Overview: UK Robo Adviser Comparison Reviews: Nutmeg vs. True Potential vs. Scalable Capital

Trending among both new and experienced investors alike is the UK robo adviser, and more and more of these robo advisers seem to be popping up each week (See: Top Rated Best UK Robo-Advisers | Ranking | Top Automated Investment Firms in the UK)

How can you decide on which of these online investment companies is the right fit for you and your finances?

Companies such as Nutmeg Investment, True Potential Investments, and Scalable Capital all promise to help you make wiser and better investments.

The best way to determine where each company shines is to perform a UK robo adviser comparison to take a look at these top companies side by side.

In order to assist you with comparing the advantages and disadvantages of these three companies, AdvisoryHQ wants to conduct a thorough Nutmeg Investment review, as well as take a look at True Potential wealth management reviews and the Scalable Capital Investment Management reviews. We will answer questions like:

What is the fee structure for Nutmeg Investment, True Potential Investments, and Scalable Capital?

- What services do they offer for investors and how are they carried out?

- Do they offer any educational resources or financial advice to assist new investors?

If you’ve been considering making an investment with a UK robo adviser for any length of time, it’s time to cover a little more information with this UK robo adviser comparison of Nutmeg Investment, True Potential Investments, and Scalable Capital.

See Also: Are Robo Advisors Worth It? Want Help Managing Risk? (Investment News & Strategies)

Nutmeg Investment Review

Nutmeg Finance is one of the more recognizable names among UK robo advisers because of its early dominance of the market.

Nick Hungerford created the platform in the early 2010s with the idea of creating more transparency in the wealth management marketplace and to make it more easily accessible for all.

Since that time, Nutmeg Investment has continued to grow in popularity, likely a result of their wide array of features and services.

Source: Nutmeg.com

Services

It’s important to understand exactly what Nutmeg Finance has to offer in terms of services in any Nutmeg Investment review. Their company can offer ISAs as well as pension accounts that are tailored to your specific investment goals. When you open up your free account with Nutmeg Investment, you will be asked to complete a short questionnaire that should require no more than ten minutes of your time.

From here, Nutmeg Investment will review your information and determine which category you fall into. Each of their portfolios is categorized by a risk level on a scale of one to ten, with one being a very conservative portfolio, and ten being a volatile and aggressive portfolio. Each category has a wide range of diversification in terms of the assets that Nutmeg Investment selects for your account.

Within your ISA, you have the option to allocate your money into several different funds under the same main “wrapper.” This allows you invest some of your money into one of the more conservative portfolios from Nutmeg Finance, perhaps to be used for an upcoming purchase. You can also invest some of your funds into one of their more aggressive portfolios for longer-term goals.

You will also find valuable educational resources on their Nutmegonomics blog with information regarding current news in the investing world as well as helpful hints and tricks for how to make smarter investments.

You can also access their tools and calculators for more help with managing your investments.

Fees

While it is free to open up a Nutmeg account, it does come with a fee structure that is charged to your account on a monthly basis based on the annual rate. Nutmeg Investment tallies up the overall value of all your investment accounts to determine your account balance and your annual fee.

The cost associated with their tiered price structure is shown in the chart below:

Minimum Account Balance | Fee Amount |

£500 | 0.95% |

£25,000 | 0.75% |

£100,000 | 0.5% |

£500,000 | 0.3% |

Table: Nutmeg Fees

When taking a look at the fees in a Nutmeg Investment review, it’s important to note that the tiered structure they advertise is not the only fee that applies to your accounts. There is an underlying fund cost, which the company is very up front about if you take the time to read all the way through the information.

Nutmeg Finance has an average of a 0.19 percent fund cost compared to the average UK fund cost of 1.43 percent.

Be prepared for the minimum investment of £500 for an ISA account, in addition to monthly contributions of £100 if your account balance is below £5,000. If you plan to open a pension account with Nutmeg Investment, your minimum starting balance will be on the higher side at £5,000.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

True Potential Reviews

True Potential Investments is a new company that is more of a self-directed investment company than a UK robo adviser.

However, its services are still worth noting in our UK robo adviser comparison because it offers a unique service among online investment companies in the UK. The aim of True Potential Investments is to pair financial advisers with technology they need to help their clients achieve better wealth management.

It’s no surprise that many True Potential Wealth Management reviews comment on this unique business structure.

Services

True Potential Investments offers clients an array of services to choose from including financial and investment advice as well as the opportunity to manage self-directed investments. Their True Potential Wealth Management platform, known as True Potential Investor, has already attracted the attention of media with awards such as the best D2C platform being bestowed upon it.

The technology that you use to make your investments with True Potential Investments is very similar to the technology used by nearly one-fifth of the traditional financial advisers in the UK. It allows you to set your goals and your risk level, while True Potential Wealth Management reviews those items in order calculate the amount you need to invest in order to achieve them.

You can invest in one of three main account types with True Potential Wealth Management: a stocks and shares ISA, pension fund, or a general investment account.

One of the features that is most appealing about the True Potential Wealth Management program is their impulseSave program. This allows you to add small amounts of money to top up your investment accounts quickly and easily with very small increments of money (as low as £1).

True Potential reviews would be remiss not to point out this feature. If saving more has been your goal, you can add money you saved from bringing lunch from home, avoiding the shopping centre on your lunch break, and spending a night in directly to your True Potential Investments account quickly. You’ll never miss the money once it’s gone.

Source: TPLLP Self-directed Investments

Related: Questions to Ask Before Choosing a Robo Advisor

True Potential Fees

True Potential reviews should always point on the very low minimum account balance they require in order to get started with your investments.

Compared to companies such as Nutmeg Investment that require £500 to begin, True Potential Wealth Management asks for an investment as low as £50.

The rest of their fee structure is relatively straightforward. True Potential Investments doesn’t charge for holding or opening an account with them, nor do they charge or dealing, buying, or selling.

Unlike Nutmeg Investment, True Potential Investments has a two-part fee that covers your account usage based on the value of your investments annually.

- Platform fee: This amount covers any administration costs associated with your account, the 24/7 access you are granted, custodian services, and the safekeeping of your assets. This fee costs 0.40 percent of your account value.

- Portfolio fee: Your portfolio fee covers investment in a managed or individual portfolio, access to fund managers through each portfolio, and the oversight of the investment committee. This results in a charge from 0.75 percent annually.

Scalable Capital Review

If you’re not a beginner investor or you’ve been saving for a while in order to make a sizeable contribution to an investment account, Scalable Capital Investment Management might be a good fit for your investment needs.

The Scalable Capital mission statement lists their objective as creating a transparent, convenient, and cost-effective form of wealth management.

Scalable Capital Review: Services

Scalable Capital Investment Management centres their model on diversifying assets among all the major categories including equities, bonds, commodities, real estate, and cash. In order to do this in the most cost-effective manner possible, Scalable Capital chooses to access these securities through ETFs or exchange-traded funds because they are not subject to pricy management fees, and they offer a highly liquid form of investing.

Unlike True Potential Investments and Nutmeg Investment, Scalable Capital Intelligent Investing does not offer a pension fund option. They are planning on launching this service toward the end of 2016 to better serve the clients who choose to invest with Scalable Capital Investment Management.

The only choice to invest through Scalable Capital is through a stocks and shares ISA. Your ISA will be configured based on the information you provide during your initial account setup stage. This involved a short questionnaire designed to determine your goals with Scalable Capital Investment Management as well as your risk tolerance.

Note that Scalable Capital Intelligent Investing does not allow you the option to modify the investment strategy or plan that they give to you. Furthermore, Scalable Capital Investment Management is not authorized to give financial advice. They can make suggestions and manage your investments, but Scalable Capital does not provide any sort of advice centre. You can, however, take a look at their Insights section to read various articles about investment strategies and gain some knowledge of the industry.

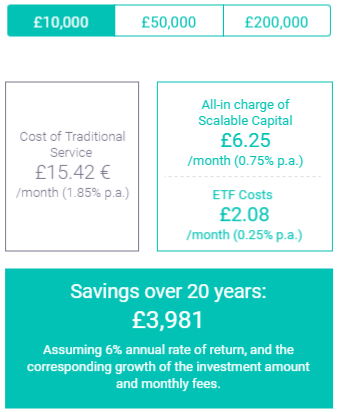

Scalable Capital Review: Fees

As mentioned previously, the minimum account balance with Scalable Capital Investment Management is much higher than the other two UK robo adviser options we covered previously. You will need to invest at least £5,000 in one up-front payment in order to have their model work efficiently for you.

Scalable Capital is very transparent and forthcoming with their fee structure. Similar to True Potential Investments, they do not offer tiered pricing or a sliding scale for how they charge their customers. Instead, you can expect to pay a 0.75 percent fee for your total assets under management with Scalable Capital Intelligent Investing. In addition, their ETFs typically have an average expense ratio of 0.25 percent built into the performance.

Source: Scalable Capital Fees

Your fees are calculated on a monthly basis using your average balance throughout the course of the month.

Similar to Nutmeg Investment, Scalable Capital will also allow you to withdraw your funds at any time with no penalties or fees other than those incurred through the selling of your assets and securities.

Popular Article: Robo Advisors vs. Financial Advisors—Is It the Future of Automated Stock Trading & Investing?

UK Robo Adviser Comparison

It’s clear that each of these three companies—Nutmeg Investment, True Potential Investments, and Scalable Capital Investment Management—are best suited for different types of investors. We wanted to take a moment to break down who may most benefit from each of these three online investment companies so you can make a wise decision with your investments.

Both Nutmeg Investment and True Potential Investments feature relatively low minimum account balances, great for investors who may just be getting started. These two companies also offer the added flexibility of maintaining your pension fund under the same login information as an ISA or a general investment account, whereas Scalable Capital does not offer the same service yet.

When it comes to fees, Nutmeg Investment has the lowest fees overall unless your account balance is going to be less than £25,000. Expect to pay more in fees with lower balances by approximately 0.20 percent. True Potential Investments has the highest fees among the three companies due to their two-part fee, with Scalable Capital Investment Management coming in solidly in the middle of the pack with a fee significantly lower than that expected from True Potential Investments.

The education centre and information available through Nutmeg Investment is definitely worth noting, however. True Potential Investments offers financial and investment advice to help you get started as well. Through Scalable Capital, you can access their insights, which gives you more detailed information on how to save and plan, various investment strategies, and news from within the industry. All three are worth investigating to get a leg up on the smartest investment strategy for you.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion

How do you know which of the top robo advisers in the UK is the best fit for your investment needs?

Take a closer look at your individual financial situation to determine what you are interested in investing, what you expected to pay in fees, and the types of services that you were hoping that a UK robo adviser could offer you.

Because your finances are unique, your investment strategy will be too, so pay close attention to which of these companies could be the best fit for you.

Nutmeg Investment, True Potential Investments, and Scalable Capital Investment Management all offer a variety of services to get your investment strategy on the right path. Once your account is set up, you can be mostly hands-off with your investment strategy, holding onto your account to build long-term wealth. Weigh the pros and cons of each of these three companies to determine whether Nutmeg Investment, True Potential Investments, or Scalable Capital is the right robo adviser for you.

Read More: Robo-Investing—What You Should Know! (Automated Stock Trading & Overview)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.