Types of Accounting Professions | What You Should Know about The Different Types of Accountants & Jobs

As businesses have become more complex, the types of accounting professions have grown. What was once a fairly straightforward role now has many variations depending on the different types of accounting each business or individual requires. For example, the types of accountants known as the personal accountant occupy a relatively new space in the accounting world.

For many years, only the wealthiest individuals thought it necessary to pay someone to keep track of their finances; now, however, many people, regardless of economic status, view these types of accountants as vital to ensuring their money is prudently spent.

Even those who don’t hire an outside personal accountant now have the necessary software available to them to act as their own money manager.

Because of this newfound complexity, the average person may struggle to name the different types of accounting professions or understand what the different types of accounting can do. Therefore, we have put together a primer that explains the most common types of accounting jobs.

Our hope is that we’ll be able to demystify the different types of accountants for you: what they do, why they’re important and how they all fit together. But first, a little history.

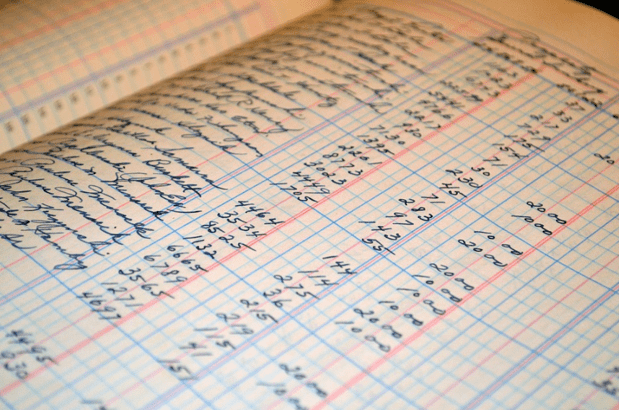

Image Source: Pixabay

There are many different types of accounting techniques, but perhaps the most widely-known and commonly-used is double-entry bookkeeping, which was developed by a Venetian monk, Luca Pacioli in 1494. According to Money Instructor, accounting was created as a response to the advancements Italy had made at the time in business and trade.

The double-entry bookkeeping method separates transactions into credits and debits, which affords accountants the ability to more easily keep track of where the company’s finances stand at any given moment.

Even today, many types of accountants use this method, which is a testament to how important it is to all types of accounting professions.

See Also: Quick Tips to Budget and Manage Your Money Better

Over the years, different types of accountants have entered the business world in order to deal with the growing complexity of most businesses. As such, there are many different types of accountants and types of accounting jobs, but what the average person may not understand is this: Why is accounting so important? Allow us to explain.

According to Accounting Simplified, there are seven different types of accounting. It may be useful to understand how each one works to gain a clearer understanding of why there are so many types of accounting professions. The first two are the most common, but each of the seven different types of accounting has its own unique utility and value to a business. We’ll also review the different types of accounting professions within each different type of accounting, so that you can see how it all ties together.

Financial Accounting

Financial accounting focuses on preparing financial statements and other documents to be reviewed externally (i.e., for tax purposes). The statements prepared using this type of accounting are designed to give the reviewer a clear picture of the business’s historical performance as well as an accurate snapshot of its current profitability. Most types of accounting jobs fall in this category.

Management Accounting

Management accounting (also known as managerial accounting) focuses on the preparation of financial statements and other documents to be used internally. Because these reports are intended for internal use, these types of accounting often provide more details than an external statement would show.

With these types of accounting, businesses can get a real-time look at their performance, which allows them to adjust their direction accordingly to ensure they remain successful.

Government Accounting

Government accounting is very similar to financial accounting, with one key difference: government accountants focus only on government or public sector businesses. The reason these types of accountants are so valuable is because, unlike private businesses, public-sector and government businesses are expected to remain within a predetermined annual budget for spending.

Therefore, these types of accountants are essential in ensuring government spending doesn’t go over budget.

Don’t Miss: How To Manage Your Money – Top Money Management Tips

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Tax Accounting

As the name implies, tax accountants focus on accounting as it pertains to the relevant federal and local tax laws. These types of accountants are important because, unlike financial accountants, tax accountants have to adhere to more stringent rules and regulations when preparing their statements.

The ultimate goal of these types of accountants is to accurately estimate a business’s tax liability and ensure it is in compliance with the tax regulations in place where the business operates.

Forensic Accounting

If you enjoy crime dramas, forensic accounting may be of interest to you. This type of accounting job uses “accounting, auditing and investigative techniques in cases of litigation or disputes.” These types of accountants often are called upon to act as expert witnesses in court cases where both parties need an estimate of the financial damages inflicted as a result of fraud.

For example, insurance claims, personal injury claims, fraud cases and professional negligence claims are all examples of when these types of accounting techniques are most useful.

Project Accounting

While financial accounting focuses on the revenue activity of the overall business, project accounting takes a microscopic approach. Although it may not seem like a very different type of accounting when compared to financial accounting, these types of accountants work diligently to ensure that the projects for which they are responsible are delivered on-time and (ideally) under budget.

By employing these types of accountants, businesses don’t have to wait for an overall report to be prepared by the Financial Accountant, as they can look at the individual reports for each project (which are generally more detailed) to see exactly where their money is coming and going.

Social Accounting

Although social accounting is one of the more rare and different types of accounting, it is still worth mentioning. According to Accounting Simplified, social accounting “refers to the process of reporting implications of an organization’s activities on its ecological and social environment.”

For example, if a company plans on building a factory, a social accountant will prepare a report that outlines the potential cost of environmental cleanup that will be necessary to offset the pollution or waste created by that factory.

Related: Must Read: Why Is It Important To Set Realistic Goals?

Why So Many Types?

The different types of accounting are all equally important for one reason: they allow a business to run smoothly, efficiently, and without unnecessary expenditures. Without the various types of accountants helping to ensure this efficiency, many businesses would struggle to keep track of their profits and losses, and the effects would be twofold.

First, the IRS requires all businesses to keep a clear record of their earnings for tax purposes, and the penalties for improperly-prepared records can be onerous. Second (and most important), a business that does not have a clear picture of where it currently stands is unlikely to succeed in the long run.

So, while there may seem to be an abundance of different types of accounting jobs, the truth is that all businesses need at least one to ensure they remain financially solvent.

Education: What Does It Take to Become an Accountant?

Now that we know the main areas of the different types of accounting professions, let’s take a look at some of the more specific types of accounting jobs to see how it all fits together. The best way to understand this is to break them up according to the level of education required of each of the types of accounting positions.

High School Diploma

If you have a high school diploma and are interested in a career in accounting, there are a few options available to you: Bookkeeping Clerk, Accounting Clerk, and Auditing Clerk. These types of accounting positions are usually available in smaller companies, and because most of the training takes place on the job, you’ll be able to familiarize yourself with some of the more common types of accounting methods while earning a paycheck.

Associate’s Degree (Accounting)

As you complete higher levels of education, the types of accounting positions available to you will grow. For example, someone with an associate’s degree in Accounting can get work in one of the following roles:

- Accounts Receivable clerk

- Accounting Assistant

- Billing Clerk

- AP Clerk

- Bookkeeper

- Management Trainee

- Payroll Clerk

Image Source: Pixabay

You’ll notice that one of the types of accountant jobs listed is “Accounting Assistant”; the main difference between an Accounting Clerk and an Accounting Assistant is that the necessary education and training required for the Accounting Assistant role must already be completed before obtaining these types of accounting positions.

Put more simply, most companies will not hire an Accounting Assistant to learn on-the-job; they will have to have existing knowledge of the different types of accounting prior to beginning their work.

Popular Article: How to Calculate Income Tax – Complete Guide to Income Tax Calculations

Bachelor’s Degree (Accounting)

Again, the higher your level of education, the more varied the types of accountant jobs. Someone with a bachelor’s degree in Accounting has access to a wider variety of the different types of accounting, including:

- Corporate Entertainment Accountant

- FBI Agent-Accounting

- Cost Accountant

- Credit Analysis Manager

- Tax Accountant

- Treasury Analyst

- Auditor

- Cost Estimator/Cost Estimator Manager

- Government Accountant

- Forensic Accountant

- AML Specialist

- Assistant Controller

- VP, Finance

- CFO

As you can see, these types of accountant jobs include some of the less-common (but still very important) different types of accounting, such as Forensic Accounting (which can lead you to roles such as “FBI Agent-Accounting,” “AML Specialist,” and of course, “Forensic Accountant”).

Having a bachelor’s degree in Accounting is generally enough to qualify for these roles, but if you don’t, not to worry: there are many types of accounting certifications you can obtain that will allow you to perform some of these more complex roles.

This is also the level at which you can aim for more executive accounting roles, such as VP of Finance and CFO.

Master’s Degree (Accounting)

Having a master’s degree in any field gives you access to the upper echelon of available jobs, and a master’s degree in Accounting provides similar access to a wider variety of the types of accounting professions available.

Someone with a master’s degree in Accounting can work in any and all of the roles above, as well as the ones listed below:

- International Accountant

- Managerial Accountant

- Environmental Accountant

- Personal Financial Adviser

- Spectator Sports Accounting

- Senior Financial Analyst

- Accounting Software Developer

- Risk & Compliance Professional

- Finance Director

- IT Accountant

- Corporate Controller

International Accountants are usually only found at large, multinational companies because this type of accounting profession is generally very complex.

This type of accountant is required not only to have an understanding of Generally Accepted Accounting Principles (GAAPs) in their own country, but also in any country where their company operates. Additionally, this type of accounting position requires you to understand tax laws and implications of wherever your company may operate.

With a master’s degree in Accounting, you’ll find that nearly all of the types of accountant jobs available are executive-level positions.

Ph.D (Accounting)

Last but certainly not least, someone with a Ph.D in Accounting can perform perhaps the most valuable service of the different types of accounting: education.

With a doctorate in Accounting, you are able to teach courses as an accounting professor at colleges and universities, allowing you to help the next generation of accountants to achieve their full potential.

Free Wealth & Finance Software - Get Yours Now ►

Overview

As you can tell, the types of accounting professions are as varied as the different types of accounting themselves. And although it may seem at first glance like a confusing and intimidating world, accounting at its very core is about simplicity: distilling all of a company’s financial information into easily-digestible numbers.

If you have a head for numbers and are interested in one of the types of accounting jobs listed above, or even if you’re just trying to figure out which of the different types of accountants would suit your needs, we strongly recommend you do some further research into the different types of accounting and the types of accountant jobs currently in the market. Perhaps you’ll find the world of accounting is not as complex as it seems.

Read More:Tips on How to Build Wealth (Steps, Ways & Habits of Wealthy People)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.