2017 RANKING & REVIEWS

TOP RANKING BEST CREDIT UNIONS IN PITTSBURGH

Intro: Finding the Top Credit Unions in Pittsburgh

If you are currently searching for a Pittsburgh credit union, you are far from alone. As banks continue on the trend of raising fees and interest rates, more and more consumers and businesses are turning to credit unions as a cost-saving measure. Because they are member-owned, not-for-profit financial institutions, Pittsburgh credit unions are able to offer residents better rates and lower fees than most traditional banks can.

There is certainly no shortage of credit unions in Pittsburgh, PA, to choose from. Thoroughly researching all of the available credit unions in Pittsburgh would be an exhausting task. Luckily, using our stringent selection methodology, we have sorted through each credit union in Pittsburgh and narrowed the list down to only the top 13 best credit unions in Pittsburgh.

Image Source: Top 13 Best Credit Unions in Pittsburgh, PA

When selecting the right credit union in Pittsburgh, PA, for you, it is important to consider whether the products and services they offer are right for you. As you read our comprehensive reviews of these top credit unions, pay attention to the factors that you are specifically looking for in a credit union in Pittsburgh, such as whether they offer business services or free checking.

The credit unions included on this list are the best that Pittsburgh has to offer in both customer service and products and services offered. No matter what you are looking for in a credit union, our list can provide a starting point in finding the best credit union in Pittsburgh for you.

AdvisoryHQ’s List of the Best Credit Unions in Pittsburgh

- Alcoa Pittsburgh Federal Credit Union

- Allegent Community Federal Credit Union

- Allegheny Health Services Employees Federal Credit Union

- Century Heritage Federal Credit Union

- City CO Federal Credit Union

- Greater Pittsburgh Federal Credit Union

- Greater Pittsburgh Police Federal Credit Union

- Iron Workers Federal Credit Union

- Omega Federal Credit Union

- Pittsburgh Firefighters Federal Credit Union

- Riverset Credit Union

- Tri-Valley Service Federal Credit Union

- VA Pittsburgh Employees Federal Credit Union

List is sorted alphabetically (click any of the names above to go directly to the detailed review section for that credit union)

Top Credit Unions in Pittsburgh | Ranking

Credit Union | Location |

| Alcoa Pittsburgh Federal Credit Union | Pittsburgh |

| Allegent Community Federal Credit Union | Pittsburgh |

| Allegheny Health Services Employees Federal Credit Union | Pittsburgh |

| Century Heritage Federal Credit Union | Pittsburgh |

| City CO Federal Credit Union | Pittsburgh |

| Greater Pittsburgh Federal Credit Union | Pittsburgh |

| Greater Pittsburgh Police Federal Credit Union | Pittsburgh |

| Iron Workers Federal Credit Union | Pittsburgh |

| Omega Federal Credit Union | Pittsburgh |

| Pittsburgh Firefighters Federal Credit Union | Pittsburgh |

| Riverset Credit Union | Pittsburgh |

| Tri-Valley Service Federal Credit Union | Pittsburgh |

| VA Pittsburgh Employees Federal Credit Union | Pittsburgh |

Table: Top 13 Best Credit Unions in Pittsburgh, PA | Above list is sorted alphabetically

Methodology for Selecting the Best Credit Unions in Pittsburgh

What methodology did we use in selecting this list of best credit unions in Pittsburgh, PA?

Using publicly available sources, AdvisoryHQ identified a wide range of credit unions that provide services to Pittsburgh communities.

We then applied AdvisoryHQ’s “Breakthrough Selection Methodology” to identify the final list of top credit unions that provide services in and around the Pittsburgh area.

Detailed Review – Top Ranking Best Credit Unions in Pittsburgh

Below, please find the detailed review of each firm on our list of top Pittsburgh credit unions.

We have highlighted some of the factors that allowed these credit unions in Pittsburgh to score so highly in our selection ranking.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

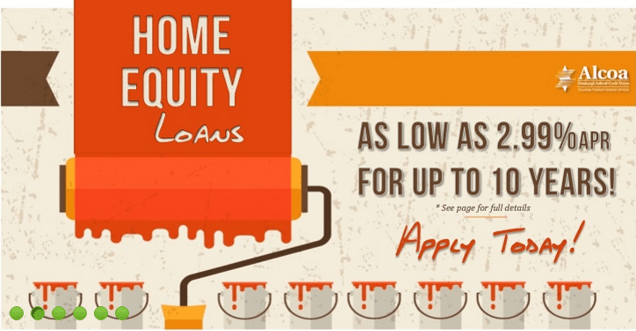

Alcoa Pittsburgh Federal Credit Union Review

Alcoa Pittsburgh Federal Credit Union was established in 1938 with a mission to provide outstanding loans and financial services to the employees of Alcoa, Inc. Today, this homegrown Pittsburgh credit union remains dedicated to that mission as they continue to serve Alcoa employees and their families as well as more than thirty-five other select companies and organizations in their extended field of membership.

This best credit union in Pittsburgh currently serves their more than 2,700 members from two locations. Alcoa Pittsburgh FCU offers an array of financial products backed by their $29 million in assets, including deposit accounts, mortgages, consumer loans, and credit cards.

Key Factors That Enabled This Credit Union to Rank as a Best Credit Union in Pittsburgh

Below are key factors that enabled Alcoa Pittsburgh Federal Credit Union to be rated as one of this year’s best credit unions in Pittsburgh.

$500 Quick Loans

In today’s harsh economic climate, more and more people are turning to predatory lenders such as payday and title loan companies to help make ends meet until they get their next paycheck. Alcoa Pittsburgh FCU is a Pittsburgh credit union that provides a more economical solution to the predatory lending practices of payday loan companies.

Members of this top credit union in Pittsburgh can get a $500 Quick loan to help them make ends meet at a reasonable interest rate and with reasonable repayment terms. Members in good standing can get approved for this loan even if they have no credit or are working on rebuilding less than perfect credit.

This small loan can be repaid over three months at a reasonable rate of 18% APR. Members of this top notch credit union in Pittsburgh, PA, can enjoy this healthy alternative to payday loans.

Mortgages

Though they are a small credit union in Pittsburgh, Alcoa Pittsburgh FCU offers mortgages and mortgage refinancing options to their members. With their friendly hometown service, mortgage applicants don’t have to deal with being shuffled from one bank to another every time they have a question. This Pittsburgh credit union’s friendly service makes the home buying process simple.

Mortgage features at this credit union in Pittsburgh, PA, are:

- Low rates

- Flexible terms

- Construction loans

- Balloon loans

- Jumbo loans

- Interest-only loans

Image Source: Alcoa Pittsburgh Federal Credit Union

As an added perk, the interest on a home loan is usually tax deductible, saving the buyer money.

Online Services

Many consumers hesitate to choose a credit union, especially a small one such as Alcoa Pittsburgh FCU, because they think that they won’t offer the same conveniences as a large name bank. This is largely false as most Pittsburgh credit unions stay on top of current financial technology, and this small credit union in Pittsburgh is no different.

Alcoa Pittsburgh FCU offers an array of online and mobile banking services, most of them the same ones that the big name banks offer to their customers.

Online and mobile services available at this Pittsburgh credit union are:

- Online banking

- Mobile banking

- Mobile check deposit

- Bill pay

- Visa check card

- eStatements

- Online check reorder

Alcoa Pittsburgh FCU understands the importance of staying up-to-date with banking technology and strives to offer the same conveniences to their members that other banks and credit unions do.

Allegheny Health Services Employees Federal Credit Union Review

Originally formed in 1973 to serve the employees of Allegheny General Hospital, Allegheny Health Services Employees Federal Credit Union has since expanded to include several other organizations. This Pittsburgh credit union operates on a mission to promote thrift among its members by affording them an opportunity to accumulate their savings and to create a source of credit for them.

Headquartered in Pittsburgh with one branch location, this credit union in Pittsburgh is a true hometown bank. With a small membership of nearly 3,500 members, this credit union in Pittsburgh, PA, is able to give each member their full attention. Though small, this homegrown credit union holds more than $12 million in assets, giving them access to the resources they need to serve the financial needs of their members.

Key Factors That Enabled This Credit Union to Rank as a Best Credit Union in Pittsburgh

Below are key factors that enabled Allegheny Health Services Employees Federal Credit Union to be rated as one of this year’s best credit unions in Pittsburgh.

Low Auto Loan Rates

Allegheny Health Services Employees FCU offers low interest rates and flexible terms on their new and used auto loans. With no hidden fees and straightforward terms, this top Pittsburgh credit union makes getting an auto loan a breeze.

This credit union in Pittsburgh will finance up to 100% of the Kelly Blue Book value of the auto. They also offer a 0.25% rate discount for approved applicants with a credit score of 700 and above. In addition, they offer motorcycle loans at the same rates and terms as auto loans.

Current auto loan rates at this top credit union in Pittsburgh, PA, are:

- New car loan: 1.99% up to 60-month term, 2.99% for 72-month term

- Used car 1-2 years old: 1.99% up to 60-month term, 2.99% for 72-month term

- Used car older than 2 years: rates beginning at 3.99% up to 60-month term

Savings Accounts

Even though they are a small credit union in Pittsburgh, Allegheny Health Services Employees FCU has several savings account options for members to choose from. Whether a member wants a place to stash away cash for the future or an emergency fund or wants to save for a short-term goal such as a dream vacation, this Pittsburgh credit union has something for everyone.

Savings accounts options are:

- Regular Savings (Share) Account

- Christmas Club Account

- Vacation Club Account

Personal Loans

When their members need extra cash for a big purchase, remodel project, or consolidating high interest credit card debt, Allegheny Health Services Employees FCU has them covered. Qualified applicants can borrow up to $10,000 in a personal loan with terms up to 60 months.

This credit union in Pittsburgh, PA, offers competitive rates on their personal loans, with rates starting as low as 8% and going up to 10% based on an applicant’s credit score rating.

Reloadable Prepaid Visa Debit Cards

This hometown Pittsburgh credit union offers reloadable prepaid Visa debit cards to its members. This prepaid option gives members the flexibility and purchasing power of a credit card without worrying about overspending or having to remember to pay a bill later.

The card can be preloaded with funds from a member’s Allegheny Health Services Employees FCU account. Once the funds on the card have been depleted, more can be loaded to it at any time. These useful cards are accepted anywhere Visa is accepted world-wide, making them perfect for use while traveling.

City CO Federal Credit Union Review

City CO Federal Credit Union has been serving the employees of Allegheny County, and now also the city of Pittsburgh, and their families since 1941. This hometown Pittsburgh credit union was organized with a mission of providing members with a place to save and borrow at affordable and reasonable rates.

City Co FCU is a credit union in Pittsburgh that currently serves more than 4,200 members and holds assets of more than $21 million. They offer deposit services including share drafts, share certificates, and overdraft protection. Other services offered include loans, insurance/investment products, and convenience services such as check cashing and money orders.

Image Source: Best Credit Unions in Pittsburgh

Key Factors That Enabled This Credit Union to Rank as a Best Credit Union in Pittsburgh

Below are key factors that enabled City CO Federal Credit Union to be rated as one of this year’s best credit unions in Pittsburgh.

No-Cost Share Draft Account

City CO FCU offers a no-cost, easy-to-use share draft (checking) account with no hidden fees and no monthly requirements to keep up with. The account comes with a Visa debit/ATM card for ease of purchases and access to funds.

This Pittsburgh credit union’s VISA debit/ATM card can be used at any Dollar Bank ATM for free. City CO FCU also offers many check styles for members to choose from.

A no cost share draft checking account from this top credit union in Pittsburgh is a great alternative to high cost, stringent checking accounts offered at many traditional banking institutions.

Christmas Club Accounts

A Christmas Club account is a great way to help take the financial strain out of the holiday season.

Members who choose to take advantage of this great savings opportunity have all year to build up their holiday funds.

Features of a Christmas Club account at this credit union in Pittsburgh, PA, are:

- Funds are transferred the first week in October

- Account is automatically renewed each year

- Withdraw or transfer funds from the account at any time

- No penalty for early withdrawal

Saving for the holidays with a Christmas Club account is made even easier with the use of ACH or payroll deduction, which City CO FCU can help members set up.

Better Choice Loans

The Better Choice loan program is intended to help low and moderate income Pennsylvanians manage their finance and meet their financial needs without having to resort to high-cost products such as payday loans.

A Better Choice loan from this grade A Pittsburgh credit union is designed as a solution to the growing problem of payday lending practices, rates, and fees.

- $200 minimum loan/$578 maximum loan

- 18% APR

- 90-day repayment term

- Must be 18 years of age

- Must be member of credit union for at least 60 days prior to applying

- Gross monthly income of at least $1,000 required

- No credit check required

- Must deposit 10% of the loan amount into a share account

- Financial counseling is provided

For those members who find themselves in a temporary financial slump, a Better Choice loan can help.

Iron Workers Federal Credit Union Review

Iron Workers Federal Credit Union has been serving the Pittsburgh area since first opening their doors in 1963. They are a federally chartered and federally insured credit union whose primary purpose is to serve employees of Pittsburgh’s primary and fabricated metals industry.

This homegrown Pittsburgh credit union currently serves almost 3,000 members and holds more than $6 million in assets. Though they are a small credit union in Pittsburgh, based on their asset size and net worth, they are considered to be a well-capitalized small credit union.

Iron Workers FCU offers a number of deposit and loan products to its members, including share accounts, auto loans, and mortgage products.

Key Factors That Enabled This Credit Union to Rank as a Best Credit Union in Pittsburgh

Below are key factors that enabled Iron Workers Federal Credit Union to be rated as one of this year’s best credit unions in Pittsburgh.

Debit Card Prewards Program

Iron Workers FCU offers a money-saving Prewards program to members who utilize their debit card. This program allows members to receive discount offers from merchants via emails, the web, or text messaging.

This program is unique in that there are no points to keep track of or special promo codes to remember. When a member receives a discount offer they want to take advantage of, all they have to do is swipe their card for the purchase and the savings will be applied automatically and instantly. It is an extremely easy way for members of this Pittsburgh credit union to rack up the savings.

This Prewards Program offers discounts from many great places that many members populate regularly, such as:

- 84 Lumber

- Aeropostale

- Barnes & Noble

- Cabela’s

- Costco

- Darden Restaurants

- Dick’s Sporting Goods

- Gander Mountain

- GameStop

- Kohl’s

- Macy’s

- Pizza Hut

- Sam’s Club

- TGI Fridays

When a member enrolls in the Prewards Program with their mobile phone number, a text message will be sent to them when a qualifying purchase has been made to let them know that their rewards have been redeemed.

Mortgage Financing

Though they are a small credit union in Pittsburgh, Iron Workers FCU has partnered with Owners Choice to offer mortgage financing products to their members. Whether a member is looking to purchase a home or refinance an existing mortgage, they can trust Iron Workers FCU to provide them with trusted advice and exceptional service.

This credit union in Pittsburgh, PA’s mortgage program features:

- Secure online application process

- Expanded loan programs

- Low interest rates

- Low closing costs

- Expert support and assistance throughout the mortgage process

Iron Workers FCU prides themselves on offering competitive mortgage financing from a lender that their members can trust.

Skip a Payment Program

Iron Workers FCU understands that sometimes members need a little extra cash in their pockets, whether to take that summer vacation they’ve been thinking about or to help cover the cost of the holiday seasons. That is why this Pittsburgh credit union gives members in good standing the option to skip a loan payment either in July or December.

There is a thirty-dollar fee for taking advantage of this program, and real estate loans and Visa balances are not eligible. All accounts must be in good standing with the credit union in order to qualify for this program. Regular payment resumes on the first regular payment date of the month following the skip a payment.

Tri-Valley Service Federal Credit Union Review

Tri-Valley Service Federal Credit Union has been serving its members for more than 65 years. The goal of Tri-Valley Service FCU has always been to assist each of their members in securing a healthy financial future. To this end, they are committed to providing packages, promotions, and services to encourage their members to protect and grow their investments through sound financial planning.

Today, this homegrown Pittsburgh credit union services more than 3,600 members and holds $16 million in assets. Tri-Valley Service FCU offers a variety of traditional banking products to their members, including checking services, share certificates, bill pay services, and lending services.

Key Factors That Enabled This Credit Union to Rank as a Best Credit Union in Pittsburgh

Below are key factors that enabled Tri-Valley Service Federal Credit Union to be rated as one of this year’s best credit unions in Pittsburgh.

Checking Account

Tri-Valley Services FCU offers a share draft checking account that has all the checking basics and none of the hassle of fees and minimum balance requirements.

A checking account with this top credit union in Pittsburgh is better than a traditional bank checking account because:

- No account fees

- No monthly service fees

- No minimum balance requirement

- Free Visa check card

- Free direct deposit services

Visa Credit Card

Credit unions are a great place to go for credit cards with low rates and little to no fees, and Tri-Valley Services FCU is no exception.

Members who need to transfer high interest balances or just need a flexible spending option for when they are on the go will find everything they need in this Pittsburgh credit union’s Visa credit card offering.

Features of this card are:

- No annual fee

- Rates as low as 8.99% APR

- 25-day grace period

- Free travel accident insurance

- ATM cash advances worldwide

- Pay ahead feature

- Scorecard rewards

Loans

Tri-Valley Service FCU’s main business is making loans to its members. In order to make borrowing as affordable and economical for their members as possible, all loans from this credit union in Pittsburgh offer competitive rates and flexible repayment terms.

Loans can be repaid with payroll deduction through direct deposit, making it easy to stay on track with payments.

Loans from Tri-Valley may be used for:

- Motorcycles

- ATVs

- RVs

- Jet skis

- Boats

- New and used autos

- Home improvements

Loan types available are:

- Auto and recreational vehicle loans

- Fully shared secured loans

- Home equity loans

- Personal loans

Additional Services

While this credit union in Pittsburgh, PA’s main business is helping their members build up savings and obtain low-cost loans, they also offer many other services to offer greater convenience to their members.

Other services offered by Tri-Valley Services Federal Credit Union are:

- Prepaid Visa debit cards

- Western Union quick cash

- Money orders

- Phone-a-teller

- Online banking

- Free bill pay

- Club accounts

- Payroll deduction

- 24-hour fax service

- Free transactions by telephone

- Family membership

- Wire/funds transfer

To browse exclusive reviews of all top rated credit unions in Pittsburgh, please click on any of the links below.

- Alcoa Pittsburgh Federal Credit Union

- Allegent Community Federal Credit Union

- Allegheny Health Services Employees Federal Credit Union

- Century Heritage Federal Credit Union

- City CO Federal Credit Union

- Greater Pittsburgh Federal Credit Union

- Greater Pittsburgh Police Federal Credit Union

- Iron Workers Federal Credit Union

- Omega Federal Credit Union

- Pittsburgh Firefighters Federal Credit Union

- Riverset Credit Union

- Tri-Valley Service Federal Credit Union

- VA Pittsburgh Employees Federal Credit Union

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – Top 13 Best Credit Unions in Pittsburgh

There are many important factors that go into choosing the right Pittsburgh credit union. While this list of best credit unions in Pittsburgh provides a good starting point, it is important to take the time to compare services and products to ensure that you are getting the best possible financial services to suit your needs.

All of the credit unions in Pittsburgh on this list offer their own unique products, but they also share a common goal of providing outstanding customer service to their members while offering them high quality, low-cost financial products and services. They also all share a deep heritage and well-respected reputation among Pittsburgh credit unions.

Things to keep in mind while sifting through credit unions in Pittsburgh, PA, are how well their products and services suit your personal financial needs, how financially sound they are, whether they are NCUA insured, and how their level of community involvement compares to other credit unions in the area.

This list covered credit unions from the entire Pittsburgh area and includes both small and large credit unions. The credit unions reviewed within this “Top 13 Best Credit Union in Pittsburgh” article also cover a variety of industry member service groups, allowing something for everyone.

Whether you are looking for a small credit union in Pittsburgh or need a credit union in Pittsburgh with a large business services department, our comprehensive reviews can provide you with the starting point you need to locate your own personal best credit union in Pittsburgh.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.