Intro: What Is Goldman Sachs and What Does It Do? Details: Reviews and Ranking

Goldman Sachs is a renowned name to many across the country and globally, hitting the headlines every now and then with great achievements. Despite Goldman Sachs being a household name, you may be interested in finding out more about this Wall Street tycoon.

You might be wondering the following questions:

- What is Goldman Sachs?

- What does Goldman Sachs do exactly?

- What do Goldman Sachs reviews say about the firm?

This AdvisoryHQ article will answer all of the above questions by providing a detailed analysis of Goldman Sachs as well as going over its organizational structure, products and services offered, rankings and awards.

Image source: Goldman Sachs

What Is Goldman Sachs: Overview of this Top Investment Bank Firm

The Goldman Sachs Group, Inc. is a top-notch global investment banking firm that offers a range of investment banking, investment management, securities, and other financial services, primarily to institutional clients.

Everything about Goldman Sachs can be summarized in its business segments, through which the bank provides strategic advisory with respect to mergers and acquisitions, divestitures, restructurings, spin-offs, and risk management as well as wealth advisory services, long-term financing, and investment services.

The bank also facilitates fixed-income and currency transactions. Its client network consists of corporations, financial institutions, governments and public authorities, boards of directors and special committees, and also individual clients.

Founded in 1869, Goldman Sachs is headquartered in New York and maintains offices in 62 countries around the world and in 22 financial centers in the United States.

See Also: Best Banks in New York | Ranking of Banks in NYC, Buffalo, etc.

Who is Goldman Sachs: The Goldman Sachs Culture

The greatest asset of Goldman Sachs is its people, leaders, and followers who are determined to offer the highest standards of service to their clients. Professionals from all over the world effectively implement the Goldman Sachs business principles, aiming to provide superior returns to the bank’s shareholders while aggressively expanding client relationships.

What does Goldman Sachs do to sustain a competitive edge? It accomplishes this particular feat by capitalizing on the strength of teamwork. The bank promotes diversity by structuring its business units with teams made up of different divisions, and it sets expertise as the basis on which shared responsibility thrives.

Everything in Goldman Sachs is career-related, but its people work collaboratively in a flat organizational structure, sharing their ideas and adding value to any project.

Leadership is also an important aspect of the firm, which really defines Goldman Sachs. Chairman & CEO Lloyd C. Blankfein and President & COO Gary D. Cohn share a mutual commitment to leadership, where people are valued for their intellect as well as for their opinions.

What Does Goldman Sachs Do?

Goldman Sachs is committed to bringing together people, capital, and ideas to better serve its clients and help the communities that it supports grow.

Through advisory on risk management and capital raising, the bank assists local, state, and national governments in investing in education, health, and transport infrastructure. In fact, Goldman Sachs assists markets in remaining liquid and efficient so that institutional investors can finance their operations.

In addition, the bank transacts for its clients in all major financial markets, including equities, bonds, currencies, and commodities, thereby preserving and growing assets for institutional clients while driving new perspectives to boost business growth.

Don’t Miss: Banks in Illinois | Ranking | Banks in Chicago, Aurora & Other IL Cities

What Does Goldman Sachs Do: High-Level Research Services Provided

Goldman Sachs’ Global Investment Research Division (GIRD) is one of the bank’s strong assets that differentiates Goldman Sachs from the other leading US investment banks. The Global Investment Research Division provides original, fundamental insights and analysis with respect to equity, fixed income, currency, and commodities markets in more than 25 stock markets and 50 economies around the world.

The dedicated teams of the Global Investment Research Division provide the following services:

- Equity research per industry and sector

- Macro research per market and economy, focusing on macroeconomic foreign exchange rate and interest rate forecasts to provide market views and recommendations

- Credit research to identify investment opportunities

- Portfolio strategy research that takes into consideration views, forecasts, and recommendations on both asset and industry sector allocations for all key equity markets

- Commodities research that analyzes market fundamentals to deliver forecasts for agriculture, base metals, natural gas, oil, and precious metals commodities

- Alongside the Global Markets Institute, the bank’s public policy arm provides top-notch advisory services to policymakers, regulators, and investors around the world

About Goldman Sachs: How Is Goldman Sachs Organized?

To get a better understanding of what Goldman Sachs is doing – besides being a leader in the industry – and how it is organized, below is an analysis of its segments.

What Does Goldman Sachs Do: Investment Banking (IBD)

Through its Investment Banking Division (IBD), Goldman Sachs seeks to be the top trusted advisor for its clients. Everything about Goldman Sachs is focused on providing first-class advice for the execution of complex strategic decisions and transactions that require the expertise of a well-established financier.

In addition, the IBD team strives to be a leading provider of financing services to assist Goldman Sachs’ clients in achieving their strategic goals.

The Investment Banking Division can be broken down into the Investment Banking Group and Financing Group. The Investment Banking Group focuses on the developed and emerging markets around the world to provide banking services for a wide range of industries.

On the other side, the Financing Group capitalizes on a market-driven environment to provide corporate and institutional investors with solutions on the most complex financing and risk management transactions with respect to equity, debt, and derivatives.

The industries covered include the following:

- Clean technology and renewables

- Consumer retail and health care

- Financial institutions

- Financial and strategic investors

- Industrial

- Municipal finance

- Natural resources

- Real estate

- Technology, media, and telecommunications

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What Does Goldman Sachs Do: Investment Management

Through its Investment Management Division (IMD), Goldman Sachs aims to provide investment management solutions to fund managers. Products of all asset classes are offered through the Goldman Sachs Asset Management (GSAM) and Private Wealth Management (PWM) divisions, which provide asset management and wealth management solutions to first-rate institutions and individual investors globally.

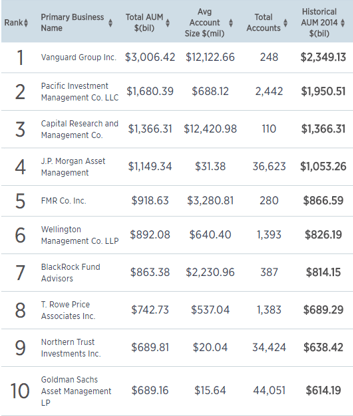

Currently, Goldman Sachs has more than $1 trillion in assets under management (AUM). In 2015, Goldman Sachs was one of the leading asset management firms in the world, with $689.81 billion assets under management (AUM), as shown in the table below, and over 2,000 professionals across 33 offices worldwide.

Image source: Goldman Sachs

The bank also offers portfolio management and financial counseling as well as brokerage and transaction services to high-net-worth clients. In fact, the answer to the question, ”Who is Goldman Sachs?” is reflected in the provision of tailor-made advice to high-net-worth individuals, families, and selected foundations and endowments to develop effective wealth management strategies.

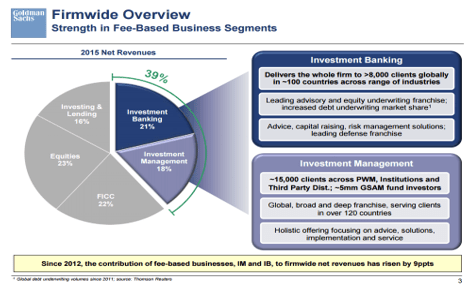

The Investment Banking Division and Investment Management Division account for the 39% of the bank’s 2015 net revenues as shown in the table below.

Related: NatWest Banking – Should You Use Its Services? A Complete Guide (Business, Mortgage & Review)

Related: NatWest Banking – Should You Use Its Services? A Complete Guide (Business, Mortgage & Review)

What Does Goldman Sachs Do: Securities

The way the Securities segment operates reflects everything about Goldman Sachs in its effort to maintain the leading position in the execution of securities transactions globally.

The bank’s team of qualified professionals has more than 30 years’ experience in client service. This, along with a suite of fully-equipped electronic platforms that offer access to a range of instruments and insights, assists fund managers to monitor and analyze transactions in real-time.

The bank’s clearing expertise enables the effective execution and settlement of transactions on more than 97% of equities and derivatives exchanges around the world. Goldman Sachs clears approximately 3 million trades per day.

Through its Securities segment, Goldman Sachs is able to assist institutional clients in developing strategies, identifying opportunities, and executing transactions. The range of products and services offered to institutional clients include the following:

- Cash equities

- Commodities

- Convertibles

- Credit

- Enhanced strategies

- Equity derivatives

- Exchange-traded funds (ETFs)

- Foreign exchange

- Futures

- Growth markets

- Interest rates

- Mortgages

- Synthetics

In addition, the bank also offers targeted introductions to pension plans, endowments, foundations, family offices, sovereign wealth funds, insurance companies, funds of funds, private banks, and consultants.

Investing & Lending (Goldman Sachs Reviews)

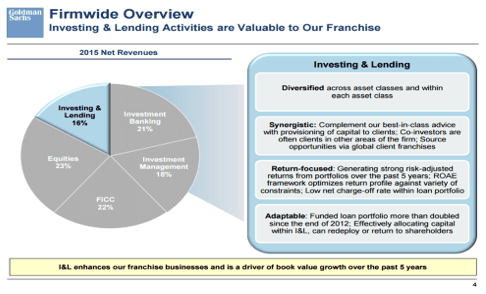

The Investing & Lending segment offers a range of investing and lending options to bring together investors and organizations in need of capital. These options include low- and middle-income housing initiatives as well as businesses that seek expansion.

Through its Banking, Direct Private Investing, Impact Investing, Middle Market Financing & Investing, and Principal Strategic Investments business units, Goldman Sachs provides specialized investment strategies at all levels of capital structures.

Popular Article: BMO Harris Bank Reviews – Everything You Need to Know (Credit Card Rewards, Private Banking & Review)

What Does Goldman Sachs Do with Its HFI Loans?

A small proportion of Goldman Sachs’ portfolio is invested in public or private equity. Most of its loans are held for investment (HFI), indicating the bank’s intention to hold them for the anticipatable future, thereby not having the obligation to record every change in their value in its quarterly accounting statements.

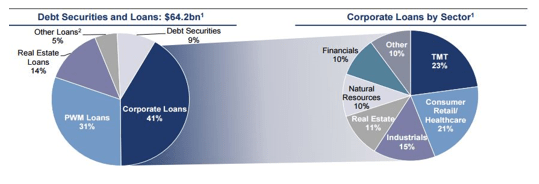

As of November 2015, Goldman Sachs’ funded loans comprised 91% of $64.2 billion in debt securities & loans, balanced across the following:

- Corporate loans (41%)

- Private wealth management (PWM) loans (31%)

- Real estate loans (14%)

- Other loans (5%)

Real estate loans are diversified across geographies whereas corporate loans are diversified by size, sector, and geography. In addition, PWM growth of 216%, increasing from $6.2 billion to $19.6 billion, is the main driver of net interest income growth – 15% annually since 2012.

Real estate loans are diversified across geographies whereas corporate loans are diversified by size, sector, and geography. In addition, PWM growth of 216%, increasing from $6.2 billion to $19.6 billion, is the main driver of net interest income growth – 15% annually since 2012.

Goldman’s PWM loans are diversified across collateral types, including securities, residential real estate, and other assets. According to Business Insider, Goldman Sachs is the second best investment bank after JP Morgan, with more than $5.1 billion in fees from equity and debt deals, M&As, and syndicated loans.

Goldman Sachs Reviews

On Vault.com, Goldman Sachs reviews from verified employees award the bank 4 out of 5 stars. In addition, Goldman Sachs ranks #1 on its list of the most prestigious banking firms.

Indeed.com provides detailed Goldman Sachs reviews with respect to management, salaries, benefits, work-life balance, management, and culture, awarding the firm 4 out of 5 stars.

Glasdoor.com provides nearly 3,000 detailed Goldman Sachs reviews awarding the company 3.7 stars out of 5. Work-life balance scores the lowest (2.7), whereas culture & values and career opportunities both score the highest (3.8). In addition, 93% of employees approve of CEO Lloyd C. Blankfein.

According to GreatPlaceToWork.com, Goldman Sachs is highly-regarded by the employees as:

- 96% of people in the company are given a lot of responsibility.

- 95% of people in the company are willing to get the job done.

- 94% of people in the company believe that management is honest and ethical in its business practices.

- 93% of people in the company believe that management is competent at running the business.

- 93% of people in the company feel good about the ways they contribute to the community.

In addition, the bank ranks #51 among Fortune magazine’s “100 Best Companies to Work for.”

Goldman Sachs Reviews: The Bottom Line

Sustaining a leading position in a competitive field, like investment banking, is an intricate task. Goldman Sachs applies a customer-centric approach that appeals to client needs and assists funds managers in achieving their goals.

The bank welcomes and values diverse backgrounds and perspectives, aiming to help people develop to their full potential. In all Goldman Sachs reviews, it is clear that Goldman Sachs’ wide range of products and services, combined with a diversified client base, a sustainable organizational culture, and acute business principles, places the company ahead of competition in achieving long-term sustainability and growth.