Overview: Wells Fargo Mortgage Reviews

Are you looking to purchase a new home but are intimidated by the number of financing options? A home mortgage is one of the biggest decisions you can make, and with so many opinions, it can be hard to know where to go. On the internet, many Wells Fargo mortgage reviews are quick to recommend them first for home equity financing.

This particular review covers all the facts regarding Wells Fargo that you need to make sure that your home loan is successful from start to finish. This will look at the positive aspects of their loan systems, as well as Wells Fargo mortgage complaints from real customers.

In the last 10 years, Wells Fargo has redefined itself from a smaller regional bank to one of the country’s biggest lenders with branches across the nation. Since their 2008 purchase of Wachovia, they’ve springboarded over the competition to take complete control over the home financing sector.

Image Source: Wells Fargo Mortgage Review

Wells Fargo mortgage reviews highlight the fact that they’ve consistently been one of the most profitable banks in North America. Its focus on mortgages has helped it continue to be a powerful company despite a recession. Famous investor Warren Buffet has taken a large stake in the company, citing that its impressive track record and consistent results put it far above the competition.

Many Wells Fargo home mortgage reviews cited higher average interest costs than most of the competition, but they justify this cost with great features and quality service. Wells Fargo has a passion for customer service, offering fantastic guides, videos, and call support ready to assist you with any need. The bank also offers the unique construction loan for those who want to build on their current estate.

Free Resource for Mortgage Information

Mortgage Information

Wells Fargo hosts a huge library of videos to help educate you on mortgages. Example videos include:

- Preparing to buy a home

- Listing add-on expenses

- Determining appropriate price range

- Benefits according to loan type

- Wells Fargo loan features

- A step-by-step guide of the overall mortgage process (this series breaks down the complex and confusing process to show how easy and seamless it can be)

- Homeowner financial liabilities

- Payment issues, such as modifications

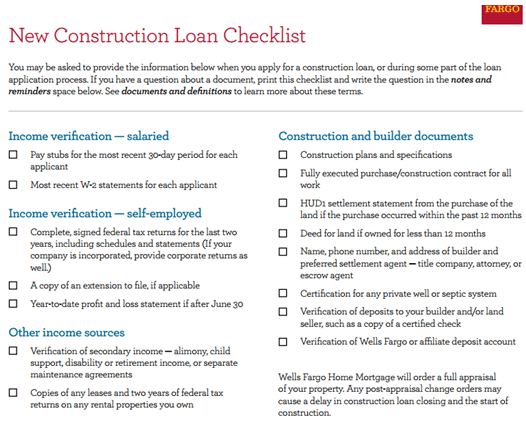

Checklists Help Prepare for Every Situation

Image Source: Wells Fargo

A variety of printable checklists make sure you’ve gathered all the correct information for your mortgage. These home lending checklists help you organize and keep track of details such as:

- A wish list—what are you looking for when buying a new home?

- Application checklists

- Construction loan application list

- Plans for selling your current home

Don’t Miss: Best Banks for Mortgages – A Complete Guide (Best Mortgage Rates & Reviews)

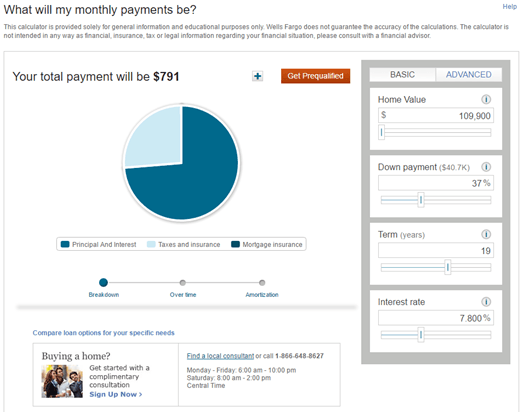

Figure Out Projected Costs with a Mortgage Calculator

Image Source: Intuitive Calculators

Wells Fargo home loans reviews praise the intuitive calculators that help you figure out costs going into the future. Simply input the data amounts and get real projections instantly. These calculators help answer key questions including:

- What can I expect my monthly payments to be?

- What amount should I borrow?

- Would it be better for me to rent or purchase?

- What is Wells Fargo home mortgage loan modification? Should I consider refinancing?

- What is the expected time frame for me to pay off the loan?

- What is the estimated amount that I qualify for?

- Should I go for a fixed-rate or adjustable-rate mortgage?

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Is Wells Fargo Right for You?

The group at Refinance Mortgage reached out to advisors for their Wells Fargo mortgage review to get real numbers regarding their mortgaging options. Wells Fargo is fairly standard when it comes to the initial payment of the mortgage. The bank requires a five percent down payment which has the potential to be lowered to three percent if this is your first time purchasing a home or you have fantastic credit.

In general, credit score is their main determinant as to whether or not a mortgage will be paid off down the line. Wells Fargo looks for those who have a credit score of six hundred or higher, but they are flexible when it comes to negotiations.

Besides credit score, an individual’s debt-to-income ratio acts as another major factor in giving out a loan. It shows their potential to balance the incoming monthly payments. Wells Fargo looks for a ratio of forty-five percent, which is an industry average.

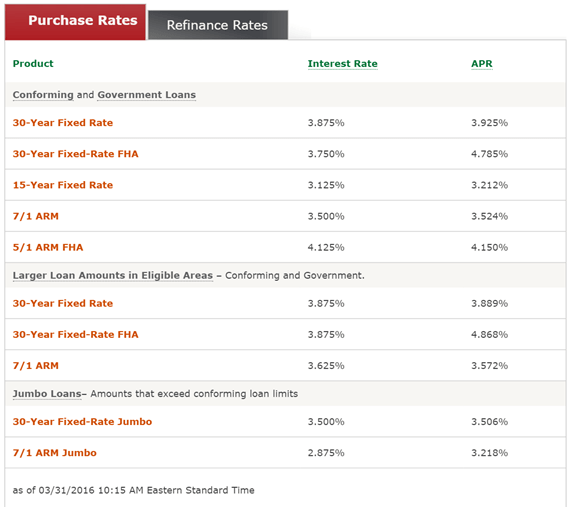

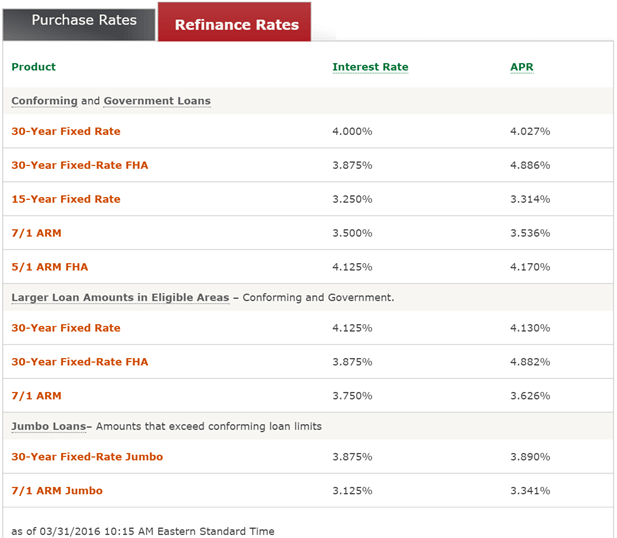

The Most Up-to-Date Interest Rates from Wells Fargo

Image Source: Wells Fargo Current Rate Page

As interest rates fluctuate, be sure to check their current rate page for their most recent report. When doing research, make sure that Wells Fargo refinance reviews offer the most up to date information possible.

Related: Types of Home Loans – What You Should Know (Different Types & House Loans)

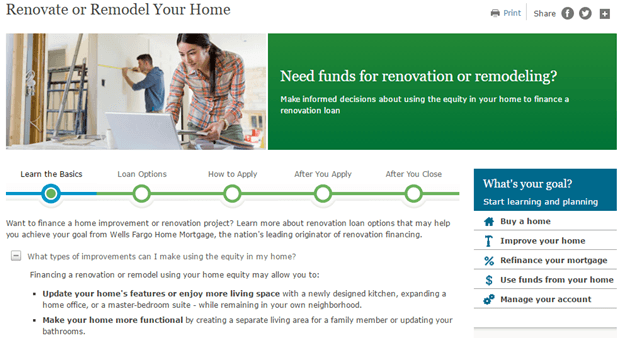

Unique Home Improvement Loans

Wells Fargo Home Improvement

Wells Fargo home mortgage reviews focus on the special home improvement loan that offers an option for those who want to build instead of buy. It focuses on those looking to improve their current home. Wells Fargo leads the nation in easily accessible renovation financing and can help you achieve your goal regardless of size and scale.

If you want to remain in your current house but are unsatisfied with your home’s features, consider looking into this option. You’re able to increase the functionality of the home, such as adding an extra bedroom or expanding a space for children to play in. Examples of home repair include roof or flooring installation, energy-efficient windows, insulation improvements, or landscaping solutions.

If you’re interested in this option, Wells Fargo prepared a list of steps to ensure that your home improvement project is a viable option:

- You should first look to write down the list of improvements you want to make. This step allows you to put the most important changes first, as the budget may not cover every change you plan to make.

- Next, looking into how much these projects will end up costing you, and the amount you’re ready to commit. Ensuring that you can comfortably manage the payments is crucial for financial safety.

- Looking into contractors is the next step, and should be handled seriously. Balance the cost of the project with long-term quality. Wells Fargo also offers the ability to verify contractor credentials to make sure you are dealing with a professional.

- Finally, you should judge whether this improvement is worth it in the present. Does it create a visible appeal to the property? Does it really improve the current living space? Are you in the position to afford it? If the answer is yes, then the project is ready to begin.

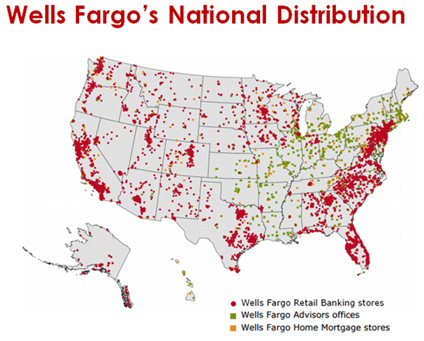

Local and National at the Same Time

Image Source: Wells Fargo

Since Wells Fargo started on a local level and expanded, it holds a unique competitive advantage over its competition. Our Wells Fargo mortgage review praises their local community focus, which ensures that your home financing is right for your local situation.

In most communities across the nation, you’re able to find a local branch where you can go in and talk directly to an advisor face to face. This is someone who lives in the community, understands you situation, and can help you get started on the mortgage of your choice.

Quality Customer Service

Compared to similar large banks, Wells Fargo is considered one of the best in terms of customer service and consumer education. When calling their help line, you are connected to a trained professional quickly. They can answer most questions and clarify terms or details. These are never pushy sales pitches for commission; Wells Fargo is always looking to educate a potential customer and help them make the decision that’s right for them.

Whether you’re a first time homebuyer, or just looking to renovate, there is always something new to learn when it comes to the financing process. For first home buyers, Wells Fargo offers a specialized guide to determine if purchasing a home is right for you, and checklists ensure that the correct information is gathered. You don’t want the added stress of having a critical document declined because of incorrect information; Wells Fargo helps make the process seamless.

The Most Common Customer Complaints

Despite Wells Fargo’s best attempts to service customer needs, there have been frequent complaints voiced both online and in person. In a recent report regarding Wells Fargo mortgage complaints, 85% of situations fell into the categories of payment difficulty or issues with payment processing.

Wells Fargo loan modification complaints have been in the news as well. Recently, a Virginia man was at risk of foreclosure; the bank only gave him two weeks to submit paperwork as opposed to the four weeks usually requested to change his payment schedule.

Most online complaints include requests to reduce the principal loan amount as well as improvements to the loan-revision process. Wells Fargo home mortgage complaints cite difficulty in negotiating with customer service and frustration in the difficulty of getting payments or documentation through quickly.

Free Wealth & Finance Software - Get Yours Now ►

Verdict

On the internet, Wells Fargo mortgage reviews show a bank that puts customers first. It looks to engage you on a local level and understand your needs. Their interest rates are higher than industry average but make up for it in quality service and honest communication with the customer. Their renovation and construction program provides a fantastic alternative for those who are not moving somewhere new but want to improve where they are now.

Even if you don’t decide to get a loan through Wells Fargo, making a phone call or visiting their website can be very informative. Is this bank the right place for you? Our Wells Fargo home mortgage review provides an informative look at one of the nation’s biggest lenders.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.