2017 RANKING & REVIEWS

TOP RANKING OPTIONS BROKERS

Finding the Top Options Trading Platforms

Your first question might be: What is options trading?

That’s understandable. The investment industry can toss around confusing lingo at times, and options trading is no different.

Chances are, however, that you heard about options trading and want to give it a spin. That’s how you landed on our list of the best options brokers for 2017. And above everything else, you want to know which is the best options trading platform on the market today.

The good news is that we did the legwork for you. We compiled a list of options trading platforms, along with key features and functionality. All you have to do is read through the list below and decide which one is the best options broker for you.

Award Emblem: Top 6 Best Options Trading Platforms

Read below on the methodology we used to select the best options brokers for 2017. Then read about the best options trading platform offered by each broker and how they might get you started as an options trader today.

AdvisoryHQ’s List of the Best Options Traders

Detailed Review – Top Ranking Options Traders

Below, please find the detailed review of each firm on our list of best options traders. We have highlighted some of the factors that allowed these options traders to score so high in our selection ranking

Firstrade Review

Firstrade is an online investment firm that offers one of the best options trading platforms in the business.

The firm was founded in 1985 as First Flushing Services. It became one of the first firms to venture into online trading when it launched in 1997 as First Flushing Securities.

One year later, the firm rebranded to Firstrade and has been a mainstay of online investing ever since.

Key Factors That Enabled This Firm to Rank as a Top 2017 Best Options Broker

Listed below are some features of this firm’s platform that we believe make it one of the best options brokers.

Competitive Costs per Order:

Firstrade doesn’t feature the absolute lowest cost per order of the best options brokers on our list, but at a $6.95 base rate and $0.75 per contract fee, it nevertheless remains competitive.

You may further compare Firstrade to competitors on its Broker Comparison page.

Extended Trading Hours:

One of the unique benefits to trading options with Firstrade is its Extended Hours Trading capability.

This feature lets you get a jump on trading that may be affected by recent developments that occur in the hours immediately preceding and following standard market trading.

Did you read something in the morning news that makes you want to place a pre-market trade? With Firstrade, you may do so between 8:05–9:25 AM.

Have you done more research into an option and want to engage in aftermarket trading? Firstrade does that, too, letting you place orders from 4:05–5:25 PM.

Online & Accessible By Mobile Phone:

Firstrade’s iPhone and Android apps let you view account information on the go. Your all-in-one dashboard is available with these apps as well. You also retain full functionality to execute trades just as you would from your PC.

As an added measure of security, iOS devices running Firstrade apps feature Touch ID. With a touch of your fingerprint, you’ll have instant, secure access to your account.

No or Low Minimums Required:

As a general rule, Firstrade option accounts don’t require minimums for most strategies. However, Spreads & Saddles strategies require a $10,000 minimum, and Uncovered Puts requires $25,000.

User-Friendly Site:

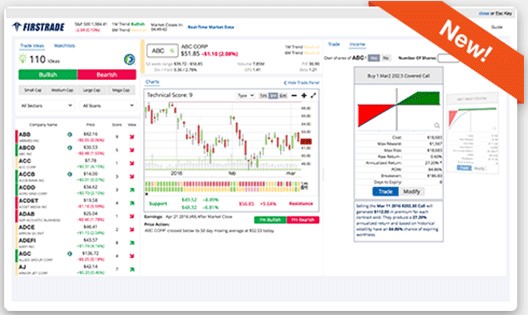

When you log into your Firstrade account, you have access to a customizable all-in-one dashboard. This dashboard shows you a panorama of your account, including history, gains, losses, research, and executing trades.

Not only that, but the Options Wizard streamlines the bulk of your research and work. It analyzes your data along with market goings-on to provide up-to-date information that you can act upon.

Image Source: Firstrade

Some ways that Options Wizard assists your trading include, but are not limited to, the following:

- One-month & six-month trend indicators

- Trading strategy checklists

- More than 65 technical indicators

- Profit & loss simulations

- Support & resistance levels

- Over 40 complex options strategies

- Technical & fundamental rankings

Investor Resources:

If you’re interested in trading options but need to shore up your options knowledge, Firstrade has you covered with its Options Investment Guide.

Some of the topics and tools available within the guide are:

- Options basics

- Advanced options concepts

- Options strategies

- Educational videos

- Podcasts

- Options calculators

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Interactive Brokers Review

Interactive Brokers is an online broker-dealer founded by current Chairman and CEO Thomas Peterffy. The firm has been involved in options trading for nearly 40 years.

IB has grown to include nearly 1,000 employees across several continents. It also boasts equity capital in excess of $5 billion, along with an estimated 1 million executed trades per day.

Key Factors That Enabled This Firm to Rank as a Top 2017 Best Options Broker

Listed below are some features of this firm’s platform that we believe make it one of the best options brokers.

Low Fees & Costs:

Base fees for options with IB cost nothing whereas its options per contract are a competitive $0.15 to $0.70.

IB requires a minimum of $10,000 to open an account. This averages out to be higher than industry standards.

However, according to IB’s own research, it proves to be more affordable than 91% of competing options trading platforms.

Also, based on which country you live in, IB may offer either Fixed or Tiered commission plans. The details of both plans are laid out below.

Fixed Plans:

- Single flat fee per contract

- All commissions included

- Exchange, regulatory, and third-party fees included

- VAT, or value-added tax (based on region)

Tiered Plans:

- Already low commissions

- When volume goes up, commissions go down

- Includes exchange, clearing, and regulatory fees

- VAT as applicable

- Rebates paid back in whole or part to you

Three State-of-the-Art Trading Interfaces:

If you’re a busy investor who needs a way to access your account while out and about, IB’s mobile app is for you. You enjoy real-time streaming quotes and most of the same functions as you would through IB’s web-based account portal, including the ability to execute trades.

However, if you’re the kind of person who’d rather sit in front of your computer and conduct your options trading, IB gives you a choice between desktop or HTML-based interface.

IB’s desktop software, known as Trader Workstation (TWS), puts the full power of the firm’s trading platform onto your PC or laptop. You can trade over 100 global markets; stream quotes, up-to-the-minute news, and research; perform risk analysis; and much, much more.

The Trader Workstation is the perfect solution for experienced traders and investors who have more complex accounts. It’s also a great option for firms and institutions that need a high-caliber, prepackaged yet customizable options trading platform.

For investors who have neither the time nor inclination to educate themselves on complicated desktop options trading platforms, there’s the IB WebTrader. WebTrader is a simplified web-based portal with an intuitive interface.

However, don’t let the streamlined look fool you: WebTrader packs the same punch found in Trader Workstation. Your functionality is just as fully realized and extensive. The only difference is a dashboard that’s less crowded and more focused on the big-picture details of your account.

Expert Assistance on Large Orders:

In the event you run into a problem or have a question while executing a large trade, the professionals at IB can help. Their Stocks and Options Trade Desk is staffed with expert brokers who average more than 15 years of trading experience.

In this way, IB’s options trading platforms let you keep your independence yet fall back on expert client care as needed. This puts you in a veritable no-lose situation when deciding whether to use IB’s powerful software in your options investing strategies.

Widgets & Resources to Help You Trade:

A wealth of resources is available to help you shore up your trading knowledge, not to mention make your time learning IB options trading platforms more efficient.

To that end, IB offers Traders’ University. Traders’ University features webinars, instructional videos, software tours, and courses, all designed to bring you up to speed in the shortest amount of time.

Not only that, but IB also hosts an abundance of documentation aimed at speeding up your learning curve. This includes cheat sheets, user manuals, FAQs, and quickstart guides, to name a few.

Widgets can be downloaded to your preferred work device to help you calculate simple tasks. These widgets include the following:

- Options pricing calculator

- Options strategies widget

- Traders’ calendar

- Traders’ University Courses app

- Options calculator

- Probability lab

Awards:

Aside from its online options trading platform, IB, as a firm, has won several awards through the years. This evidences the firm’s leadership and innovation throughout the online investing and options trading industry.

For a complete listing of awards won by IB from 2005 through today, visit the awards page on its website. A sampling has been reproduced below:

- Barron’s Top Online Broker 2011–2016

- WSL’s 2016 Award for Best Options Trading Platform – Broker

- FX Week 2015 Award Winner for Best Retail FX Platform

- CTA US Service Award 2015 for Best FCM – Innovation

Lightspeed Trading Review

Lightspeed Trading is an online broker in business since 1994. The firm is headquartered in New York City with an additional office in Chicago, Illinois.

The firm’s main clientele consists of active or frequent traders. To these investors, Lightspeed markets its array of proprietary options trading platforms and third-party trading software.

Key Factors That Enabled This Firm to Rank as a Top 2017 Best Options Broker

Listed below are some features of this firm’s platform that we believe make it one of the best options brokers.

Range of Options Trading Platforms:

Lightspeed has a broad range of options trading platforms suited to your needs, comfort, and level of expertise.

The options trading platforms available to you include:

- Lightspeed Trader: Lightspeed’s flagship options trading platform. Designed for intermediate to advanced investors. Downloadable to your desktop complete with real-time data streams. Fully customizable to suit your needs. $100 monthly platform fee.

- Lightspeed Web Trader: Online portal if you prefer a web-based options trading platform. Identical functionality as desktop programs, including real-time streaming and full customization. No monthly fee.

- Sterling Trader: Advanced users only. Full-featured downloadable software. Comes with a $130 per month platform fee.

- Livevol X (LVX): Free desktop options trading platform for novice investors or those who want uncluttered, streamlined trading software. Includes real-time risk analysis, trade execution, volatility alerts, price alerts, and much more.

- RealTick Pro: The most sophisticated of Lightspeed’s options trading platforms. For use by professional traders, hedge funds, and Registered Investment Advisors (RIA). Monthly platform fee of $275.

To view specs for each options trading platform, including a side-by-side comparison, visit Lighstpeed’s Platform Comparison page.

Trading Account Minimums:

The minimum amount required to open a Lightspeed options trading account depends on three variables: (1) the type of platform you wish to use, (2) the type of account you open, and 3) whether you’re a new customer.

For example, both Lightspeed Trader and RealTick accounts require $10,000 minimum for existing accounts.

If you open a new account, however, you’ll pay more. New Lightspeed Trader, Sterling Trader, and RealTick accounts require $25,000 for options trading.

Using the Web Trader options trading platform? You only need $10,000 to open an account.

Livevol X options trading platform accounts demand the highest minimum balance at $35,000.

Low Base Rates & Commissions:

Whether you classify as an occasional trader, or even if you actively trade but not in high volume, then you’ll be subject to Lighstpeed’s standard per contract rate of $0.60 ($0.65 if using Livevol X options trading platform).

However, if you actively trade in higher volumes, you may qualify for Lighstpeed’s Active Trader Commission Group. Commissions vary based on volume and are broken down as follows:

Image Source: Lightspeed Trading

Once qualified, the above amounts are applied to all shares traded, not just those shares above the monthly threshold.

Additionally, Lightspeed applies the following base rates per order based on your preferred options trading platform:

- Lightspeed Trader & Sterling Trader: per share rate x 100

- RealTick: $3.00

- WebTrader: $4.50

Investor Education & Resources:

Lightspeed’s website hosts an impressive trove of educational and instructional materials. This includes a Knowledge Center with FAQs, a deep selection of product tutorials, and webinars.

OptionsHouse Review

OptionsHouse is a financial services company founded in 2005. The firm is located in Chicago, Illinois and is owned by Aperture Group, LLC.

Key Factors That Enabled This Firm to Rank as a Top 2017 Best Options Broker

Listed below are some features of this firm’s platform that we believe make it one of the best options brokers.

Industry-Leading Low Base Rate & Commissions:

When you work with OptionsHouse, you save money from the start. OptionsHouse boasts the lowest base rate of any online broker, at $4.95 for options trading. Equally low is its per contract commission fee of $0.50 per contract.

As if that wasn’t enough, OptionsHouse doesn’t require account minimums nor does it charge maintenance fees.

Awards:

OptionsHouse has been recognized by leading industry publications for its innovation and customer service.

The following represent a sample of the many awards that OptionsHouse has achieved:

- Barron’s 2016 Best for Options Traders in the Online Broker rankings

- Barron’s Best for Options Traders – 4.5/5 stars 2011–2016

- Stockbrokers.com’s Number 1 Web-Based Platform Award 2016

- Stockbrokers.com’s Number 1 for Options Trading 2016

- Stockbrokers.com’s Best in Class – Active Trading

- Stockbrokers.com’s Best in Class – Mobile Trading

- Ranked first in Investor’s Business Daily’s list of 2016 Best Options Trading Platforms

Comprehensive Options Trading Platform with Streamlined Process:

Unlike other online options brokers, OptionsHouse doesn’t offer a plethora of interfaces and platforms. This could be an issue for certain investors who want a tool prepackaged with bells and whistles inside a complex interface.

While this works well for some investors and top options brokers, OptionsHouse takes a different tack. Instead, it favors a streamlined options trading platform that focuses on process.

In this respect, OptionsHouse breaks the mold. Its options trading platform enables you to execute trades from start to finish within a proven process called tradeCYCLE.

tradeCYCLE has six distinct steps, each step building on the previous one. When all the steps have been coordinated in this manner, you’re able to execute tested, better-informed trades.

The following graph illustrates the tradeCYCLE process:

Image Source: OptionsHouse

That’s the beauty of OptionsHouse’s options trading platform. You don’t need to be an advanced user when it comes to trading software. You don’t need to be a trading professional. You only need a desire to learn and a willingness to be taught.

In this way, OptionsHouse proves itself to be one of the best brokers for options trading. It teaches you how to transition from “hunt and peck” investing into solid, thoroughly analyzed orders.

However, tradeCYCLE’s effectiveness stems from the power of OptionsHouse as a top options trading platform. Some benefits of OptionsHouse’s options trading platform include, but are not limited to, the following:

- Anytime access from any location with an Internet connection

- A litany of top-notch tools and customizable options to gel with your investing strategy

- Real-time, streaming market data to make faster, more knowledgeable trade decisions

- Instant alerts that highlight trade opportunities fitting your specific criteria

- Risk and benefits analysis of potential trades

Mobile & Tablet Apps:

If you’re busy and need to review your account, stream real-time data or execute a trade, OptionsHouse has you covered with its line-up of phone and tablet apps. There’s an app for you whether you operate an iPhone, Android phone, iPad or Android tablet.

Even if you don’t have one of the above types of hardware, you can still access your account and trading information via OptionsHouse’s Stock and Options Trading app. The app is suited for Blackberrys and most other mobile phones.

Resources for New Customers & New Investors Alike:

OptionsHouse is a best options trading platform due in no small part because of its generous educational and informational resources.

OptionsHouse has written several in-depth guides to guide you as you first get to know the software.

Once you have a grasp on the technology, OptionsHouse can walk you step by step through the tradeCYCLE process. Each step is broken down even further and explained in clear, practical terms that help you master the overall process.In addition to the above tools, OptionsHouse holds regular webinars for continuing education. It also archives past webinars for your convenience. This means you can still benefit from the expert teaching at OptionsHouse even if you miss a scheduled webinar.

TradeKing Review

TradeKing is an online broker founded in 2005. It is part of TradeKing Group, Inc.

In December 2012, TradeKing merged with sister company Zecco Trading. As a result, TradeKing manages $2.6 billion in assets across 500,000 customer accounts.

TradeKing is headquartered in Ft. Lauderdale, Florida, with offices in Charlotte, North Carolina; El Segundo, California; and Plano, Texas.

Key Factors That Enabled This Firm to Rank as a Top 2017 Best Options Broker

Listed below are some features of this firm’s platform that we believe make it one of the best options brokers.

Honors & Recognition:

In recognition of TradeKing’s innovative and customer service excellence, it has received numerous awards through the years. Some of these include:

- Ranked 2016 Best in Class for Commissions & Fees by Stockbrokers.com

- Rated 4-stars by Barron’s Online Broker survey between 2006–2016

- Stockbrokers.com’s 2015 Number 1 Broker Innovation for its TradeKing LIVE platform

- Ranked Number 1 in Trader Community for 2013–2014 by StockBrokers.com’s Broker Survey

- SmartMoney’s Number 1 in Customer Service for 2010–2012

Leading Base Rates & Competitive Commissions:

TradeKing’s base rate sits at $4.95. This is rivaled only by OptionsHouse in offering the lowest base rate for the cost-conscious options trader.

And while TradeKing’s per contract charge of $0.65 isn’t the lowest in the industry, it remains extremely competitive with lesser-known firms.

Compared to big-name firms, however, TradeKing’s fees provide a clear advantage. These overall cost-savings benefits make TradeKing a standout among our choices for best options broker.

All-in-One Options Trading Platform:

TradeKing’s software gives you everything you need in a comprehensive, fully functional options trading platform.

A few of the key features include:

- Single dashboard overview of your account that lets you view trading history, track your assets, gains and losses, and more

- A tax manager that registers your taxes across all accounts

- The ability to grant secure account access to family and friends

- Simplified money transfers and withdrawals

- 19 option chains, of which 14 are based on strategy

TradeKing hosts a page within its Education Center that specializes in options trading. This page features option trading tools, option strategies, and on-demand videos to boost your option knowledge bank and make the most of TradeKing’s technology.

TradeStation Review

TradeStation is an online options trading platform offered through TradeStation Group, Inc., and TradeStation Securities, Inc.

TradeStation Group is located in Plantation, Florida. It is a subsidiary of Monex Group, Inc., located in Japan.

The firm is considered a best broker for options trading due to its flexible pricing structure and OptionStation Pro trading platform.

Key Factors That Enabled This Firm to Rank as a Top 2017 Best Options Broker

Listed below are some features of this firm’s platform that we believe make it one of the best options brokers.

Awards:

TradeStation options trading platform has been recognized throughout the industry as one of the best for buying and selling options. Some of the awards and honors that the software has received include the following:

- Rated highest by Barron’s in the Best for Frequent Traders Category 2016

- Stockbrokers.com’s awards for Best Platform Technology 2012–2016

- Stockbrokers.com’s Best in Class for Mobile Trading 2016

- Investor’s Business Daily’s Top Five Online Brokers 2016

Flexible, Tiered Pricing Structure:

You may think options trading platforms of the kind offered by TradeStation are reserved for professional, high-volume traders. While pro traders can indeed make good use of TradeStation’s platform, TradeStation has made it possible for its software to benefit even those who don’t trade as often.

It can do this through its tiered pricing structure. Depending upon the frequency and volume with which you trade, you can take advantage of either a per contract or per trade plan.

Per contract is best for infrequent traders or those who don’t trade with high volume. You pay a flat fee of $1.00 per contract with no applicable base fee. You are required a one-contract minimum, however.

For those of you who are to option trading as “whales” are to gambling, you save money with the per trade pricing plan.

Under this plan, you pay a base rate on each trade along with a per contract fee. These rates and fees vary according to volume. The higher the volume, the lower the rate.

For instance, if you execute over 200 trades per month, your base is $4.99 plus $0.20 per contract. Fewer trades result in higher costs. The key below details TradeStation’s full pricing structure.

- $4.99 base plus $0.20/contract at 200 trades/month

- $5.99 base plus $0.30/contract at 100–199 trades/month

- $6.99 base plus $0.40/contract at 30–99 trades/month

- $7.99 base plus $0.50/contract at 10–29 trades/month

- $9.99 base plus $0.70/contract at 1–9 trades/month

Trading at the $9.99 base rate ($10.69 total) with TradeStation isn’t as cost-effective compared to some of its competitors, as this broker comparison chart shows. Even then, TradeStation remains very competitively priced.

Once you move beyond that base rate, however, the comparison chart clearly proves that TradeStation is the most cost-effective choice against the bigger names in the business. This is true no matter the volume.

OptionStation Pro:

TradeStation set out to build the best platform to trade options, and there’s no doubt it’s become one of the industry leaders in online options trading. It’s a powerful, feature-rich platform that lets you take control of your options trading.

Some benefits you enjoy with OptionStation Pro include:

- Ability to quickly discover and rank potential trading opportunities

- Employ a pre-set strategy to reduce lag time between discovery and trade execution

- Build, analyze, and track almost all options positions

- One-click order placement directly from an option chain

- Fully customizable interface, including position management, spread types, graph displays, and more

TradeStation Mobile:

Another reason TradeStation made our list of the best options brokers was for the variety of access points it affords its customers.

Not only can you access your account from the web, but you can download the TradeStation Mobile app to your iPhone, iPad, Android phone or Android tablet. The apps aren’t quite as fully functional as what you’ll get through direct web-based access. TradeStation made sure to keep its apps as robust as possible, however.

For instance, you can still view quotes, look over graphs and charts, view real-time streaming data, and execute trades. Not only that, but you can easily track positions and keep a close eye on your watch lists, among other features.

Conclusion – Top 6 Best Options Trading Platforms

One of the more noteworthy takeaways from our list of best options trading platforms is the ability to customize your experience. If you’re an experienced or even intermediate user of trading software, you may feel right at home in maneuvering such platforms, even at their most complex.

However, for traders who’ve never bought or sold an option in their life, the customizable nature of the above software is essential. Without it, your proficiency can slow to a crawl as you try to wrap your head around more advanced, sophisticated tools.

Most of the above software, the best options trading platforms to be found on the Internet, let you customize to the extreme. You get a streamlined, intuitive options trading platform that strips away the extraneous details. This frees you to focus on the basics and to learn options trading that much faster.

But even the simplest tool is of no use if you don’t get some training on how to use it. To that end, the above list of best options brokers extends a plethora of resources to educate you on the science and art of options trading.

Equipped with both knowledge and the right instrument, you can undertake your newfound interest in options trading with confidence.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.