Intro: What Is an FHA Loan?

If you are in the market for a home and exploring your loan options, you may have heard the term FHA and asked yourself the question, “What is an FHA loan?”

As defined by Bankrate.com, “An FHA loan is a mortgage loan that is insured by the Federal Housing Administration. Borrowers with FHA loans are required to pay for mortgage insurance, which protects the lender from a loss if the borrower defaults on the loan.”

The FHA, or the Federal Housing Administration, is part of the U.S. Department of Housing and Urban Development (HUD). Since 1934, the FHA has been issuing FHA home loans and providing other related services.

For first-time homebuyers or those in the market to buy a new home, it is essential to learn what an FHA mortgage is and how the process works. This AdvisoryHQ FHA loan reviews article will provide you with an in-depth analysis of FHA mortgages as well as detailed information on FHA financing and insurance requirements.

Image Source: What Is an FHA Loan?

See Also: Best Bad Credit Mortgage Lenders for Bad Credit Borrowers (Mortgage Lenders and Programs)

FHA Review

The FHA, through HUD, provides a variety of resources to assist you in the process of becoming a homeowner.

HUD’s mission statement is as follows: “HUD’s mission is to create strong, sustainable, inclusive communities and quality affordable homes for all. HUD is working to strengthen the housing market to bolster the economy and protect consumers; meet the need for quality affordable rental homes: utilize housing as a platform for improving quality of life; build inclusive and sustainable communities free from discrimination; and transform the way HUD does business.”

What might this mean to you personally?

First of all, if you’re purchasing a home for the first time and don’t have a large savings account, then an FHA loan can be a great option.

With an FHA-approved loan, you may be able to make a down payment of at least 3.5% of the asking price.

Secondly, if you’re 62 or older, HUD offers a wide range of services, including the below:

- Reverse mortgages

- Federal housing programs

- Housing counseling

- Rural housing loans

- Housing discrimination complaints

Thirdly, if you’re interested in purchasing a manufactured or mobile home, you may be interested in learning about HUD’s Office of Manufactured Housing Programs.

Basically, this national program is charged with assisting and protecting mobile homeowners through the following programs:

- Construction and Safety Program

- Dispute Resolution Program

- Manufactured Home Installation Program

To learn more about HUD’s available programs, you may want to download this PDF document: Programs of HUD – 2016. This document will assist you in gaining a broader sense of all that the FHA has to offer.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

FHA Financing and Approval

When determining what an FHA loan is, it’s important to note that the FHA insures, rather than awards, loans. Since your loan will be insured by the FHA, you stand a better chance of obtaining a “better deal” from a lender.

Furthermore, getting approved for an FHA loan will subsequently lead to lower down payments, lower closing costs, and an easier credit-qualifying process.

So, how do you know if you qualify for an FHA loan?

According to Zillow.com, there are a number of FHA requirements. While you’ll want to review all of these in detail and consult an expert to clarify, here are a few borrower basics:

- Have regular employment or have been with the same employer for the previous two years

- Have a Social Security number

- Be a lawful U.S. resident

- Must be old enough to enter into a mortgage contract, which varies by state

- You must make a down payment of at least 3.5%

- You must be purchasing the house for your primary residence

- You must have the property appraised by an FHA-approved appraiser

- Your front-end ratio must be less than 31% of your gross income

- Your back-end ratio must be less than 43% of your gross income

- Your credit score must be at least 580 if making a 3.5% down payment

If, after reviewing all of these requirements, you still feel confident that you might qualify for an FHA loan, then one of the next steps is to locate an FHA mortgage lender.

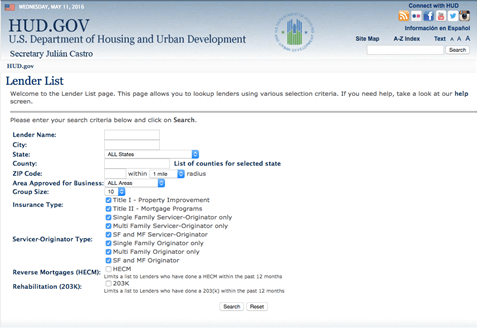

One of the many helpful features at HUD.gov is the “Lender List” page:

Image Source: Lender List

This may also be a good time to speak with a HUD-approved housing counselor. If you weren’t already aware of this, certain types of counseling are provided free of charge. According to HUD.gov, this includes foreclosure prevention and homeless counseling services. These agencies are, however, allowed to charge “reasonable and customary fees” for providing counseling in these topic areas:

- Pre-purchase

- Reverse mortgage

- Rental

- Non-delinquency post-purchase

It’s also important to be aware of your rights, as HUD has explicit criteria that need to be met by these counseling agencies:

- The agencies need to provide free counseling for those individuals who are unable to afford it.

- Prior to receiving counseling, potential clients must to be informed of the fees and fee structure, when applicable.

- The fees must be reasonable given the services provided.

For more information, to locate an agency close to you, and/or if you’d like to lodge a complaint against a specific agency for non-compliance to the above criteria, you can contact HUD’s Office of Housing Counseling at (800) 569-4287.

What Is an FHA Mortgage?

You might also be curious about FHA insurance or asking yourself the question, “What is FHA mortgage insurance?” Basically, this is a form of loss protection offered to lenders by the FHA, according to HUD.gov. If, for example, you were to default on your FHA-approved loan, the FHA would pay the lender’s claim. The loan needs to meet specific criteria to qualify for FHA mortgage insurance, however.

According to FHA.com, which is not a government agency, if your down payment is less than 20%, then the FHA would require that you have FHA mortgage insurance. Currently, the Up-Front Mortgage Insurance Premium, or UPMIP, is set at 1.75% of your base loan.

Don’t Miss: Fairway Mortgage Reviews – What You Want to Know! Complaints and Independent Mortgage Corporation Review

Where Can I Locate Reliable Reviews?

Part of being a smart consumer is reading reviews from a variety of sources. Since reviews, by their nature, tend to be subjective, it’s a good idea to locate reliable and objective sources. Once you’ve read a number of reviews, you’ll have a much better idea if you want to work with a particular FHA-approved lender or agent.

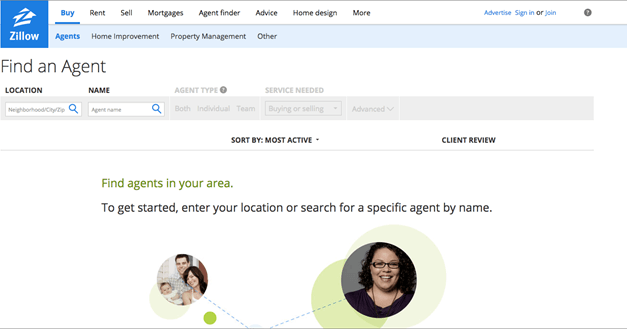

One helpful source for real estate agent reviews is Zillow.com. This site’s search feature is easy to use – if you don’t already have an agent’s name, you can plug in your zip code to find a listing.

Image Source: Zillow.com

When you’re searching for reviews on FHA-approved mortgage lending companies, you may have questions such as these foremost in your mind:

- What is an FHA loan?

- What is an FHA mortgage?

- Where can I find FHA loan reviews?

- What is FHA financing?

- What is FHA insurance?

- What does FHA approved mean?

One helpful resource is ConsumerAffairs.com. Here, a review that may be of interest is the “Top 10 of the Best Reviewed Mortgage Companies”:

- AmeriSave Mortgage Corporation – received 5 stars

- Jersey Mortgage Company – received slightly over 4.5 stars

- Caliber Home Loans – received slightly over 4.5 stars

- Prospect Mortgage – received slightly over 4.5 stars

- Nationstar Mortgage – received 4 stars

- Lendingtree – received 4 stars

- Network Capital Funding Corporation – received 5 stars

- QuickenLoans – received slightly over 3 stars

- Guaranteed Rate – received 3 stars

- Gateway Mortgage Group – received slightly over 2 stars

Once you’ve located some mortgage loan company reviews, you want to make sure they also include information that pertains to FHA loan reviews. After visiting the individual company sites provided above, you’ll be able to determine if they are HUD-approved. Another way to accomplish this task, of course, is to contact each company directly.

To provide an example of why ConsumerAffairs.com is considered to be a reliable source, consider the first four companies – all of which handle FHA loans – that are listed in the “Top 10 of the Best Reviewed Mortgage Companies”:

Related: What Is a Jumbo Loan? A Complete Guide (Loan Limit, Mortgage & Rates)

How to Avoid Housing Scams

Unfortunately, where financial matters are concerned, scams are often present. In order to protect your credit and investments, show caution and do your homework ahead of time. An agency or lender that may seem reputable and trustworthy at first may prove to be otherwise. One of the best ways to perform your due diligence is to review reputable sites that provide up-to-date information on housing and mortgage scams. Government sites, such as USA.gov, are an obvious choice.

Two of the relevant scams discussed by USA.gov are “foreclosure scams” and “predatory loans.” If you’re purchasing your first home, you may not encounter a foreclosure scam; you may, however, encounter a predatory loan company or other type of company engaged in taking advantage of you. According to USA.gov, any of the following could be a potential predatory lender:

- Appraisers

- Mortgage brokers

- Home improvement contractors

In order to avoid a potential scam, USA.gov provides some excellent warning signs:

- Properties are being appraised and sold for well beyond their market value.

- Borrowers are encouraged to lie on their loan applications.

- Loans will exceed the amount a borrower can realistically afford.

- High interest rates are charged to discriminate against a specific group of people rather than based on credit history.

- Fees are charged for products and services that either don’t exist or are unneeded.

One of the best ways to avoid scams, according to USA.gov, is to become educated on the home-buying process. In this way, you will also learn how to be a smart – or smarter – consumer. Here are a few recommendation highlights:

- Attend a HUD-approved course to learn about becoming a homeowner.

- When you interview prospective real estate agents, be sure they have valid credentials and good references.

- Review the prices of other homes in the neighborhood to determine if the one you’re interested in is comparable in price.

- Ensure your home inspector is not only qualified and licensed but is able to negotiate on your behalf should repairs be necessary.

- Engage in a lender cost comparison and be wary if someone attempts to manipulate you into working with a particular lender.

- Contact HUD if you suspect a potential predatory lending scam.

Popular Article: Should I Pay off My Mortgage Early? Prepayment Penalty Definition!

Free Wealth & Finance Software - Get Yours Now ►

Remember Your Goal Is Homeownership

Now that we have answered your question, “What is an FHA loan?” and you have more information on the requirements you’ll need to meet – as well as the services you’re likely to require – it’s important to stick with the process. While it may seem overwhelming at first, keep your homeownership goal in sight, and remember, there are FHA-approved services and counselors available to assist you with understanding FHA-approved mortgage loans, financing, insurance, and other essential aspects of becoming a home owner.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.