2017 RANKING & REVIEWS

TOP RANKING BEST KIDS’ CHECKING & SAVINGS ACCOUNTS

Finding the Top Savings Accounts for Kids

As the hardworking adults and providers that we already are, we most likely have plenty of experience in using banks, checking accounts, and possibly some other financial services.

As parents, it’s our responsibility to do the best we can for our kids. This can mean providing them with proper nutrition and taking them to regular checkups, as well as getting them started on the road to financial success by finding a great savings account for kids.

As you begin looking at the details of a variety of kids’ savings accounts, you’ll begin to realize that some offer more ease and convenience than others. The best kids’ savings accounts out there offer low or no monthly maintenance fees, a decent chance at growing your savings over time through interest, and interactive features that get kids interested in saving from the get-go!

At AdvisoryHQ, we’ve taken into account a multitude of factors as we assessed the successful offerings of numerous kids’ savings account options nationwide. For your review, we’ve compiled them into the following comprehensive list of the top 7 best savings accounts for kids.

Award Emblem: Top 7 Savings Accounts for Kids

AdvisoryHQ’s List of the Top 7 Best Savings Account for Kids

List is sorted alphabetically (click any of the names below to go directly to the detailed review section for that firm):

- Bank of America Custodial (UTMA) Savings Account for Children

- Capital One Kids Savings Account

- Fifth Third Bank Minor Savings Accounts

- Regions Financial Corporation Savings Accounts for Minors

- Union Bank Youth Banking – Kids Savings Accounts

- USAA Bank Youth Savings

- US Bank Star Savers Club Account

Methodology for Selecting the Best Savings Accounts for Kids

What methodology did we use in selecting this list of best savings accounts for kids?

Using publicly available sources, AdvisoryHQ identified a wide range of kids’ savings accounts that provide services to a wide range of clients.

We then applied AdvisoryHQ’s “Breakthrough Selection Methodology” to identify the final list of top savings accounts for kids.

Click here for a detailed review of our methodology: Methodology for Selecting Top Banks & Credit Unions

Detailed Review – Best Savings Accounts for Kids

Below, you will find detailed reviews of each of the kids’ savings accounts that have been selected to be on our list of the best savings accounts for kids. We have highlighted some of the factors that allowed these savings accounts to score so high in our selection ranking.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Bank of America Custodial (UTMA) Savings Account for Children Review

A Custodial (UTMA) Savings Account for children from Bank of America gives parents the ability to save money on their child’s behalf and then allow the child access once he/she reaches a certain age. Bank of America has an over 200-year history of connecting its customers to what matters the most to them. Its global reach further exemplifies the holistic nature of its products and services, and flexibility remains one of its strong suits.

Image Source: Best Savings Accounts for Kids

Key Factors That Enabled This Bank to Rank as a Best Kids Savings Account Provider

The following is a listing of key factors that allowed Bank of America to offer one of the top 7 savings accounts for kids.

The Benefit of Saving:

Bank of America’s custodial savings account for kids has a few great benefits that most parents would be thrilled with, including the following:

- Complete parental access to manage funds on behalf of their child

- Only $25 to open an account

- Funds are FDIC-insured for your peace of mind

Fees by the Numbers:

As with any checking or savings option, there are inherent fees that accompany great service. However, it’s easier than ever for kids and parents to minimize fees and not have to worry about them chipping away at their child’s financial future. Below, we’ll take a brief look at how fees break down for this account:

- A $5 monthly fee applies to a custodial checking account but can be waived if the daily balance remains at a minimum of $300.

- You have the option to make up to 6 withdrawals or account transfers per month with no additional fees.

- Maintain a $2,500 per month balance in your account, and enjoy unlimited withdrawals and transfers with no additional fees.

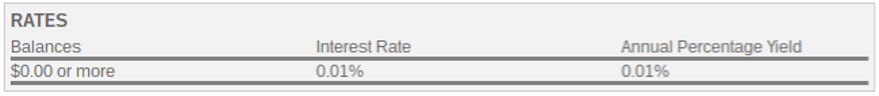

A Look at Interest Rates:

While this account does not offer an opportunity to grow your child’s savings substantially, the 0.01% interest rate and 0.01% annual percentage yield are enough to make a difference during your child’s adolescent years.

Taking it Further:

If you are interested in additional savings options that can also help you save for college expenses, take a look at Bank of America’s college education planning options powered by Merrill Edge.

Capital One Kids Savings Account Review

Offering a great savings opportunity for kids, the Capital One Kids Savings Account from Capital One has many financial tools to get your little ones on the right track to saving. While primarily an online and mobile banking source, Capital One gives clients around-the-clock access to all of their banking services. Online and mobile banking are the most popular options, but if you need a little face-to-face interaction, it has 11 Capital One Cafes across the country – stop to have some coffee, chat with an associate, and anything else you need.

Key Factors That Enabled This Bank to Rank as a Best Kids Savings Account Provider

Here is an overview of the key factors that enabled Capital One to offer one of the 7 best savings accounts for kids.

The Tools to Get You There:

Perhaps one of the biggest reasons parents want to open a savings account for their children, other than to help the save for the future, is to teach them at an early age the value of money and the different ways in which we use it in our everyday lives. Capital One offers a variety of educational tools which can make the process that much smoother. They include the following:

- Multiple Accounts: Open up to 25 accounts, completely free of charge, and give them useful names to help your kids save for individual goals, like a new tablet or bike.

- My Savings Goals: Set a savings goal, track it, celebrate your success, and repeat.

- Automatic Savings Plan: Put your savings on autopilot and see how quickly it adds up. Kids love that “money in the bank” feeling, too!

Let That Interest Build:

Capital One offers an appealing 0.75% variable annual percentage yield (APY) that is sure to get your money off the ground. The more you save, the more you earn. Who doesn’t like that?

In Their Hands:

If your child has a savings account, you can bet that they want to do more than just deposit money. With Capital One, kids get to be hands-on with the following features:

- Checking their balance

- Changing their account name or PIN

- Creating a custom username

- Practicing being money smart by downloading tax forms, eStatements, and more.

Protection Guaranteed:

All of your Capital One deposits are safely and securely insured with the FDIC , so you never have to worry about what your money is doing when you can’t keep an eye on it.

Fifth Third Bank Minor Savings Accounts Review

With over 1,250 full-service branch locations and over 2,600 ATMs, Fifth Third Bank is a bank driven by curiosity and its commitment to understanding your dreams. When it comes to helping kids open their first savings account, you have 2 admirable options to get you and your child started off on the right foot. These options include a Goal Setter Savings Account and a Relationship Savings Account, both with great features depending on your needs.

Key Factors That Enabled This Bank to Rank as a Best Kids Savings Account Provider

The following is a list of main factors that allowed Fifth Third Bank to offer one of the 7 best savings accounts for kids.

All the Regular Benefits:

Minor savings accounts offer all the traditional benefits and services that are available to Fifth Third Bank customers, including:

- Instant alerts

- Easy deposits

- Online and mobile banking

- Preferred benefits

- And more

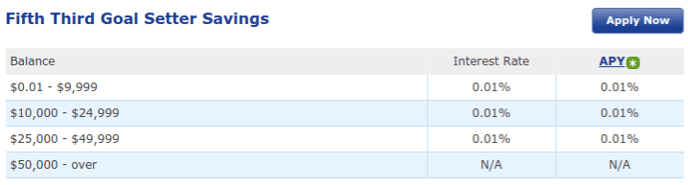

The Goal Setter Savings Account:

The Fifth Third Goal Setter Savings Account is a fantastic option for young savers with added bonuses along the way. The most exciting thing about this account is that it allows you to set financial goals and receive a one-time, interest-added bonus when you reach that goal! Along with competitive interest rates, account features for the Goal Setter Savings Account include:

- An easily waived $5 monthly fee

- Ability to limit funds to branch-only access to help avoid the temptation of making withdrawals

- Tracking progress online to show your kids how their money is growing

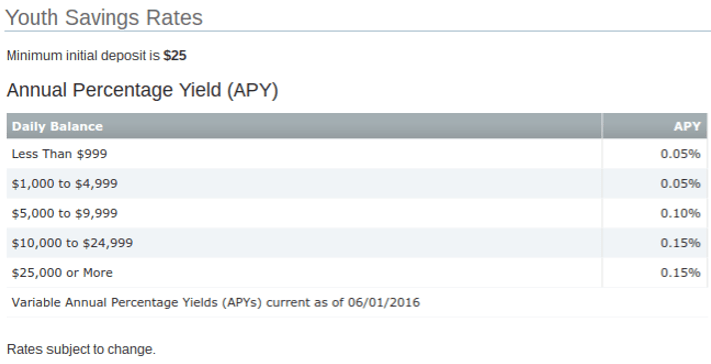

Lastly, let’s take a look at interest rates for the Goal Setter Savings Account:

Image Source: Fifth Third Bank

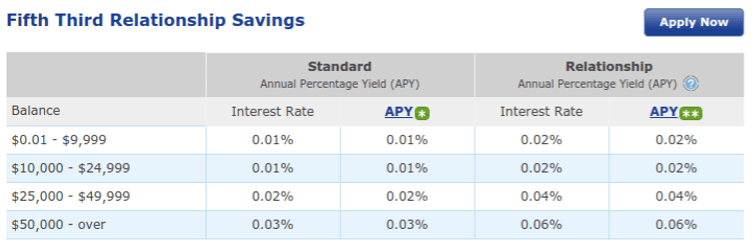

The Relationship Savings Account:

If you have a serious saver on your hands, you may want to take a look at the features of a Fifth Third Relationship Savings Account. With higher interest rates, this account rewards you with a monthly interest deposit to your account as long as you keep an eligible checking account along with your savings. The $5 monthly fee still applies but can be waived if you meet one of the following:

- You have a Fifth Third Checking Account

- You have a monthly balance of $500 or more

- You or someone over the age of 18 is signed on as the owner of the account

Most Relationship Savings Accounts are linked with a checking account for the added convenience of:

- Automatically scheduled checking-to-savings transfers

- Combined checking and savings statements

- Teaching children the difference between earning, budgeting, and saving

Current rates for a Relationship Savings Account are as follows:

Image Source: Fifth Third Bank

Planning for Education:

As a parent, you may want to plan for your child’s future educational needs as well, and Fifth Third allows you to do so with support through its student planning and education planning services. Check them out here.

Regions Financial Corporation Savings Accounts for Minors Review

As a full-service provider and one of the nation’s largest consumer and commercial banks, Regions Financial Corporation goes beyond the basics and works to do what is right, put people first, and reach increasingly higher to help clients enjoy their lives and be financially secure, no matter what their goals are.

When seeking savings options for the young people in your life, Regions has a Savings Account for Minors which offers simplicity loaded with features and discounts that parents are sure to love.

Key Factors That Enabled This Bank to Rank as a Best Kids Savings Account Provider

Here is a look at the key factors that allowed Regions Financial Corporation to offer one of the 7 best savings accounts for kids.

Major Benefits:

Starting children and grandchildren on the right path to more green offers them a head start on a lifetime of financial responsibility. Regions makes this process even more enjoyable through the following key features:

- Open an account with just $5

- Receive a 30% discount on a safe deposit box

- Interest compounds daily and is paid monthly

- Automated savings plans make growing your child’s savings simple

- Up to 6 fee-free transactions per month

Interest Yield Rates for Savers:

Rates are set by region, but the following should offer a good idea of what annual percentage yield one can expect on their savings through Regions:

Image Source: Regions Financial Corporation

Involving Kids in the Process:

As we discussed earlier, kids are naturally hands-on, and they relish in being an integral part of something normally reserved for grownups. Armed with this realization, Regions allows minors to do their part as they learn by encouraging them to make deposits and allowing 24/7 access via online and mobile banking to see how much they’ve saved and earned.

Union Bank Youth Banking – Kids Savings Account Review

While today’s focus is on Union Bank’s youth savings accounts, it’s worthy to note that Union Bank is a multi-venture global entity serving a variety of clients with assets hovering over $120 billion in total. Union Bank covers 3 convenient youth banking options for kids and teens which grow with them and engage them in the pleasure of saving money. These options include its Kidz Savings Account, Teen Savings Account, and Teen Access Checking Account.

Key Factors That Enabled This Bank to Rank as a Best Kids Savings Account Provider

Next, please find a list of contributing factors that enabled Union Bank to offer one of the 7 best savings accounts for kids.

The Kidz Savings Option:

The Kidz Savings Account is designed for kids ages 8–12 and teaches the fundamentals of saving. Accrued interest is compounded and paid out quarterly, and there is a 6-item transaction limit. Other attractive features include:

- Just $1 to open an account

- No monthly service charge

- Unlimited deposits and balance inquiries

- Interest-earning

- Kidz Savings Bonus Card: Earn a stamp for every deposit you make and get rewarded!

The Teen Savings Account:

As kids get older and become ready to set financial goals of their own, the Teen Savings Account is the next step up on the ladder. Like the Kidz Savings Account, interest compounds and is paid out quarterly as well. Features are designed for teens ages 13–17 and include the following:

- Open an account with just a $1 deposit

- No monthly service charge

- Interest-earning

- Around-the-clock account monitoring

- $100 daily withdrawal allotment

The Next Step:

When your teen is ready, he/she can move on to a Teen Access Checking Account which will allow him/her to continue to learn financially while gaining more control and personal responsibility for transactions. This account features an ATM or debit card, overdraft protection, and access to a variety of traditional banking features, such as online banking and bill pay.

USAA Bank Youth Savings Review

A Youth Savings Account from USAA Bank offers parents the ability to introduce their kids to the world of savings and financial responsibility while maintaining control and setting boundaries. USAA Bank has been a member of the community since 1922 and, today, stands as one of America’s few fully-integrated financial corporations.

Key Factors That Enabled This Bank to Rank as a Best Kids Savings Account Provider

The following is a listing of key factors that allowed USAA Bank to offer one of the 7 best savings accounts for kids.

Designed for Parents:

Designed to guide kids to better financial understanding and allow parents to choose how and when kids can access their accounts, a USAA Youth Savings Account offers features such as the following:

- Complete access for parents as a joint account holder

- Set specifications as to withdrawal and deposit limits

- Allows teens mobile access on the go

- Grant limited USAA.com access

- Set which accounts kids can see and which they can’t

- Make quick and easy transfers

- Hassle-free deposits using [email protected] via a smartphone

Made for Kids:

A few convenient perks make banking easy and exciting for young kids that are learning to save. Your child can watch his/her savings grow with no monthly service fees and access to a nationwide network of over 60,000 free ATMs. Also, it only takes a deposit of $25 to open an account.

The USAA Advantage:

As a USAA member, you and your child will still have the privilege of the following convenient banking services to help you build upon your financial strength:

- Instant access to your money

- Online and mobile banking

- Hassle-free deposits

- Goal planning tools to simplify your financial goals

Savings Rates Examined:

USAA’s Youth Savings offers competitive annual percentage yields for young savers. The rate increases with the daily balance and can really add up over time. Variable rates are always subject to change, but the following chart offers an inside look at current rates:

Image Source: Youth Savings Account

Free Wealth & Finance Software - Get Yours Now ►

US Bank Star Savers Club Account Review

Designed for all stages of your child’s financial life, the Star Savers Club Account from US Bank offers kids under 17 the help they need to be financially responsible and have a positive future. US Bank brings unmatched strength and knowledge to the table through a broad range of banking services that encompass the needs of everyone from individual clients to large global corporations.

Key Factors That Enabled This Bank to Rank as a Best Kids Savings Account Provider

Below is a listing of key factors that allowed US Bank to offer one of the 7 best savings accounts for kids.

A Trusted Home for Your Deposits:

When making deposits into your child’s Star Saver Club Account, you can do so with absolutely zero worry – all deposits are FDIC-insured for ultimate peace of mind.

Key Savings Features for Kids:

Your Star Savers Club Account grants you access to a variety of tools and services that support your mission and goals. The following is an overview of key banking features for kids:

- Requires only a $25 deposit to open an account

- No pesky monthly maintenance fees

- Steady annual percentage yields

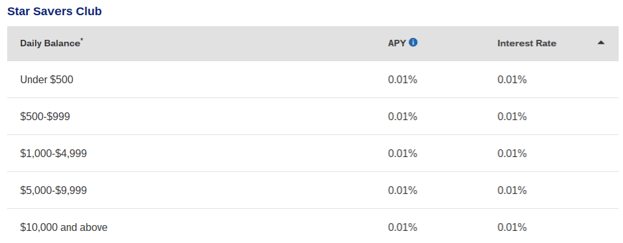

Current Rate Standards:

One of the great benefits to starting a savings account for your children is that they can earn interest on their money as they save. Based on your daily balance, the following is a look at US Bank’s annual percentage yields for the Star Savers Club Account:

Image Source: Star Savers Club Account

The Future Ahead:

Once your child reaches the age of 18 (as impossible as that may seem!), his/her Star Savers Club Account will be converted to a traditional savings account with full features. Additionally, US Bank offers a variety of student banking and college savings information that is well worth a look as well.

Conclusion – Top 7 Savings Accounts for Kids

We know it’s hard to make important decisions about your children’s futures, and when a kids’ savings account is the topic of choice, it’s an extremely important consideration. As you narrow down your choices to a select one or two kids’ savings accounts, ask yourself the following questions:

- Why do I want to open a kids’ savings account?

- What features are most important to me?

- Do I want to be able to link my child’s savings account to my checking?

- What are my expectations when my child turns 18?

Understanding your own point of view on these nuances of what you want from a kids’ savings account can help you choose the best savings account for your child. Remember, there is no one right option for everyone, but, with a little due diligence, you can find the best kids savings account to satisfy your hopes and dreams for your child and lead him/her to a bright financial future.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.