Overview: Thomson Reuters’s Client Onboarding Software

Below is a detailed review of Accelus’s Client On-Boarding compliance platform.

Based on the number of features and wide-range capabilities, we are rating Accelus’s Client On-Boarding compliance platform as one of this year’s best anti-money laundering (AML) and compliance platforms for banking and non-banking financial firms.

Product Highlight

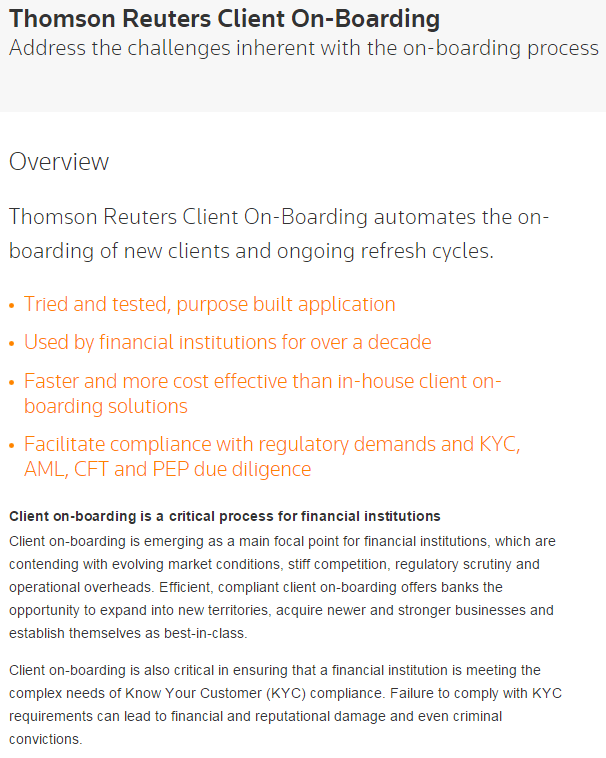

Accelus Client On-Boarding, offered by Thomson Reuters, has been used in a vast number of banking institutions and financial services firms for the past decade.

As an organization-wide software platform, Thomson Reuters’ Client On-Boarding is structured to provide a streamline, compliant system for users to ensure that client onboarding is a simple but comprehensive process.

Image Source: Pixabay

Image Source: Pixabay

The program helps address challenges faced by the somewhat complex process by performing the following functions:

- Facilitate compliance with regulatory requirements related to know your customer, anti-money laundering, CFT, and PEP due diligence

- Coordination and collaboration of all parties involved in client onboarding

- Ongoing due diligence on clients

- Expand the ability to grow while remaining compliant

- Integrate with other internal systems

Thomson Reuters Client On-Boarding platform is part of the Accelus Relationship Risk Management software solution.

See Also:

- Top 6 Best Personal Finance Software – 2016 Ranking (Mac, PC, Windows, Online, Mobile Devices)

- Top 10 Financial Advisors in Wisconsin (Milwaukee, Pewaukee, Waukesha, Cedarburg, and Mequon)

- Top 6 Best Personal Finance Software – 2016 Ranking (Mac, PC, Windows, Online, Mobile Devices)

Company Overview – Accelus Thomson Reuters

Thomson Reuters has been a prominent player in institutional software solutions for centuries, focusing its efforts on connecting advanced knowledge of business needs with workable product offerings.

The company launched its Accelus software solutions interface in 2010 to strategically provide programming geared toward regulatory compliance management for banking institutions and financial services firms.

The addition of the Client On-Boarding (GoldTier) tools has enhanced its portfolio of compliance-focused programs and works in harmony with other Thomson Reuters and Accelus solutions.

With over 60,000 employees, Thomson Reuters offers its technology products and software solutions to 10,000 companies, with over 125,000 organizational users spanning 180 countries.

Image Source: Thomson Reuters

Accelus Ranking and Accolades

As a recognized, reputable industry leader in technology and business program offerings, Thomson Reuters has received a number of distinguished awards:

- Named as a leading enterprise governance, risk and compliance (EGRC) solutions provider

- Named as Operational Risk and Regulation’s operation risk software provider of the year in 2013

- Positioned as a leader in the 2013 Magic Quadrant for Enterprise Governance, Risk and Compliance Platforms’ Leaders Quadrant from Gartner

- Named as a leading operational risk management solutions provider by Chartis Research in 2013

The Accelus software solutions through Thomson Reuters are consistently ranked in the top 10% of industry products focused on regulatory compliance management systems.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Review – Thomson Reuters Client On-Boarding Software Solution

Thomson Reuters Client On-Boarding platform provides an intuitive customer onboarding software solution to organizational users, assisting with the complex client onboarding processes required by regulatory bodies.

As a part of Accelus Relationship Risk Management programming, this program offers customers a better option than in-house onboarding systems since it accurately collects pertinent client information.

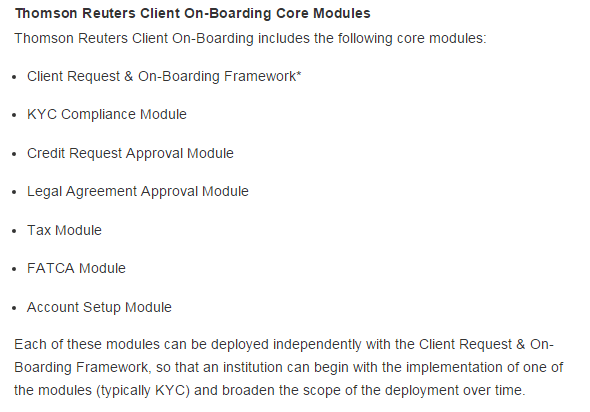

Thomson Reuters Client On-Boarding is an automated process that manages workflow for its users, achieving the following organizational goals:

- Client On-Boarding Core Modules

- Client Request and On-Boarding Framework

- Know Your Customer Compliance Module

- Credit Request Approval Module

- Legal Agreement Approval Module

- Tax Module

- FATCA Module

- Account Setup Module

An organization has the option to run each of the aforementioned modules independently after the Client Request and On-Boarding Framework is deployed.

This creates a customizable experience for the organizational user and the ability to broaden the program’s use over time, as necessary.

Image Source: Thomas Reuters

Key Features and Benefits of Thomson Reuters Client On-Boarding Software Solution

Domain Experts

Thomson Reuters has long been a pioneer in the development and implementation of advanced software programming available to organizations worldwide.

The Client On-Boarding platform is no exception, as it is backed by experts in the field who are well-versed and up-to-date on regulatory policies and the processes necessary to implore a compliant program.

Automated Processes

The Client On-Boarding tool through Accelus provides users with a streamline solution to client data collection and information management.

This is achieved through its automated processes within the program that include:

- Automatic workflow task routing

- Customizable prioritization

- Activity monitoring

- Escalation management

- Lifecycle management

Each of these automated processes can be determined by the organizational user at the time the program is deployed and changed as necessary.

Additionally, each can be integrated with other in-house systems and interfaces as needed, allowing the completion of work without additional effort from the user.

Facilitation and Coordination of Client Onboarding Parties

Thomson Reuters Client On-Boarding processes offered through this program allow for users to collaborate with each of the parties involved in the onboarding process in a simple and strategic manner.

While ensuring compliance with know your customers guidelines, this feature coordinates all efforts of the individuals responsible for onboarding processes and facilitates cross workflows through rule-based sharing of data and documentation.

Ongoing and Retrospective Due Diligence

As with most Accelus product offerings, Thomson Reuters Client On-Boarding offers a great deal of ongoing compliance monitoring of the entire client database, checking against regulatory and internal requirements constantly.

The user organization is able to continue its compliance efforts through this program feature, allowing for accurate due diligence on a consistent basis.

Integration with Internal Systems

For some organizations, the desire to utilize an external system for client onboarding purposes can be an overwhelming thought.

The cost can be prohibitive, and the need to overhaul ancillary internal systems can stop progress quickly.

The Thomson Reuters Client On-Boarding tool, however, has a robust integration feature that is compatible with the following internal systems already in place:

- Document repositories

- Client repositories

- Single sign-on environments

- Transaction systems

Checked Against World-Check Risk Intelligence

Thomson Reuters has a vast amount of data available to its users, specifically focused on regulatory compliance information.

This powerful database is integral to the early detection of organizational risk in the realm of know your customer due diligence, and users of the Client On-Boarding (GoldTier) tool have unlimited access to this information through World-Check.

Satisfy Regulatory Demands

Both the reporting and auditing capacity within the Client On-Boarding solution allow organizational users the ability to meet compliance and regulatory demands for know your customer, anti-money laundering, CFT, and PEP due diligence.

As with other Accelus solutions, auditable proof is available for these reports which can be automated.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.