Overview: Best Trading Tools Review

Today, there are over 500 types of trading software tools, charts and analysis platforms available to the average individual investor or day trader.

Trading software tools and platforms provide you with a tremendous amount of high level trading capability.

Their “ease of use” interfaces allow you to quickly learn to use and apply them to achieving your day trading / long term investment goals.

Below is a list of top trading tools you should consider when trading stocks, options, forex or futures.

The below list is followed by an overview of each software trading tool.

List of Best Trading Software Tools

- Stock Screeners

- Streaming Quotes

- Watch Lists

- Trading Strategy Builders

1. Stock Screeners

Whether you are a long term investor, a passive or active day trader, you should consider a stock screener as one of your key investing and trading tools.

A stock screener allows you to focus on a specific subset of stock symbols from amongst a vast universe of stocks. You choose any number of stocks and vet them against a select list of criteria.

The stock screener tool will run the stocks against your selected criteria, and provide a short-list of candidates to meet specific trading goals you would like to meet.

Image Source: Top Day Trading Tools

Stock screeners are pretty much a basic tool provided by most brokerage firms today. E*Trade for instance provides a stock screener that screens for both stocks and mutual funds.

The screener from TD Ameritrade allows you to create and save screens based on a wide range of selection criteria, including by Exchange, Index, Sector and Sub-sector, amongst many others.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

The list of target stocks can then be whittled down based on other selection criteria: Fundamentals, Valuation, Performance, Technicals, Price, Volume and much more.

You are also able to quickly save your criteria for future reuse, and pull it back up in an instant.

The same thing you would have spent hours or days doing, a stock screener is able to do in seconds.

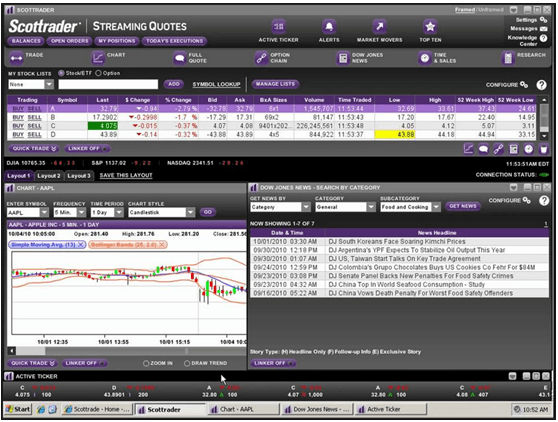

2. Streaming Quotes

In order to quickly jump in and out of stocks, take profits, or quickly place an order, you have to constantly evaluate trading prices and volume.

Using trading tools such as real-time quote data and other valuable streaming data points, you can customize your trades on the fly, enabling you to instantly react to changing market conditions.

Scottrader Streaming Quotes is an excellent example of just such a tool that active traders and individual investors absolutely adore.

Using a host of customizable features, you can personalize quotes, both Level I and Level II, to fit your unique trading styles.

Image Source: Scottrader Streaming Quotes

Select from a range of type fonts and colors to trigger specific responses to trading events.The tool gives you the ability to chart over 30 different trend lines and technical indicators on informative charting objects.

Traders can tailor these features to plot and analyze the most recent volume and price patterns on helpful charts. You even have access to Market Makers – a list of the top winners and losers on the trading floor.

In the absence of such a tool, traders would find themselves doing multiple look-ups across dozens of sites. Instead, with Streaming Quote tools you now have access to all of these bells and whistles on a single screen!

3. Watch Lists

Even if you are a full-time day trader, trading around the clock (across world markets), there’s no way you can keep an eye on each and every stock within your trading universe.

If only there was a way to automatically keep watch on stocks that you were interested in.

Enter the Watch List!

Now, once you have used the stock screener and kicked the tires of some stocks that you are interested in; you can add them to a Watch List for future monitoring.

Like many other online brokerages, Charles Schwab offers a great Watch List tool as part of its StreetSmart Edge trading platform.

Image Source: StreetSmart Edge

StreetSmart Edge – Thinks Like a Trader

You can use the tool to create, maintain and organize a list of interesting Stocks, Options and Indexes that you want to keep track of.

To get you off to a flying start, Schwab offers some handy pre-loaded Watch List templates that you can quickly tailor to fit your unique requirements and trading goals.

Trading software tools like these come with convenient drag-and-drop features that allow you to produce uniquely personal Watch List columns, reorder information to suit your liking, as well as one-click sorting of data on the list.

For the more studious trader, the Watch List data may also be seamlessly exported to productivity tools like Microsoft Excel or Google Sheets for further dissection and analysis.

And traders with trigger fingers are allowed to rapidly launch a trade by gently tapping or clicking a symbol on the Watch List.

4. Trading Strategy Builders

Whether you are new to Options trading or a seasoned pro at it, it is often hard to keep up with the most appropriate strategy to use when pursuing a trade that you’d like to quickly execute.

We have Condors, Iron Condors, Butterflies, Iron Butterflies, Vertical Spreads, Calendar Spreads and so many more strategies.

So which one is the most optimal given a specific set of priorities you’d like to achieve?

Enter StrategySEEK from tradeMONSTER!

Free Wealth & Finance Software - Get Yours Now ►

This sleek little tool has been designed to tremendously reduce the amount of time it takes you to go from strategy to trade execution.

All you need to do is enter your forecasts and risk priorities, and strategySEEK runs a simulation algorithm based on over 300,000 calculations to present you with the top 5 most optimal strategies that will meet your proprieties.

A single click allows you to navigate to any of those strategies, analyze them further, alter them or simply trade the suggested idea of choice.

If you were to use a calculator or build a spreadsheet model to do this, it would leave you no time to actually trade!

This is one tool that really helps you trade SMART and not HARD!

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.