Guide to Finding Used Car Loans & Financing

It’s time to kick your old clunker of a car to the curb, but you can’t afford a brand new car and you can’t afford to pay cash for your next purchase either.

Navigating lenders to find a used car loan and used car finance options can be tiresome and confusing. There are so many different things that you need to consider before you sign on the dotted line with any particular lender.

What should you be considering before you agree to any used car finance option?

AdvisoryHQ wants to help you determine what the best used car interest rates are, how to manage your payment with a used car finance calculator, and more. If you’re considering a used car loan, you’ll want to know all of these basic facts first.

Ready to find out more about what a used car loan requires? Let’s look into it together.

See Also: Online Auto Loans: How to Find the Best Car Loans Online

Used Car Loan Calculator

Before you begin to shop for your next used car, you should have a general idea of how much you’re willing to or able to spend each month. A detailed monthly budget makes note of how much excess cash you have at the end of your expenses each and every month. Knowing what this bottom line number is can be a key factor in determining what you can afford to spend when it comes to a car payment.

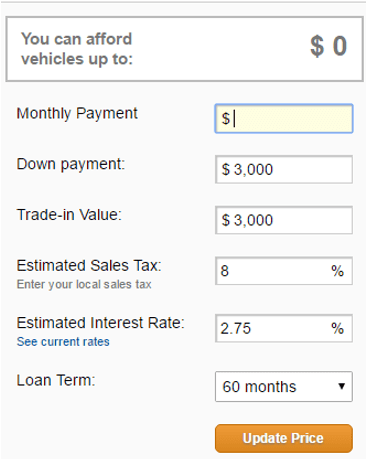

Make the most of a used car loan calculator to determine exactly how much you can afford overall and on a monthly basis. A good used car loan calculator will allow you to figure out how much car you can afford in one of two ways.

The first way allows you to input exactly how much you want to spend each month and then tells you what the proper loan term, interest rate, and maximum borrowed amount would be to accommodate that payment. An example of a used car loan calculator of this variety would be this one from U.S. News & World Report.

Used Car Loan Calculator

The second type of used car loan calculator allows you to play around with what your monthly payments would be based on loan amount and various interest rates.

A used car loan calculator of this variety gives you the best option for testing out the potential monthly payments. If you have several offers from various lenders, this kind of used car payment calculator can help you to figure out which one offers the deal that fits most reasonably into your budget.

For an example of a good used car loan calculator that has this sort of feature, you can check out this used car finance calculator from Bankrate.

Alter your loan amount, term, and used car interest rates in order to determine if this used car finance choice is the right one for you. A bonus feature on this used car calculator is the option of extra payments. Determine what one extra payment each year, each month, or just a one-time payment can do for the overall term of your used car loan.

Don’t Miss: Top Best 0 Interest Credit Cards | Ranking

Don’t Let the Dealership Finance

Used Car Finance

In some situations, you can definitely find the best used car loan through a dealership. Certainly most individuals would find dealership financing the most convenient option.

When you’re out searching the lot for a car worthy of taking out a used auto loan, you might as well allow them to assist you with your monthly payment at the same time. This strategy can seriously backfire when it comes to taking out a used car loan, though.

By the time you make it to the dealership, you’re no longer considering whether a used car loan is a good deal or not.

You’re likely to fall in love with the perfect beige sedan with low mileage or the shiny blue minivan to tote around your tots.

What that vehicle will cost you may not be your primary concern anymore, and dealerships can capitalize on this by offering you used car finance choices that may not benefit you for the long haul. Their used car interest rates will likely be higher than what you would find through other lenders.

Specifically, online lenders are usually able to provide consumers with the lowest used car interest rates.

A used auto loan through an online lender is not only convenient and comfortable for you, but you can ensure that you are receiving the best used car loan available before you fall in love.

Financing your used car loan (or at least getting prequalified for one) before you leave the house allows you time to compare, shop around for the best rates, and make the most of a used car loan calculator to decide which lender is right for you.

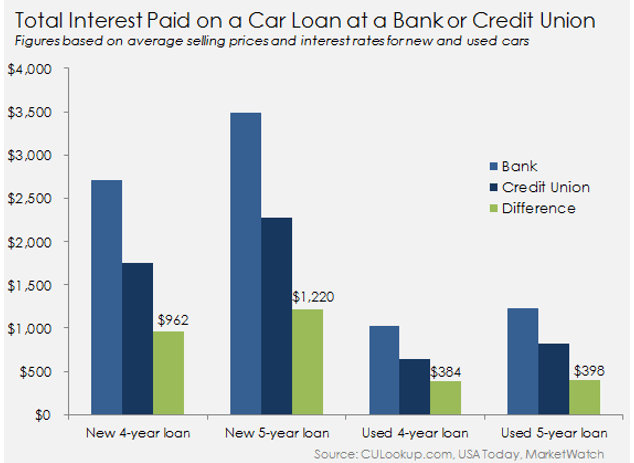

Most experts in the world of used car finance choices suggest looking at banks and credit unions second to online lenders. This option still typically allows you to fare better than you would through a dealership.

Simply knowing what your used car loan will cost you allows you to negotiate the price of your new-to-you car with confidence and power, instead of mixing up the price with the financing.

Many dealerships use this tactic to come out ahead, confusing your used car loan and monthly payment amount with the overall cost of the car. Without doing your own research, it’s possible that this method could have a serious financial impact over the course of your used car loan.

Related: Finding the Best Subprime Auto Lenders & Companies

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Used Car Loan Rates

You’re committed to getting a used car loan, but how do you know if you’re getting the best interest rates that you possibly can?

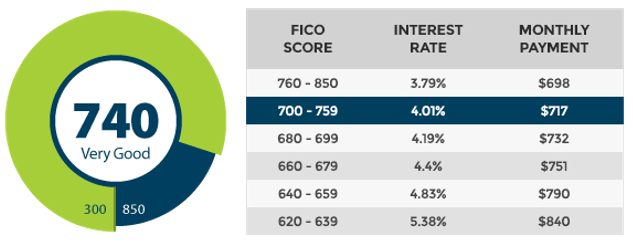

Most lenders will reserve their lowest interest rates for consumers with the highest credit scores. Maintaining a FICO credit score of 760 or above is likely to produce the best results if what you’re most interested in is receiving the lowest rates.

Used Car Loan Rates

The best way to ensure that you qualify for low used car interest rates (which can be pulled on a daily basis through the Bankrate used car finance calculator) is to keep an eye on your credit score. Regularly check your credit report and take advantage of free credit score sites to determine how healthy your current financial situation could be.

Many of these sites will also offer suggestions for how to maintain your score or boost it, if necessary.

Once you’re sure that all of your personal financial affairs are in order for a used car loan, it’s imperative that you do some rate shopping. Assuming that the very first offer you receive is the best one is unlikely to be true. A used car auto loan can have interest rates that vary pretty significantly.

Credit reporting agencies will view several inquiries that occur in close succession as just one inquiry when you’re shopping for the best rates on a used car loan.

Simply be sure to keep all of your applications and inquiries for a used auto loan close together, timewise. You typically have a two-week window in which you can rate shop in this manner for a used car loan. Yes, making any sort of hard inquiry for financing can have a slight impact on your credit score, but it shouldn’t cause severe damage if all you’re doing is shopping for a used car loan. Most lenders will only be doing soft pulls, which aren’t harmful to your overall borrowing ability.

One of the easiest ways to compare all of the possible used car finance rates is to use a broker such as LendingTree. LendingTree allows you to fill out one application and then pairs you with several lenders that would qualify you based on the information you presented in your used car auto loan application. With several offers on the table, you get a good idea (in a short amount of time) of what your potential used car loan rates would realistically look like.

Short Term Might Be Better

For some individuals, the end goal is for the monthly payment on their used car finance choice to be as low as possible.

Unfortunately, they hold this standard so high that they can be blinded to the financial impact of lowering their monthly payment. Requesting a reduction in the amount you pay toward your used car loan each month typically stretches out the term of your loan.

Why is having a longer-term used car loan a bad thing?

First, the longer your loan term lasts, the more likely it is that you are going to be paying more in interest. Even the lowest possible used car finance rates stretched out over a 72 month period are likely to rack up some hefty interest payments, and you won’t have much to show for it. The amount of interest that you pay over the course of your used car loan term is significantly decreased for each year that you subtract from the overall length of time.

Used Car Interest Rates

Short-term used car finance options will usually have a higher monthly payment. Fortunately for you, it is typically offset by a lower interest rate on the entirety of the used car loan. This can have a beneficial financial impact on the bottom-line cost of your vehicle when all the financing is said and done.

Not only is saving on the interest rate of your loan an extremely positive thing, you also will free up more money in your monthly budget sooner with a short-term loan. This allows you to plan for other uses of your finances, like a luxurious vacation or replenishing an emergency fund in the event that you face financial hardship.

Using a used car loan calculator with an amortized schedule can help you to determine exactly how much you’ll be paying in interest over the course of the loan. Use this bottom line number to determine if it would be more beneficial for you to take the lower interest rate with the short-term loan or to pay more in interest over the course of your loan at a higher rate for a longer period of time. A used car payment calculator and a detailed monthly budget can show you which option would be best for you.

Popular Article: Best Bank for Auto Loans

Bad Credit Used Car Finance Choices

Is your bad credit holding you back from receiving a used car loan? The good news is that there are plenty of choices out there for used car finance options that will grant you approval even with a lower credit score. But you should be prepared for a handful of things when it comes to getting a used car loan with bad credit.

First, you are far more likely to face high interest rates than your good credit counterparts. Fortunately, you could always accept the consequences of higher interest rates now and know that timely payments can boost your credit score for the future. Refinancing once your score has improved will grant you the relief from exorbitant interest rates that you’ve been craving.

Second, there tend to be more restrictions on the types of vehicles you can purchase with a used car loan.

Especially for individuals with bad credit, automobiles that are significantly older tend to be more affordable and to fit more comfortably into a budget. Keep an eye out for mileage and age restrictions from various lenders when it comes time to apply for a used car loan. These can help you to narrow the path of which lenders will work best for you if they only offer used finance options for newer model cars.

Online lenders typically have the best chances of issuing a used auto loan to an individual with bad credit. They’re more willing to take high-risk clients and consumers for their financing programs.

However, if you do have bad credit, you will need to really evaluate whether or not you need a new used car loan at the present time.

Utilizing a used car loan calculator or a used car payment calculator can help you decide whether it fits comfortably within your budget. If you don’t possess the ability to make timely payments on your used car auto loan and end up defaulting on the loan, your credit score certainly will not improve in the years ahead.

Read More: Top Best Credit Cards to Build Credit | Ranking & Reviews

Conclusion

Getting a used car loan can be an exciting time in your life as you prepare for the new set of wheels that’s coming your way. However, we can also understand the trepidation that you might encounter, making sure that you can afford it and worrying about what the best used car interest rates might be.

Using some of these tools, like a used car calculator, can help you to better determine exactly which car is the best fit for your family.

By making the most of a used car calculator, you can weigh the various interest rates and loan terms to make sure you’re getting the best bottom line on your used car auto loan. Comparing interest rates and monthly payments has never been easier than when you’re using a used car loan calculator.

AdvisoryHQ wants to help you find the best used car loan that you possibly can. That’s why we’ve assembled this list of tips and tricks to help you find a great deal on a new-to-you car. So before you head out to the dealership or start scouring through the ads, keep these used car finance tips in mind.

Image Sources:

- https://cars.usnews.com/cars-trucks/car-loans-and-leasing/car-affordability-calculator

- https://pixabay.com/photos/auto-column-mirror-traffic-road-978599/

- https://www.myfico.com/

- https://dayair.org/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.