2017 RANKING OF TOP IDENTITY THEFT PROTECTION SERVICES

Finding the Best Identity Theft Protection Services

Imagine checking your credit report or even your banking statement to find someone had stolen your identity.

It would be a shock for most of us, yet it’s so common. It’s not just things like insecure passwords that leave many of us open to the threat of identity theft anymore. Thieves and cybercriminals are targeting everything from the data of small businesses around the country to taxpayers through the IRS.

It’s incredibly difficult to protect yourself against identity theft, and unfortunately, if you are a victim, it can wreak havoc on your finances and your life. So, what’s the best course of action?

Award Emblem: Best Identity Theft Protection Services

Award Emblem: Best Identity Theft Protection Services

Using identity theft protection is the number one way savvy consumers are protecting their personal information and monitoring their finances and credit to ensure they’re not a victim.

While identity theft protection may be the best route to ensure safety and peace of mind, consumers often wonder how to choose the best identity theft protection service.

The ranking below highlights top identity theft protection services, as well as details of what makes them unique and how they’re valuable to consumers. Each of the names on this ranking of the best identity protection services maintains an excellent reputation and features that are robust and effective, plus they’re designed with the purpose of keeping consumers not just aware but protected against a variety of threats.

AdvisoryHQ’s List of the Best Identity Theft Protection Services

This list is sorted alphabetically (click any of the below names to go directly to the detailed review of that best ID protection service).

What Is Identity Theft?

Before deciding on the best ID theft protection, you may want to explore what identity theft really is. It’s a term we often hear, but what does it mean?

Identity theft is a situation in which an individual or a group takes victims’ personal information, which can include their banking and financial information, their Social Security number, or even a driver’s license number.

Once particular information is obtained, the criminal can then assume the “identity” of that person, which means they may make purchases, open credit accounts, or even commit crimes using the person’s stolen identity.

There are two main classifications for identity theft. The first, referred to as “true name” identity theft, means a criminal takes personal information and establishes new accounts. With the other theft, “account takeover,” the thief would typically utilize personal information to access existing accounts, such as checking, savings, or credit accounts.

What Are the Signs Your Identity Has Been Stolen?

One of the many things that make identity theft so difficult to deal with is the fact that it’s challenging for most of us to know when our identity has been compromised. With the prevalence of digital shopping and transactions, criminals can use the identity of someone else without ever having to do so in person, and it can take some people years to realize they’ve been the victim of identity crime.

It’s become such a common problem that industry professionals often advise consumers to assume their identity has already been stolen or comprised over the past decade.

So what are some of the usual signs you’re a victim?

- Look at your credit and debit card statements. Many times, identity thieves will make very small, incremental purchases over time, so it’s important to go over these documents and statements very carefully. Even if it looks like a small charge, don’t assume it’s a mistake you can overlook.

- If you receive credit cards you didn’t apply for, there may be someone using your identity.

- One way consumers may be tipped off that their identity is compromised happens when they start receiving calls from the bill or debt collectors that are unfamiliar to them. What’s tricky about this is that you may write these calls off as being harassing but not part of a bigger problem. If you’re surprised to receive these types of phone calls, do some digging to find out the root cause.

- Credit reports can reflect identity theft, but unfortunately, many consumers don’t check them until they need to, to get a mortgage for example.

What Is an Identity Theft Protection Service?

While the above are signs and signals your personal information could be jeopardized, most of us don’t have time to continuously monitor against fraud.

What’s the solution? For most people, relying on a top identity theft protection service.

Image Source: BigStock

Image Source: BigStock

The best identity protection services will provide monitoring services, which can include credit monitoring of all three major credit reporting agencies, as well as more comprehensive identity monitoring. With credit monitoring, you’ll receive an update if your reports at the three agencies change or there’s a red flag.

With in-depth identity monitoring, if there’s a sign your personal information is being used, you’re alerted. This can include anything from requests for a change of address to social media activity.

In addition to monitoring, other similar services including identity recover, which helps you repair the damage and remedy the problems that occur after your identity has been stolen, as well as the identity theft insurance. Identity theft insurance covers the expenses that can be incurred as you seek to repair your credit after a breach.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Methodology for Selecting the Best Identity Protection Services

What methodology does AdvisoryHQ use in selecting and finalizing the identity theft protection services on this ranking?

Please click here “AdvisoryHQ’s Ranking Methodologies” to find a detailed review of AdvisoryHQ’s selection methodologies for ranking top firms.

Detailed Review—Top Ranking of the Best Identity Protection Services

After carefully considering identity theft protection services, we compiled the following list of the top five. As you continue reading, you’ll find detailed reviews of each of our picks, as well as an outline of the factors used in the decision-making process

IdentityForce Review

IdentityForce provides high-level identity and credit protection, as well as general privacy protection services. For over 35 years, IdentityForce has been a leader in this area, and all of the services and products offered by this company are based on powerful technology and innovative solutions.

IdentityForce has a Better Business Bureau A+ rating and is an approved Federal Government Contractor.

Key Factors That Enabled Us to Rank This as One of the Best Identity Protection Services

Below are key reasons IdentityForce was selected for this ranking of the best identity theft protection services.

Alerts

Users of IdentityForce can receive convenient alerts, at home or on-the-go, thanks to flexible options which include mobile text alerts and email.

The alerts that are sent to members of the IdentityForce community include:

- Change of Address: If a customer’s address is changed, they’ll receive an alert from IdentityForce.

- Court Record Alert: Millions of court, criminal, and public records are searched to make sure the identity of customers isn’t being used.

- Credit Report Alerts: If there are any changes in your credit report, you’ll be alerted by email or text.

- Identity Alert: This includes searches of black-market chat rooms, blogs, and other sources of data where personal information may be being sold.

Other alerts include bank and credit card activity, fraud alert, payday loan alert, and sex offender alerts.

Identity Theft Restoration

Part of the complete suite of services provided to clients of IdentityForce is identity theft restoration. IdentityTheft works with Certified Protection Experts, and they’re available to provide service and support 24/7.

The specialists help the customer with identity restoration, but they also go beyond that to save customers hundreds of hours if their identity is comprised of completing paperwork, making calls, and doing most of the work to make sure identity is fully and adequately restored.

Additionally, IdentityForce offers identity theft insurance, which helps the customer recover out-of-pocket expenses and lost wages if their identity is stolen.

ChildWatch

Children are becoming an area of growing concern when it comes to identity theft. Thieves and criminals often steal children’s Social Security numbers because they’re devoid of existing credit history.

With the IdentityForce ChildWatch service, which can be added to adult membership, if suspicious activity is detected for your children, their alerts are sent to your identity protection dashboard. All alerts are centralized and sent to one location. ChildWatch also includes ongoing fraud monitoring, access to an identity restoration specialist, and $1 million in identity theft insurance.

Medical Identity Theft

Medical identity theft is a relatively new and increasingly concerning area of identity theft. In this scenario, the thief steals personal information as a way to receive medical care and prescription drugs.

IdentityForce offers specifically targeted medical identity theft protection, monitoring medical accounts that include insurance ID numbers. IdentityForce also provides a medical identity form, which is a simplified way to receive a benefits payout report from medical and health insurance companies.

This service also features protection under the IdentityForce nationwide $1 million master insurance policy.

Identity Guard Review

As a top identity theft protection and credit monitoring service, Identity Guard offers tools and services that allow customers to proactively yet effortlessly monitor their financial information, public records, personal data, and computers and devices.

They’re designed to be flexible to a wide variety of needs, and Identity Guard is a subsidiary of Intersections Inc., which is a publicly-traded NASDAQ company. Along with providing one of the best identity theft protection services for individuals, Identity Guard also helps financial institutions, businesses, and Fortune 100 corporations.

Key Factors That Allowed This to Rank as one of the Best Identity Theft Protection Services

Below are details of why Identity Guard was selected for inclusion in this ranking of the best ID theft protection services.

Software Protection Tools

IdentityGuard offers protection through a suite of software tools, so their service goes beyond monitoring and also includes protection.

This protection includes the ZoneAlarm Internet Security Suite, which is an easy download that protects your PC from a range of threats with antivirus, firewall, and anti-spyware protection.

PrivacyProtect is designed to encrypt your keystrokes so that they’re not decipherable by malware, and ID Vault stores users’ log in and credit card information, while providing one-click online shopping access.

Plan Options

To ensure there is an option for everyone, Identity Guard offers several plans. With Identity Guard Essentials, customers pay a low monthly fee, and they receive identity protection features including social security number monitoring, ID verification alerts and $1 million in Identity Theft Insurance.

The next plan is Total Protection, which includes all Essentials, plus Public Record monitoring and quarterly credit score and bureau reports from three agencies.

With the Platinum Service, you receive all of the features of the other plans, as well as monthly credit score and report updates.

SafeConnex

SafeConnex is a free service available from IdentityGuard that securely remembers all of your passwords in one convenient location. It’s a downloadable platform that’s also available for iOS and Android devices. It works by storing all of your information on passwords and logins in a single location right on your hard drive.

You can then browse the internet with peace of mind. As well as securely storing all of your passwords, SafeConnext also saves your online accounts in a secure way, provides one-click access to add accounts, and gives a security rating for each website that you visit.

Mobile App

The Identity Guard mobile app lets customers stay updated anytime and anywhere. With the download, you’ll receive fast, secure, and convenient access to monitoring alerts, your current credit score, and the other benefits you’re eligible for through your Identity Guard account.

Accessible features available through the Identity Guard app include:

- Credit scores

- Message Center inbox alerts

- Credit score details

- Alert details

- Answers to questions about credit and identity theft

- General news and alerts on identity theft and current issues

LifeLock Review

LifeLock is one of the most well-known and best identity theft protection services, founded in 2005. Because of its long history and innovation, LifeLock is often considered a leader among the best identity protection services. LifeLock has more than 4.4 million members, and it became a publicly-traded company in October 2012.

LifeLock offers a full suite of products for individuals seeking the best identity protection, and the company also offers options for financial institutions, insurance, employee benefits, and more under LifeLock Business Solutions.

Key Factors That Enabled Us to Rank This as One of the Best ID Protection Services

Below are details why LifeLock was included in this ranking of the best identity protection services.

LifeLock Experience

Essential to the services provided by LifeLock is the “LifeLock Experience.” This refers to the award-winning combination of member services and innovative tools. The experience includes the following approach:

- Members sign up for the level of protection that is right for them. Enrollment takes only a few minutes, and protection begins immediately.

- Members can then login to the LifeLock portal to update their profile, view alerts and learn tips to better protect their identity.

- With monthly account summaries, members will have constant access to their identity protection information.

LifeLock Junior

As one of the best ID theft protection services, members can opt to take advantage of Lifelock Junior, which is a program designed for those customers who have children. LifeLock Junior protects children under the age of 18, and it’s only $5.99 per month.

A LifeLock Junior membership includes the following:

- Identity Alert System access

- Lost Wallet Protection

- Credit File Detection

- Identity Resolution Support

- Stolen Funds Replacement

- File-Sharing Network Searches

- Live Member Support

- $1 Million Service Guarantee

LifeLock Mobile App

The LifeLock mobile app offers the functionality available through your particular membership with the company, so it scans a trillion data points every day for threats. Members are supported by Identity Protection Agents, and everything is backed by a $1 Million Total Service Guarantee.

Users who download the app, which is available for iOS and Android devices, will be able to receive all of their protection alerts straight to their phones. You can also download images of all of your payment cards into the app for simplified management.

Three Layers of Protection

As one of the best identity theft protection services, Lifelock works to continually provide the highest level of security to members, which they do through the delivery of three layers of protection.

The first layer is detection, and LifeLock operates on the philosophy that better fraud detection is better protection. Advanced technology is designed to monitor more than a trillion data points to detect any and all suspicious activity or uses of members’ information.

The next protection layer are alerts. The LifeLock Identity Alert system ensures members receive potential fraud alerts in the most convenient way for them, whether that’s by text, phone or email. If the suspicious transaction is confirmed as fraudulent, the LifeLock team begins work.

The final layer of protection is restoration, where U.S.-based Identity Protection Agents begin the process of helping you as you repair the damage

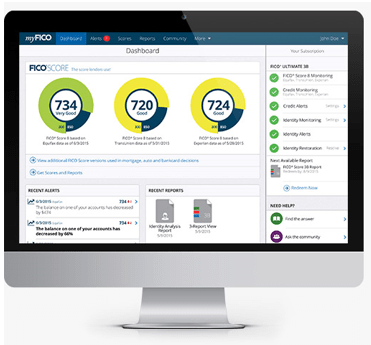

myFICO Review

MyFICO is a credit monitoring service that allows consumers to better manage not just their finances but also their identity. MyFICO is a division of the Fair Isaac Corporation, which has been a leader in credit reporting since the 1960s, with the introduction of the FICO score.

MyFICO operates as the consumer division of Fair Isaac, and it’s designed to provide consumers with their scores directly. Currently, myFICO is the only source that can provide a consumer with access to all three of their scores.

Key Factors That Enabled This to Be Named as One of the Best Identity Theft Protection Services

Some critical reasons myFICO was included in this ranking of the best ID protection products and services are listed below.

FICO Ultimate 3B

FICO Ultimate 3B is a product offering available from this top identity theft protection service, which is the most popular option for most consumers. It includes instant access to a 3-bureau credit report and FICO scores.

It also features quarterly access to a new and updated 3-bureau credit report, and your credit reports are monitored from all three bureaus.

Other features of this comprehensive plan include identity theft monitoring, a historical tracking graph for each bureau, lost wallet protection, 24/7 full-service identity restoration, and $1 million in identity theft insurance.

Image Source: MyFICO

Achieving Goals

MyFICO is unique from the other names on this list of the best identity theft protection services because they’re also a financial services company. One area of focus is helping members achieve their financial goals, whatever they may be. There are products and guides available to help members repair their credit, pay off credit cards, obtain a mortgage, or pay off their student loans.

MyFICO is a great comprehensive financial and identity protection service because as well as having the peace of mind that comes with knowing you’re protected, you can simultaneously work toward a secure financial future with the available tools and resources.

myFICO Blog

The myFICO blog adds excellent supplementary information for members. The myFICO blog offers information on credit scores and reports, credit card-specific information and guidance, and also a place where members of myFICO can access news and updates regarding data breaches and other topics related to identity theft.

Some of the recent topics covered on myFICO Blog include:

- Does your credit impact your health?

- Your debt payoff plan and how it could impact your FICO scores

- Surprising reasons you should work on your credit

- Quiz: How well do you really know your credit?

- Quiz: How well do you know your significant other’s credit behavior?

One-Time Purchase

While many of the top identity theft protection services are offered only as a monthly subscription, myFICO does have one-time purchase options, which can be convenient for consumers who want to get a view of their credit history to protect their identity but don’t want the commitment of a long-term subscription.

One-time purchase options include the FICO Score 1B report, which is a TransUnion report, or the more comprehensive 3B Report, which includes reporting for all three credit bureaus.

TrustedID Review

TrustedID is one of the best identity theft protection options, with services available to individuals, families, and businesses. TrustedID has been featured in The Wall Street Journal, Newsweek, The New York Times, and many other high-profile media outlets.

Service range from 3-bureau credit monitoring to a data breach program designed for businesses and organizations of all sizes.

Key Factors That Led Us to Rank This as One of the Best Identity Theft Protection Services

Unique and valuable features of TrustedID that led to its inclusion in this ranking of the best identity theft protection services are highlighted below.

IDEssentials Identity Protection

The signature product offering from TrustedID is the IDEssentials option, which is designed to make it simple and affordable to maintain control of your identity. This proactive product aims to prevent ID theft, and features include credit monitoring and alerts.

Other features of IDEssentials include:

- 3-bureau credit monitoring

- 3-bureau credit score

- Medical benefits protection

- $1 million identity theft insurance

- Protection specialists

- Family protection

- Fraud alerts

- Lost wallet protection

Facebook Privacy Monitoring

One of the unique offerings available through some of the TrustedID identity theft protection plans is Facebook monitoring. This is available through the signature IDEssentials plan, and it provides monitoring of members’ Facebook profiles.

Privacy settings are monitored to make sure members’ personal information is not at risk as a result of these settings, and this monitoring is continuous.

Users can also take advantage of Family Protection Plans so that they can add their spouse, children, or any other family members of their household to their monitoring, which will include Facebook Privacy Monitoring.

Identity Threat Score

Another different and valuable element of the services offered by TrustedID, one of the best identity theft protection platforms, is their Identity Threat Score.

The Identity Threat Score is designed to gauge the approximate level of risk a member has for identity theft, which can be low, moderate, or high. This score is created by considering the type, amount, and source of publicly available information.

This is an important part of being proactive when it comes to the protection of your personal information, which is something TrustedID takes very seriously.

Yet another proactive product offering is Junk Mail Reduction. Through this service, the TrustedID team helps members have their name and information removed from marketing databases, and it puts a stop to pre-approved credit card offers, leaving members less vulnerable to breaches and theft.

Employee Benefits Program

The Employee Benefits Program is something designed for employers so they can provide the best identity theft protection as part of their employee benefits package. It will help employees reduce their risk of being an identity theft victim, and it’s also a good way to improve employee retention and performance.

The Employee Benefits Program includes more than 15 protective elements, and it’s available as a monthly or annual payment plan. It also includes a family program that will protect everyone in an employee’s household.

The subscription fees can be paid by the company or the employee, and special pricing ensures it’s affordable, regardless of who pays for the service.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion—Best Identity Protection Services

Identity theft is not an abstract concept. Rather, it’s something that affects tens of millions of people each year, and it continues to be a growing problem. Instead of hoping for the best, consumers are advised by advocates to take control of their personal information and protect themselves against the ever-increasing threats that are present.

Protecting your identity and personal information isn’t just about making sure money isn’t stolen. It’s about protecting yourself and your credit so you can make big purchases in the future, and it’s also important to protect your family, including your children.

Each of the best ID theft protection services listed above offers affordable pricing, flexible plans, and robust features that protect consumers against threats in a way that’s effective and proactive.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.