptance, no annual fees, and no balance transfer fees, the Platinum Rewards card is the premium option for members.

Golden 1’s Platinum card includes a 3% cash rebate on gas, grocery, and restaurant purchases, and a 1% rebate on all other purchases. Credit lines are available up to $50,000 and this card also includes chip-enabled security, plus the option to use Visa Checkout and Mobile Wallet.

For those consumers looking for an inexpensive way to build or rebuild credit, there is the Golden 1 Platinum Secured card.

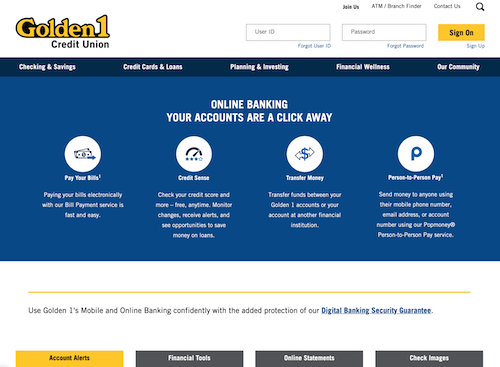

Advanced Online Banking

Along with many in-person credit union locations, this credit union also puts a significant emphasis on offering robust online banking options for its members. Golden 1 recently revamped its online banking to include even more improved features to make banking faster and easier than ever before.

Some of the advanced features offered by this credit union’s online banking service include:

- Easy sign-on with one-step log on options

- Touch ID and Mobile PIN options for mobile users

- Less cluttered navigation and most frequently used tabs displayed with user-friendly sub-tabs

- A transfer center that allows for transfers between Golden 1 accounts, transfers to external accounts, and Popmoney availability

- Customizable options for both Online and Mobile Banking

- Budgeting tools

- Pay Bill options

Image source: Golden 1

Free Workshops

The Golden 1, as part of an effort to become a collaborative financial partner to members, offers many educational resources including regularly held free workshops designed to help participants achieve their financial goals, whatever they may be.

These education workshops begin with the basics and then move toward more advanced topics. Some of the recent topics have included:

- Getting Started with a Mortgage

- Checking That Fits Your Needs

- Estate Planning

- Credit Cards with Low Rates and High Rewards

- Investing and Planning

- Debt and Credit Management

- Protect Yourself

- Golden 1 Credit Union Scholarships

Savings Accounts

All savings accounts available from The Golden 1 are designed to help members address both short- and long-term savings goals. All savings accounts from this leader among credit unions in Sacramento, CA, include free online bill pay and statements and no-fee ATM usage through CO-OP.

Savings account options are:

- Regular Savings lets account holders save money and earn dividends and provides a sense of stability to reach long-term goals

- FlexSavings is a program designed to help members save for special occasions while earning high dividends

- Youth Savings accounts help kids learn about savings and provides them with financial fundamentals

- Santa Saver is holiday shopping savings account that’s simple and straightforward

- Money market accounts are designed to offer higher dividends but also let account holders maintain access to their money and withdrawal availability

- Term-Savings Certificates deliver a safe, guaranteed return, and terms vary from 3 to 60 months, with no minimum balance requirement

Click any of the links below to browse exclusive reviews of all top-rated banking firms:

Image Sources:

https://www.golden1.com/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.