Finding the Top Online Stock Brokers

Online stock brokers are computer-based systems that allow you to buy and sell stocks. These services provide the access you’ll need to engage in the stock market and generally have lower fees than traditional stock brokerage firms.

The decision to go with either an online discount stock broker or a traditional brokerage firm largely depends on your specific needs, level of experience, and goals. Aside from the fee comparison, these two types of stock brokers each have different services and benefits to offer their clients.

If you have already decided to go with an online discount broker, you may still be unsure of which of the best online brokerage firms will suit your needs. As compared to a traditional broker, online stock brokers may each offer somewhat similar prices, but their services are also extremely varied, and it may be difficult to decide which broker to use.

In order to assist you in your search, AdvisoryHQ has compiled this list of top online stock brokers.

Award Emblem: Top 6 Best Online Stock Brokers

Award Emblem: Top 6 Best Online Stock Brokers

AdvisoryHQ’s List of Top 6 Best Online Stock Brokers

List is sorted alphabetically (click any of the names above to go directly to the detailed review section for that advisor)

Differences Between Traditional Brokerage Firms and Online Brokers

Traders buy and sell stocks using a broad range of services and brokers.

Traditional brokerage firms typically offer a larger selection of investment options beyond stocks and bonds, including mutual funds and exchange-traded funds. These firms charge higher fees per trade and also offer investment advice and financial planning services.

Online brokerage firms typically don’t offer the level of investment advice that you’ll find at a traditional firm, which is why you’ll pay a lower commission per trade. You may find some general investment advice from these online brokers, but the advice will probably not be targeted for your specific needs and offered to a wide audience.

If you aren’t looking for personalized investment advice, then you will likely prefer using a discount broker to make your trades. Discount brokers can also be a wise choice for beginners who have limited funds with which to invest.

Features to Consider When Choosing an Online Stock Broker

Before evaluating different online brokers, it’s important to understand the varied features that different companies offer.

Fees and Account Minimums

Although discount brokers offer lower rates than traditional brokers, each of the best online discount brokers will still have its own way of charging fees. Some brokers offer a flat fee, so that you’ll pay the same fee regardless of the type of trade you make, but others charge different fees depending on the type and amount of shares traded.

Before signing on with a particular broker, make sure that you fully understand how you will be charged.

You may also come across a broker with an account minimum. If this doesn’t work for you, you’ll have to choose another broker.

Customer Service

Check that the broker you’re looking at has highly rated customer service. You should be able to contact an actual person via phone, email or live chat to help resolve potential issues.

Image Source: Pixabay

Investment Selection

This may seem obvious, but you should verify that a potential broker offers the investment product with which you’d like to invest before opening an account.

Trading Tools and Mobile Access

Some brokers offer better interfaces and platforms for trading. Be sure that you’re satisfied with the platform and technology that a potential broker has to offer before opening an account. Also, if you want mobile access to your account, check that it offers an app that you can use to manage your account.

Market Research and News

Some brokers offer current market research and news that you can stream while managing your trades. This is great because you can get all of the information you need to manage your account in one place.

Education

Check out the quality of the educational tools offered. If you are a novice to the market, these educational tools, like fact sheets, videos, and live webinars, may prove invaluable to you. The best stock brokers should offer a myriad of educational tools and resources.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated firms, products, and services.

Detailed Review – Top Ranking Online Brokers

Below, please find a detailed review of each firm on our list of best online brokerage accounts. We have highlighted some of the factors that allowed these discount stock brokers to score so high in our selection ranking.

eToro Review

eToro is an online stock broker that allows users to trade currencies, commodities, indices, and CFD stocks. Over 4.5 million people utilize its services in at least 170 countries.

eToro links users with a social trading network that it describes as the largest online financial trading community. This platform allows traders to watch the markets in real-time and gain valuable insight to how other traders function within the markets.

Key Factors That Enabled This Firm to Rank as a Top 2016 Online Broker

Below are primary reasons we selected eToro to be rated as one of 2016’s best online discount brokerages.

Social Trading

This online broker’s social trading feature allows users to interact with other investors in real-time. You can choose to follow particular investors using the site rankings, the investor finder tool or by simply finding a trader whose investment style you admire.

You can then choose to mimic investments made by investors you follow with a percentage of your finds using the CopyTrader feature. This “relationship” can be paused, resumed or stopped at any time.

Social trading can benefit beginners because it provides a window into the investment choices made by experienced traders. It also provides a platform to connect with other investors. Popular investors may also benefit because they gain recognition and, if eligible, receive rewards.

Learning How to Trade the Market

eToro provides a few features that assist new investors with making trades in the stock market.

It has a number of interactive videos and quizzes that introduce new members to the world of trading and investing.

Users may also learn about the principles of trading using a free practice account. eToro will credit your practice account with $10,000 for you to trade with on a practice basis. This means you can make some decisions regarding trades and get your feet wet before actually making real investments and taking on actual risk with your choices.

Encouraging Responsible Trades

eToro provides a number of features to help circumvent emotional or rash trading choices:

- Default leverage setting of 1:50 max

- Maximum 20% from total account equity can be placed in one trade

- Maximum 40% total balance to copy one trader

These are default settings that may be disabled; however, eToro does recommend that all novice traders utilize these default responsible trader settings

Firstrade Review

Founded in 1985, Firstrade is an online broker offering online stocks, options, mutual funds, exchange-traded funds, bonds, treasuries, agencies, and CDs. It offers extended-hours trading and a 1-second trade execution guarantee.

Firstrade is proud of its core values: “Low Costs, Higher Standards.”

Key Factors That Enabled This Firm to Rank as a Top 2016 Online Broker

Below are primary reasons we selected Firstrade to be rated as one of 2016’s top online brokers.

Company History

In 1985, Firstrade began as a discount broker named First Flushing Securities. As the company grew, it set its sights on the Internet and launched Firstrade.com in 1997, one of the first few online stock brokers.

Since then, Firstrade has continued to grow and has been rated as a top online broker by publications such as Barron’s, Forbes, SmartMoney, and Kiplinger.

Investment Products and Services

Firstrade offers a wide range of investment products and brokerage services:

- Stocks: Trade stocks listed on NYSE, AMEX, Nasdaq, and various OTC markets

- Options: Trade puts and calls or use Complex Option Strategies

- Exchange-Traded Funds: A bundle of securities that track an index market, sector or stock type but still trades like a single stock

- Mutual Funds: Over 11,000 mutual funds from which to choose and a simple way to diversity your investments

- Bonds/CDs/Fixed Incomes

- Margin Investing: Offered at competitive rates

- Dividend Reinvesting: Automatically reinvest your dividends at no extra charge

- Securities Lending Income Plan: Enables you to earn income on fully-paid stock shares in your account

Account Types

Firstrade has a number of online brokerage accounts that you can choose from depending on your particular needs:

- Regular Investing

- IRA Retirement

- International Accounts

- Business Accounts

- ESA Education Planning

- Custodial Account

- Cash Management Account

More Than One Way to Trade

Firstrade also provides a few ways for investors to make trades.

- Online: Easily watch your portfolio and make trades

- Mobile: Use the Firstrade app to make trades with the same commissions as with regular online trades

- Stock Broker Assisted: You can also place orders over the phone with a Firstrade stock broker

Customer Service

Firstrade is proud of its level of customer service. It offers live chat support that is available Monday – Friday, from 8:00am – 6:00pm ET.

For users trading as Gold and Platinum members, you’ll receive a dedicated representative that offers personal assistance. A Gold account has a $50,000 equity requirement, and Platinum accounts have a $100,000 equity requirement

Interactive Brokers Review

Interactive Brokers’ mission is: “Create technology to provide liquidity on better terms. Compete on price, speed, size, diversity of global products and advanced trading tools.”

Interactive Brokers was founded by Thomas Peterffy. The origins of the firm began when Peterffy bought a seat on the American Stock Exchange in 1977 and traded as an individual in equity options. The firm now handles almost 1,000,000 trades per day and employs over 900 staff members throughout international offices in the USA, Switzerland, Canada, Hong Kong, UK, Australia, Hungary, Japan, India, China, and Estonia.

Key Factors That Enabled This Firm to Rank as a Top 2016 Online Broker

Below are primary reasons we selected Interactive Brokers to be rated as one of 2016’s best brokerage firms online.

Awards and Recognition

Interactive Brokers has received a number of industry awards. In 2016, it was rated as a top online broker by Barron’s for the sixth consecutive year. In 2016, it was also named “Best Options Trading Platform – Broker” and “Best Broker-Dealer Futures” by WSL Institutional Trading Awards.

It has won a number of other awards in previous years, such as “Best Retail FX Program” by FX Week. You can find a complete list of awards and recognition on the Interactive Brokers website.

Cutting-Edge Technology

Interactive Brokers provides traders with cutting-edge technology that supports record numbers of daily average revenue trades.

Its programs allow you to manage your account easily and to watch the factors influencing the markets. It offers tools such as:

- Research, news, and market data

- Real-time monitoring

- Algorithms and trading tools

- Risk management tools

- Paper trading

Interactive Brokers offers Trader Workstation Mosaic to provide an optimum trading experience for users. This workstation is customizable, and you can tailor it to fit your precise needs. In one screen you’ll get access to:

- Trading

- Order

- Live quoting

- Technical research

- Analysis tools

Trader’s University

This broker has set up Trader’s University, a compilation of training programs. There you’ll find:

- Live and recorded webinars

- Short videos, courses, and tours

- Documentation (written trainings, FAQs, cheat sheets, and more)

- Apps and tools

- Traders glossary

- Links to international trading

These features will assist a beginning trader in becoming familiar with the markets and trading tools. It also offers programs that assist experienced traders to stay up to date with current market trends or changing programs and tools

Scottrade Review

Founded by Rodger Riney in 1980 as Scottsdale Securities, Scottrade has functioned as a stock broker for over 35 years.

Besides providing exceptional services to traders in the market, Scottrade also has made a commitment to making a difference to local communities. The company promotes volunteerism among its staff and donates to several charitable causes.

Key Factors That Enabled This Firm to Rank as a Top 2016 Online Broker

Below are primary reasons we selected Scottrade to be rated as one of 2016’s bestonline brokers.

Market Services and Accounts

Scottrade offers a large selection of investment services and accounts. Some of the investment products include:

- Stocks

- International investing

- Fixed income

- CDs

- Options

- Mutual funds

- ETFs

- Margins

Accounts offered by Scottrade are:

- Brokerage

- Retirement

- Specialty

- Education

- Business

- Custodial/guardian

Culture and Values

Scottrade’s mission is to help make your life better by opening the door for you to access financial success. It has five solid tenants it sees as paramount to operations:

- Customer service

- Individual development

- Teamwork

- Trust and integrity

- Open communication

Awards and Recognition

Scottrade is the recipient of a number of industry awards for both client experience and workplace culture.

Community Involvement

Scottrade encourages associate involvement with charitable causes. In 2014, 2,990 employee hours were volunteered, and $123,368 associate donations were matched that year as well. Scottrade matches employee contributions to nonprofit domestic charities dollar for dollar.

Further, employees are encouraged to participate in the “Day of Caring” and take a day off of work to volunteer for a charitable cause. Scottrade will donate $20 to the nonprofit for every hour an employee volunteers.

TD Ameritrade Review

TD Ameritrade has worked with investors for over 40 years. It seeks to lead you to your financial goals using its trading tools and resources.

It has also been the recipient of a number of accolades and awards. For example, it has won the #1 Long Term Investor from Barron’s for four years in a row. Barron’s also rated this firm as the #1 for novice investors. You can see a full list of TD Ameritrade’s awards and accolades on its website.

Key Factors That Enabled This Firm to Rank as a Top 2016 Online Broker

Below are primary reasons we selected TD Ameritrade to be rated as one of 2016’s top brokerage firms online.

TD Ameritrade offers investors a wide range of investment products including:

- Amerivest portfolios

- Annuities

- Bonds and CDs

- Cash management

- ETFs

- Forex

- Futures

- Mutual funds

- Options

- Stocks

Education Center

For each investment product or account type, TD Ameritrade provides educational resources. It offers videos and fact sheets that help traders understand the basics of investing with each particular product.

Some of the other many educational resources include information on portfolio management, tools and platforms, retirement, taxes, and a full glossary. In the education center, you’ll find videos, webcasts, publications, and courses.

Cutting-Edge Technology

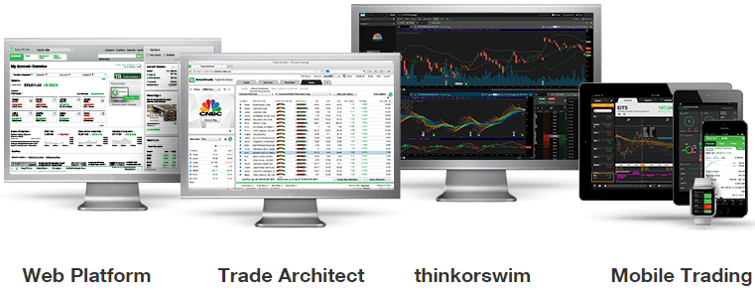

TD Ameritrade has a number of trading platforms for you to choose from depending on your needs. TD Ameritrade users get access to all of the available platforms.

Image Source: TD Ameritrade

- Web Platform: This platform allows you to access third-party research and investment tools, educational resources, and to check trading information from social media.

- Trade Architect: This platform is for streaming live market news and other independent research as well as viewing trades with customizable and interactive charts.

- thinkorswim: Professional traders can use this platform for premier-level tools for analysis and testing.

- Mobile Trading: TD Ameritrade also offers an app for mobile access to investments and more

Free Wealth & Finance Software - Get Yours Now ►

TradeKing Review

TradeKing prides itself in offering simple and fair pricing, innovative thinking, exceptional customer service, and great tools and resources for trading. The firm’s motto, “Be Good,” is exemplified in both TradeKing’s treatment of customers and its employees.

Key Factors That Enabled This Firm to Rank as a Top 2016 Online Broker

Below are primary reasons we selected TradeKing to be rated as one of 2016’s top stock brokers online.

Award-Winning Customer Service

TradeKing was awarded #1 in Customer Service by SmartMoney Broker Surveys in 2008, 2010, 2011, and 2012. It offers real phone help, meaning your calls will actually be answered within seconds, and you won’t get caught up in frustrating phone menus or long hold times.

TradeKing prides itself on the quality of its stock brokers that are available to answer your questions, from simple to complex. You can also access brokers online using TradeKing’s live chat feature.

Another way to receive assistance is by emailing a TradeKing broker. The brokers make it their goal to respond to every email within two hours during normal business hours and within 24 hours on the weekend.

Trader Network

TradeKing’s popular online trader network connects traders and provides a platform to share experiences, ideas, and strategies. Other benefits of the network include:

- View most actively-traded stocks and options in live stream

- Network with other traders

- Speak out in the trader forums

Research and Trading Tools

Your account will get you access to TradeKing’s research and trading tools. Such tools include:

- Options pricing calculator

- Probability calculator

- Profit and loss calculator

- Options and strategies scanner

- Stock, ETF, and mutual find screeners

- Maxit tax manager

- Technical analysis

- TradeKing LIVE

Education

You’ll also find a number of educational tools, such as videos and webinars, on TradeKing’s website. It has conveniently separated educational resources with several varied categories, including:

- Security type

- Experience level

- Market outlook (tolerance for risk)

Conclusion – 6 Best Stock Brokers Online

Each of the firms selected for this list has different qualities and features to offer potential traders. The best match for you depends on your particular experience level, preferences, and goals.

Here, we have provided a breakdown of the varied features offered by some of the best discount brokers. Hopefully, it has helped you decide which firm’s services line up with what you’re looking for in an online broker.

With so many online brokers to choose from, there is certainly one out there that will suit your needs. Be sure to do your research to ensure that you select the best discount brokerage that is most aligned with your needs.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.