Intro – Washington Federal Reviews & Ranking

Washington Federal was recently ranked and reviewed by AdvisoryHQ as a top rated banking firm. Firms on our top rated lists were selected after they successfully passed AdvisoryHQ’s ground-breaking, four-step banks and credit unions selection methodology.

Click here for a step-by-step breakdown of the methodology and selection process used during our Washington Federal review: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

The Washington Federal review below provides a detailed assessment, including some of the factors used by AdvisoryHQ News in its ranking and selection of Washington Federal.

Washington Federal Review

Since getting their start in 1917, Washington Federal has been striving to help build thriving communities.

This national bank makes it their mission to deliver simple and straightforward banking solutions to help their customers make the most of their money.

After being in business for nearly a century, Washington Federal currently operates 250 locations throughout eight states.

Washington Federal prides itself on providing friendly, one-on-one, and professional service to their customers. This banking firm offers customers a variety of financial products to choose from, including checking, savings, retirement accounts, and home loans.

Photo courtesy of: Washington Federal

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Banking Firms

Upon completing our detailed reviews, Washington Federal was included in AdvisoryHQ’s ranking of this year’s best banking firms based on the following factors.

Washington Federal Review: Washington Federal Foundation

Washington Federal has a motto that they support the well-being of the communities they serve “because the place you call home is our home too.”

This mission shines through in the Washington Federal Foundation, which facilitates direct giving to community-based nonprofits that serve the needs of low and moderate income individuals.

Washington Federal is dedicated to their giving back initiative and uses the foundation to offer their support to help with housing and community development, senior citizens and low-income families, and financial literacy.

The foundation also supports employees’ involvement in giving back to the community by donating grants to organizations where employees serve as volunteers or board members.

This strong commitment to giving back to the communities that they serve is one of the factors that makes Washington Federal rank as a top ranking bank.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Washington Federal Review: MoneySync

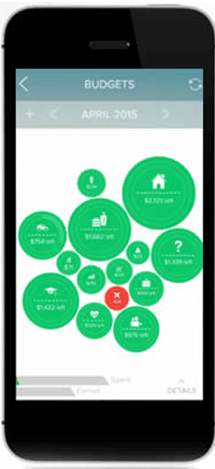

MoneySync is a tool provided by Washington Federal to help customers keep track of their overall financial well-being.

With MoneySync, customers can keep track of how much money they have, what they owe, what they buy, and what their budget is — all in one place.

Photo courtesy of: Washington Federal

Account holders can enroll in MoneySync through online banking and can download the app on their smart phone or tablet. With MoneySync, consumers can:

- See a complete picture of their entire finances

- Manage debts to see how paying a little extra can have a big impact

- Create and track spending with Bubble Budgets

To ensure the safety of customers’ information, MoneySync uses military-grade encryption. They have also had their controls and safeguards audited and improved to ensure maximum protection.

Washington Federal Review: Basic Checking

Sometimes simple is better, as is the case with Washington Federal’s Basic checking account. This checking account comes with no minimum monthly balance and no monthly maintenance fees.

The account at Washington Federal also comes with free online banking and bill pay, mobile banking, and access to their MoneySync budgeting tool.

With only a $100 minimum deposit required to get started, opening a Basic Checking account with Washington Federal couldn’t be any easier.

Washington Federal Review: Small Business Banking

Washington Federal supports local businesses. They offer many financial solutions for small business owners, including ways to help them manage cash flow and process payments.

In addition to business checking and savings accounts, Washington Federal also offers small businesses financial products such as:

- Online banking

- Merchant services

- Business financing

The also offer innovative process solutions such as ScanDeposit, which allows business owners to deposit checks remotely without having to visit the bank.

In addition to reviewing the above Washington Federal review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top rated banking firms:

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.