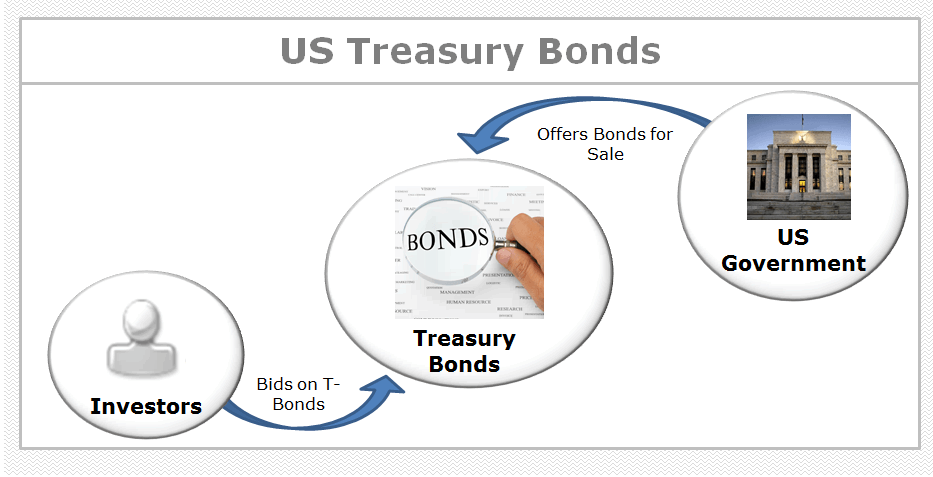

US Treasury Bonds Transational Flow Chart

(US Government offers T-bonds on the open market for investor bidding)

Image Source: AdvisoryHQ

Image Source: AdvisoryHQ

What are US Treasury Bonds?

US Treasury Bonds, also known as T-Bonds or U.S. Treasury Securities, are marketable securities offered by the United States government. U.S. Treasury bonds are tied to U.S. government debt and backed by the U.S. Treasury.

From an investment standpoint, U.S. Treasury bonds offer the following advantages:

- Very low-risk

- Semi-annual interest payments

- Bond is backed by the United States government

The smallest U.S. Treasury bond available is $1,000.

The U.S. government puts its treasury bonds up for sale through auction.

If the buyer agrees to the interest rate set by the government, a maximum of $5 million worth of treasury bonds can be purchased.

Duration and Maturity

US Treasury bonds have a maturity of 10-30 years. 10 year treasury bonds have become more common since the 1990s.

In 2002, the government stopped issuing 30 year treasury bonds as part of a long term strategic to reduce US government debt.

However, it was determined that 30-years bonds were already fully integrated into the financial system and their absence left a void.

As such, 30-years bonds were brought back to the market.

10 year treasury bonds continue to remain the most common U.S. Treasury bonds.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.