WorldRemit Reviews – Get All of the Facts Before Using Worldremit.com

Money transfers should be one of the easiest things to do in a society driven by technology and instant gratification. However, senders who still use money transfer agents are hit with high fees, and recipients are left waiting twice as long as they should to get their money.

At www.worldremit.com, its main goal is “to get your money, to your recipient, however they want it, whenever they need it.” You shouldn’t have to wait to get your money, and you shouldn’t have to pay a ridiculous fee to send that money.

Image Source: WorldRemit

WorldRemit Raises $100M from WallStreet

In a bid to take on Western Union and MoneyGrams (the world’s largest money transfer giants), WorldRemit recently raised another $100 million — funding that it said it’ll use to continue building out its service globally, and in the U.S.

Image Source: Financial Times

Review of WorldRemit

WorldRemit money transfers are making a difference for people who need to send money internationally. In 2010, WorldRemit.com was founded by Ismail Ahmed who, after his own trying experiences, felt that sending money should be a fast, easy experience for both the sender and the recipient.

Ahmed also felt that technology should play an important role, which is why WorldRemit money transfers can be completed using a phone, tablet or computer. From 2014–2015, WorldRemit gained over $140 million dollars in backing from Accel Partners, a very high-end investment company, and Technology Crossover Ventures, or TVC, which has allowed Ahmed to expand to many different countries, discover new ways that recipients can receive money, and create a brand-new mobile application for money transfers.

If you’re looking for an easy way to send your loved ones money for a very low fee, almost instantly and from afar, WorldRemit may be the best choice for you.

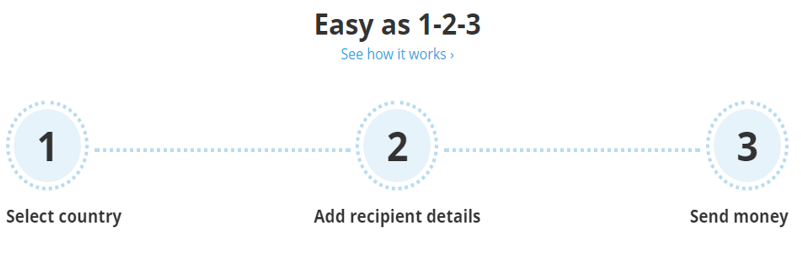

Sending Money in 1-2-3

Step One: Sign up

Signing up at www.worldremit.com is free and easy. You only have to choose what country you’re sending from and enter your name, phone number, email address, and home address. It is important to note that a sender can only change his/her home country by calling customer service – for security reasons. After signing up, you immediately have access to all WorldRemit services and, most importantly, the ability to add recipients.

Step Two: Choose Your Recipient

In order to choose a recipient to send money to, you first have to add a drop-down list of recipients you may send money to either now or in the future. Adding a recipient is as easy as putting in the individual’s name, address, and phone number. There is no limit to how many recipients you can add to your list; however, there are presently only 50 countries that you can send money from and 110 countries that you can send money to.

According to worldremit.com, it is working to add more countries for both senders and recipients every day.

Step Three: Send Money

When it comes to actually sending the money, there are only a few steps, but there can be some ambiguity. The amount of money that you can send to someone varies depending on where you are sending it from; this is due to the different rules and regulations that vary from country to country. It also depends on how you are paying for the transfer (credit cards tend to offer a higher max. limit than using your bank account).

In order to make this process a little clearer, WorldRemit reviews say that there is a “send to” calculator that pops up on the screen before the transaction is complete. This calculator allows you to type in the country that you want to send money to and in turn will show you the maximum amount that you’re allowed to send.

Image Source: WorldRemit

According to multiple WorldRemit reviews online, WorldRemit fees are the lowest around. The amount it will cost you to send an international money transfer depends on which country you are sending it from as well as where it’s being sent to. Even though the costs may vary, WorldRemit fees could cost you as low as $5, and worldremit.com gives you great options for how you can pay.

There are three ways that you can pay for the fees: with a debit card, credit card, and bank transfer. As many WorldRemit reviews note, cash for payment for the transfer is not accepted, but cash can be received by your recipient. Another thing to remember is that your money transfer will not begin until after your payment has already been approved.

WorldRemit also offers a free first-time member money transfer to try out its services.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

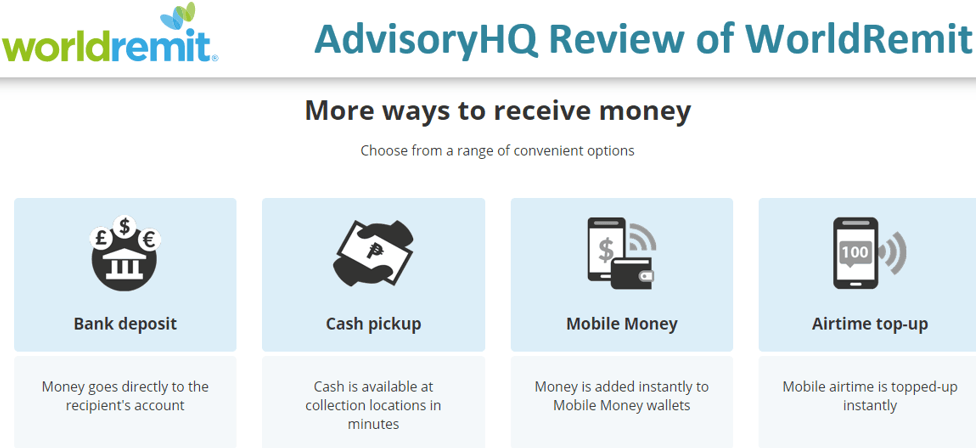

Receiving Money – WorldRemit Reviews

There are five different ways that recipients can receive WorldRemit money transfers depending on where they live. Senders can choose which way their recipients will receive their money right before it is sent to them.

Bank deposit: Recipients can link their checking or savings accounts to worldremit.com and receive money directly into their bank accounts.

Cash pick up: Recipients can also collect their cash from any of the local WorldRemit agent collections.

Mobile money: This option is perhaps the most interesting. If the sender chooses mobile money, the money gets transferred electronically into a wallet service on either a smartphone or basic feature phone. This wallet acts as a bank account and allows recipients to shop online, pay bills, and add more airtime (talk minutes) to their phones. WorldRemit reviews show that a lot of people, especially WorldRemit USA members, use this option because it’s quick, safe, and a near immediate transaction.

According to worldremit.com, mobile money is vital in economic growth because of how easy it is to track transactions and keep your money safe.

Mobile airtime top-off: Sort of similar to mobile money, mobile airtime top-off goes directly to the recipient’s mobile phone; however, the recipient can only use this towards adding more minutes, sending text messages, and increasing his/her data. Airtime top-off cannot be used to pay for the same things that mobile money can.

One downfall of this feature, a WorldRemit review stated, is that some countries do deduct taxes for using this service. However, if you are sending to a country that charges taxes, WorldRemit will notify you before the transaction is completed.

Home delivery: This is only an option if you live in the Philippines. If you do, you can have cash delivered right to your door in a window of 24 hours–7 days.

Exchange rate: Although the exchange rate can change on a day-to-day basis, worldremit.com guarantees the correct rate every time. WorldRemit reviews state that, as a sender, you know exactly how much your recipient will get before you send him/her money.

For example, if you are a WorldRemit USA member sending $100 dollars to London, an exchange rate calculator will pop up on the screen and tell you the exact rate and how much your United States dollars will turn into once received by your recipient. Varying exchange rates are not included in a sender’s WorldRemit fees.

Besides the low WorldRemit fees, the almost immediate transactions, the up-to-date electronic transfers, and many positive online WorldRemit reviews, senders and recipients can find comfort in how trustworthy and safe this company is and, of course, in their responsive customer service agents.

Should You Choose WorldRemit?

Customer service: I called WorldRemit USA, as part of my review, to find out if its customer service was as good as I’d heard it was. I was pleasantly surprised when I only had to wait about 1 minute, after going through one set of prompts, before speaking to a rep who answered all of my questions to the best of his ability.

WorldRemit also has 24/7 email support through filling out a contact form on its website. Worldremit.com not only wants to create a fast, easy, and secure way to electronically send money internationally but also, in my experience, remain dedicated to providing its customers with the best service possible.

Trustworthy Source: WorldRemit duly notes on its website that it uses industry-leading privacy and payment security systems including Norton and TrustE. Worldremit.com ensures its customers that it only partners with companies who comply with its strict security and data protection standards and offers links to those who want to find out more about these standards. WorldRemit also suggests that sending large amounts of money online through a trusted source is a lot safer than traveling with large sums of money to a money transfer agent, which it says a lot of people still do.

After sending money online to a recipient, WorldRemit offers a confirmation email/SMS text message to both the sender and the recipient that the money has been processed. Once the transaction is complete, i.e., the recipient receives the money, WorldRemit sends out another confirmation email/SMS text message to both participants to ensure the validity of the money transfer.

So what happens if you are unsure or uncomfortable about a WorldRemit money transfer? WorldRemit guarantees a team of experts who are trained specifically to spot criminals trying to scam customers. WorldRemit also offers a guide to common Internet scams in its FAQ section to help people spot possible criminal activity and prevent it. If you are still unsure of how safe WorldRemit is, you can read the many WorldRemit reviews on trustpilot.com.

The Not-So-Great Things About WorldRemit

If you are looking to know exactly how much money you will be spending on fees and the exact exchange rate for the country that you’re sending money to before you even sign up, this is not the service for you.

While WorldRemit offers many great services, the varying rules and regulations for the many different countries it works with creates a lot of ambiguity until you are one or two steps away from pressing the send button. The good news is that you are still two steps away and can back out very easily by canceling the transaction.

If you want to know what country offers its recipients all or only one way to receive money, you can get a little information in its FAQ section; however, not every country is listed in that section so you do have to do a little digging and research before sending to your recipient.

WorldRemit is an international money transfer service only. National money transfers are not an option with this company.

If you are looking to pay with cash or a check for your money transfers, this is also not the company for you. Since everything for worldremit.com is mainly done online, cash and checks are not accepted because they can’t guarantee the utmost protection once your money is mailed to WorldRemit and then sent back out again.

Are You Ready to Transfer Money with WorldRemit?

If you feel that this service is best suited for you, stop by www.worldremit.com and sign up for free easily. WorldRemit offers fast, secure, easy, and cost-effective money transfers for over 100 countries worldwide and continues to expand every day.

Visit www.worldremitstores.com to read more about successful money transfers from people all around the world.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.