Overview: Review of Ameriprise Financial Advisors

A financial advisor guides and manages your finances in the best way to produce the most efficient results. For a new investor, a financial advisor advices how and where to invest to suit the investor’s lifestyle.

A financial advisor has expertise in the field of finances and management and can offer you their insight and expertise on various kinds of investments that you may not have known about.

Financial advisor reviews such as this aims to provide you with key information before selecting a financial advisor. This particular review consists of Ameriprise Financial reviews.

Image Source: Ameriprise Financial

Building a strong and reliable relationship with your financial advisor is crucial. However, you must know about the importance of a financial advisor before you read any financial advisor reviews.

Reading financial advisor reviews is a must. A financial advisor can provide you advice and help to:

- Make correct decisions while choosing investment products that will be beneficial for your life.

- Make you realize what is good for you and suits your lifestyle.

- Provide you with the knowledge of the rules and regulations of the IRS and regularly update you on any changes.

- Help you choose the best plan for your life insurance policy.

- Guide you through the transaction process of investments.

- Keep you well aware and informed about the financial obligations that are associated with the death of a spouse.

See Also: Sofi Reviews (What Is Sofi?). Should You Use it? Is Sofi Legit?

How do you choose a financial advisor? (Financial advisor reviews)

Choosing a financial advisor is an important decision to make. Someone who understands you, looks out for your financial well-being, and guides you throughout is the right advisor for you.

You need to trust your financial advisor with your funds and investments. You will be relying on his advice. You will seek his response in certain situations. So, before choosing your financial advisor, consider this financial advisor review. Watch this video to learn more about Ameriprise financial advisor reviews.

Review advisor qualifications

Choose a financial advisor who is a Certified Financial Planner (CFP). Know the exact kind of expertise you are looking for. Based on your requirements, review the qualifications and the advisor’s field of practice. Check out the financial advisor’s reviews and ratings. If his or her profile looks impressive enough, go to the next step.

Also, if your financial advisor is qualified to do the job, find out the kind of security license that he holds. It is good if the advisor has a “core” Series 6 or 7 license. Advisors selling insurance products must bear a state insurance license. Verify everything before you choose your financial advisor.

Look into the history

You are strongly advised to look into the past of the advisor you are choosing. They must be an avid follower of the law, rules, and regulations. Remember, if they have skirted with the law once, they may do it again.

Keep a track of the quarterly report

Before you hire your financial advisor, you may want to see the kind of work they have done before. Ask him or her for an example of previous work. Let them explain it to you in detail, including rationale behind the investment and the result.

Get to know the fees

You must understand what motivates your financial advisor. Learn how he wants to be paid and what will keep him delivering the best results for your work. The fees that you will pay must meet standard criteria that both you and your advisor should agree on.

Advisors who are fiduciaries must put their clients’ interests before their own, so this is important to look for. For an in-depth discussion of fee types, be sure to read our article about financial advisor reviews and fees here: Fee-Only vs Fee-Based Advisors – Commission vs Independent Financial Advisors.

Don’t Miss: Can Capital Reviews – Get All the Facts Before Using Can Capital

About Ameriprise financial advisors (Ameriprise Financial reviews)

Ameriprise Financial was founded by John Tappan in the year 1894. Since then, we have been guiding and helping millions of clients in fulfilling their financial goals and making the right choice for their investments. Our company’s strength lies in the leadership and integrity of our experienced team.

Integrity forms the basis of this company that has been maintained through the times of the Great Depression. This is how Ameriprise Financial has become one of the prominent leaders in the financial world. Its method is covered in this Ameriprise Financial review.

Ameriprise Financial has its headquarters where it was founded, situated in Minneapolis, MN. There are several corporate houses in the United States and worldwide, offices in London, Boston, New York, and India. You may be thinking, why Ameriprise? Read the rest of this Ameriprise Financial review to know further details.

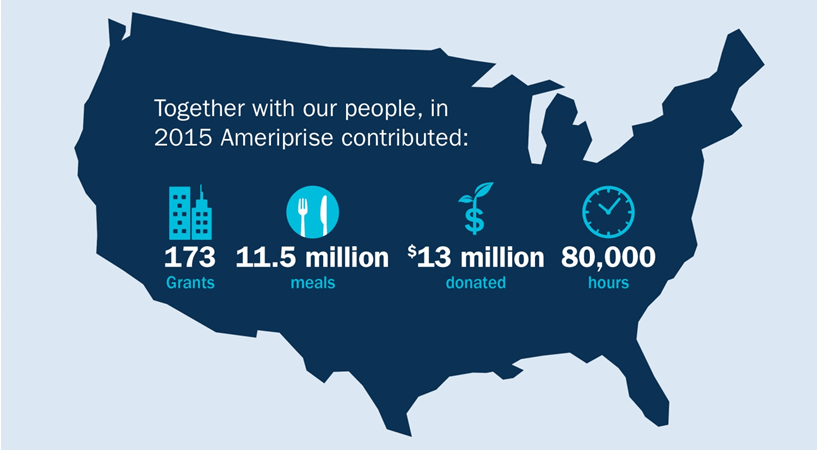

Image source: InvestmentNews.com

Care and concern for customers have been their top priority, which is why they have gained good business financial services reviews. With more than $800 billion in assets under management and more than 2 million business, individual, and institutional clients, Ameriprise Financial advisors can surely meet your needs in three business segments:

- Asset Management

- Advice and Wealth Management

- Annuities and Protection

Ameriprise Financial advisors are fully committed to their clients, and their priorities come before everything else, which is a reason behind their high financial advisor reviews and ratings.

Image source: Ameriprise.com

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How to work with an Ameriprise financial advisor (Ameriprise financial planning reviews)

Ameriprise Financial provides you with a financial advisor who will understand and cater to your every need. You can rely on the services provided by Ameriprise Financial advisors.

Our Ameriprise Financial planning review will break down how your relationship will work. First, your advisor will get to know you and learn about your financial goals. Then they will inform you about everything you need to know and identify the steps that you need to take to achieve your goals. After that comes planning every step very carefully, watching out for your best interests as proved by the Ameriprise Financial services reviews and business financial services reviews.

In your first meeting with an advisor, you can communicate your requirements, goals, and priorities. You can ask questions. Here are a few matters to be prepared with before your first meeting with an advisor:

- Your worries about your finances

- What excites you and what you want to achieve

- If you are saving for your child/children’s or your grandchild/grandchildren’s education and future

- If you are planning on investing in a new property or a new home

- When you would like to retire

- Your plans and ideas on how you ensure your legacy

- If you are getting the attention that you need from your financial advisor

Now that you are prepared with a few questions and have your goals in mind, it is your advisor’s turn to help you plan the steps to achieve them by creating and implementing a plan.

First, your advisor will review your important documents and files, including bank statements, insurance policies, 401(k) statements and investment statements. This step in the Ameriprise financial advisor reviews will give the advisor a good understanding of your financial life.

Image source: BusinessWire.com

Next, your advisor will discuss with you the steps that need to be taken. If you do not find that particular financial advisor and their plan suitable for you, you have 10,000 more Ameriprise advisors to choose from. One of them will surely suit you and your personality. You can also follow the financial advisor reviews and Ameriprise financial reviews from BBB.

Related: CuraDebt Customer Reviews – Get all the Facts before Starting with CuraDebt

Your relationship with your advisor

You can have meetings in person with your advisor; Ameriprise also offers a secure site where you can communicate with your advisor online. It ensures full security, so you need not fear any security issues, based on positive financial advisor reviews ratings. On the secure website, you can:

- Share information with your financial advisor

- Check your account balance

- Pay your bills

- View your documents

- Organize and store your financial documents

Your financial advisor will keep track of your goals and help you adapt to any changes in your life. They will also keep you updated with every change that occurs in your financial situation, another reason for those positive business financial services reviews.

Ameriprise Financial advisor fees (Ameriprise Financial reviews)

The fees that you pay your advisor will depend on the level of financial planning services you are being provided, the complexity of your financial situation, and the products that you may need from Ameriprise Financial. These fees will, in part, depend on the following:

- The number of goals to be fulfilled over a certain period of time

- Financial planning needs like business ownership or advanced investment planning

- Your financial position and circumstances like debt, sources of income, security needs, and net worth value

The fees also depend on a few factors related to your advisor. They are:

- The experience or years of planning experience

- The professional credentials

- Qualification and certificates

- Specialized areas and expertise that focus on financial planning

Regardless of your needs, the first meeting with an Ameriprise Financial advisor will be complimentary. The advisor can answer all your questions regarding fees and any other queries. The initial consultation does not include a plan or advice. The following section of the financial advisor reviews explains it in details.

What will you receive from your Ameriprise Financial Advisor? (Ameriprise Financial reviews)

The services that will be provided to you by Ameriprise will include:

- A detailed review of your financial circumstances, your security needs, and estate needs

- Strategic planning and action steps based on the reviews of your financial situation

- You will receive ongoing financial planning guidance and advice

- You are free to contact your Ameriprise financial advisor at any time without charge

You will get to know how many clients are satisfied with Ameriprise Financial advisors by checking out Ameriprise financial reviews from the BBB and other reputable financial publications. The Ameriprise financial planning reviews prove that they are good at the work they do. The only question that remains is whether they are right for you and your particular circumstances.

Popular Article: OptionsHouse Review – Fees, App, Commission, Services, Speed, Trading

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.