Overview: What Is Amazon Payments?

You have created a website offering a great product or service to whoever might be interested. Good job! You are on your way to fame and fortune. But wait… How will your customers pay you?

You could work something out on your own, but coding and security issues might bring major headaches. One possible way to tackle payments is to become one of the sites that accept Amazon Payments.

This Amazon Payments review is an in-depth look at this payment solution.

Image Source: What Is Amazon Payments?

What is Amazon Payments anyway? Simply put, it lets customers use their Amazon login to make purchases on sites other than Amazon. Amazon’s payment platform can be integrated to your website very easily, at least according to stores that accept Amazon Payments.

See Also: SaveYa Review – Tips on Buying and Selling Gift Cards on SaveYa

“It’s Amazon, So It Must Be OK”

A major advantage of such a famous and beloved platform is trust: people are naturally more willing to make an Amazon Payment than to reveal their credit card information to a site they only just discovered.

Furthermore, it will certainly make life easier for many of your visitors. There are more than 300 million Amazon customers who have already given their payment details to Amazon.

Image Source: Amazon Payments

And, amazingly enough, at least 46 million are Prime members, spending an average of $1,500 on Amazon’s site each year.

So, if you were wondering if anyone would send money with Amazon Payments, you have your answer right there. And all those people will not have to re-enter their payment information to buy products on your site.

Last but not least, you don’t have to worry about breaking anything. When people send money with Amazon Payments, Amazon takes care of the delicate stuff, like coding updates or fraud protection. You just need a button on your site to have your customers make an Amazon payment.

How does Amazon Payments work? There must be a catch, right? Well, Amazon will make some money off you, that’s for sure.

Clash of the Titans

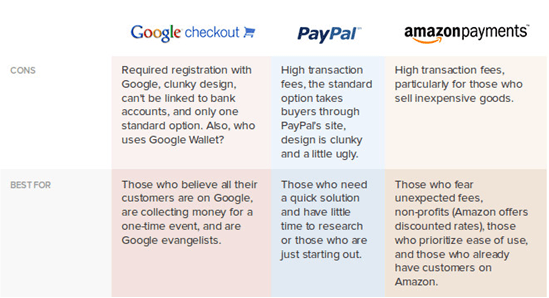

As one would expect, Amazon is not the only trusted online giant with a payment platform out there. The helpful folks at Grasshopper have created a very useful table, which is a Google Checkout, PayPal, and Amazon Payments review. It compares the good and bad sides of all three major payment solutions.

What is Amazon Payments doing that is better than Google or PayPal? Or let us rather go the other way round. What is Amazon Payments doing that is worse?

Don’t Miss: Best Gifts for Older Women – All You Need to Know (Gifts for Women Over 40, 50, and Elderly Women)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

The Bad…

When we look at the pros and cons, Amazon seems to be doing great. While Google Checkout has a total of five cons and PayPal has three, Amazon Payments has only one. However, it is a big one: high transaction fees.

The standard fee of 2.9% plus 30 cents is the same for all three service providers. However, Amazon has a big exception: the standard fee applies only to payments of $10 or more. If your client wants to make an Amazon payment lower than $9.99, you will lose 5% plus five cents. Compared to other payment platforms, it is no small difference.

It makes us think that Amazon did it on purpose to scare away small fry because it wants its users to send money with Amazon Payments only if the amount is large. If that is the case, it has succeeded – the average order size in 2015 was $84.

Image Source: Grasshopper.com

…And the Good

The “BEST FOR” row is interesting if you read between the lines. It basically says that Google Checkout is for Google geeks and that PayPal is a primitive platform. What is Amazon Payments column saying, then?

The way we see it, the three crucial words are “ease of use.” When users are about to pay for something, they are already nervous. So there is nothing as confusing (and scary) as PayPal redirecting them to its own site. However, when you make an Amazon payment, you never leave the site where you decide to make a purchase.

Related: Wealthminder Review – What You Should Know Before Using Wealthminder (Investors and Advisors)

How Much Will You Lose?

In other words, how much does it cost? The good news is that there are no monthly or set-up fees, no cancellation fees, and no hidden fees. However, when users make a payment on Amazon, there is always a commission.

Amazon charges 2.9% of the order value plus 30 cents, unless you sell something under $9.99, which is an exorbitant 5% plus 5 cents, as mentioned earlier. Out of this, 2.9% is for the domestic processing fee; if you do cross-border business, the fee rises to 3.9%.

When you are just starting out, there is a nice bonus: the Self-Starter Package offers free payment processing on your first $10,000 in transactions over 12 months while the Portfolio Package offers free payment processing on your first $100,000 in transactions over 12 months.

When Are You Getting Paid?

Let’s say you decide to become one of the stores that accept Amazon payments. Once you add the Amazon button to your web page, you wait for your wonderful product to convince someone to make an Amazon payment. The payment will be deposited into your Amazon payment account, and it will be automatically transferred to your bank account on the next settlement date.

You will have to wait a bit for the first transfer, though. It has a 14-day waiting period. After that, however, your account will be settled daily.

Both U.S. and international customers can use major credit cards to make a payment to Amazon Payments. However, only the customers from the U.S. can make bank account and Amazon Payments account balance transfers.

Push the Button

What about site integration? Amazon has identified the five most frequent navigation structures used by sites that accept Amazon Payments. It offers a “best practices guide” that explains in detail how to add Amazon buttons for each of those five site types.

There is also a simpler button guide on how to integrate Login and Pay with Amazon buttons.

Adding the “Login with Amazon” button to your site has several benefits. As soon as customers see your site, they will know that you are one of the stores that accept Amazon payments. They can log into your website with their Amazon account credentials and later make an Amazon payment without re-entering them. And your site looks better by association. Neat!

Popular Article: LegalMatch Reviews – What You Should Know Before Using Legalmatch.com

Embrace Your Inner Geek

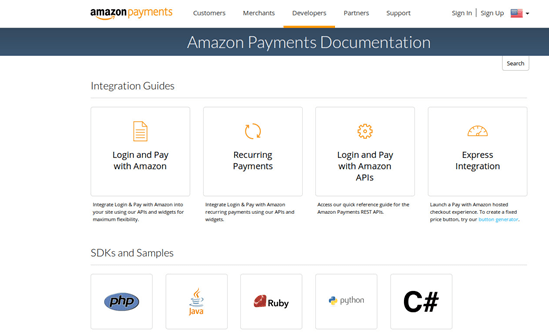

Image Source: Amazon Payments

If you get all warm and fuzzy when hearing words like “PHP,” “Ruby” or “Python,” check out Amazon’s comprehensive documentation. It includes instructions on how to make an Amazon payment more varied with various Amazon APIs and other stuff that few people understand. In short, you can decide how your visitors will make a payment to Amazon.

If you need plain vanilla buttons, Amazon has made it really easy for developers: you just need to copy the code and paste it on your page. Amazon Simple Pay has a set of such copy-and-paste HTML buttons, with variants such as Donations or Subscriptions.

Is Your Provider Already There?

Your integration will be equally painless if you choose an Amazon partner. If you are using a shopping cart or e-commerce provider, chances are it is already integrated with Amazon Payments.

Earlier in 2016, Amazon launched Amazon Payments Global Partner Program, which helps e-commerce platform providers integrate with Amazon Payments. If your provider is integrated, there should be an option to make a payment on Amazon.

If you are not sure, you can take a look at the list of supported providers.

Should You Make an Amazon Payment Integration?

The cautious answer would be “it depends.” If you missed the Grasshopper table earlier in this article, you can take a look at it now. If you intend to sell very cheap stuff or collect money for a specific event, you should consider Google or PayPal.

Do you want to hear our honest answer? Yes, you should go for it. In our opinion, the ease with which you can make an Amazon Payment integration beats the advantages of other service providers. And having an “Amazon” button adds that bit of flair to your site that you would not have with Google upholstery.

Free Wealth & Finance Software - Get Yours Now ►

In a Nutshell

To summarize this Amazon Payments review, here are a few short reminders.

When SHOULDN’T you be one of the sites that accept Amazon Payments?

- When you sell products cheaper than $10.

- When you make a one-time money collection.

When SHOULD you be one of the sites that accept Amazon Payments?

Image Source: Amazon Payments

- When you want a popular and trusted brand on your site. It seems it doesn’t hurt even if you are famous yourself. The British fashion retailer AllSaints claimed its conversion rates increased by 34% after it added Amazon Payments to its web site.

- When you don’t want to worry about coding or fraud.

- When you believe most of your customers already have an Amazon account. Such customers will make an Amazon payment easily and without disclosing payment information. Do not underestimate customer paranoia about giving away credit card details; it is a powerful deterrent.

- When you want to learn more about your customers. When a customer decides to send money with Amazon Payments, you get his/her name, email address, and zip code, so you can complete the order and make the checkout experience more personal.

- When you want a platform that is seamlessly integrated into your site.

- When your customers have sausage fingers. (i.e., an actual plan for the future. With obesity rates going up, the term isn’t as ridiculous as it sounds.)

Since its inception in 2007, Amazon Payments took a while to find its footing. However, the usage of the service in stores that accept Amazon Payments rose 150 percent in 2015 from a year earlier. With the payment service popping up in all kinds of places recently, it may be the right time to jump on the bandwagon.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.